SoundInsightN°30

Bonds

Equities

Between Crash and Opportunity

At the beginning of April, financial markets were rattled by significant volatility. Within just two trading days, global equities lost nearly 10%, a drop in speed and magnitude only exceeded by the Global Financial Crisis and the COVID-19 pandemic.

The sharp correction unsettled many investors. The sudden reversal raised key questions: What does this mean for my portfolio? And where do we go from here?

In this edition, we aim to put recent events into perspective, examining the underlying risks as well as emerging opportunities. We also share our assessment of the most likely scenario ahead and how we are currently positioning our portfolios.

What Happened, and Why?

In early April, the U.S. administration under President Trump announced sweeping tariff increases, a dramatic pivot towards deglobalization. These measures not only cast doubt on the future of international trade but have also triggered a wave of uncertainty for businesses and investors alike.

Markets responded swiftly and sharply: global equities temporarily shed more than USD 10 trillion in market capitalization, an amount equivalent to the combined GDP of Germany, Japan, and Canada. This underscores the scale and impact of the policy shift.

At the same time, the U.S. dollar came under pressure as a growing number of analysts began to question the long-term sustainability of American economic leadership. The sudden shift in trade policy has undermined confidence in the current economic trajectory and prompted capital reallocations. Traditional “safe havens” such as gold benefited meaningfully from this surge in uncertainty.

While the trigger was political, the repercussions are economic: the new trade barriers are broadly perceived by investors as a headwind for global growth. Corporates are holding back on investment, and for the first time in years, many private investors are confronted with meaningful market losses.

What Lies Ahead?

We see three potential scenarios unfolding over the coming months. At present, we view a volatile sideways market as the most probable outcome.

Base Case: Sideways with Volatility

There is currently no clear direction: policy announcements and trade rhetoric remain erratic and inconsistent. As a result, we expect markets to oscillate between hope and skepticism, with continued high volatility driven by political headlines, macroeconomic data, and central bank commentary.

Stabilizing Factors:

- Sentiment indicators are signaling excessive pessimism, often a contrarian indicator pointing to oversold conditions and the potential for short-term rebounds

- Initial discussions with key trading partners suggest a willingness to negotiate, fueling hopes of de-escalation

- Consumer spending among affluent households remains stable, according to Bank of America credit card data, no discernible "wealth effect" so far despite the market pullback

- Bloomberg Economics continues to project positive, albeit slower, global growth

Headwinds:

- Existing tariffs are accelerating deglobalization, with long-term implications for productivity and trade

