SoundInsightN°38

Bonds

Equities

Structural shift: Growth over price stability

Geopolitical tensions between the US and China intensified again in October. Bloomberg reports that Washington is weighing sweeping export restrictions on software that could affect a wide range of critical applications. The move follows Beijing’s announcement that it will curb exports of rare earths - the metals essential to the global high-tech industry.

The result could be a further decoupling of technology and supply chains between the world’s two largest economies. Recent developments underscore how closely geopolitical rivalry and technology policy are now intertwined.

Macroeconomic overview

The world economy is in transition - disinflation is taking hold even as growth risks rise.

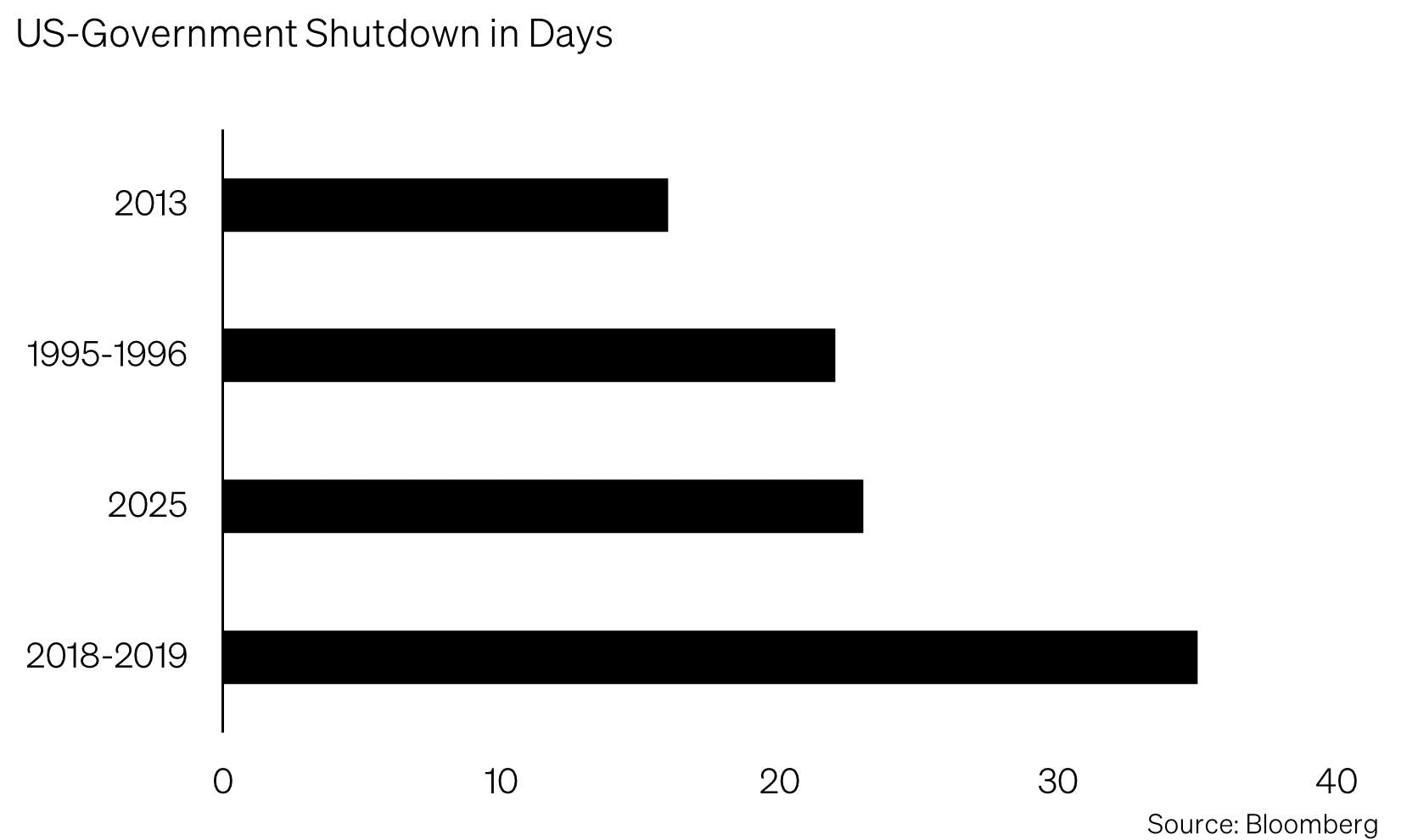

Economic activity in the United States is broadly flat, according to the Fed’s Beige Book, a periodic report summarizing regional economic conditions. Consumption and employment still support the cycle, but momentum is fading. The labor market remains stable, though hiring has turned more cautious. The government shutdown that began on 1 October complicates assessment by delaying key data releases, and it is now considered one of the longest shutdowns in history.

Inflation sits modestly above the Federal Reserve’s target but is trending lower - leaving room for a 25 bp rate cut at month-end.

European growth remains below trend. France’s budget dispute is weighing on the euro area, while Germany’s investment programs in defense and infrastructure could provide longer-term impulses.

Moreover, the rekindled US–China trade conflict adds uncertainty. Washington is threatening tariffs of up to 100% on Chinese imports from November, while new port fees are pushing up transport costs. Despite these risks, equities are trading just shy of record highs - perhaps reflecting hopes that a meeting between Donald Trump and Xi Jinping could offer a window for political de-escalation.

Overall, the global economy remains resilient, but outcomes are increasingly shaped by political decisions and geopolitics.

Capital markets & corporate earnings

Equities oscillated in October between political nervousness and solid fundamentals. After setting new highs early in the month, markets posted their sharpest pullback since April, triggered by the threat of new US tariffs on China. In the aftermath, 10-year US Treasury yields fell below 4%, signaling rising doubts about growth.

At the same time, the US earnings season provided a stabilizing anchor. An unusually high share of companies beat analyst expectations, and earnings breadth improved - especially across Financials, Industrials, and selected cyclicals.

