SoundInsightN°17

Bonds

Equities

Bad news is good news

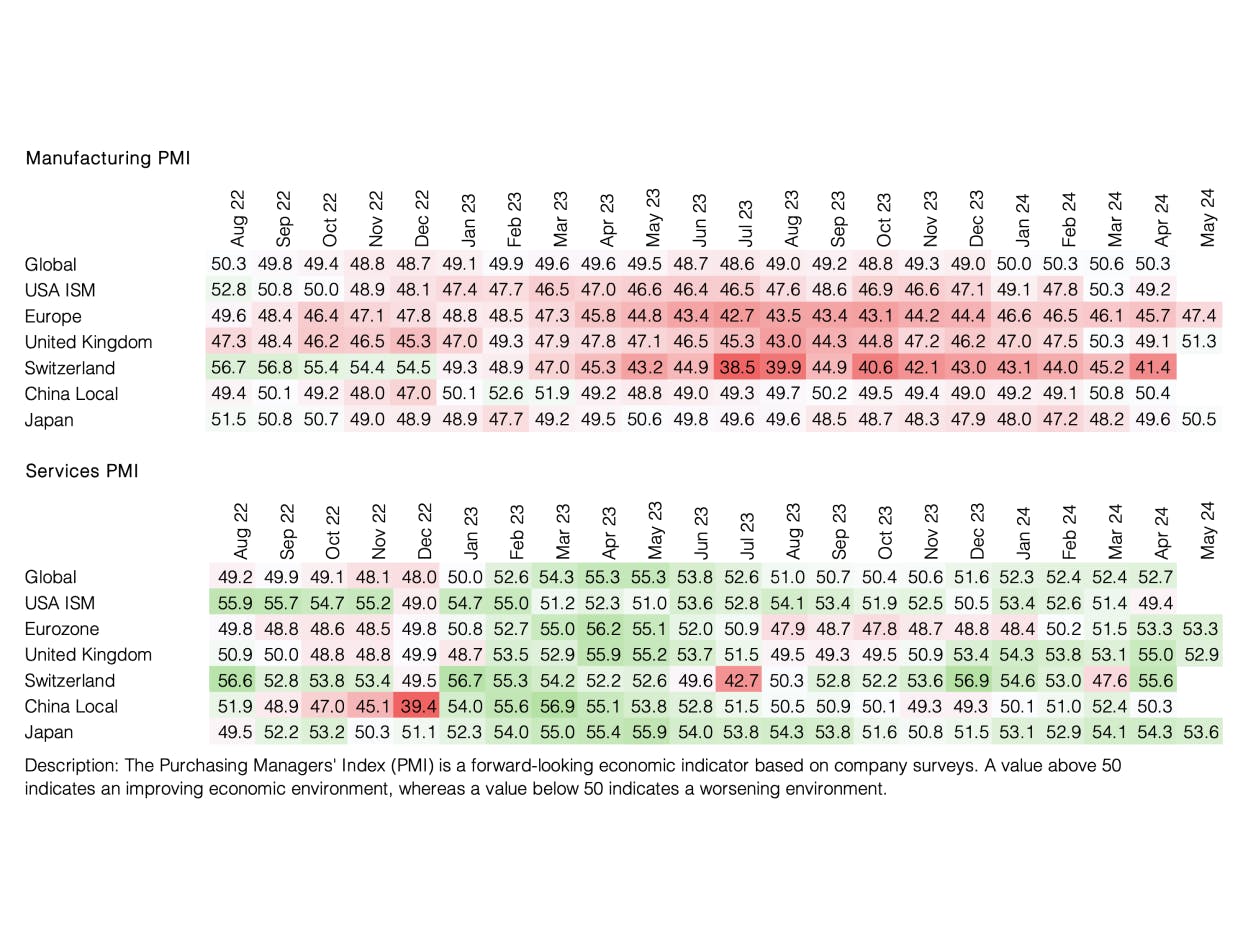

Last month offered a glimmer of hope for those anticipating lower interest rates. For the first time this year, a variety of economic indicators fell short of expectations. However, a clear trend remains elusive.

April was marked by surprising economic developments in the US. Inflation rose by 0.3% compared to the previous month, falling short of economists' expectations. It was the first time this year that inflation data printed lower than projected, which can certainly be seen as a positive sign. However, it is still unclear whether economic growth will stabilize sustainably around current levels and if inflationary pressure will trend lower.

