SoundInsightN°33

Bonds

Equities

Between Record Highs, Politics, and Artificial Intelligence

This summer brings fresh record highs in equity markets, mixed signals from the Federal Reserve, a reality check for the corporate world, and continued momentum around artificial intelligence. While global equities (in USD) set new all-time highs, the outlook is shaped by political uncertainties, corporate earnings, and the question of how profoundly AI will transform the economy.

New Records – Tempered by Currency Moves

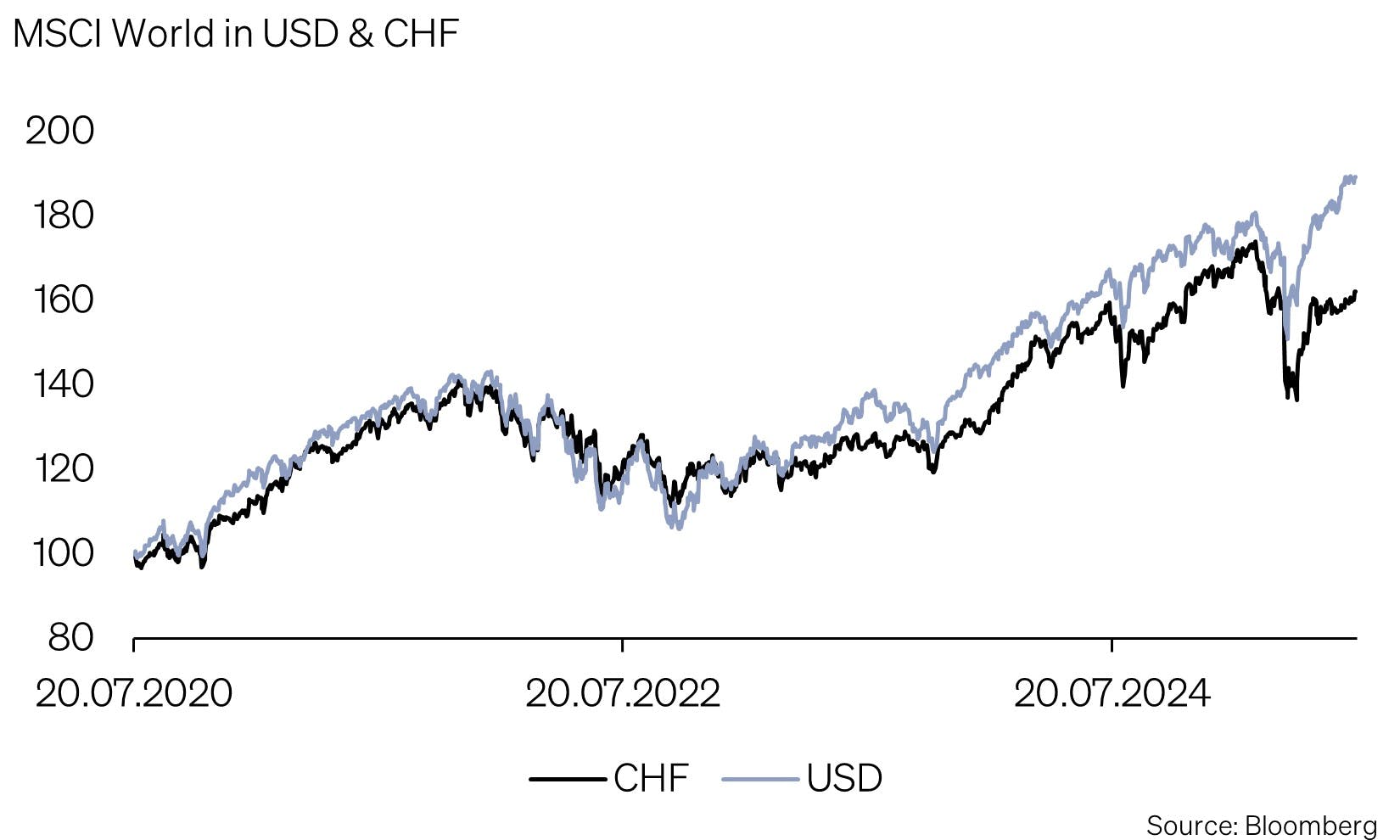

Global equity markets climbed to new highs in USD in July 2025, but in Swiss francs the record stayed out of reach, weighed down by the dollar’s weakness.

