SoundInsightN°32

Bonds

Equities

From Trade War to Middle East War

In June, tensions between Israel and Iran escalated into open warfare, marked by dramatic airstrikes, U.S. intervention and nuclear implications. Yet while missiles were flying, financial markets remained surprisingly calm. This apparent calm amid the storm has its reasons.

Systematic Escalation – Background to the Conflict

Israel's strike on Iranian nuclear facilities and the subsequent involvement of the United States, including targeted attacks on underground sites in Fordo, Natanz and Isfahan, mark the most serious military escalation in the region in years. The U.S. justified its intervention as a step to permanently block Iran’s nuclear ambitions, a move charged with both strategic and symbolic weight.

What may have looked like a regional exchange of blows from the outside carried significant domestic implications. In Israel, hardliners openly voiced hopes for regime change in Tehran. Former President Trump hinted that he would welcome a «free Iran» under new leadership, a scenario with unpredictable consequences.

Markets React with Caution, Not Panic

Despite the gravity of the geopolitical situation, international financial markets responded with relative composure. Equity market losses were moderate. Technology stocks remained fairly stable, while airline and consumer shares came under pressure. At the same time, defense and energy companies saw short-term gains. It was clearly a risk-off environment, but without panic.

Several factors explain this reaction:

- Markets do not expect a broader escalation

- Many companies had already prepared as tensions mounted

- After years of crises, from the pandemic to the war in Ukraine and global trade conflicts, investors have become more resilient and better equipped to handle geopolitical shocks

