SoundInsightN°41

Bonds

Equities

The Art of Threat

The start of 2026 is defined by a tense interplay of geopolitical developments, political interference in monetary policy, and at the same time resilient corporate fundamentals. While the underlying economic environment remains broadly constructive, political uncertainty has increased noticeably. This divergence shapes our current assessment—and explains a positioning that deliberately balances opportunity capture with disciplined risk control.

Geopolitics Takes Center Stage

Geopolitics is the dominant market driver at the beginning of the year. The U.S. military operation in Venezuela, which led to the arrest of President Maduro in early January and his transfer to the United States, marks a new level of escalation. The subsequent blockade of Venezuelan oil tankers—including vessels sailing under the Russian flag—underscores the strategic nature of these actions.

At the same time, repeated political signals from the U.S. regarding Greenland have caused irritation in Denmark and within NATO. After an initial phase marked by threats, statements made at the World Economic Forum suggest a shift toward a more multilateral framing.

This pattern is characteristic of current U.S. foreign policy: pressure is deliberately built when political or economic concessions are not forthcoming. Under the current Donald Trump administration, policy increasingly resembles less the “art of the deal” and more the art of the threat—a negotiation style dominated by coercion aimed at extracting unilateral concessions rather than mutual benefit.

For financial markets, this primarily translates into heightened sensitivity to political headlines, without necessarily implying a sustained or uncontrollable escalation.

Monetary Policy – Independence Under Pressure

Another key source of uncertainty is the growing tension surrounding the U.S. Federal Reserve. The initiation of criminal proceedings against Fed Chair Jerome Powell has reignited a fundamental debate: the conflict between political influence and central bank independence.

The issue has become even more sensitive following President Donald Trump’s attempt to dismiss Fed Governor Lisa Cook. During hearings, the Supreme Court appeared reluctant to allow such a dismissal—partly due to concerns over potential real-economy consequences. At the heart of the legal dispute are questions about what constitutes legitimate grounds for removal and which procedures a president must follow.

This episode highlights how sensitive markets can be to perceived intrusions into monetary policy independence—most visibly through rising risk premia, higher volatility, and an ever-increasing gold price.

Fiscal Policy – A Familiar Debate

In the U.S., the risk of another government shutdown recently resurfaced. The House of Representatives has since passed a government funding package, temporarily reducing the immediate shutdown risk. From a market perspective, however, it is important to recognize that this issue is structural and recurring. Budgetary and funding disputes are a permanent feature of the U.S. political process.

As the year progresses, public debt levels are also likely to attract renewed attention—particularly in the context of rising interest costs and shrinking fiscal policy flexibility.

Corporate Earnings – Fundamentals Remain Strong

Away from political noise, the fundamental backdrop remains remarkably robust. The fourth-quarter earnings season has started very strongly: around 80% of reporting companies have exceeded profit expectations. This confirms that the global economy entered the new year with solid momentum.

In addition, UBS analysts expect double-digit earnings growth again in the fourth quarter (around 12%), further underscoring the current strength in corporate profitability. For the investment committee, earnings growth remains a key pillar supporting a broadly positive market environment in 2026.

Artificial Intelligence – Investment as a Growth Engine

Artificial intelligence remains a central structural theme. New agreements between the U.S. and Taiwan to strengthen semiconductor and AI supply chains—including substantial investment commitments—highlight the strategic importance of this sector. AI is no longer just an innovation story; it is increasingly an industrial and geopolitical factor with long-term relevance for capital allocation.

Investment Committee Positioning

Overall, the macroeconomic environment remains constructive: solid growth, strong corporate earnings, and powerful structural investment themes. At the same time, market sentiment is highly optimistic. Our contrarian sentiment indicator has moved into euphoric territory. A Bank of America survey also shows that fund managers are currently holding the lowest cash levels since the survey began in 1999.

Historically, such positioning increases the likelihood of interim pullbacks in risk assets—even during fundamentally positive market phases.

