SoundInsightN°24

Bonds

Equities

A new chapter for the Global Economy?

The decisive outcome of the U.S. elections has triggered significant price movements in financial markets, driven by the political measures outlined during the campaign. However, in the medium term, fundamental economic data is likely to play a more critical role in shaping market developments.

This years U.S. elections, often referred to as “the most important election” by many observers, turned out to be less closely contested than polls had suggested. Not only was Donald Trump decisively elected as the 47th President of the United States, but the Republican Party also secured a majority in both chambers of Congress. This clear electoral outcome, avoiding the uncertainty of a contested vote count, led to notable gains in risk assets across the U.S. Additionally, the "Trump Trade," which had begun to take shape even before the election, continued to gain momentum based on campaign promises.

One of the key pledges during the campaign was tax reform, including a reduction in corporate tax rates. Lower taxes are expected to boost corporate profits, attract more investment, and positively impact economic growth. The new administration has also committed to a strategy of deregulation, particularly in the financial and energy sector, which has driven significant stock price gains in these industries.

However, the administration's proposed trade policies present notable risks to growth. Tariffs of 60% on imports from China and 10% on imports from other parts of the world could disrupt global trade, weaken domestic demand in the U.S., and slow economic growth, particularly in China. Furthermore, tariffs would likely lead to higher prices, increasing the risk of rising inflation.

