SoundInsightN°31

Bonds

Equities

Volatility, Made in Washington

Roughly two months ago, U.S. President Donald Trump unveiled a sweeping new tariff package. Since 5 April, a flat 10% import duty has applied to nearly all inbound goods. On top of this, country-specific punitive tariffs were introduced, calibrated to each nation’s trade surplus with the U.S. and their existing tariff barriers.

Trump justified the measures on both economic and national security grounds. Longstanding trade deficits and a growing dependency on imports, he argued, represent a threat to U.S. national security. The core objectives are reshoring production to the U.S. and improving the trade balance. At the same time, tariffs are being wielded as leverage in bilateral negotiations.

Deadlines, 90-Day Suspension, and Exemptions

Following intense turmoil in financial markets in early April, Trump granted a 90-day suspension of the country-specific tariffs to several nations, including the EU. China, however, was initially excluded from this exemption. The baseline 10% import duty also remained in effect.

A diplomatic turnaround followed in the case of China: After an initial escalation and retaliatory tariffs from Beijing, U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer held talks with a Chinese delegation in Switzerland. On 12 May, 2025, both sides announced a mutual reduction in tariffs: the U.S. cut its total duties on Chinese goods from 145% to 30%, and China reduced its counter-tariffs on U.S. goods from 125% to 10%.

Timeline of Key Developments

- 2 April, Trump announces sweeping new tariffs (10% on all imports; additional country-specific tariffs).

- 5 April, Implementation of the 10% base import duty.

- 9 April, 90-day suspension of country-specific tariffs announced (excluding China).

- 13 April, China responds with retaliatory tariffs.

- 12 May, U.S. and China announce mutual tariff reductions following talks in Switzerland.

- 23 May, Trump threatens to raise EU tariffs to 50% starting 1 June.

- 26 May, Trump extends the EU tariff deadline to 9 July.

- 29 May, U.S. trade court rules tariffs illegal. Government files appeal.

- 29 May, Appeals court grants stay of suspension.

- 9 July, Scheduled end of the 90-day negotiation window.

Legal Setback on May 29, 2025

On 29 May, 2025, Trump faced a significant legal defeat: A panel of three judges at the U.S. Court of International Trade in New York ruled that Trump had overstepped his authority by imposing blanket tariffs under emergency powers. The court declared the tariffs unlawful, effectively blocking nearly all duties introduced since January, except for those on specific sectors (e.g., steel, aluminum, automobiles) enacted under separate legal frameworks with congressional backing.

Later that evening, the Department of Justice secured a stay from the appellate court, postponing enforcement of the ruling. The case is widely expected to end up before the U.S. Supreme Court.

Media Reaction and Political Assessment

Global media outlets are increasingly critical of Trump’s unpredictable trade policy. The swift implementation and subsequent reversal of measures, most notably in the case of China, are seen as hallmarks of tactical, inconsistent leadership. Many analysts interpret this less as a coherent strategy and more as an attempt to extract short-term negotiation advantages.

Doubts are growing on both sides of the Pacific regarding the reliability of this approach. Analysts point out that, so far, the tariffs have yielded little measurable economic benefit, while significantly undermining business and investor confidence.

On Wall Street, the term TACO has gained traction, an ironic acronym for “Trump Always Chickens Out.” The phrase reflects a prevailing view among investors: Trump's tariff threats are primarily tactical, often causing market disruption only to be softened or withdrawn later, much like the China episode. As a result, many now see market swings as overreactions and potential buying opportunities.

Tariffs Backfiring? A Closer Look at Import Prices

Recent data from the Bureau of Labor Statistics and Bloomberg Economics show that the intended effect of the tariffs has largely failed to materialize. April’s import price indices indicate that U.S. importers, rather than foreign exporters, are bearing most of the cost burden.

While "tariff-adjusted" import prices showed only minor increases, actual import prices, including tariffs, rose sharply. For consumer goods, prices have climbed by 32 percentage points since January, nearly matching the theoretical impact if all tariff costs were absorbed domestically. Even for heavily taxed Chinese imports, price declines were minimal. Imports from the EU and UK saw price hikes that outpaced the tariffs themselves, largely due to currency effects.

These findings suggest that the U.S. is increasingly shouldering the economic cost of its own tariff policy. No offsetting price concessions from exporters have been observed, meaning both businesses and indirectly consumers face rising costs.

Investor Positioning

With continued uncertainty surrounding tariffs, the 9 July deadline, and erratic shifts in trade policy, further market disruptions and heightened equity market volatility appear likely. A cautious positioning strategy is therefore recommended.

In such an environment, a clear and disciplined investment approach becomes crucial. Rising volatility often leads investors to unintentionally shorten their investment horizons, increasing the risk of poorly timed exits. All the more reason to position portfolios today to take advantage of future opportunities when market swings inevitably resurface.

