SoundInsightN°40

Bonds

Equities

SoundInsights - Outlook 2026

The past year reaffirmed a timeless market truth: forecasts generate attention, discipline generates returns. Unexpected political decisions—most notably U.S. trade policy—triggered sharp market reactions and rapid revisions to earnings expectations. Many investors responded to announced tariffs with panic selling and subsequently missed the recovery that followed. Contrary to widespread expectations, inflation and interest rates remained broadly stable, and equity markets quickly reached new highs.

The lesson is clear: investment success is not driven by forecasts, but by consistent execution based on a clear and robust investment process. Staying invested, filtering out market noise, and treating corrections as opportunities once again proved decisive in 2025. With this compass, we look ahead to 2026—free of forecasting illusions, but guided by strong conviction.

Outlook 2026

Major strategic shifts are already behind us: inflation has been contained, the interest rate cycle has turned, and fiscal policy has expanded. At the same time, globalization has been fragmented by tariffs, and artificial intelligence has emerged as a dominant investment theme.

In 2026, greater clarity will emerge as to who benefits from these decisions—and who does not.

Price targets dominate many annual outlooks, yet their informational value is often limited and procyclical. More insightful is the identification of the key fault lines around which market dynamics are likely to revolve.

Five forces will shape markets in 2026:

- Monetary policy: Rate cuts will become less frequent and more selective; the tailwind is fading.

- Fiscal policy: Expanding government spending meets higher capital costs. Deficits, debt service, and credibility create tension.

- Geopolitics & tariffs: Trade barriers, sanctions, and power politics affect margins, inflation, and risk premia.

- Global growth: Growth remains positive, but increasingly fragmented by region.

- AI & investment: The technological transformation is real. Capital intensity and bottlenecks define the cycle.

These forces do not operate in isolation. They overlap and interact—determining where risks accumulate and where opportunities emerge. The SoundInsights Outlook 2026 systematically examines these themes before drawing conclusions through our proven indicator framework.

A Constructive Environment – With New Drivers

Many signals point to a constructive investment year in 2026, albeit with more moderate returns than in 2025. Monetary policy support is waning, while fiscal policy and geopolitics gain influence. Inflation has stabilized but remains structurally higher. Growth persists, though it is becoming more politicized and increasingly driven by heavy investment in AI-related infrastructure.

Monetary Policy: The Price of Money Remains the Conductor

Few variables influence valuations as directly as interest rates. Central banks will therefore continue to set the tone in 2026, albeit with a clear shift from broad-based easing to a more selective approach.

Inflation Resets the Rules

The era of ultra-low interest rates is over. COVID was not a temporary shock, but the catalyst for a monetary and real-economy regime change.

Before the pandemic, the real neutral rate hovered near zero. Today, a higher equilibrium appears likely, driven by rising public debt, more active fiscal policy, deglobalization, re-industrialization, and the energy transition. Inflation is no longer out of control, but structurally higher than in the decade preceding COVID.