While local-currency prices have advanced, political pressure is weighing on the dollar and eroding confidence in its stability. President Trump has been loudly demanding lower interest rates and a weaker dollar to boost U.S. competitiveness. This rhetoric undermines faith in the Federal Reserve’s independence and the integrity of monetary policy itself, culminating in unprecedented personal attacks on Fed Chair Powell and calls for his resignation.

For now, however, markets are largely shrugging off the turmoil in monetary and currency policy. As equities climb, sentiment brightens: fund managers are holding little cash, but full-blown euphoria has yet to emerge, leaving room for further gains. Seasonal trends also favor July, which has delivered positive average returns for over a decade.

Fed: Patience Despite Easing Inflation

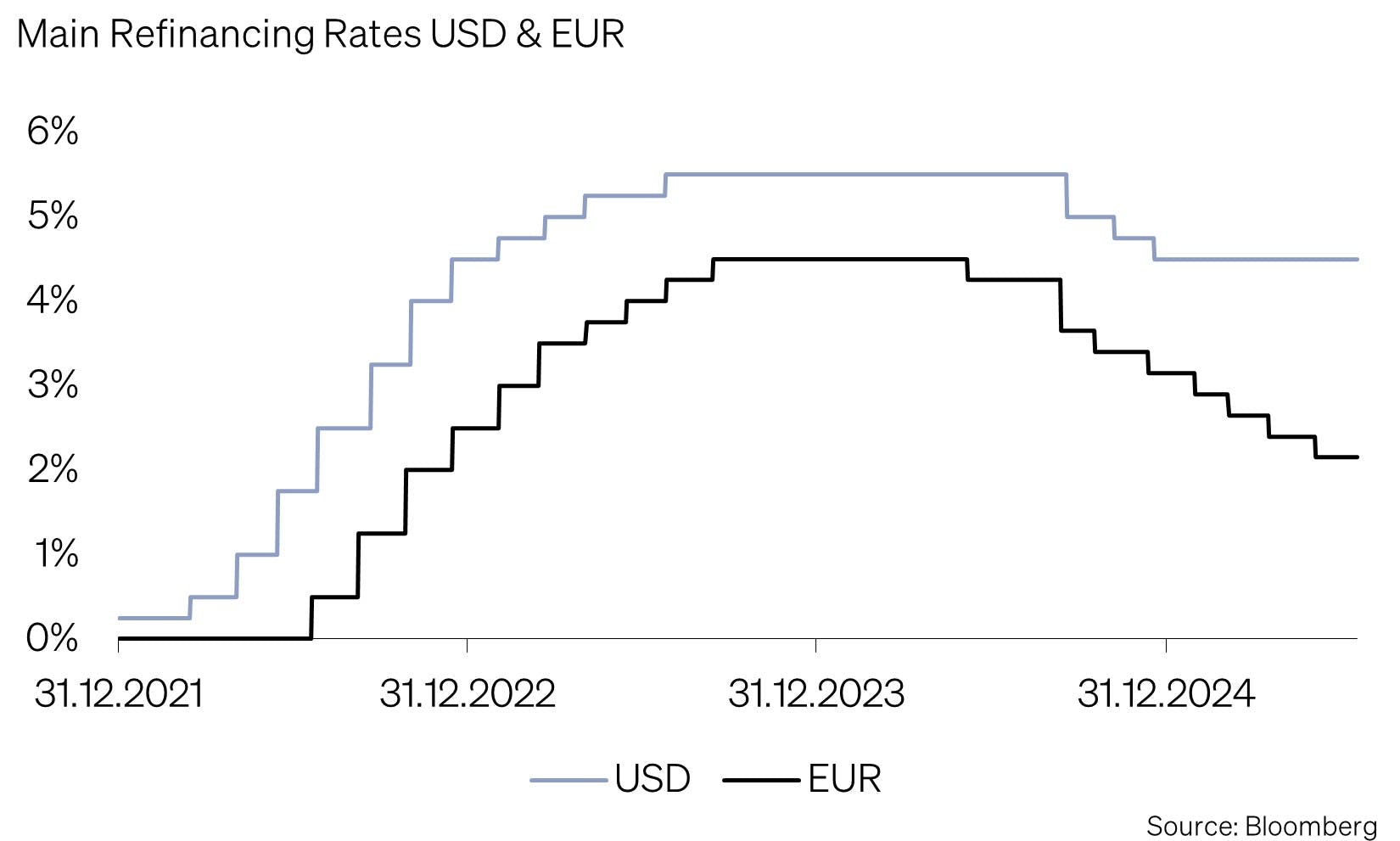

The Fed remains cautious about cutting rates, even as inflation has eased in recent months. Yet this downward trend appears to have stalled, with prices rising again in several areas. Contributing factors include new import tariffs, erratic White House policies, and potential second-round effects. Nevertheless, markets still expect two rate cuts by year-end, totaling about 0.5%.

Risks to the economy persist:

- Government tariff revenues have already increased by about USD 230 billion (annualized) since the end of 2024, equivalent to roughly 1% of GDP and 10% of corporate profits.

- The new budget is likely to deliver only modest stimulus later in the year, while stricter immigration policies act as an additional brake.

- Trump’s public pressure on the Fed and Powell further clouds the outlook.