Fixed Income

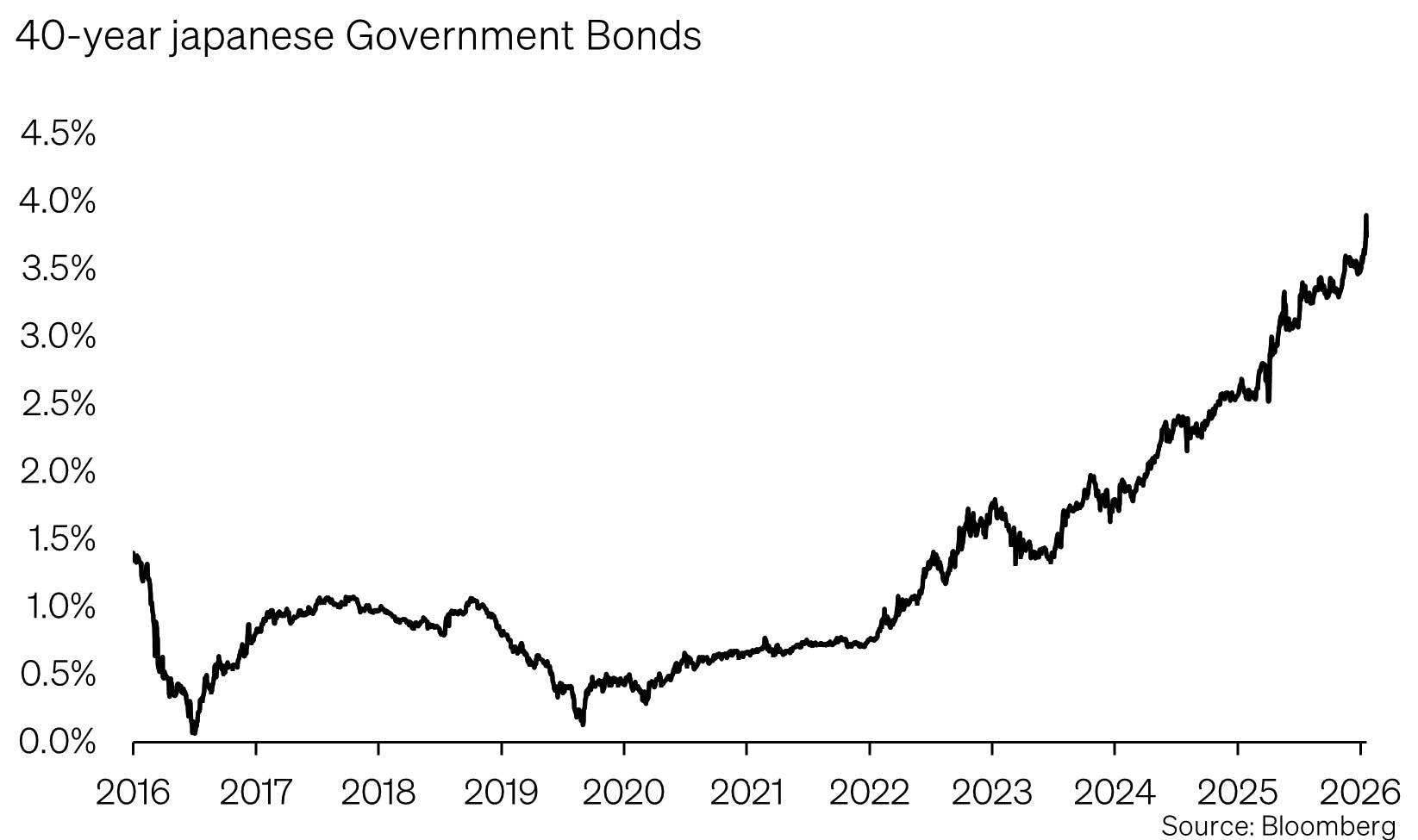

Bond markets are currently characterized by low short-term volatility and a pronounced search for yield. Particular attention has been drawn to the Japanese bond market. The sharp rise in long-end yields is especially sensitive in a country with very high public debt. Rising interest rates not only increase refinancing costs but may also undermine confidence in the long-term sustainability of fiscal policy.

From a market perspective, the key risk lies less in individual policy steps by the Bank of Japan and more in the potential for a rapid rise in the term premium—the additional yield investors demand for holding long-dated bonds. Should this premium become unanchored, yields could rise faster than fundamentals would justify, creating potential spillover effects for global bond markets. This situation warrants close monitoring.

In the U.S. and Europe, yield curves have recently flattened slightly. Against this backdrop, the committee sees no need for adjustment. Bond positioning remains unchanged, with a focus on high-quality corporate bonds, an underweight in government bonds and high-yield bonds, neutral duration in USD, EUR, and GBP, and a short duration in CHF.