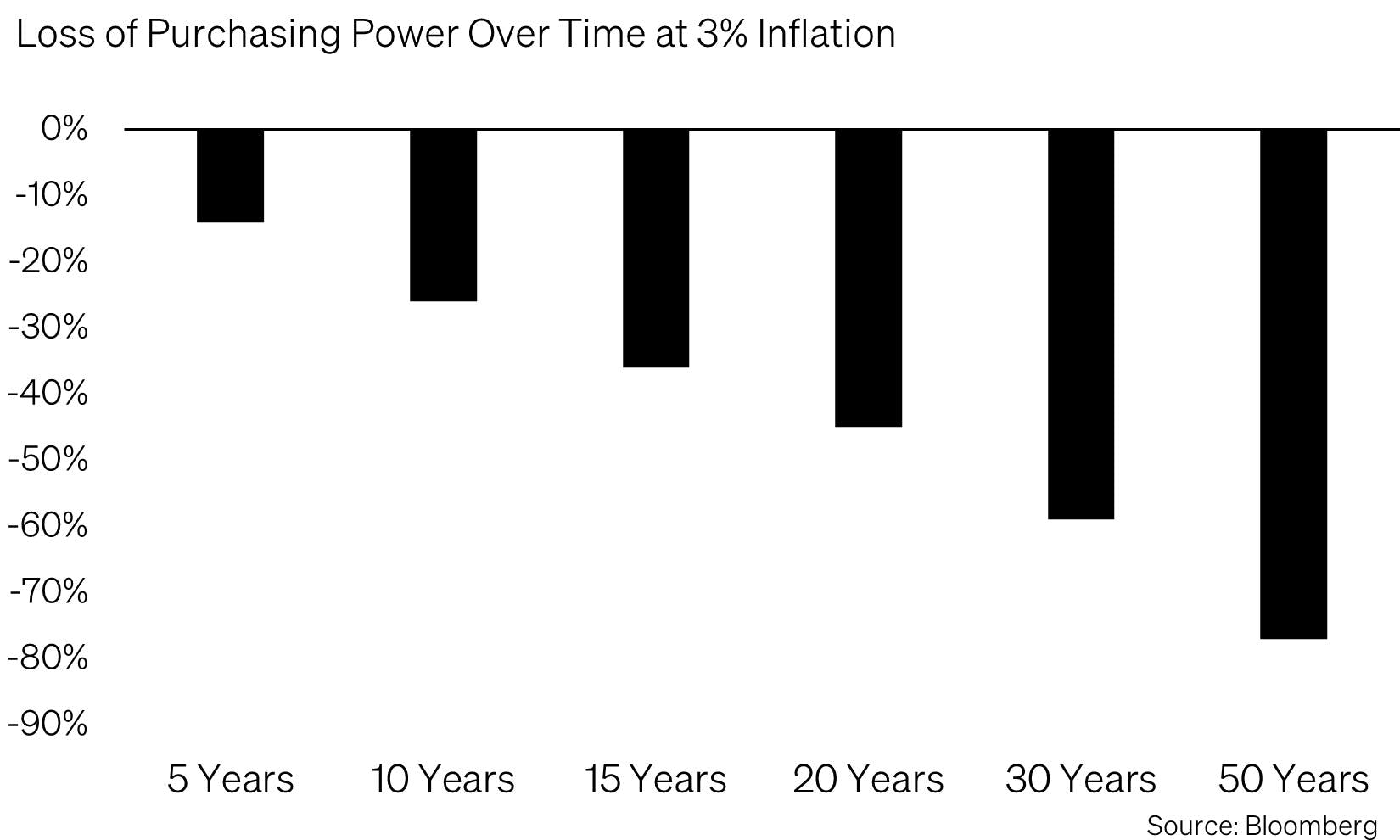

This is evident since normalization began: average inflation in the U.S. is now around 3.0%, versus 1.5% between 2008 and 2020; in Europe, approximately 2.1% versus 1.2%. For investors, the distinction between inflation rates and price levels is critical: falling inflation does not imply falling prices. At 3% inflation, purchasing power erodes by roughly one-third over 15 years—placing particular strain on households and rendering cash structurally unattractive.

A deep deflationary recession and a return to zero rates are considered unlikely. Central banks caution that tariffs, industrial policy, and geopolitically driven supply chain shifts could reignite price pressures.

Uncertainty Factor: Politics and Central Banks

2026 will test the market-declared victory over inflation. At the same time, signs of cooling in the U.S. labor market bring the second pillar of central bank mandates back into focus.

In the U.S., politics add another layer: Fed Chair Jay Powell’s term ends in May 2026. Donald Trump has repeatedly signaled his preference for a more rate-cut-friendly successor. While the Fed currently points to one cut in 2026, markets are pricing in closer to two—creating room for surprises.

In Europe and Switzerland, the base case is policy stability. Switzerland remains a special case: with policy rates at 0%, currency dynamics take center stage.