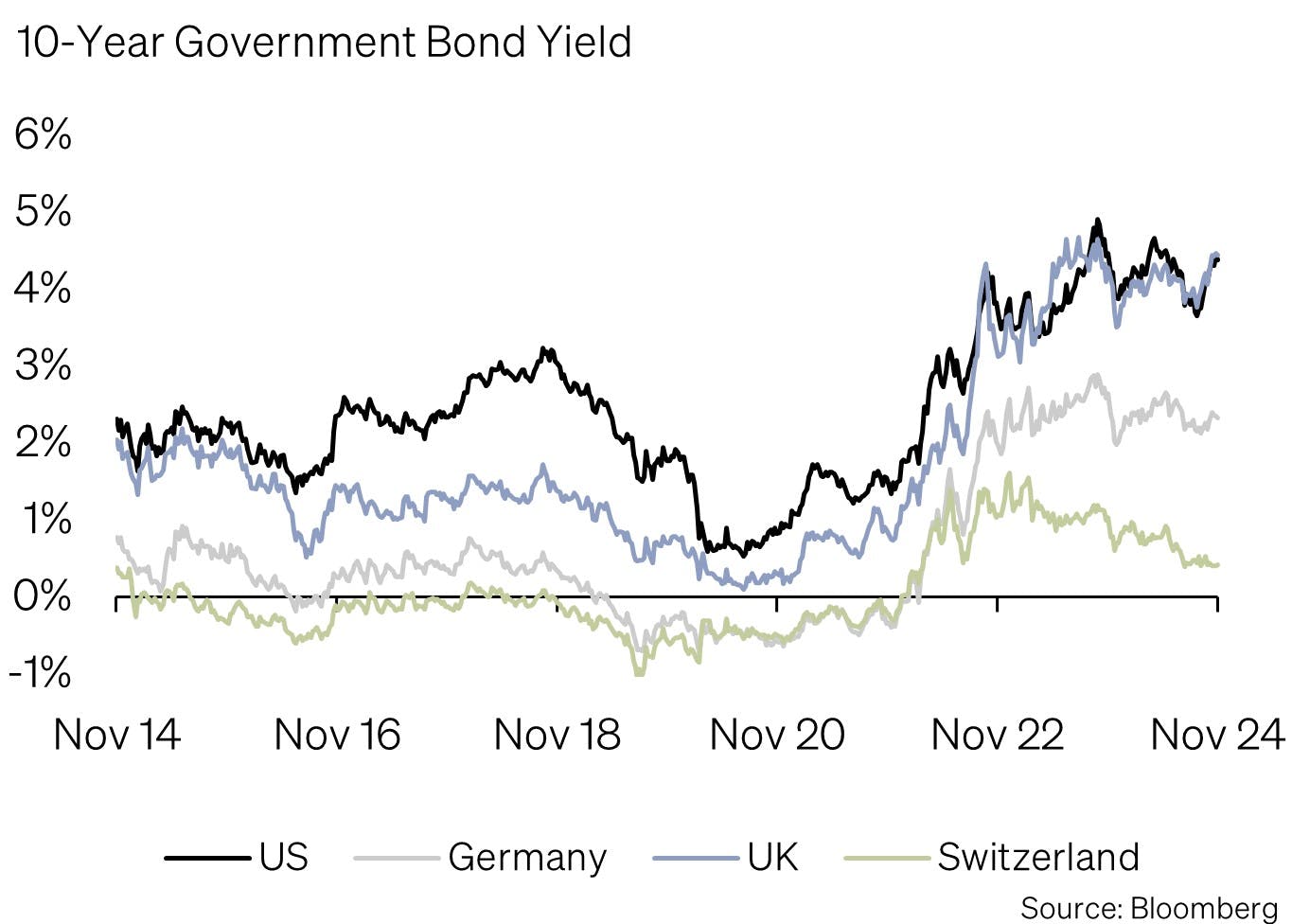

In summary, the planned measures are likely to provide only limited long-term growth impulses, with the structure and implementation of tariffs playing a decisive role. Both campaign promises - tax cuts and trade policies - are inherently inflationary. The rise in interest rates, particularly at the long end of the yield curve, suggests that markets are pricing in the potential inflationary effects of Trump’s policy agenda. However, significant uncertainty remains about whether these measures will be implemented as planned and how they will ultimately impact price developments.

Tax cuts, which would increase the fiscal deficit, are expected to spark debates, even with a Republican majority in Congress. Moreover, the Trump administration is likely aware that a significant portion of its electoral success stems from public dissatisfaction with rising prices. A resurgence of inflation would not align with the administration’s interests. Additionally, higher interest rates and the associated rising debt burden could pose a challenge for the new government.

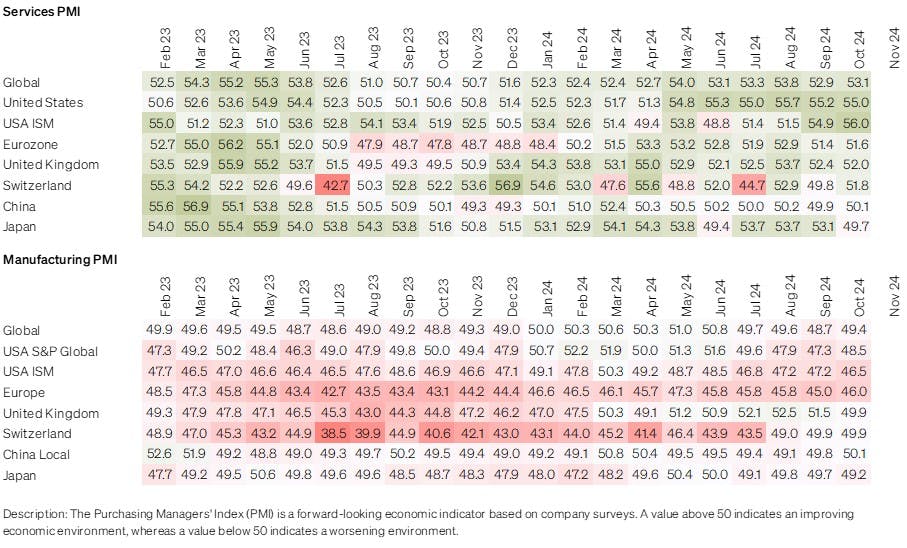

As Trump’s tax and trade policies are unlikely to take effect until the second half of 2025 or early 2026, medium-term market developments are more likely to be driven by economic fundamentals. In this context, we consider a soft landing for the U.S. economy to be a probable scenario, which would give central banks room to lower interest rates further.