Equities

Equity markets remain resilient, supported by the strong start to the earnings season. The investment committee sees no reason to reduce overall equity exposure. At the same time, euphoric market positioning argues for a disciplined approach to risk management.

Accordingly, the committee has decided to hedge existing equity exposure using a put option on the S&P 500 rather than reducing exposure outright. In the current low-volatility environment, hedging is attractively priced by historical standards and allows potential drawdowns to be cushioned without limiting upside participation.

Regional adjustment

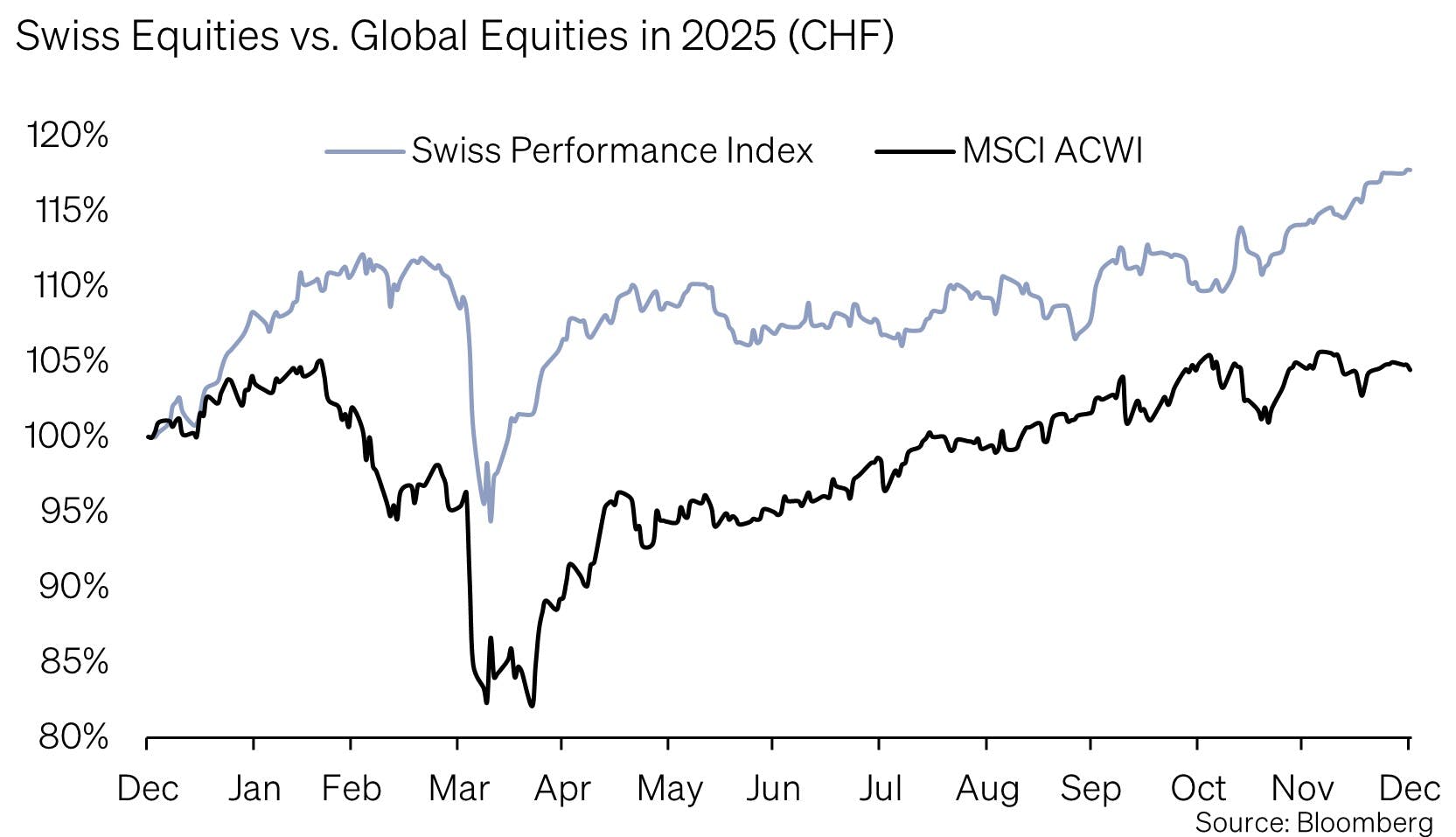

Switzerland: Positioning is reduced from overweight to neutral. A key reason is the strong outperformance versus the MSCI World in 2025 when measured in CHF. The strong Swiss franc has supported this performance but could increasingly weigh on foreign-currency earnings as the year progresses.

