SoundInsightN°11

Bonds

Equities

Gloomy outlook unsettles investors

Long-term interest rates are experiencing a significant increase, which could trigger additional economic downside risks. A gloomy outlook from some companies is leading to heightened volatility, but it also presents opportunities in the stock market.

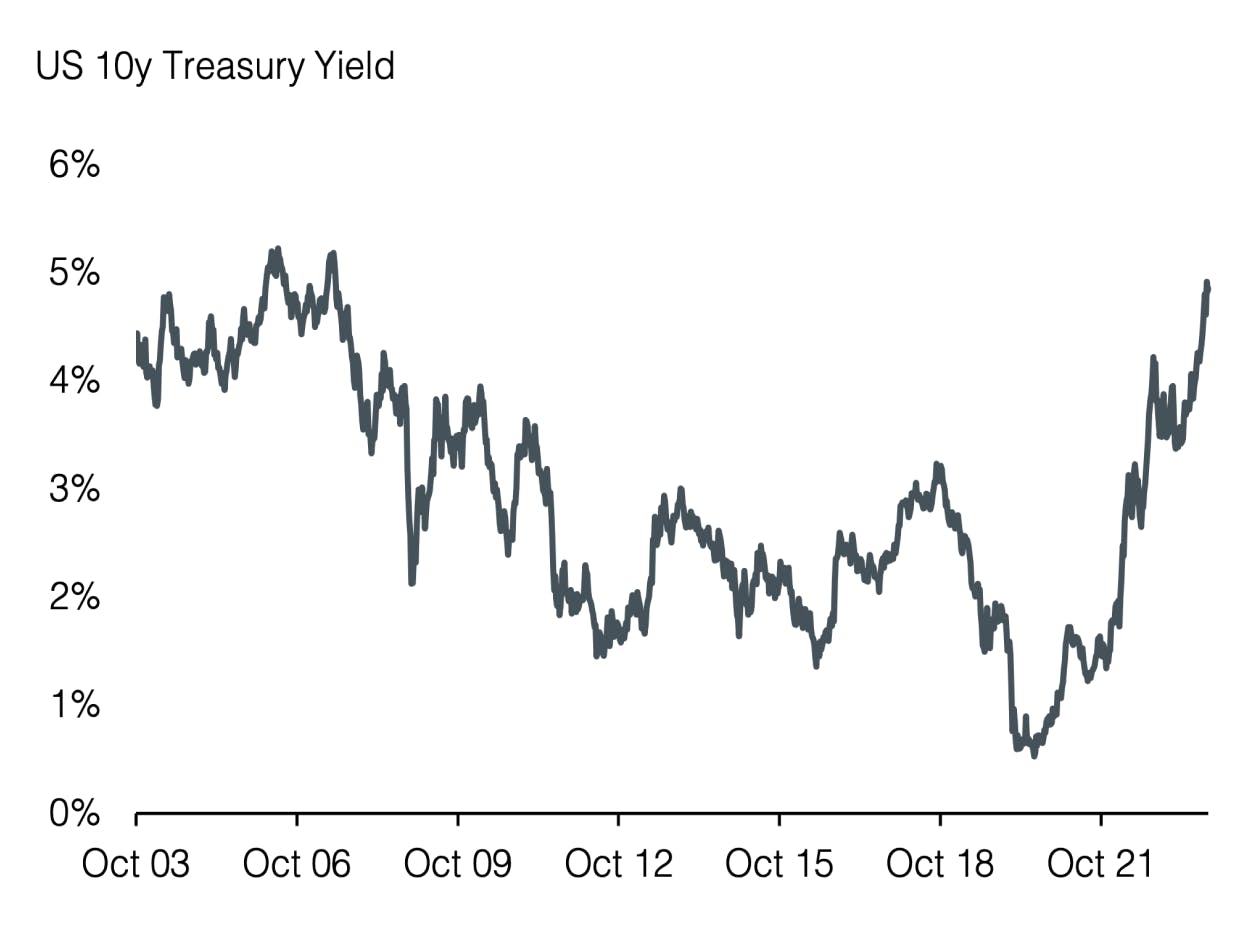

The rise in yields on long-term US government bonds, known as 'Bear Steepening', threatens the expected 'soft landing' of the economy, as it leads to further tightening of the already restrictive monetary policy. Although the yield curve is still inverted (with the yield on two-year Treasury-Notes remaining above the equivalent with a ten-year maturity), the extremely rapid increase in the yield on 10-year Treasury-Notes has reduced the yield spread versus 2-year Treasury-Notes from -1.1% at the middle of the year to now only -0.2%.

