SoundInsightN°39

Bonds

Equities

Data Fog & Money Market Tensions

The fourth quarter has so far been dominated by the longest government shutdown in U.S. history. The consequences: slower economic momentum, distorted or delayed economic data, and heightened uncertainty for both businesses and the Federal Reserve. For investors, this means visibility is low and short-term market swings may become more pronounced.

The 42-day shutdown has left clear marks on Q4. Instead of expanding by nearly 2%, GDP is now expected by Bloomberg to grow only around 0.5%. Some of this weakness is likely to be recouped in early 2026, supported by a modest rebound in the services sector.

More problematic than the temporary slowdown is the lack of reliable data: For months, key indicators have been missing – a rare scenario forcing both economists and markets to navigate in the dark.

Labor Market & Business Surveys: Cooling, Not Contracting

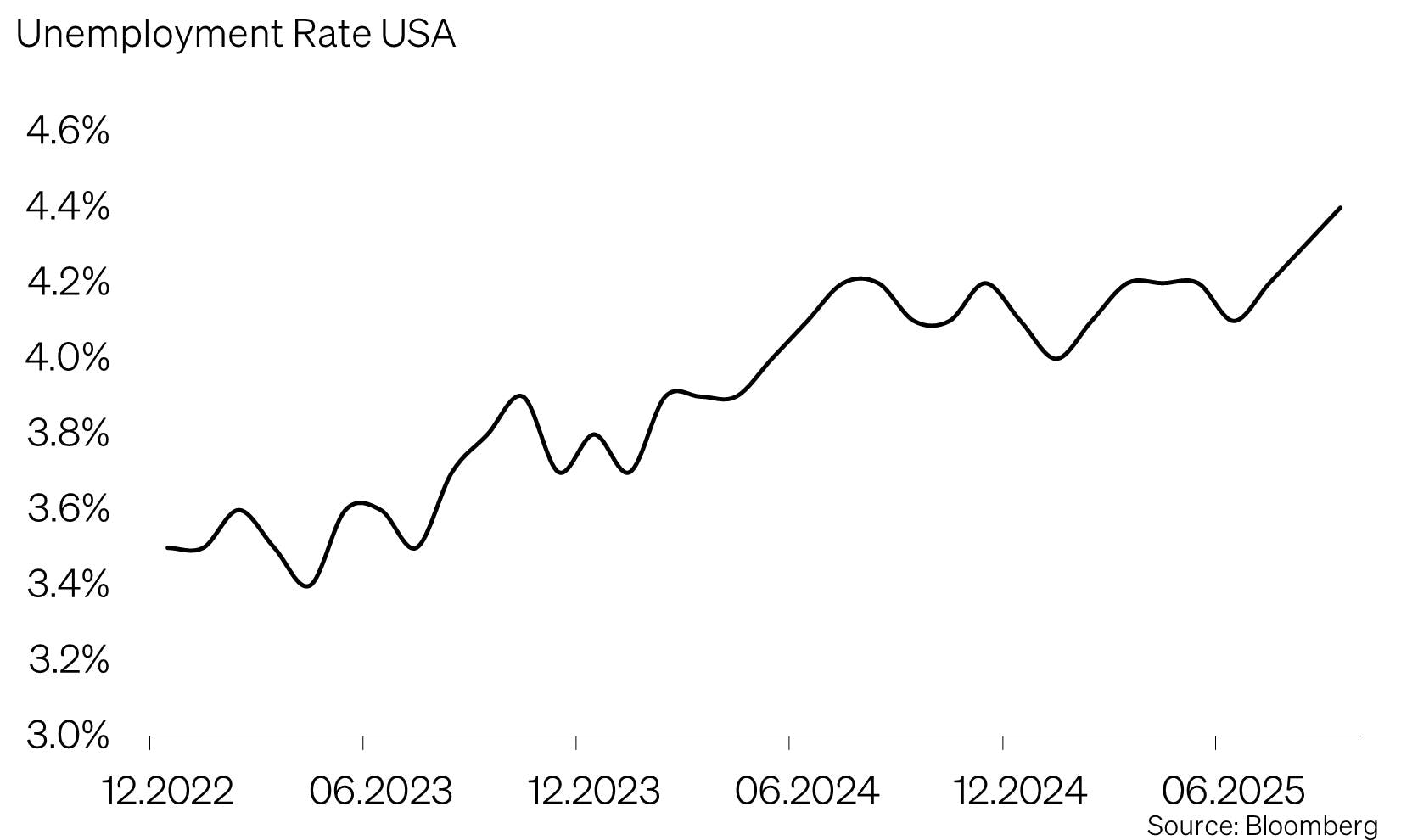

Alternative high-frequency indicators point to a loss of momentum:

- The labor market remains solid but is showing fatigue — fewer new hires and a stronger focus on efficiency.