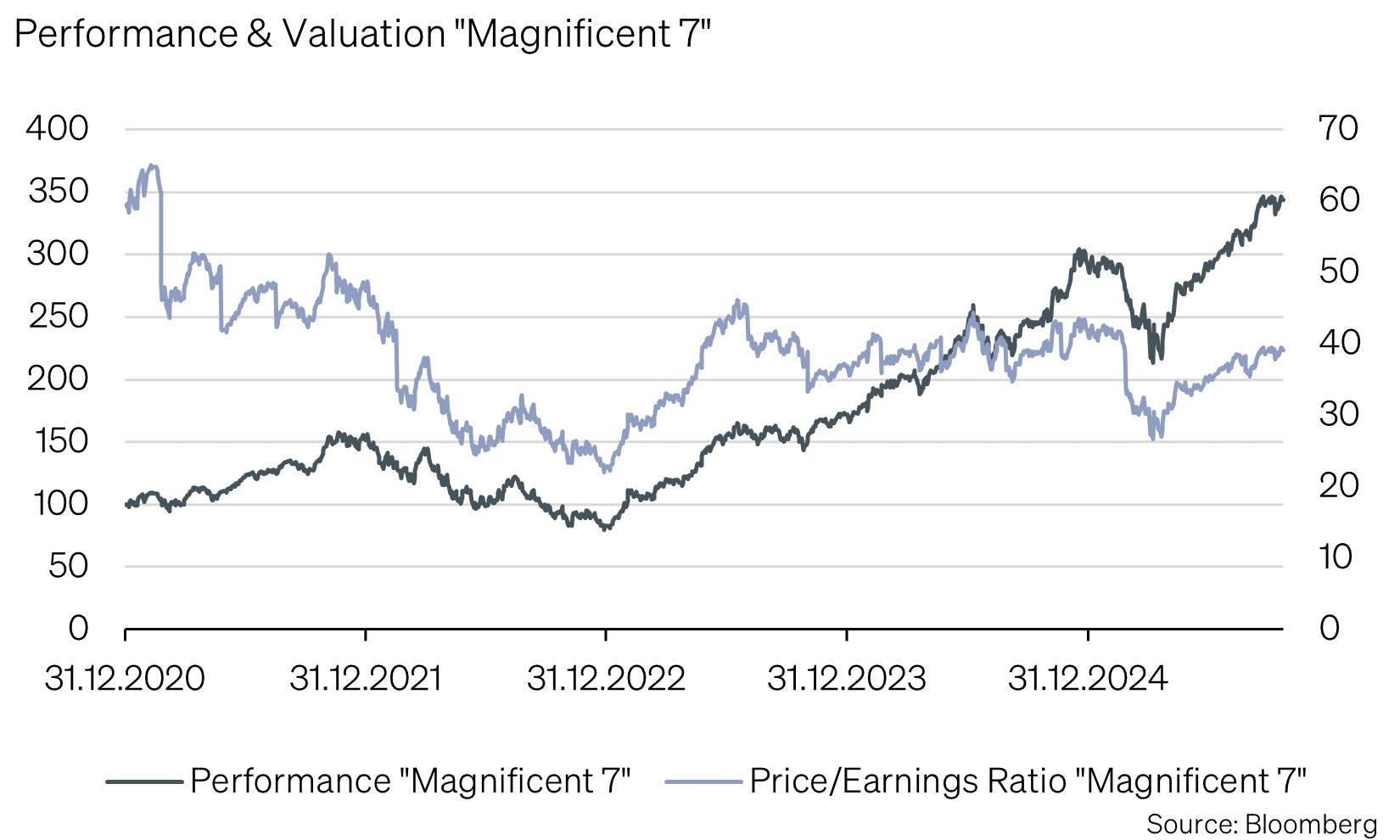

Technology remains in an upswing. Heavy investment in cloud and AI infrastructure is powering the cycle, while also stoking concerns about potential overheating. Strong capital inflows and some circular investment within the AI ecosystem evoke past excesses. That said, today’s leaders differ from the dot-com era: many generate robust profits, lending structural support to valuations.

From inflation watch to growth diagnosis

After two years dominated by inflation control, markets are shifting toward assessing the sustainability of global growth. Three forces define this transition:

- Policy: The US government shutdown and trade frictions create short-term uncertainty but also increase pressure for monetary easing.

- Earnings breadth: Positive surprises are expanding beyond Tech—an essential precondition for more durable growth.

- Rate cycle: A turn toward easier US policy could prove the decisive catalyst.

Years of elevated USD rates have parked substantial cash in money market funds. By Bank of America estimates, US households hold ~USD 19.6 trillion - potential fuel for the next growth phase. Falling yields could redirect capital into higher-return assets, supporting liquidity and valuations.

The key is a sufficiently stable macro backdrop to cement confidence in a “soft landing.” If that materializes, today’s “idle” liquidity could become tomorrow’s demand.

Implication: Keep portfolios quality-oriented while selectively adding cyclicality - for example, Industrials and targeted AI-infrastructure suppliers. Extend duration to re-establish bonds as shock absorbers, especially against growth shocks rather than inflation shocks.

Positioning & strategy

Bonds

- Duration: Prefer longer duration in USD and GBP as the rate cycle has likely peaked; neutral in EUR; shorter in CHF.

- Quality: Focus on investment-grade issuers with solid balance sheets; keep high yield underweight.

Equities

- Regions: Favor Switzerland and emerging markets with a China focus.

- Sectors: Emphasize companies leveraged to the AI infrastructure build-out.

- Style: Tilt to quality and cash-flow-strong dividend stocks. The prior low-volatility US tilt has been recalibrated toward a more benchmark-aligned allocation.

Alternatives

- Commodities: Maintain a slight overweight in gold as a strategic diversifier. After a strong run, partial profit-taking remains prudent given higher volatility.

Outlook & conclusion

Markets sit between geopolitical risk and robust corporate earnings. Despite rising uncertainties, the base case remains one of stable but moderating expansion.

We view this as a transition from inflation worries to growth questions. A measured policy easing alongside continued corporate earnings growth could set the stage for a constructive investment environment in 2026.

Appendix & Disclaimer

SoundInsights is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials

Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong. - Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with SoundInsights. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by SoundCapital (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2025 SoundCapital. All rights reserved.

Datasource: Bloomberg