Commodities, Gold and Rates: Caution Without Alarm

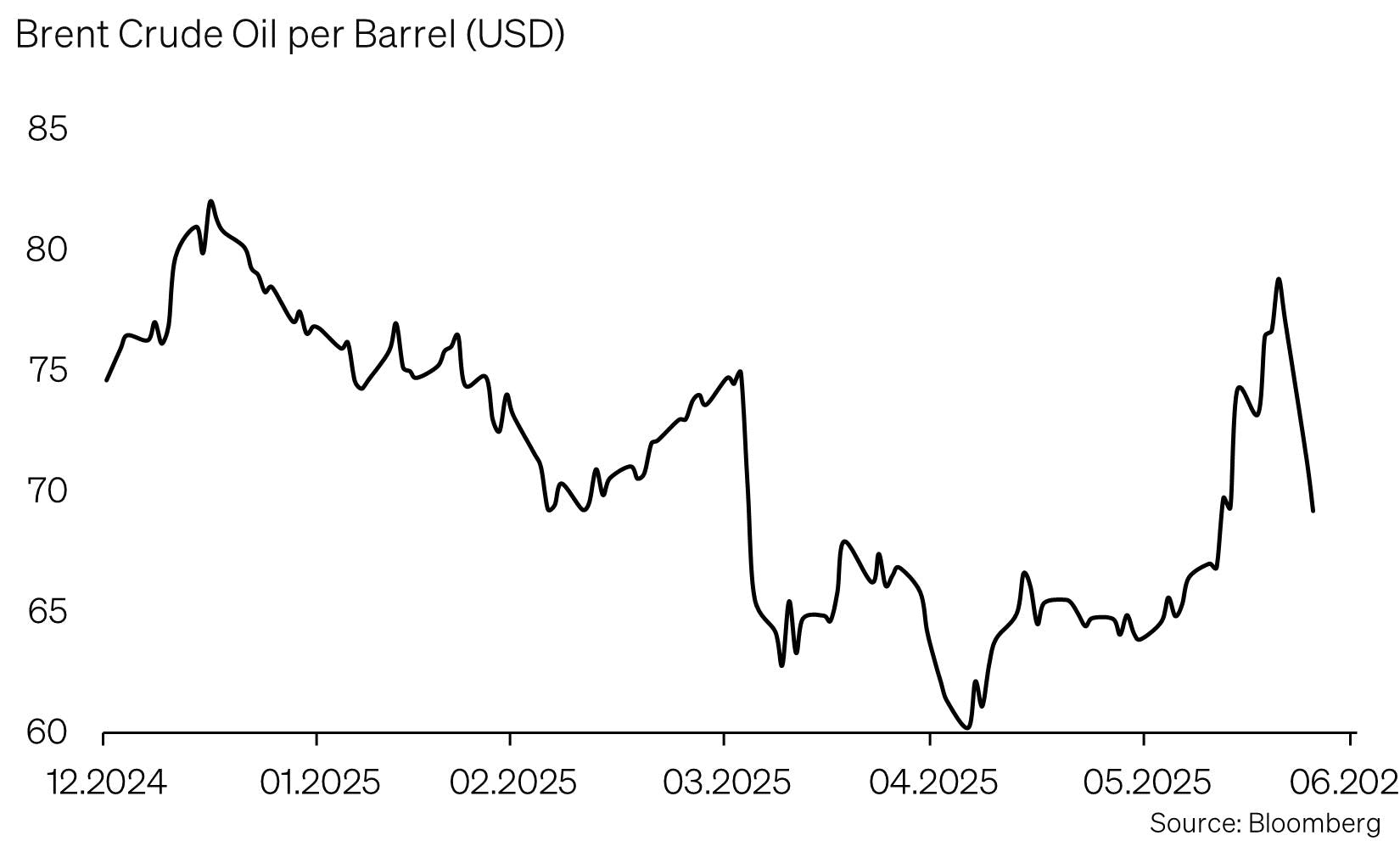

Oil prices jumped over 10 percent in response to the news, driven more by risk premiums than supply shortages. Central to this is the Strait of Hormuz, a vital maritime chokepoint through which about 20 percent of global oil trade passes. It connects the Persian Gulf with the Gulf of Oman and the Arabian Sea and serves as the only sea route for exports from several key producers including Saudi Arabia, Iraq, Kuwait, Qatar and the UAE.

Following U.S. airstrikes, Iran’s parliament hinted at closing the strait. But a full blockade seems unlikely. It would be illegal under international law, militarily risky and economically self-defeating. Iran itself exports over a million barrels of oil daily, most of it through that same waterway. Disrupting shipping would provoke a strong U.S. military response and cut into Iran’s own revenues. The market expects that the threat is primarily domestically motivated, without concrete implementation intent.

Since the attacks, markets have significantly scaled back expectations of further escalation. Oil prices have retreated below recent highs, signaling that investors do not foresee a lasting disruption in supply. Gold, which had briefly benefited from safe-haven flows, has also given up gains.