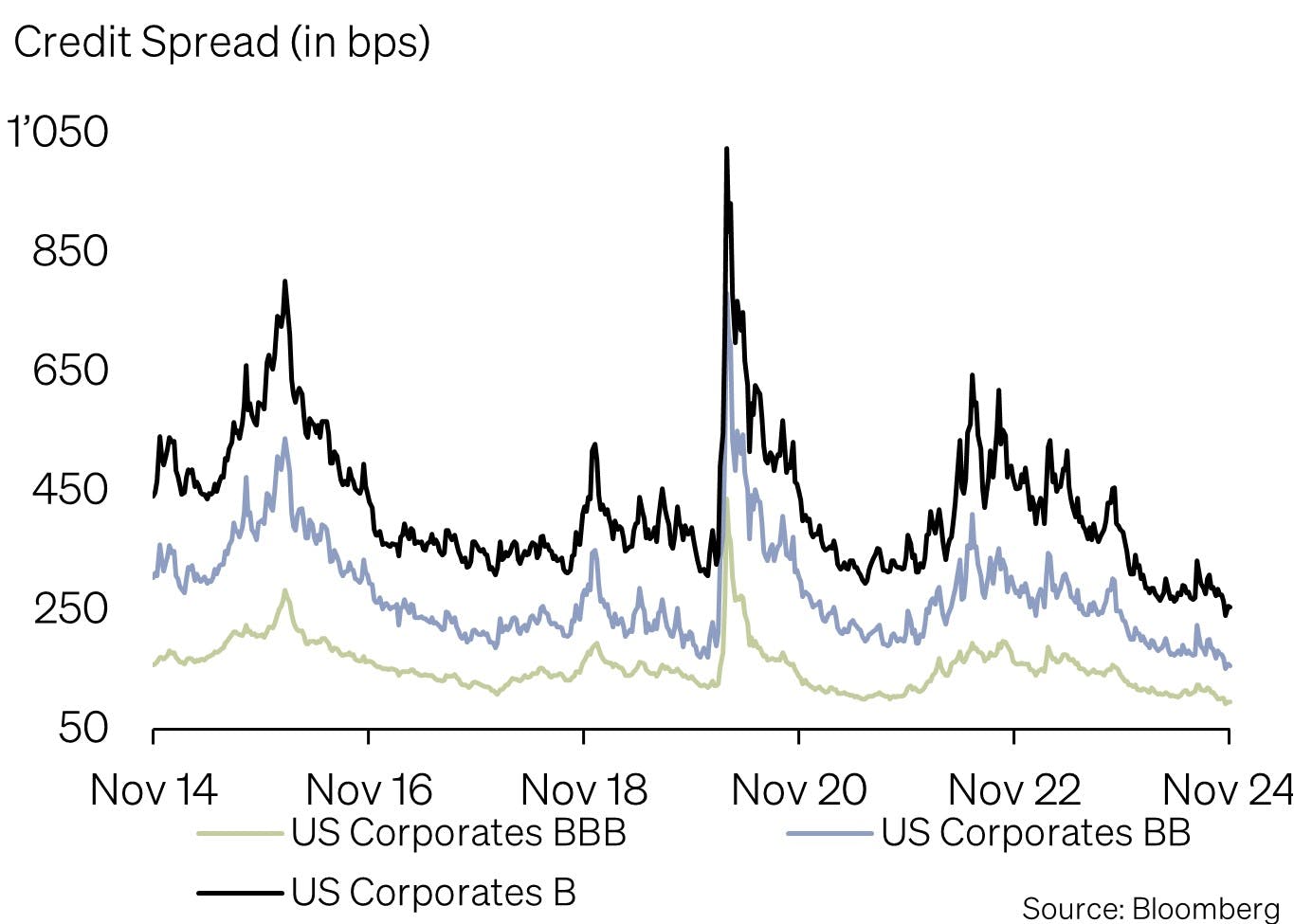

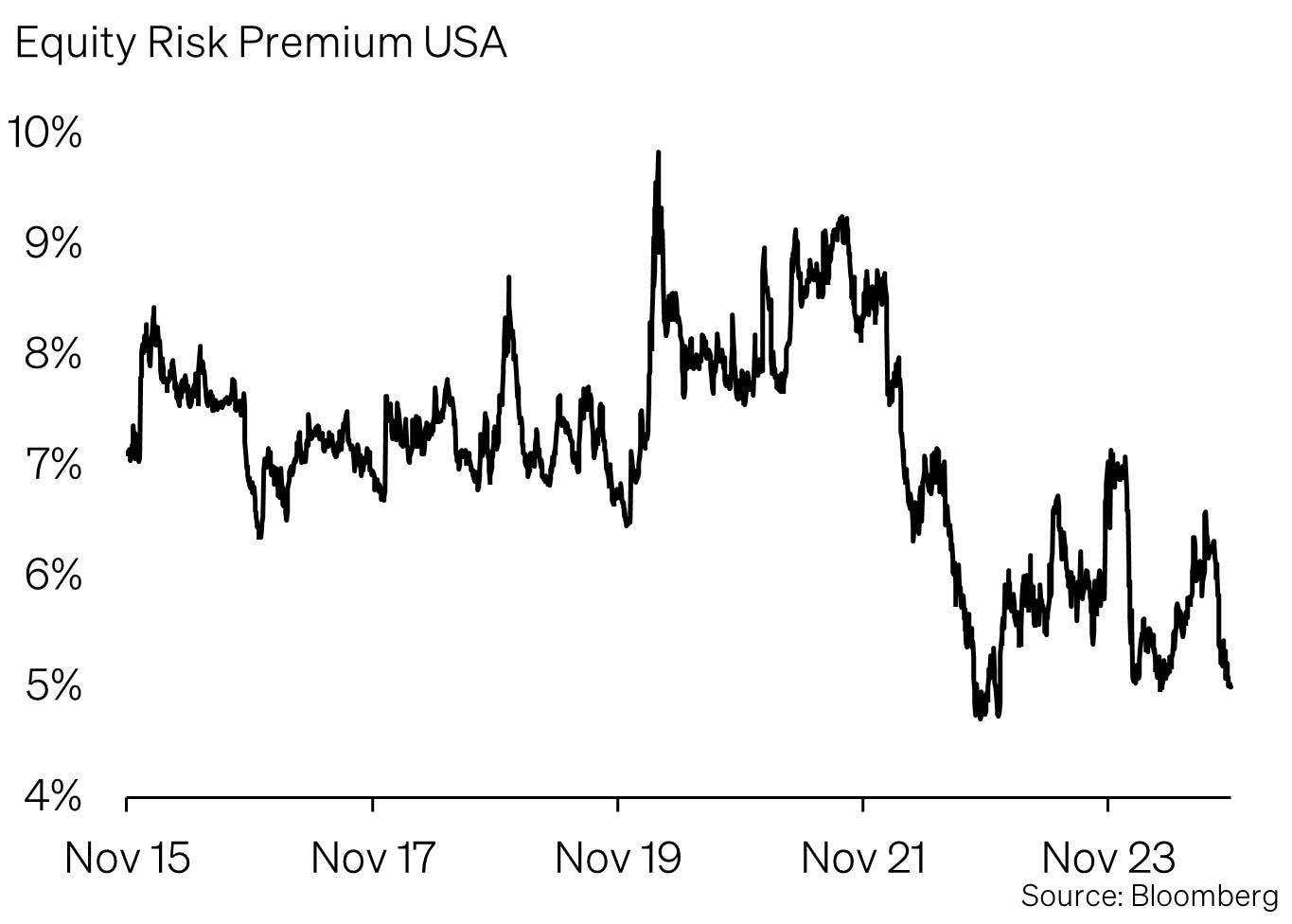

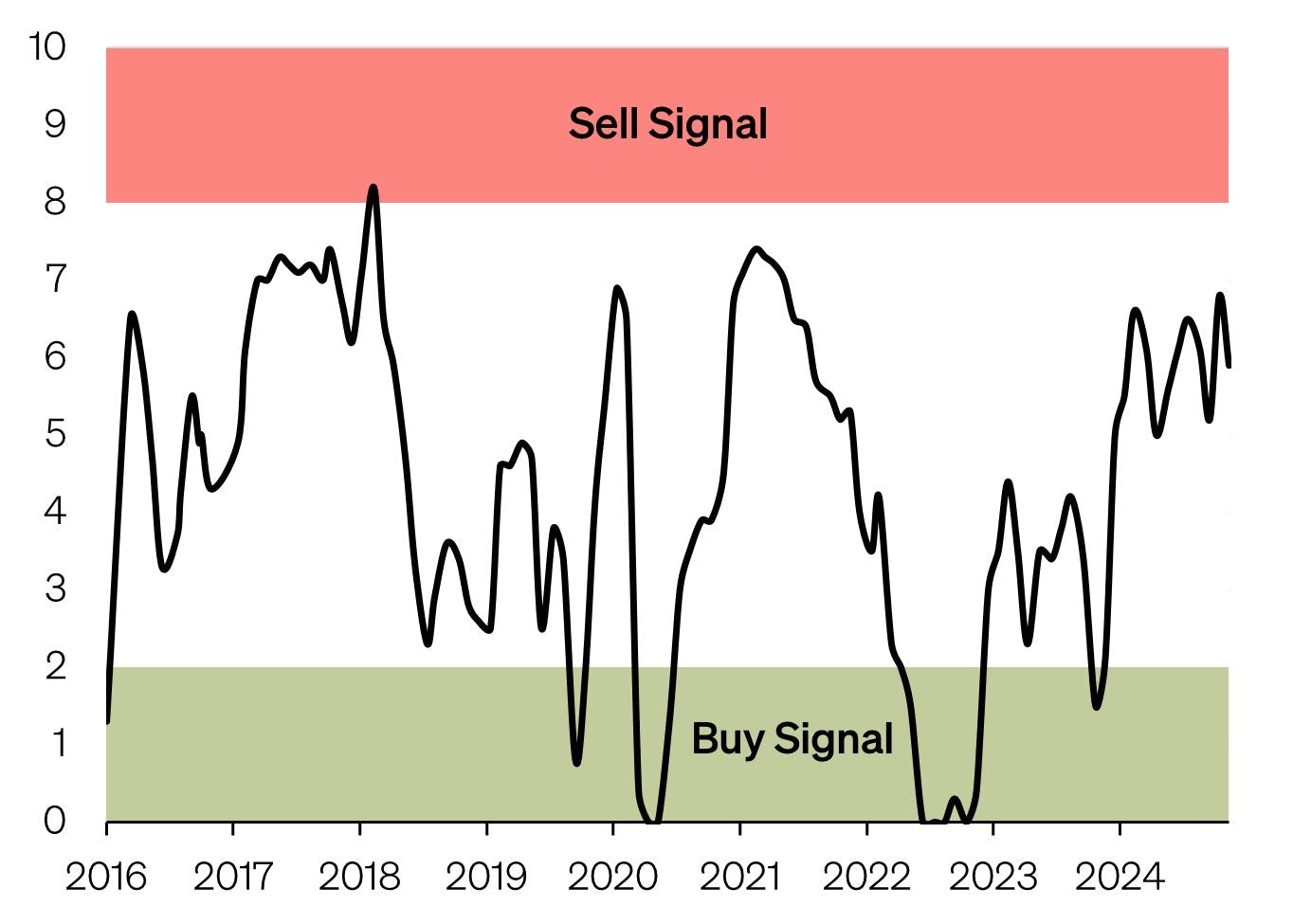

Given current high valuations and ambitious earnings expectations for 2025, we maintain a neutral stance on equities. In light of the subdued outlook for the consumer staples sector this earnings season, we are reducing our overweight in the sector to a neutral position. In fixed income, we continue to avoid credit risk, as risk premiums have fallen to record lows following the U.S. elections.

Appendix

SoundInsights is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with SoundInsights. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by SoundCapital (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2024 SoundCapital. All rights reserved.

Datasource: Bloomberg, BofA ML Research