Thematic focus

Energy infrastructure & electrification: In addition to AI, an overweight is established in electrification and grid infrastructure. The expansion of power grids is widely seen as one of the defining infrastructure themes of the decade—driven by data centers, digitalization, and the energy transition.

Alternative Investments

Gold remains a core component within alternative investments. Elevated geopolitical uncertainty at the start of the year once again highlights the precious metal’s role as a stabilizing anchor during periods of heightened political risk.

Conclusion

The beginning of 2026 is shaped by a clear tension: strong fundamentals on the one hand, rising political uncertainty on the other. The investment committee maintains a constructive baseline outlook but responds to pronounced market euphoria with targeted risk management. The objective remains to participate in positive developments while staying resilient in the face of short-term setbacks.

Appendix & Disclaimer

Mit SoundInsights beurteilen wir systematisch und konsistent die Aspekte, die für die Entwicklung der Finanzmärkte relevant sind. In der Folge können sich unsere Kunden auf eine rationale und antizyklische Umsetzung unserer Anlageentscheidungen verlassen.

- Konzentration auf das Wesentliche

Zinsniveau, Risikoaufschlag, Bewertung, Wirtschaftsentwicklung, Anlegerstimmung und -positionierung. Das sind die zentralen Faktoren. Sie entscheiden über den Erfolg an den Finanzmärkten. Besonders in turbulenten Zeiten, wenn die Versuchung besonders gross ist, irrational den Schlagzeilen hinterherzulaufen. - Vergleichbarkeit über Ort und Zeit

Die genannten Faktoren sind für alle Märkte und zu jeder Zeit gleichermassen relevant. Dies ergab sich aus einem strengen «Backtesting», welches sich rollend in die Zukunft fortsetzt. - Bündeln unserer kumulierten Anlageerfahrung

Unsere Stärke liegt in den langjährigen Erfahrungen unserer Partner und Principals. Genau diese Erfahrungen fassen wir zusammen und machen sie mittels SoundInsights anwendbar. - Transparenz

Durch die monatliche Publikation wissen unsere Kunden stets, wo wir im Anlagezyklus stehen und wohin die Reise an den Finanzmärkten geht.

Das vorliegende Dokument dient ausschliesslich zu Informationszwecken und ist als Werbung zu verstehen. Es wurde von SoundCapital (nachfolgend «SC») mit grösster Sorgfalt erstellt. Trotz sorgfältiger Bearbeitung übernimmt SC keine Gewähr für die Richtigkeit, Vollständigkeit oder Aktualität der enthaltenen Informationen und lehnt jegliche Haftung für Verluste ab, die durch die Nutzung dieses Dokuments entstehen könnten. Die in diesem Dokument geäusserten Meinungen spiegeln die Einschätzungen von SC zum Zeitpunkt der Erstellung wider und können sich ohne vorherige Ankündigung ändern. Es handelt sich weder um ein Angebot noch eine Empfehlung zum Kauf oder Verkauf von Finanzinstrumenten oder zur Inanspruchnahme von Dienstleistungen. Empfängern wird empfohlen, eigene Beurteilungen vorzunehmen und gegebenenfalls unter Hinzuziehung eines Beraters die Informationen in Bezug auf ihre individuellen Umstände sowie deren rechtliche, regulatorische und steuerliche Auswirkungen zu überprüfen. Obwohl die Informationen aus als zuverlässig angesehenen Quellen stammen, übernimmt SC keine Garantie für deren Genauigkeit. Vergangene Wertentwicklungen von Anlagen sind kein verlässlicher Indikator für zukünftige Ergebnisse. Ebenso sind Prognosen zur Wertentwicklung nicht als verlässlicher Indikator für künftige Ergebnisse zu verstehen. Dieses Dokument richtet sich nicht an Personen, deren Nationalität oder Wohnsitz den Zugang zu solchen Informationen rechtlich einschränkt. Eine Vervielfältigung, auch auszugsweise, ist nur mit ausdrücklicher schriftlicher Genehmigung von SC gestattet.

© 2026 SoundCapital.

Datenquelle: Bloomberg, BofA ML Research