Another significant economic indicator, the number of new jobs created, showed its lowest reading since October 2023. This could indicate that the closely watched US labor market is losing momentum. Additionally, retail sales fell short of expectations. Given an almost too hot US economy, this is good news for all major asset classes.

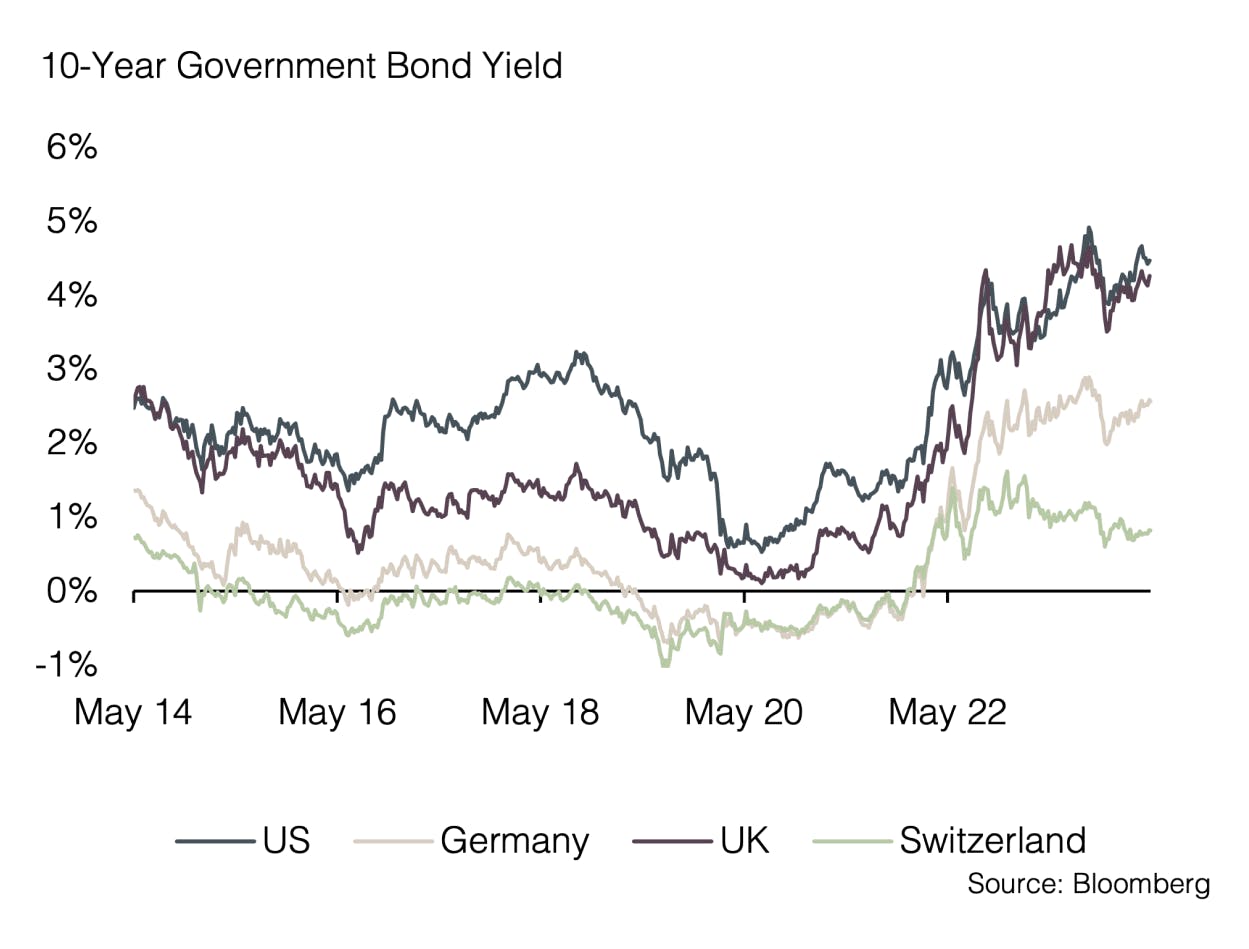

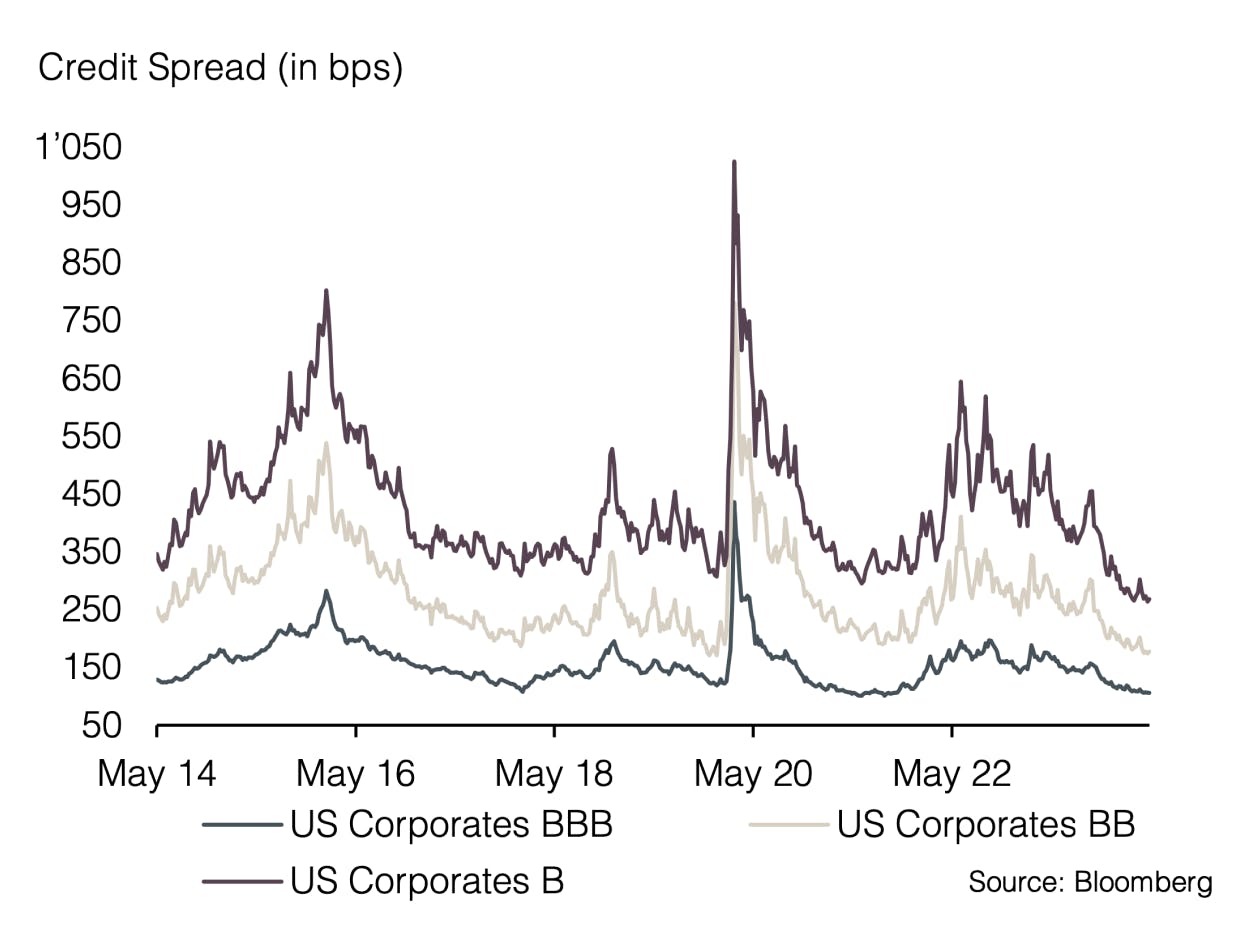

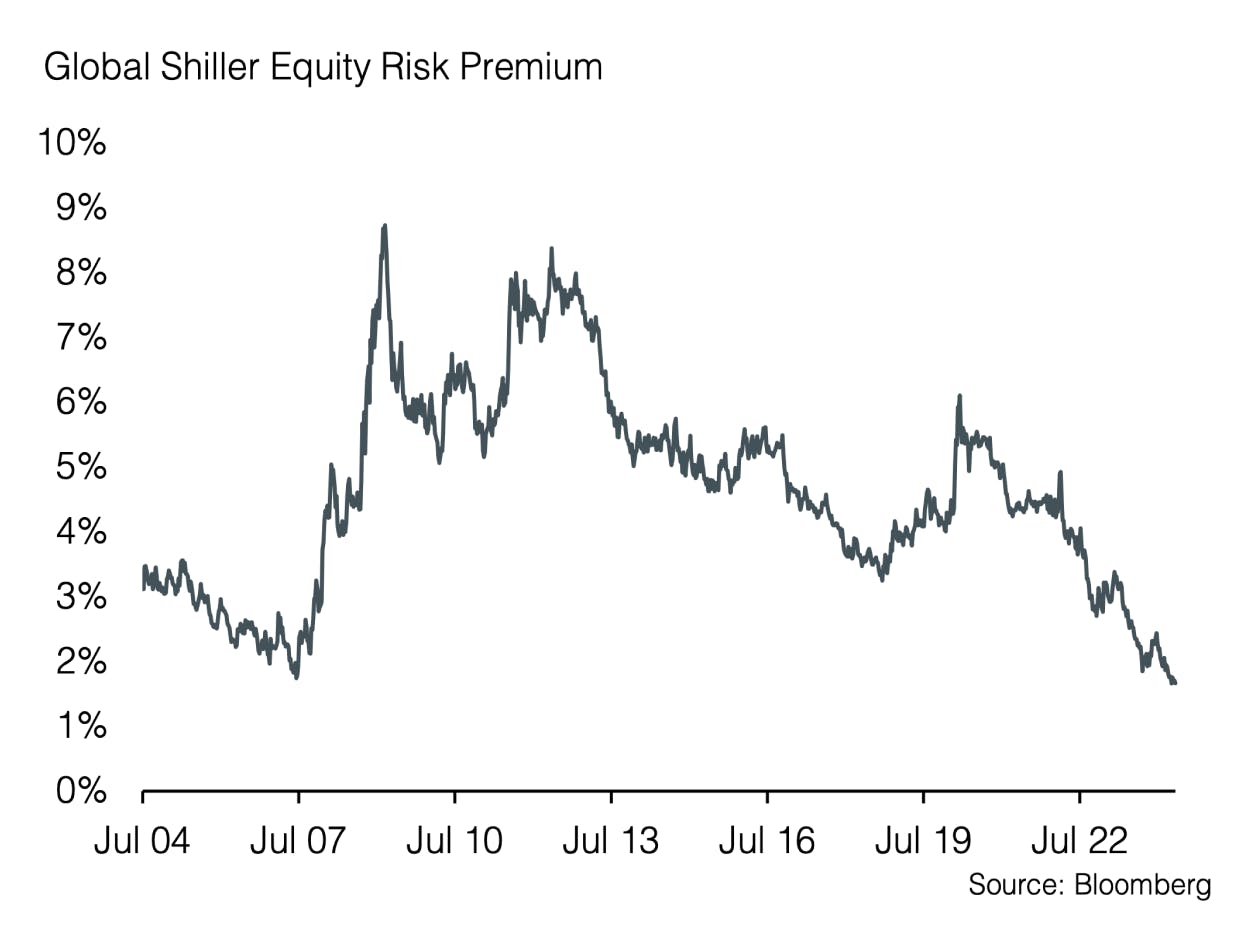

In the current market environment, negative economic surprises paradoxically led to a positive reaction in financial markets. Investors around the globe interpreted the weaker economic data as a sign that central banks, particularly the Federal Reserve, might cut interest rates multiple times this year. The economic trajectory has been continuously fluctuating between positive and negative developments regarding inflation for some time now. While data in the fourth quarter