The specific reasons for this development are contentious. Long-term yields have certainly risen due to surprisingly positive economic data in the US, with GDP growing by 4.9% in the third quarter. Hence, economic growth significantly surpassed the expectations of most observers, including central bank policymakers. However, there are also negative factors driving yields higher such as the doubling of the US deficit by adding an additional trillion USD compared to the previous year. Furthermore, the rising issuance of bonds to cover an ever-increasing pile of debt causes investors to demand a higher premium to carry the risk associated with long-term bonds.

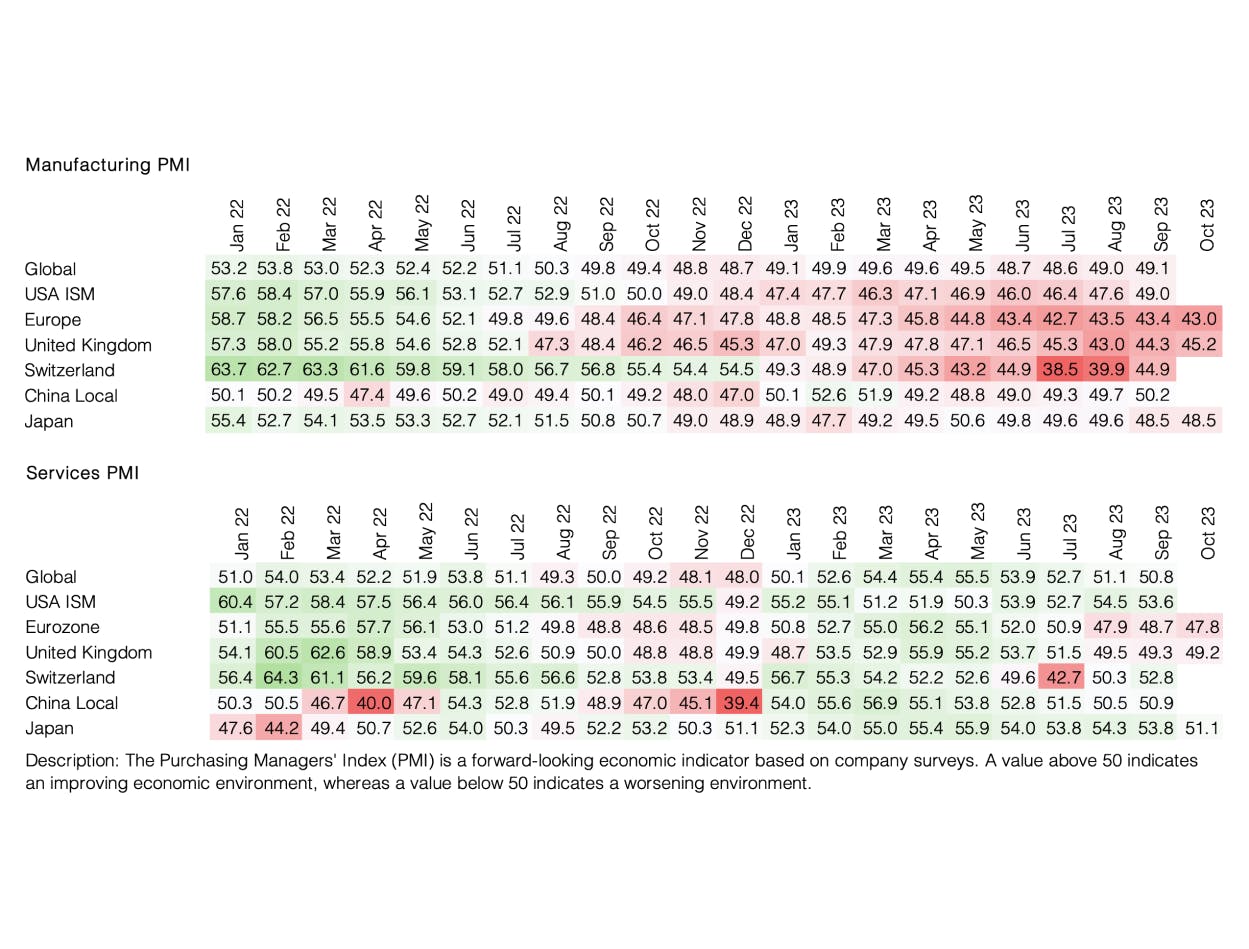

It's evident that rising costs are tightening financial conditions for mortgages and loans, leading to less investment and a subsequent decline in economic momentum. The negative shift in money supply confirms this trend: money has a challenging price again, and it will likely stay this way for the foreseeable future.