The End of the Easing Wave

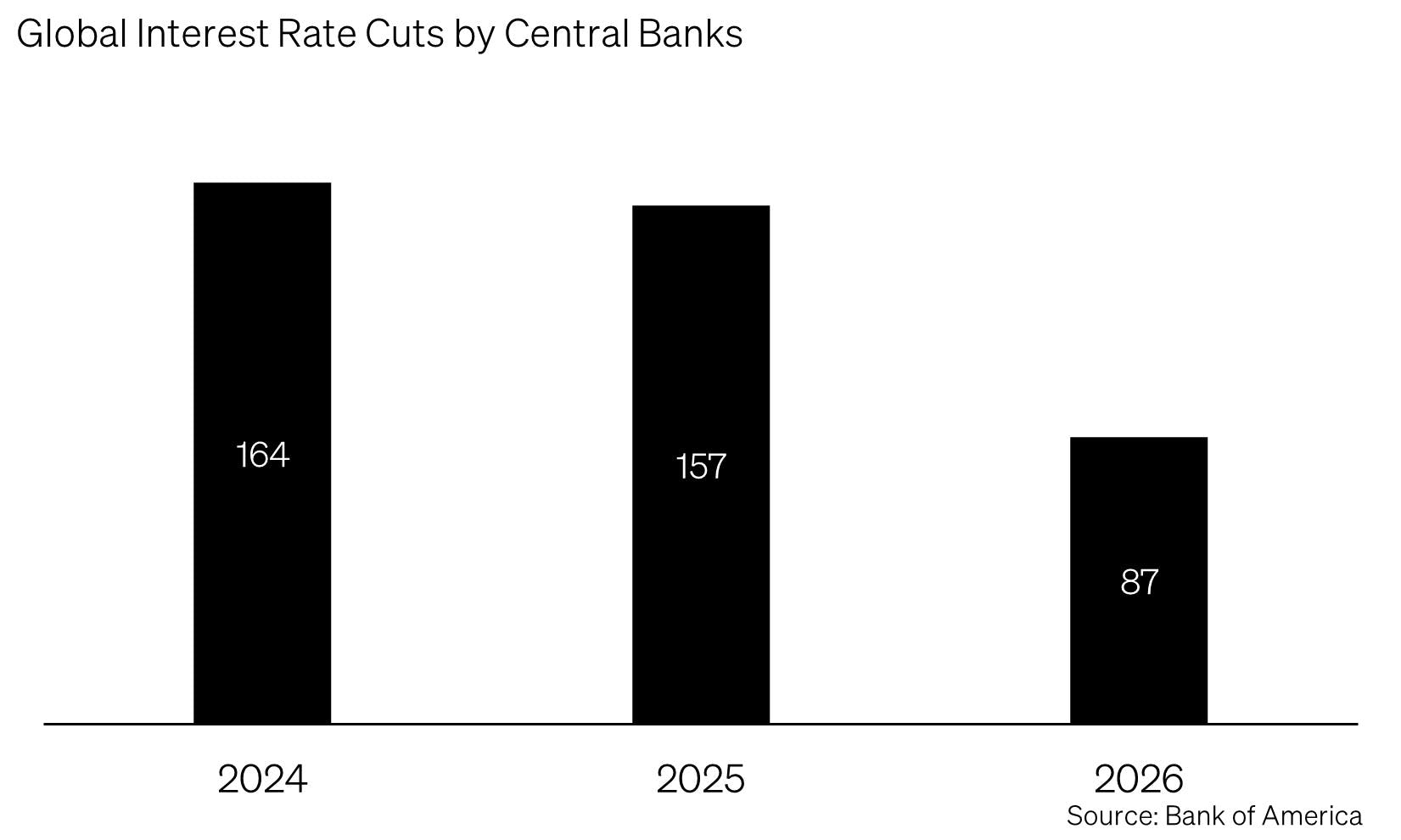

The global tailwind from rate cuts is diminishing. In 2024, 164 rate cuts were recorded worldwide; in 2025, 157. For 2026, Bank of America expects only around 87. Rather than broad-based easing, 2026 will be a year of fine-tuning—and potential surprises. Easing remains a theme, but slower, more selective, and increasingly data-dependent.

Fiscal Policy: Higher Spending, Less Room for Error

Governments are spending more—but money has become more expensive. This defines the fiscal tension of 2026: security, industrial policy, and social spending collide with historically high debt levels and elevated interest rates.

From Stabilizer to Stress Factor

High debt combined with higher rates constrains fiscal flexibility and increases political friction. Debt-to-GDP ratios across G10 countries remain well above pre-COVID levels (U.S. ~120%, Eurozone ~90%, Germany ~65%, Japan >250%). Meanwhile, debt service costs have risen sharply:

- United States: Annual interest costs of roughly USD 880 billion (2024), nearly triple the level of 2020.

- Germany: Interest expenses rose from ~EUR 4 billion (2021) to ~EUR 40 billion (2023).

- Japan: Debt service already consumes about 9% of the budget, with significant upside risk as yields rise.

Fiscal policy will support growth in 2026, but risks slowing disinflation and creating new pressure points in refinancing, political feasibility, and credibility. Distributional issues take center stage: taxpayers, savers, future growth—or inflation as a form of “silent” deleveraging. Moderate inflation reduces real debt burdens for highly indebted states—an incentive investors should not ignore.