of 2023 fostered expectations for up to six rate cuts for 2024, data of recent months cast doubt on whether US interest rates would be cut at all this year. Now, for the first time this year, April seems to bring a bit of optimism for rate cuts again. Nevertheless, a clear trend with regards to the further path of inflation has yet to emerge. Fixed income benefited from the lowered interest rate expectations and gained globally. Investors responded positively to the possibility of stable or even declining rates. Stock markets were also supported by lower interest rates, reaching new record highs in various regions. The reaction to the latest set of data highlights how strongly markets are currently betting on lower rates and how sensitive they are to economic indicators.

A crucial factor in the coming weeks will be the central bank meetings of the European Central Bank (ECB) and the Federal Reserve (FED) in early June. The ECB is expected to announce its first rate cut since 2016, which would be a significant step in European monetary policy. A rate cut could stimulate economic activity in the Eurozone and weaken the euro, supporting the export industry. On the other hand, the FED is likely to focus on clear communication regarding the further path of monetary policy. Although a rate cut is only expected at the end of the year, the FED's statements will be carefully analyzed for how the policymakers assess the current situation. In the alternative investment space, the development of commodity prices does not indicate lower inflation from our perspective. In particular, base metals are reaching record levels, increasing production costs in many industries and potentially worsening inflationary trends in the long term. Since commodity cycles run over longer periods, this topic will continue to be discussed in depth in our investment committee.