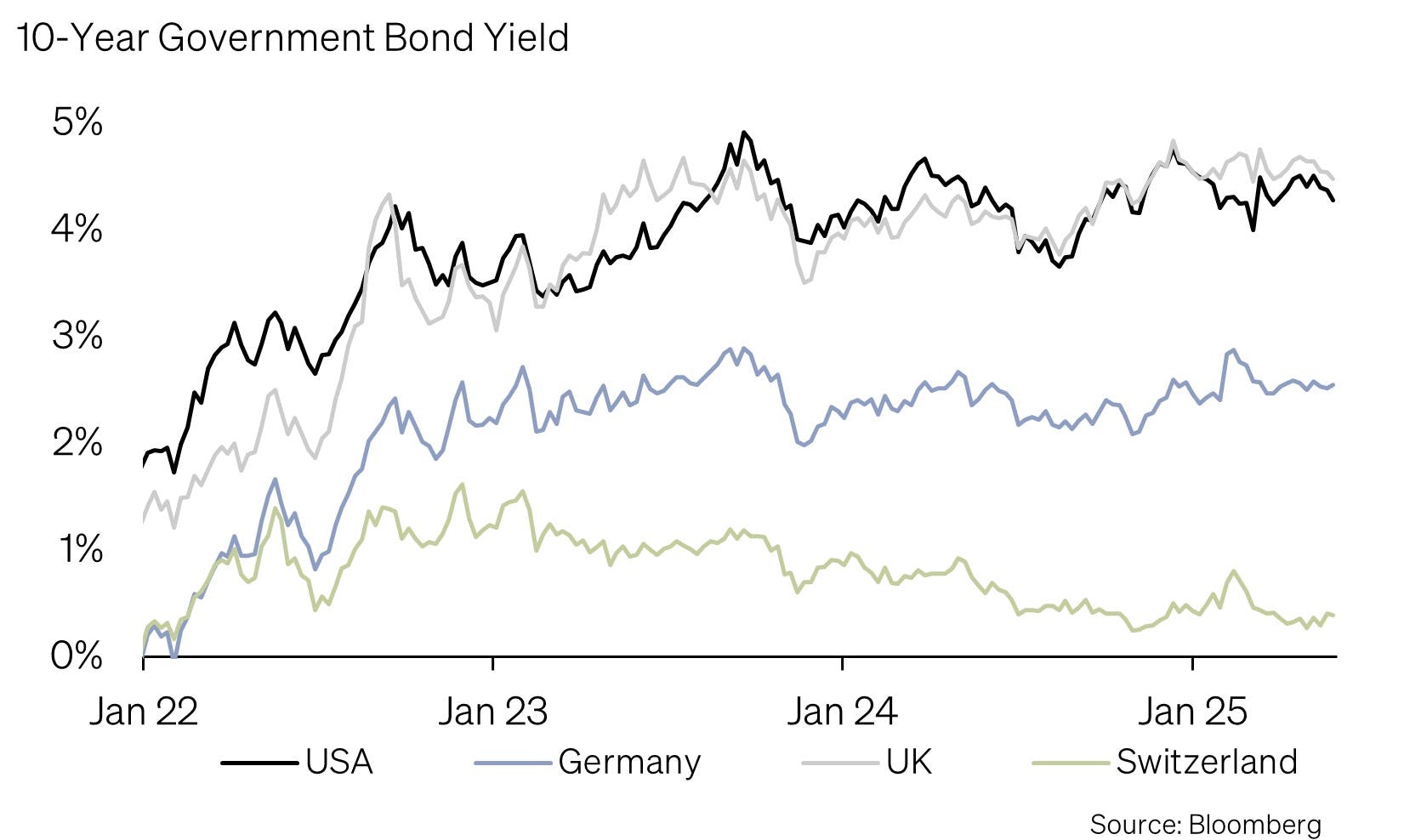

Bond markets, too, have started to normalize. Still, there is no indication of a shift in monetary policy. At its June 2025 meeting, the Federal Reserve maintained a cautious tone. While rate cuts remain a possibility, policymakers stressed that they are waiting for more reliable signs that inflation is on a sustained path back toward the 2 percent target. As a result, bond market reactions were muted.

Regime Change as a Long-Term Opportunity

While still speculative, a gradual political shift in Tehran could mark a turning point with significant economic implications. A more moderate and predictable Iran could help stabilize the region and become more integrated into the global economy.

Iran has substantial natural resources, a young and educated population and a large domestic market. Economic reforms, coupled with the easing of sanctions, could open new avenues for trade, investment and regional growth, similar to past developments in countries like Vietnam or, to some extent, Saudi Arabia.

For global markets, such a shift would primarily mean lower geopolitical risk premiums, more stable energy prices and improved economic visibility, particularly for Europe, which relies heavily on raw material imports. While the political path forward remains uncertain, the potential for a regional reset is already being factored into long-term capital market outlooks as a possible catalyst for stability and growth.

What Does This Mean for Investors?

