SoundInsightN°37

Bonds

Equities

U.S. Labor Market – From Anchor of Stability to Source of Risk

This fall, the U.S. labor market has moved into the spotlight. After a period of tight monetary policy, the Federal Reserve cut interest rates for the first time since late 2024. Investors are now watching employment numbers closely, as they are key for both economic momentum and the Fed’s policy path. The latest weak job data has fueled expectations of further easing. With the labor market at the heart of consumer spending, corporate profits, and market sentiment, it is the right time for a closer look.

Key Developments

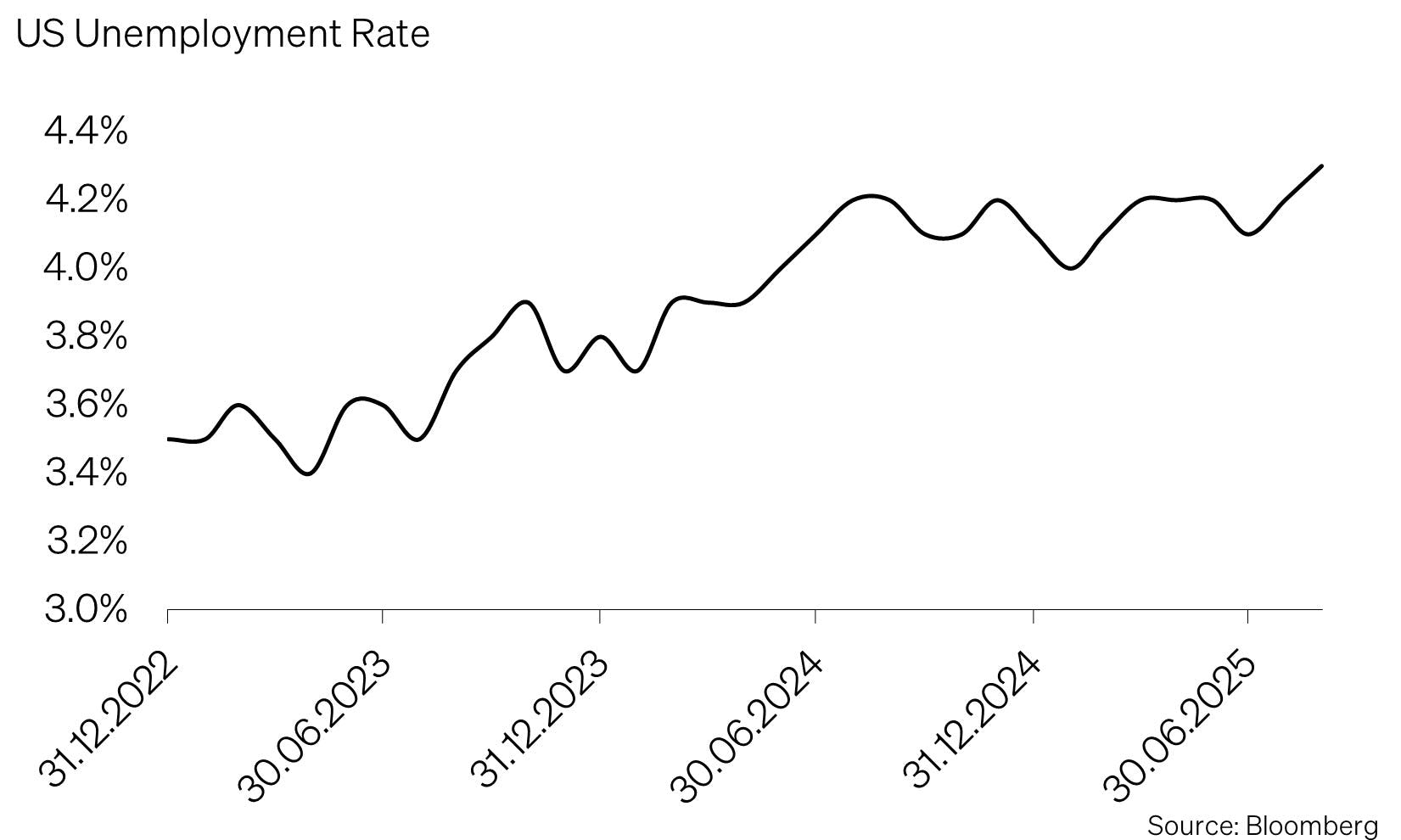

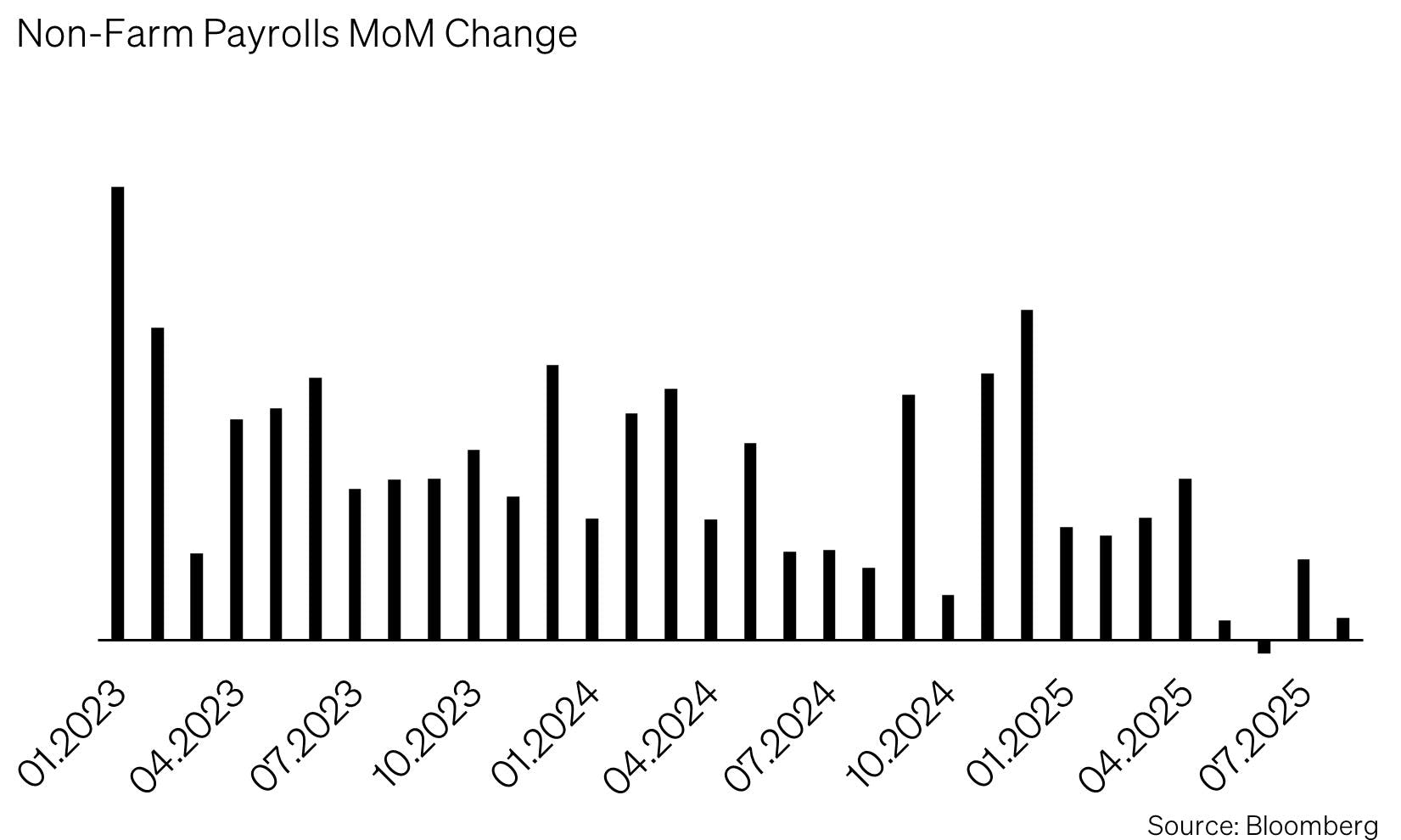

Since spring 2025, labor market momentum has slowed noticeably. From April to July, job creation almost came to a standstill: only 14,000 new jobs were added in June, compared with 158,000 in April. On a three-month average, job growth was just 35,000 – well below the level needed to keep unemployment steady. The jobless rate climbed to 4.3% in August, the highest in nearly four years.

A Mirage of Job Growth

A preliminary revision by the Bureau of Labor Statistics (BLS) painted an even weaker picture: in the twelve months through March 2025, about 911,000 fewer jobs were created than initially reported. That puts monthly job growth at just 71,000 instead of 147,000. Political interference – such as President Trump’s dismissal of the BLS director following disappointing June numbers – has further raised concerns about data reliability.

Headwinds: Policy and Demographics