Given this backdrop of uncertainty, the Fed’s cautious stance appears prudent and justified.

Earnings Season: A Reality Check

With the earnings season underway, fundamentals are back in focus. Large technology firms are under particular scrutiny, tasked with meeting high expectations for AI-driven growth. The key question is whether they can deliver on ambitious revenue and margin targets.

We expect growing differentiation: companies that clearly benefit from new technologies are likely to outperform those buoyed only by general enthusiasm. For Q2, Wall Street forecasts just 2% earnings growth for the S&P 500, the weakest in two years. Excluding the technology sector, a decline of around 0.7% is projected, reflecting more cautious expectations following “Liberation Day.”

Encouragingly, technological progress shows no signs of slowing. Other industries are also beginning to reap the rewards of significant data center investments, evidence that AI is having a broad and meaningful impact.

Artificial Intelligence: More Than Just Hype

AI remains a defining theme. After strong market performance, the question arises: are valuations justified? In our view, yes, for now. Growth expectations have been met, and momentum remains strong. AI is becoming an increasingly central driver of productivity and innovation, well beyond the tech sector. Early efficiency gains are already visible in other industries, and these are expected to accelerate in the years ahead.

Demand for computing power remains high, particularly from inference workloads, the computational demands of running AI models millions of times daily. This is fueling demand for data centers and graphics processors.