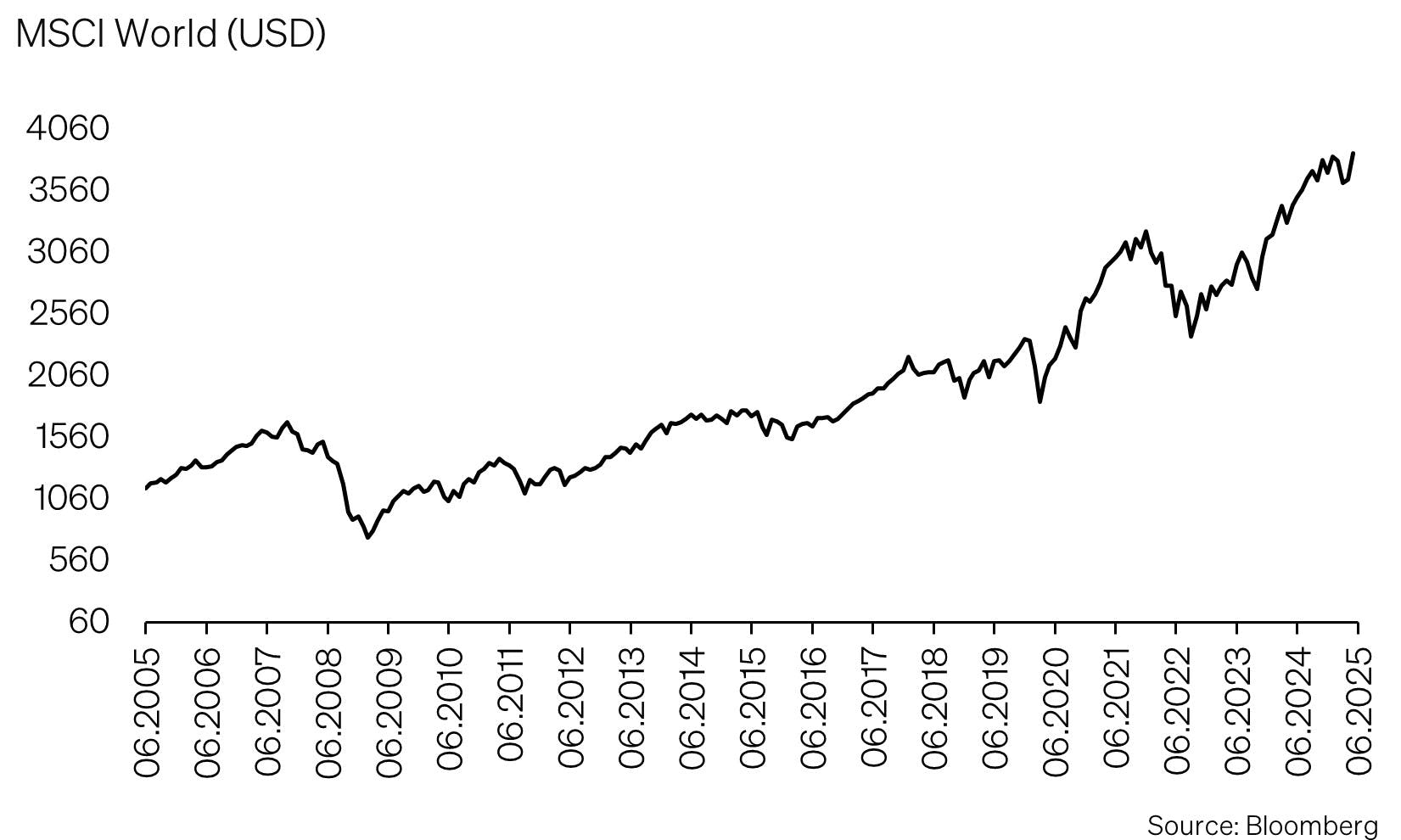

If someone had predicted at the beginning of the year that the U.S. would impose sweeping tariffs in April, abandon free trade and later take military action in the Middle East with stealth bombers and cruise missiles, few would have bet on equity markets reaching new highs.

And yet, the MSCI World Index is trading at new all-time highs. This may seem counterintuitive, but it reflects a broader trend. Markets are pricing in geopolitical risks more rationally and selectively. Not every headline leads to a shock.

Markets have historically tended to overreact to geopolitical shocks. This pattern appears repeatedly in long-term strategic market observation. Whether it was the UK's FTSE index after Brexit, US exchanges on Trump's election day in 2016, or the tariff announcements of April 2nd.

UBS's US equity and derivatives team has examined numerous geopolitical events with a clear result: Investors often react excessively to risks that are difficult to quantify. Uncertainty creates volatility, even when the actual economic effect remains manageable.

Stabilization with Risks – Defensive Stance Remains Appropriate

That said, the situation remains fragile. Iran has threatened further retaliation, and renewed conflict cannot be ruled out, whether through direct escalation or actions by proxy actors in the region.

At the same time, equity valuations look stretched. With low risk premiums, companies need to deliver solid earnings growth to justify current prices. That is a high bar, especially in an environment shaped by geopolitical uncertainty and only modest economic momentum.

Against this backdrop, we are maintaining a defensive stance. Our overall equity allocation remains neutral, but within that allocation we favor clearly defensive sectors such as utilities. We also lean toward quality dividend strategies, which tend to offer more stable returns and lower volatility in turbulent market phases.