Several factors are weighing on the labor market. Tighter immigration rules and reverse migration have reduced labor supply, while government budget cuts have eliminated nearly 100,000 public sector jobs since January. Industry has also been hit by new import tariffs, with manufacturing posting job losses for a fourth straight month this summer.

Demographics add another structural headwind. The Congressional Budget Office (CBO) has cut its population forecast for 2035 by 4.5 million compared to earlier this year, reflecting lower immigration and declining birth rates. A slower-growing population directly limits labor supply. According to Bloomberg economists, the U.S. now needs only about 70,000 new jobs per month to stabilize unemployment – far fewer than the long-standing rule of thumb of 150,000.

Interpretation and Outlook

Analysts increasingly view the labor market through the lens of the economic cycle. Bloomberg Economics estimates that the employment boom peaked as early as Q2 2024. Since then, growth has weakened sharply, even turning negative in some months. This suggests the U.S. economy may be on the brink of recession – or at the start of a new expansion. Signs of a turning point in mid-2025 are mounting, with June seen as the trough.

Fed Response and Market Impact

The Federal Reserve cut its key rate by 25 basis points on September 17, 2025. Chair Jerome Powell described the move as a precautionary “risk management” step and signaled openness to further easing.

Markets reacted quickly: short-term Treasury yields fell, long-term yields edged higher, and the yield curve steepened. Equity markets saw the strongest gains in interest-rate-sensitive technology stocks, while broader indices were more subdued. Corporate bonds and other risk assets also benefited.

Investment View

With monetary policy shifting from fighting inflation to supporting jobs, the risk remains that inflation could unexpectedly reemerge. The macro backdrop is fragile and calls for selective positioning.

- Bonds: We maintain our overweight in longer U.S. maturities. Should growth prospects weaken further and yields decline, we would move duration back in line with the benchmark.

- Equities: We closed our overweight in utilities after strong outperformance. Attractive opportunities now arise from a weaker U.S. dollar and compelling valuations in China. Accordingly, we upgraded emerging markets to overweight, with a clear focus on China.

- Alternative Investments: We remain overweight in gold. However, after a strong rally of over 40% in USD terms year-to-date, investors may consider taking partial profits if the position has grown too large.

For investors, the decisive question is whether labor market weakness leads to a soft landing, a deeper downturn, or the start of a new cycle. The ideal case would be falling inflation without significant job losses – allowing the Fed to ease rates gradually and support risk assets.

Our Investment Committee continues to monitor the situation closely and will adjust strategy as needed – aiming to capture opportunities while cushioning risks early.

Appendix & Disclaimer

SoundInsights is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials

Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong. - Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with SoundInsights. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by SoundCapital (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2025 SoundCapital. All rights reserved.

Datasource: Bloomberg