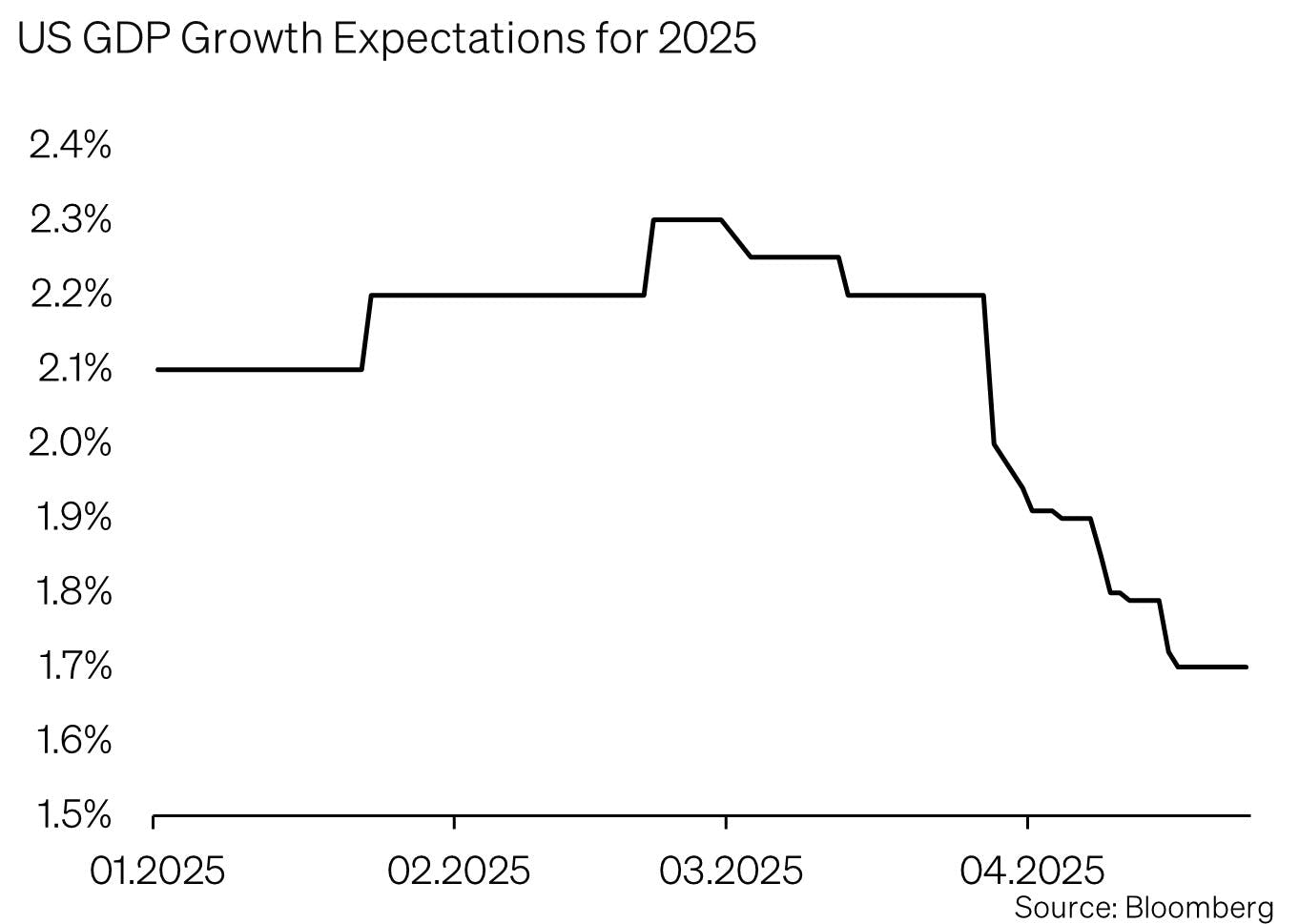

- Downward revisions to growth forecasts are weighing on investor sentiment

- Labor market indicators are beginning to soften, particularly in hiring trends

- Inflation expectations are rising sharply again

- The Federal Reserve’s hands are tied, no strong monetary stimulus is currently expected

- Capital outflows may increase as the U.S. loses relative appeal as an investment destination

At present, these opposing forces are largely in balance. This supports the view that we may remain in a volatile trading range, directionless, but highly sensitive to new developments.

Positive Scenario: A Swift Recovery

In a best-case scenario, tariffs are rolled back entirely. Such a move would likely spark a rapid market recovery from the recent sell-off.

Key Preconditions:

- Progress in trade negotiations, particularly with China

- Strong corporate earnings, especially from high-growth sectors

- Supportive central bank actions (e.g., rate cuts or liquidity measures)

- A rebound in investor sentiment and renewed risk appetite

Still, the recent turbulence is likely to leave lasting effects. Many investment decisions have already been postponed due to diminished planning certainty. Growth expectations set at the beginning of the year now appear overly optimistic.

Negative Scenario: Prolonged Weakness or Recession

In a more adverse scenario, the market shock signals the beginning of a broader economic downturn. Trade conflicts intensify, confidence erodes, and the global economy enters a phase of stagnation, or even recession.

Key Preconditions:

- An escalation of tariffs and retaliatory measures

- Declining corporate investment and weakening consumption

- Inadequate or delayed central bank responses

- Rising political uncertainty on a global scale

While this scenario remains a possibility, we currently view it as unlikely. President Trump, the driving force behind current trade policy, has little interest in triggering a self-inflicted recession, particularly with an eye toward reelection. The tariffs are best interpreted as a bargaining tool rather than a long-term strategy. A severe economic downturn would undermine his political standing, suggesting a strong incentive to avoid further escalation.

How Should Investors Position Themselves?

In a volatile environment, stability, flexibility, and targeted opportunity are essential. Our current portfolio positioning reflects this mindset: cautious, yet ready to act when opportunities arise.

Focus on Quality and Dividend Resilience

We favor companies with robust business models, consistent cash flows, and sustainable dividend policies. High-quality dividend stocks not only offer ongoing income but also tend to demonstrate resilience in volatile markets.

Utilities as a Defensive Element

Utility stocks provide stable, non-cyclical revenue streams, making them a valuable defensive component in any portfolio, especially during periods of economic slowdown.

Swiss Equities

Swiss companies are globally recognized for their quality, innovation, and international footprint. Combined with political stability and a strong currency, Swiss equities form a solid portfolio anchor in uncertain times.

Liquidity

We are currently maintaining elevated cash positions, not as a retreat, but as a tactic tool. This liquidity gives us the flexibility to act swiftly and decisively when market dislocations create attractive entry points.

Strategic Thinking, Tactical Execution

We remain committed to our long-term strategy while reacting tactically to market shifts. Short-term pullbacks are not a reason to panic, but a chance to selectively add to quality positions at compelling valuations.

Gold as Strategic Insurance

Given ongoing geopolitical and monetary uncertainties, gold remains a reliable portfolio hedge. Its low correlation with other asset classes enhances overall portfolio resilience, particularly during periods of market stress.

Conclusion: Calm, Perspective, and a Clear Strategy

The current market environment is undoubtedly challenging: politically charged, economically uncertain, and marked by high volatility. Yet it is precisely in such times that the value of a long-term investment strategy becomes clear.

Those who act with discipline, prioritize quality, and maintain a well-diversified portfolio can not only mitigate risks but also seize opportunities.

Flexibility remains crucial. Market downturns may push equity allocations below their strategic targets, not through active decision-making, but simply due to falling prices. That’s precisely why we maintain liquidity: to rebalance portfolios and reallocate capital when valuations become compelling.

As asset managers, we closely monitor developments and intervene where market disruptions call for tactical adjustments. Always with the aim of acting in the long-term interest of our clients.

While the short-term outlook remains uncertain, markets continue to reward investors who stay disciplined, diversify thoughtfully, and follow their strategy with enough flexibility to capitalize on emerging opportunities.

It’s also essential to keep a broader perspective: despite current turbulence, technological innovation marches on. In particular, the accelerating adoption of artificial intelligence promises significant productivity gains in the years ahead, a powerful structural driver of long-term economic and market growth.

Appendix & Disclaimer

SoundInsights is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials

Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong. - Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with SoundInsights. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by SoundCapital (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2025 SoundCapital. All rights reserved.

Datasource: Bloomberg, BofA ML Research