United States: Fiscal Stimulus, Rising Interest Burden

From 2026 onward, additional provisions of the 2025 fiscal package (“One Big Beautiful Bill Act”) take effect. Tax and deduction changes support incomes and consumption—growth-friendly, but potentially inflationary. The deficit remains elevated at around 6% of GDP even outside a recession. Large refinancing needs increase the risk of higher long-term yields, even amid policy rate cuts. Partial financing via tariffs shifts burdens but does not resolve structural issues and sustains price pressure.

Europe: More Fiscal Space – Germany as a Turning Point

Europe also balances investment needs against fiscal discipline, but the tone has shifted. Germany has loosened its debt brake and launched a large-scale infrastructure and defense package. Government investment is expected to rise by roughly 20% in 2026—a clear break from past restraint.

This gives fiscal policy greater traction across Europe. Experience from the past decade suggests that limited fiscal support was a key reason for Europe’s growth gap versus the U.S. The policy shift is growth-positive, but not without consequences for public debt.

Interaction with Monetary Policy

More important than the size of fiscal packages is their interaction with monetary policy. Rising debt service increases political pressure to avoid overly restrictive monetary settings—a form of “light fiscal dominance” that further constrains central bank independence.

The issue is not debt levels per se, but their cost. Fiscal policy is likely to support growth in 2026, but rising uncertainty, higher term premia, and waning confidence could turn tailwinds into headwinds—an environment that continues to structurally support gold.

Geopolitics & Tariffs: Lower from Here?

Even with slightly slower growth, politics remain a key price driver. In 2026, U.S. tariffs again represent a major source of uncertainty.

Delayed Impact, Rising Pressure

The full effects of Trump-era tariffs are only partially visible. Front-loading and bonded warehouses have shifted costs into 2026. These effects are increasingly felt by U.S. consumers, fueling dissatisfaction and political pressure. With midterm elections in November 2026 approaching, the likelihood of tariff relief to regain voter support increases—making trade policy explicitly domestic policy.