- Large-scale layoffs have not materialized.

- Manufacturing PMIs signal softer activity, while conditions in the services sector are gradually improving.

Overall, the evidence is consistent with a late-cycle environment rather than the start of a sharper downturn.

Consumer Behavior & Sentiment: Households Turn More Cautious

Consumers entered the quarter on a restrained note:

- Auto sales are declining.

- Small businesses are growing more pessimistic.

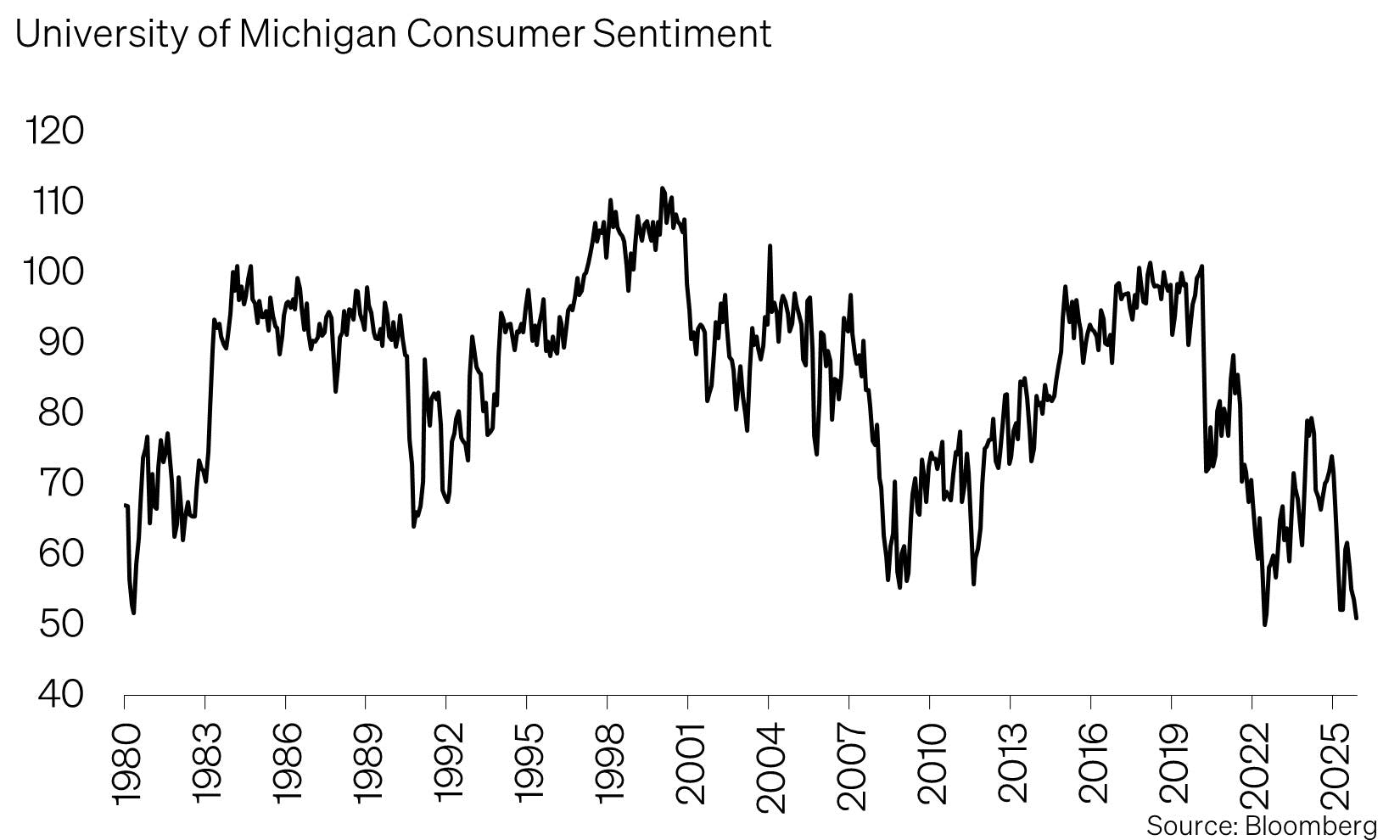

- Consumer sentiment (University of Michigan) has fallen to historically low levels.