At the regional level, we maintain an overweight in Swiss equities. Solid companies with strong pricing power, stable dividend profiles and a central bank supportive of its zero-interest-rate policy, as reaffirmed by the SNB in June, make Switzerland an attractive market in uncertain times.

In short, the immediate crisis appears contained, but geopolitical risk remains a structural feature of today’s investment landscape. Attention now turns to July 9, when the U.S. tariff deadlines set by Donald Trump expire. This could prove a pivotal moment, providing greater clarity on future U.S. trade policy and more planning security for companies.

In this environment, a resilient and risk-aware positioning with a focus on quality remains the right approach. Market pullbacks, especially those driven by emotional overreactions, can offer selective buying opportunities. Our defensive positioning gives us the flexibility to selectively add risk during periods of elevated volatility.

Appendix & Disclaimer

Mit SoundInsights beurteilen wir systematisch und konsistent die Aspekte, die für die Entwicklung der Finanzmärkte relevant sind. In der Folge können sich unsere Kunden auf eine rationale und antizyklische Umsetzung unserer Anlageentscheidungen verlassen.

- Konzentration auf das Wesentliche

Zinsniveau, Risikoaufschlag, Bewertung, Wirtschaftsentwicklung, Anlegerstimmung und -positionierung. Das sind die zentralen Faktoren. Sie entscheiden über den Erfolg an den Finanzmärkten. Besonders in turbulenten Zeiten, wenn die Versuchung besonders gross ist, irrational den Schlagzeilen hinterherzulaufen. - Vergleichbarkeit über Ort und Zeit

Die genannten Faktoren sind für alle Märkte und zu jeder Zeit gleichermassen relevant. Dies ergab sich aus einem strengen «Backtesting», welches sich rollend in die Zukunft fortsetzt. - Bündeln unserer kumulierten Anlageerfahrung

Unsere Stärke liegt in den langjährigen Erfahrungen unserer Partner und Principals. Genau diese Erfahrungen fassen wir zusammen und machen sie mittels SoundInsights anwendbar. - Transparenz

Durch die monatliche Publikation wissen unsere Kunden stets, wo wir im Anlagezyklus stehen und wohin die Reise an den Finanzmärkten geht.

Das vorliegende Dokument dient ausschliesslich zu Informationszwecken und ist als Werbung zu verstehen. Es wurde von SoundCapital (nachfolgend «SC») mit grösster Sorgfalt erstellt. Trotz sorgfältiger Bearbeitung übernimmt SC keine Gewähr für die Richtigkeit, Vollständigkeit oder Aktualität der enthaltenen Informationen und lehnt jegliche Haftung für Verluste ab, die durch die Nutzung dieses Dokuments entstehen könnten. Die in diesem Dokument geäusserten Meinungen spiegeln die Einschätzungen von SC zum Zeitpunkt der Erstellung wider und können sich ohne vorherige Ankündigung ändern. Es handelt sich weder um ein Angebot noch eine Empfehlung zum Kauf oder Verkauf von Finanzinstrumenten oder zur Inanspruchnahme von Dienstleistungen. Empfängern wird empfohlen, eigene Beurteilungen vorzunehmen und gegebenenfalls unter Hinzuziehung eines Beraters die Informationen in Bezug auf ihre individuellen Umstände sowie deren rechtliche, regulatorische und steuerliche Auswirkungen zu überprüfen. Obwohl die Informationen aus als zuverlässig angesehenen Quellen stammen, übernimmt SC keine Garantie für deren Genauigkeit. Vergangene Wertentwicklungen von Anlagen sind kein verlässlicher Indikator für zukünftige Ergebnisse. Ebenso sind Prognosen zur Wertentwicklung nicht als verlässlicher Indikator für künftige Ergebnisse zu verstehen. Dieses Dokument richtet sich nicht an Personen, deren Nationalität oder Wohnsitz den Zugang zu solchen Informationen rechtlich einschränkt. Eine Vervielfältigung, auch auszugsweise, ist nur mit ausdrücklicher schriftlicher Genehmigung von SC gestattet.

© 2025 SoundCapital.

Datenquelle: Bloomberg, BofA ML Research