United States: Tariffs as a Tax

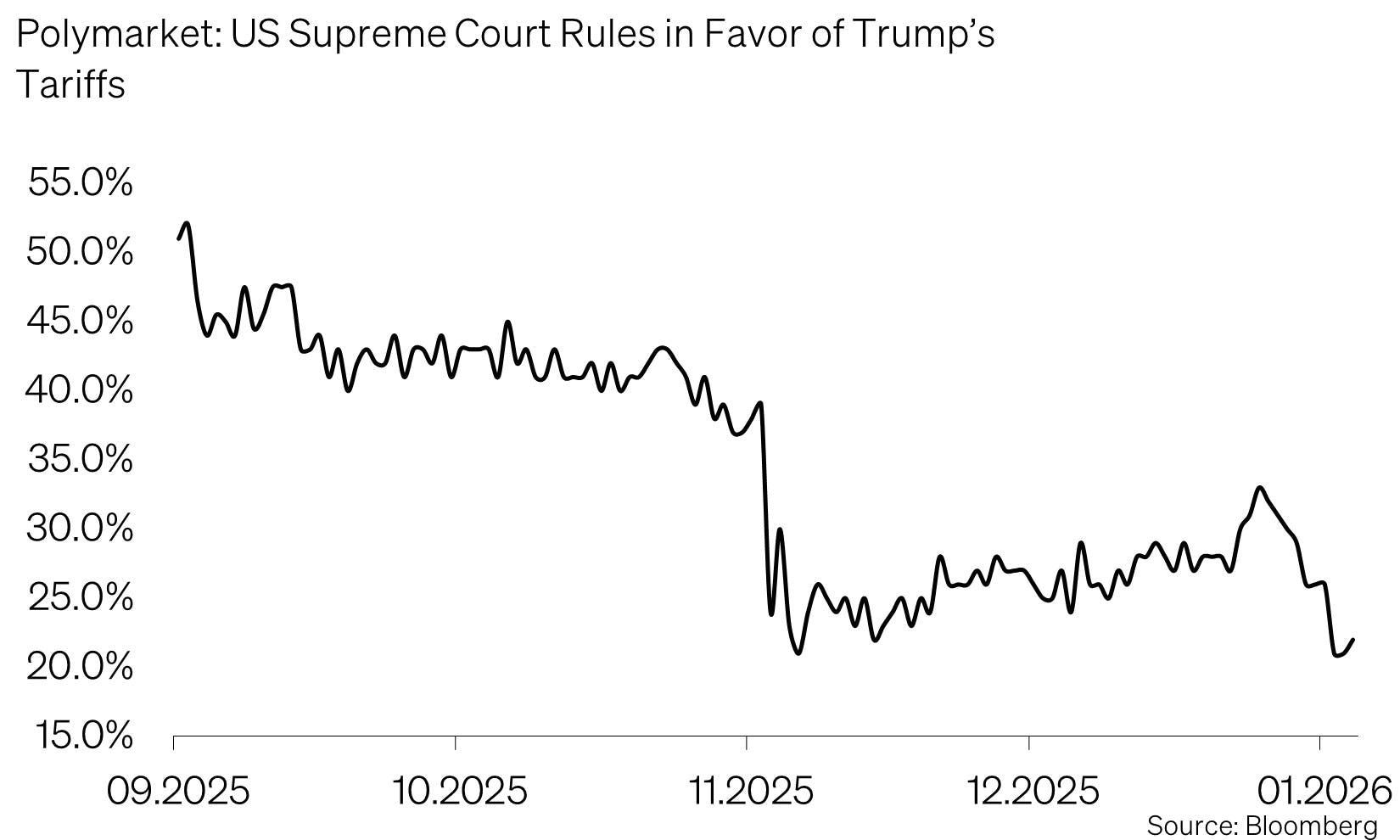

The 2025 tariff regime remains in place: 25% on autos and parts, along with higher steel and aluminum duties. Import prices and cost bases remain elevated. Legal event risk adds uncertainty: parts of the tariff framework could be overturned by the Supreme Court, potentially triggering abrupt market reactions.

Geopolitics: A New Escalation Level

The U.S. operation against Venezuela marked a departure from multilateral norms, signaling willingness to enforce economic interests militarily if necessary. For markets, this implies more geopolitical shocks, higher risk premia, and a growing role for energy and commodity policy.

China & Europe: Fragile De-escalation

While extreme U.S. tariff threats have been paused, structural tensions persist. China’s overcapacity exports deflationary pressure and invites countermeasures. In Europe, countervailing duties—such as on Chinese EVs—are becoming reality, retaliatory tariffs affect individual countries, and from 2026 the duty-free threshold for low-value e-commerce shipments will be abolished.

Key takeaways for investors:

- Tariffs are inherently growth-negative, raising costs and distorting trade flows.

- Second-round inflation effects have so far been limited. Margins suffered, but a broad inflation surge did not materialize.

- Political incentives favor de-escalation: approaching midterms and affordability pressures in the U.S. increase pressure to roll back tariffs.

- In politically driven markets, a disciplined investment process is more valuable than any short-term view.

Global Growth: Not If – But Where

The global economy continues to grow in 2026—but not in sync. Deglobalization and divergent industrial policies fragment the cycle.

Base Case: Positive Growth

Consensus expects around 3.0% global growth in 2026—slightly below 2024 and 2025, but clearly positive. The structure matters more than the level: growth is increasingly driven by investment and government spending rather than consumption.

Growth Poles

- United States: Cooling to around 1.7% (OECD). A softer labor market, lower immigration effects, and tariffs weigh—slower, not collapsing.

- Eurozone: Moderate growth of roughly 1.2%. Easier financing conditions help, while geopolitics and trade policy restrain.

- Switzerland: Growth around 1.3%, supported by domestic stability and exports, but highly currency-sensitive.

- China: At roughly 4.5%, still the largest single contributor to global growth—and the largest uncertainty. Export momentum fades, and real estate remains a drag.

Investment Replaces Consumption

Growth dynamics are shifting. AI, infrastructure, energy transition, and defense spending drive investment. Consumption remains relevant but less dominant, particularly where inflation and higher rates erode purchasing power. Trade frictions dampen global trade and reduce self-sustaining growth.

Soft Landing – or No Landing

Risks stem less from demand collapse than from shocks and policy missteps. Excessively strong growth raises inflation risk (“no landing”), while weak growth pressures earnings and investment.

Productivity: A Joker, but Not for 2026

AI-driven productivity gains could eventually enable faster growth without inflation—a rare positive scenario. For 2026, however, it is too early to expect broad, measurable effects. Capital investment will support growth first; productivity gains will follow with a lag.