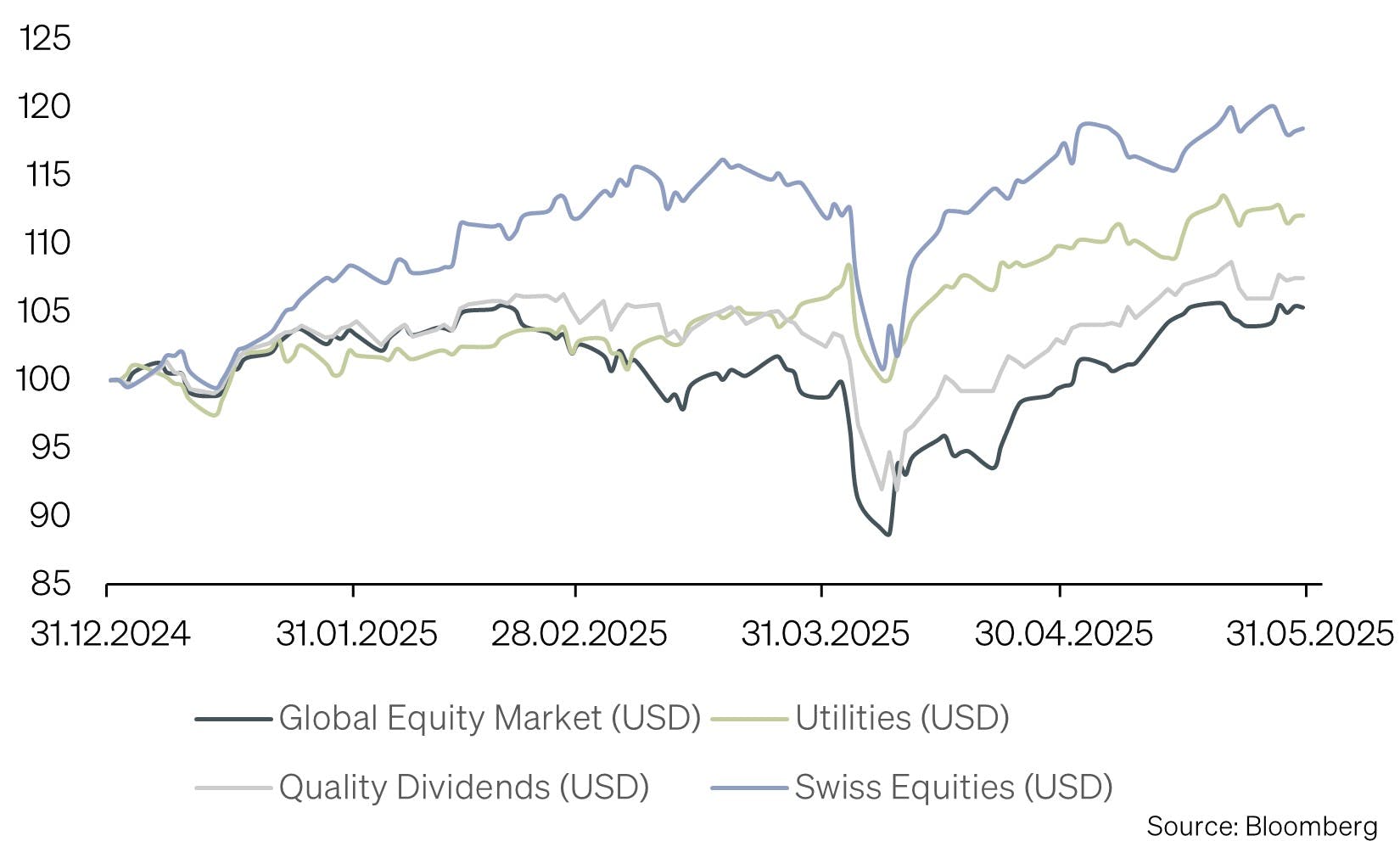

On a regional level, we currently favor the Swiss equity market, supported by the anticipated return of negative interest rates. Additionally, we have lifted our previous underweight on emerging markets, given a weaker USD outlook and improved earnings momentum. In exchange, we’ve reduced our position in Japanese equities, where monetary normalization is still underway and previous gains have been strong.

From a sector perspective, we are selectively focusing on utilities, which benefit from the structural tailwinds of electrification and offer greater resilience to economic cycles compared to many other industries.

High-quality dividend stocks also remain a cornerstone of our strategy for mitigating portfolio volatility. A slightly elevated cash allocation gives investors flexibility to respond to pullbacks and seize emerging opportunities. Overall, our stance remains defensive and selective, aimed at preserving stability in a politically charged market environment.

Appendix & Disclaimer

SoundInsights is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials

Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong. - Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with SoundInsights. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by SoundCapital (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2025 SoundCapital. All rights reserved.

Datasource: Bloomberg, BofA ML Research