Over the last month, we made no changes to our asset allocation. Currently, macroeconomic data leaves much room for interpretation. Therefore, we are focusing on our systematic process and prefer longer duration and high quality in bonds. In the equity space, we remain neutrally weighted but note an increasing risk appetite as markets become more expensive.

Appendix

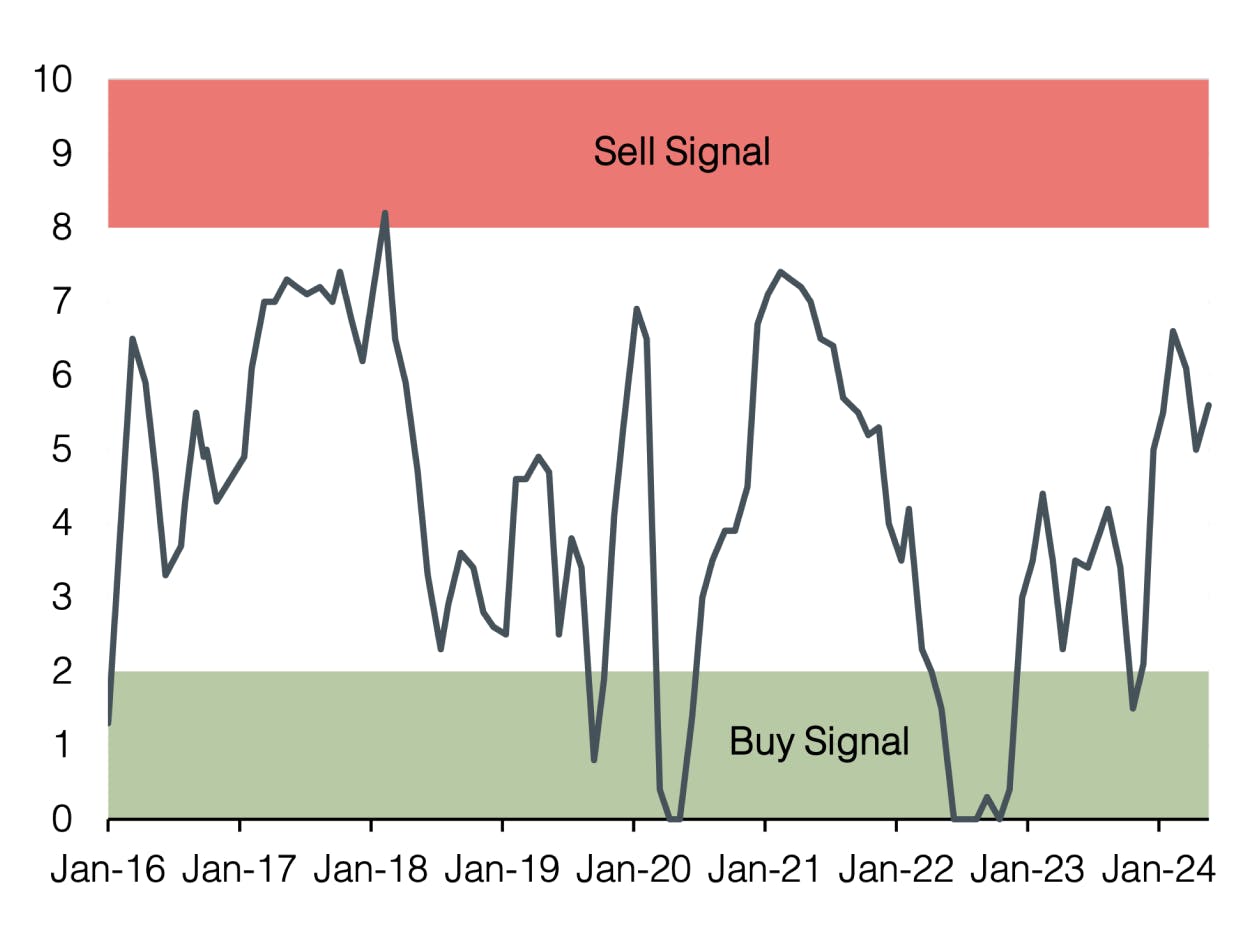

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research