This increases the risk that consumption — previously a pillar of growth — could become a vulnerability. Notably, history shows sentiment troughs have often marked strong entry points for equities:

When sentiment was at record highs, the S&P 500 averaged only 3.9% over the following 12 months; after record lows, returns averaged 24.9%. A clear reminder: pessimism is often a contrarian opportunity.

Inflation & the Fed: Monetary Policy in a Data Vacuum

For its final meeting of the year, the Federal Reserve lacks key inflation and labor-market readings. At the same time, the pending Supreme Court decision on the legality of U.S. tariffs (IEEPA) adds another layer of uncertainty.

Most Fed officials continue to signal a tilt toward easing. The direction — lower rates — is clear; the pace remains uncertain.

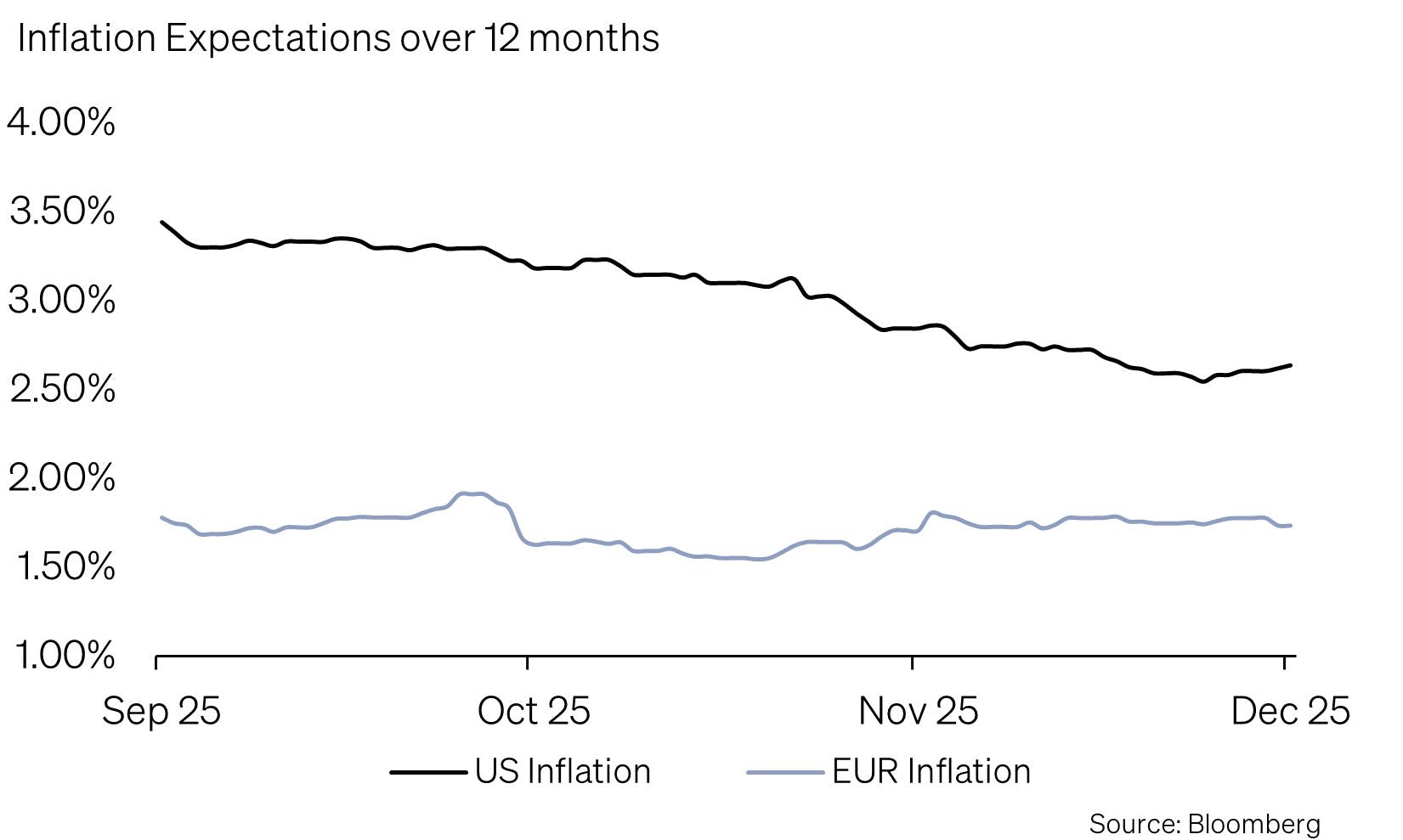

After the Fed refrained from committing to a December rate cut, yields initially rose. However, weaker data have since led markets to price in a 95% probability of a cut. U.S. yields and inflation expectations have moved lower accordingly.