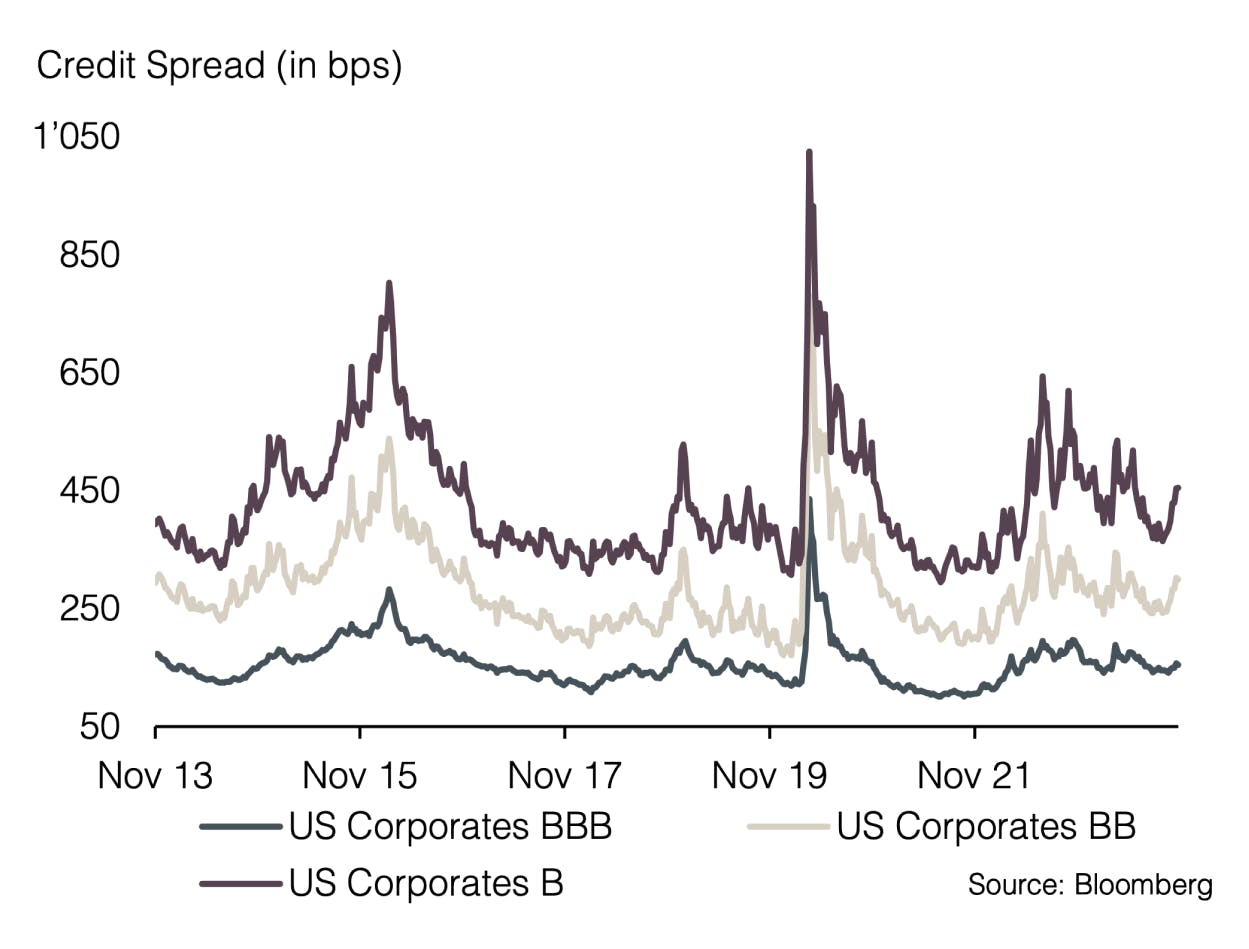

In the corporate world, this new reality is increasingly evident. While recent quarterly earnings results mostly exceeded analysts' expectations, a gloomy outlook has, in some cases, led to significant stock price declines. Alongside rising costs, especially affecting debt-fueled business models, a significant warning of declining consumer demand has been another reason for a currently disappointing earnings season.

Despite these challenges, the global stock market has still shown substantial gains since the beginning of the year. However, it is widely known that a few heavyweight companies in the technology and communications sector have significantly distorted the overall returns. When considering an equal-weighted view, the same index has experienced a loss since the beginning of the year. Particularly, small caps, which often act as precursors for the general stock market, are performing poorly this year and posting high losses year-to-date.