AI & Capex Boom: A Growth Engine

Artificial intelligence is not a pure software cycle. The boom resembles a large-scale construction, energy, and infrastructure program: data centers, chips, power grids, cooling systems. This infrastructure build-out makes AI a permanent fixture on investor agendas in 2026.

Investment First, Productivity Later

AI immediately boosts capital expenditure, while measurable productivity gains lag. Major tech firms are investing over USD 300 billion annually in 2025/26, totaling roughly USD 1 trillion by 2027. This supports growth but can be temporarily inflationary due to bottlenecks and costs. 2026 is a year of building, not harvesting.

A Young, Global Capex Cycle

The investment cycle is historically large but still early. To match past tech booms, AI capex must continue scaling—which is currently happening. This is a global race, not just a U.S. story: China is also expanding AI infrastructure despite export controls.

Energy as the Bottleneck

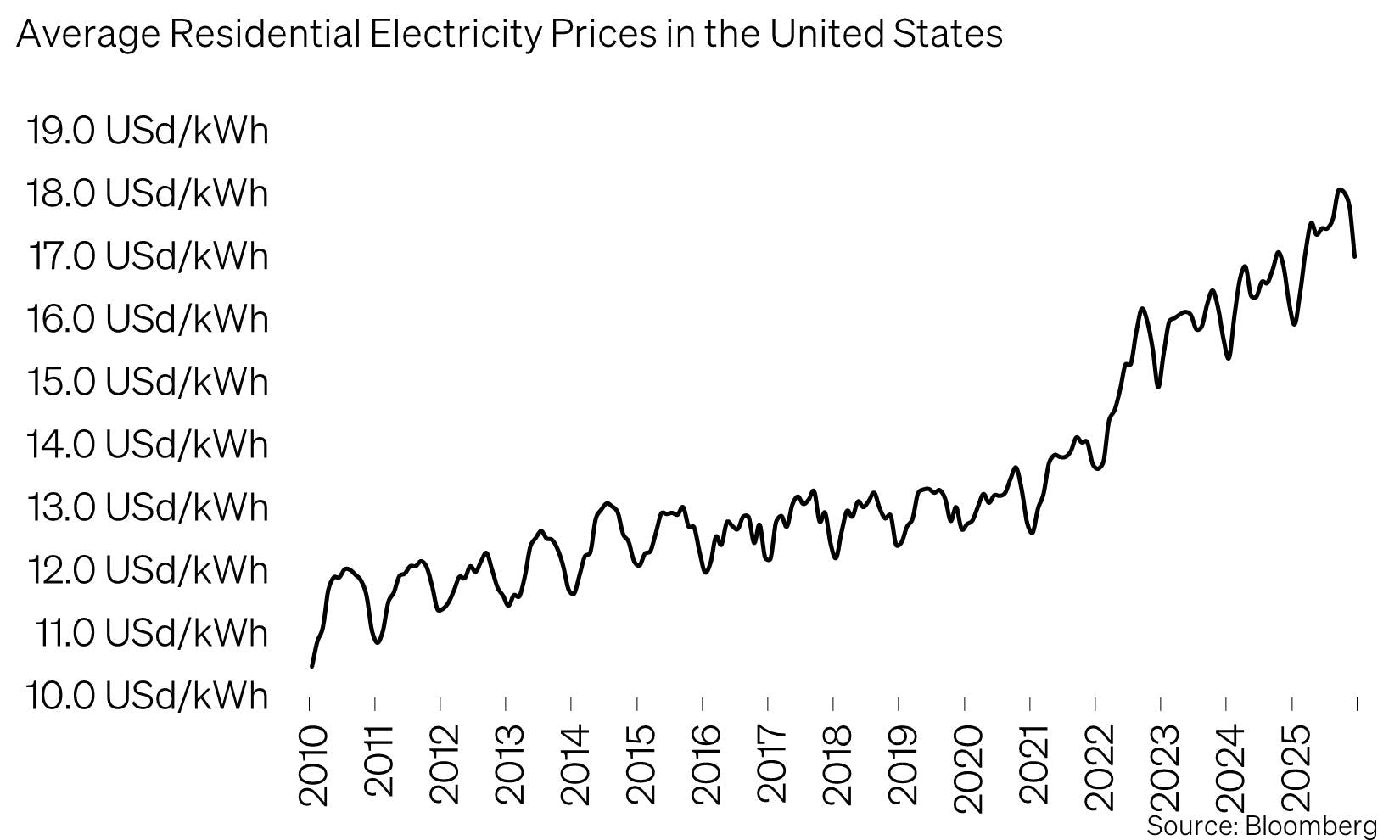

Data center electricity demand is rising rapidly. In the U.S., data centers already account for 4–5% of power consumption; by 2030, this could rise to 10–12%. Globally, consumption could increase from ~860 TWh today to over 1,500 TWh by 2030. Grid capacity, connections, and permits become bottlenecks in 2026. Big Tech increasingly secures energy strategically—the key question is whether data centers actually come online.

Semiconductors: Capacity Up, Dependencies Persist

Global chip capacity is hitting record levels (>30 million wafers/month), led by China, with the U.S. and Europe catching up later. However, production of leading-edge AI chips remains highly concentrated. Capacity expansion reduces scarcity, not geopolitical dependence.

Policy and Regulation as Volatility Drivers

Export controls, tariffs, and permitting processes affect timing and profitability. In Europe, regulation is becoming more concrete (AI Act), adding compliance costs and influencing rollout and scaling.

Key implications for investors:

- AI capex has reached historic levels—and valuations already reflect significant optimism, raising correction risk.

- Beneficiaries are primarily bottleneck solvers: chips, energy, grids, cooling, and infrastructure—not applications.

- Productivity and cash flows follow capex with a lag; timing and valuation remain critical.

AI remains a central growth driver in 2026, but the realization of its potential depends heavily on infrastructure and permitting.

Outlook 2026 – Conclusion & Positioning

2026 marks the transition into an environment with significantly less monetary tailwind. Rate cuts lose prominence, while fiscal policy, geopolitics, and real investment shape market dynamics. Inflation remains structurally elevated, interest rates volatile, and risk premia across several asset classes compressed.

The five forces outlined jointly influence inflation, rates, volatility, and earnings quality. This leads to a clear and structured positioning framework, guided by our proven indicator model as the central reference for allocation decisions.