Equity Markets: Strong Earnings, Narrow Market Breadth

Despite the challenging environment, equity markets remain resilient — largely because corporate results continue to impress.

U.S. Q3 earnings again delivered:

- Earnings growth was roughly 13% year-on-year, marking the fourth consecutive quarter of double-digit gains.

- About 82% of companies beat earnings expectations — well above the 5-year average (78%) and the 10-year average (75%).

- Ongoing investment in artificial intelligence and infrastructure remains a key driver.

Still, valuations are demanding, and a small cohort of mega-caps continues to power the majority of market gains. Sustained progress will require earnings strength to broaden.

We therefore maintain a neutral stance on equities and express our conviction through regional and thematic positioning.

Focus Topic: Why the U.S. Money Market Is Under Strain

What’s happening?

Since September 2025, signs of stress have emerged in U.S. money markets. SOFR — the key benchmark for overnight secured dollar funding — has repeatedly exceeded the Fed’s target range. The New York Fed even convened an unscheduled meeting with major Wall Street banks in mid-November to address tensions — an unusual step reflecting the Fed’s concern.

Why is cash becoming scarce?

Three forces are draining dollars from the system:

- Quantitative Tightening (QT)

Since June 2022, the Fed has reduced its balance sheet by around USD 1.8 trillion by allowing maturing securities to roll off — directly removing liquidity from the banking system. - High Treasury Issuance

Large volumes of short-dated T-Bills pull cash from banks and money-market funds, reducing the liquidity available for short-term financing. - Year-end Balance Sheet Effects

Banks shrink their balance sheets for reporting purposes, further tightening cash availability.

Bank reserves fell from around USD 3.2 trillion at the end of 2024 to roughly USD 2.9 trillion in November 2025 — approaching a critical level.

Potential implications

- Similar tensions occurred in September 2019, when repo rates suddenly spiked to 5.25% and the Fed had to intervene.

- Higher repo rates could destabilize the hedge-fund “basis trade,” potentially triggering selling pressure in Treasuries.

- If banks grow concerned about their own liquidity, they may restrict lending — ultimately affecting businesses and consumers.

How is the Fed responding?

- QT ended on December 1, 2025, halting the ongoing liquidity drain.

- The Standing Repo Facility (SRF) is ready to provide cash against Treasuries as a backstop.

- The Fed has already injected more than USD 50 billion in a single day via the SRF — the highest amount since 2021.

The situation is tense but not alarming. The Fed has learned from 2019 and is acting proactively. While year-end turbulence is possible, liquidity conditions should improve in 2026 as QT ends.

Portfolio Positioning at a Glance

Bonds

- Duration: Long in USD & GBP, neutral in EUR, short in CHF.

- Credit: Focus on high-quality issuers; avoid high-risk credit.

Equities

- Switzerland overweight: stable business models, strong balance sheets, attractive dividends, reasonable valuations.

- Japan underweight: rising rates and a potentially stronger yen weigh on corporate earnings.

- Emerging markets overweight: beneficiaries of lower U.S. rates; early stabilization in China; attractive valuations.

- Artificial Intelligence overweight: remains a powerful structural growth engine.

- Quality dividend stocks overweight: provide stability and reliable income.

Alternative Investments

Diversified strategies and select real assets such as gold serve as portfolio stabilizers and long-term inflation hedges.

Outlook

The coming months will remain clouded by uncertainty — primarily due to missing or distorted U.S. economic data. Nonetheless, indicators continue to point toward a moderate cooling rather than an abrupt downturn.

For the Fed, the balancing act remains challenging: lower inflation and a softening labor market argue for cuts, while the data fog and money-market strains caution against moving too quickly.

In this environment, portfolio quality, liquidity, and broad diversification are crucial. We remain flexible and will adjust positioning as conditions evolve.

Year-End Message

This edition of SoundInsights is the final one of the year. We extend our sincere thanks for your continued engagement. Your interest and feedback give this newsletter its purpose and value.

We wish you a peaceful, joyful holiday season and a successful end to the year.

We’ll be back at the start of 2026 with an extended edition — including a full review of 2025 and our outlook for 2026. We look forward to staying at your side in the year ahead.

Appendix & Disclaimer

SoundInsights is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials

Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong. - Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with SoundInsights. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by SoundCapital (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2025 SoundCapital. All rights reserved.

Datasource: Bloomberg