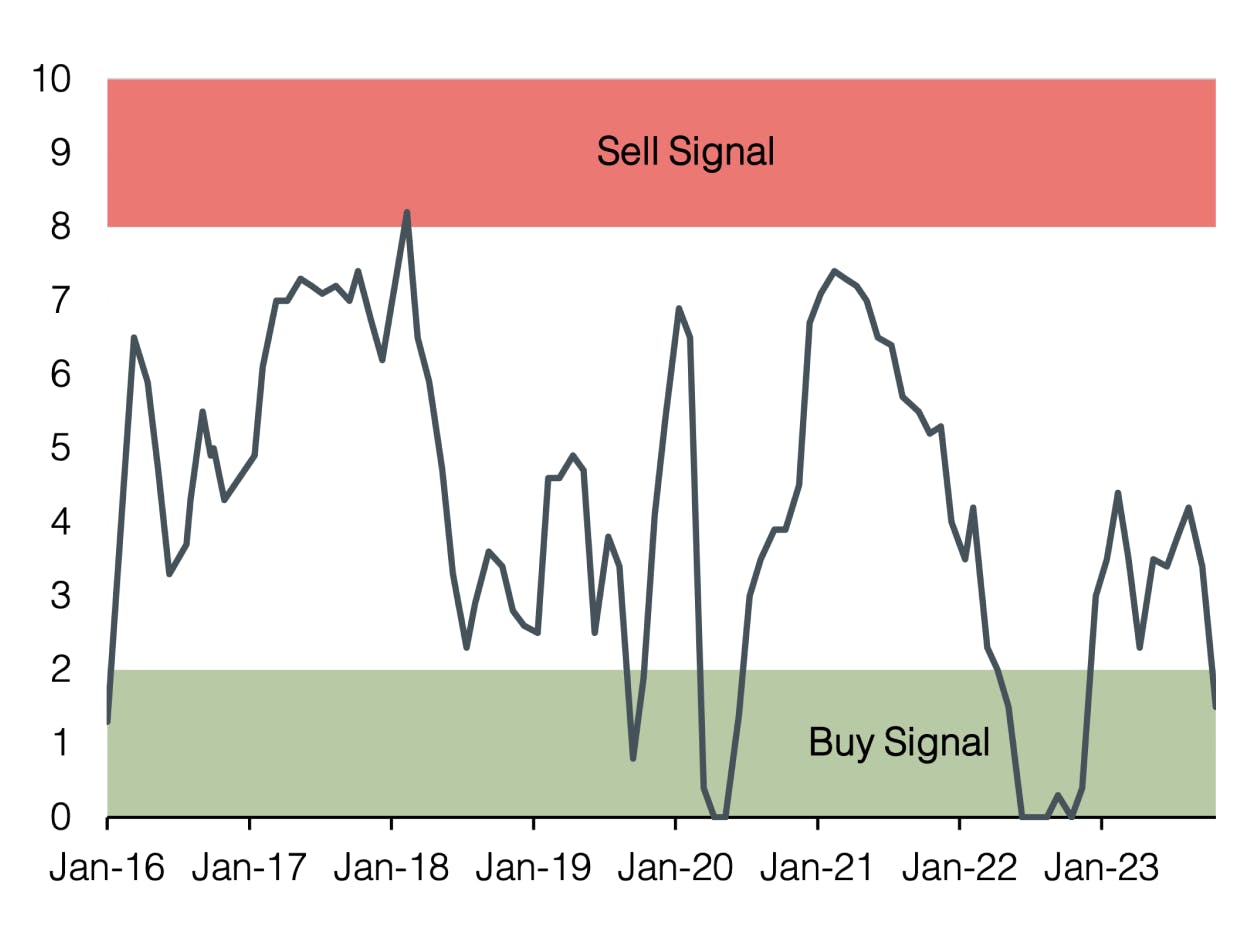

It's worth noting that currently more than 70% of companies in the S&P 500 are trading below their 200-day moving average. However, this situation also presents opportunities. Investor sentiment is as negative as it was during the turbulent May of 2022. Our factor model's contrarian risk index is signaling a counter-cyclical buy signal for the first time in a long while. Therefore, we are increasing our exposure to equities at the expense of liquidity, which leads to a neutral allocation of the asset class. In this market environment, it's highly recommended to continue focusing on quality and avoid substantially leveraged companies, as they are likely to face a significant increase in interest costs in the coming months. Due to the higher volatility in the stock market, we recommend a gradual increase in the equity allocation. Our preference remains with quality stocks offering attractive dividend yields, healthcare, and the energy sector. Overall, fundamental valuation levels are also coming back to the forefront in stock selection.

Appendix

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research