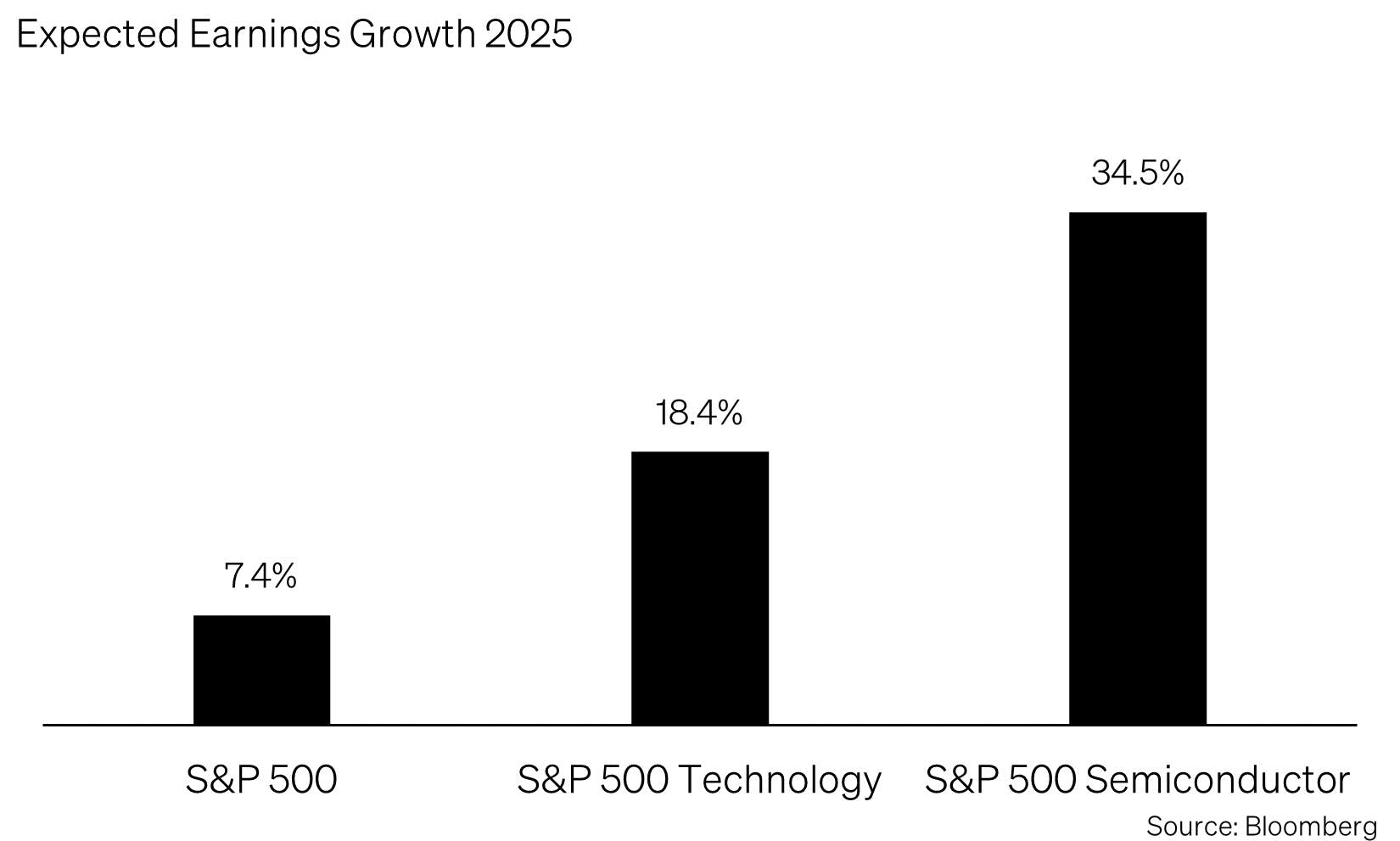

Current earnings forecasts for 2025 underscore this dynamic: while overall S&P 500 earnings are projected to grow by 7.4%, the technology sector is expected to deliver 18.4%, with semiconductors achieving an impressive 34.5%.

The medium-term outlook for AI remains constructive. According to Bank of America, global data center investments could reach USD 1 trillion by 2030, growing 26% annually. By then, AI could account for over 10% of global IT budgets, up from around 1% in 2023.

What Does This Mean for Investors?

Rising U.S. political uncertainty, spanning trade, fiscal, and monetary policy, has diminished the appeal of Treasuries as a safe haven. In contrast, investment-grade corporate bonds have emerged as an attractive refuge, currently offering higher total returns and lower volatility than U.S. government bonds, a rare reversal driven by policy uncertainty and fiscal laxity.

Although Treasuries are traditionally seen as the risk-free benchmark, their recent volatility has challenged that perception. By comparison, the stable earnings and low perceived credit risk of high-quality corporate bonds stand out.

We have therefore reduced our allocation to government bonds and increased our exposure to high-quality corporate debt, which currently offers a more balanced risk-return profile and benefits from the robust financial health of many issuers.

We also deliberately integrate the AI megatrend into our portfolios. Technological progress remains the key driver of productivity, innovation, and earnings growth in the coming years, now evident across an entire value chain, not just among “Big Tech.”

Accordingly, we have established a dedicated AI position within our portfolios, ensuring investors can participate directly in the structural growth opportunities and efficiency gains ahead.

In addition to focusing on corporate bonds and AI, we maintain a broadly defensive positioning. We favor quality dividend-paying stocks with strong balance sheets and reliable earnings, which provide resilience even in challenging markets. We also continue to find attractive opportunities in the Swiss equity market.

Appendix & Disclaimer

SoundInsights is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials

Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong. - Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with SoundInsights. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by SoundCapital (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2025 SoundCapital. All rights reserved.

Datasource: Bloomberg, BofA ML Research