Key Messages & Investment Implications for 2026

Use liquidity with discipline

Liquidity provides stability and flexibility—not returns. In a structurally inflationary environment, cash steadily loses purchasing power. It should be used tactically for rebalancing, corrections, and opportunities, not as a strategic anchor.

Bonds generate income—but selectively

Bonds remain neutrally positioned, primarily serving income and stability. Regional differences matter: attractive yields persist in USD markets, a neutral backdrop in EUR, and limited appeal in CHF due to low rates.

Given expansionary fiscal policy, high-quality corporate bonds are preferred over government bonds. Tight credit spreads cap upside at higher risk levels. Convertible and inflation-linked bonds remain important for diversification and protection against inflation surprises.

Equities remain indispensable

Equities are the cornerstone of long-term real wealth preservation and inflation protection. However, low equity risk premia and elevated risk indicators signal vulnerability to negative surprises. Staying invested is essential, with emphasis on quality and selection. Preferred exposures include:

- The Swiss equity market with resilient business models

- Quality dividend stocks with reliable cash flows

- Structural growth in artificial intelligence

- Emerging markets, particularly China, where valuations and long-term growth prospects are relatively attractive

During phases of pronounced euphoria, temporary reductions or hedging may be appropriate—not as market exits, but to stabilize return profiles.

Deploy alternatives selectively

Alternative assets should primarily enhance diversification in 2026, with low to neutral equity correlation.

Gold remains a core holding as protection against geopolitical risks, inflation surprises, and declining confidence in fiat currencies. Other alternatives should be selected strictly based on diversification quality.

Accept and use volatility

Volatility is structurally higher and no longer an exception. After several years of above-average equity returns, the risk of temporary excesses increases. Active rebalancing, selective hedging, and disciplined allocation become key success factors.

Final Takeaway

Investment success in 2026 will not be driven by timing, but by structure, quality, and disciplined selection. Liquidity remains tactically necessary but strategically costly. Bonds generate income but do not replace inflation protection. Equities remain the primary engine of real wealth preservation. Alternative assets—especially gold—enhance portfolio resilience.

Appendix & Disclaimer

SoundInsights is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials

Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong. - Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with SoundInsights. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by SoundCapital (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2026 SoundCapital. All rights reserved.

Datasource: Bloomberg