SoundInsightN°4

Bonds

Equities

Crisis of confidence

The financial sector is flashing a clear warning signal. Higher interest rates are leaving the first cracks in an obviously fragile banking system. The consequences could turn out to be a paradigm shift in terms of monetary policy.

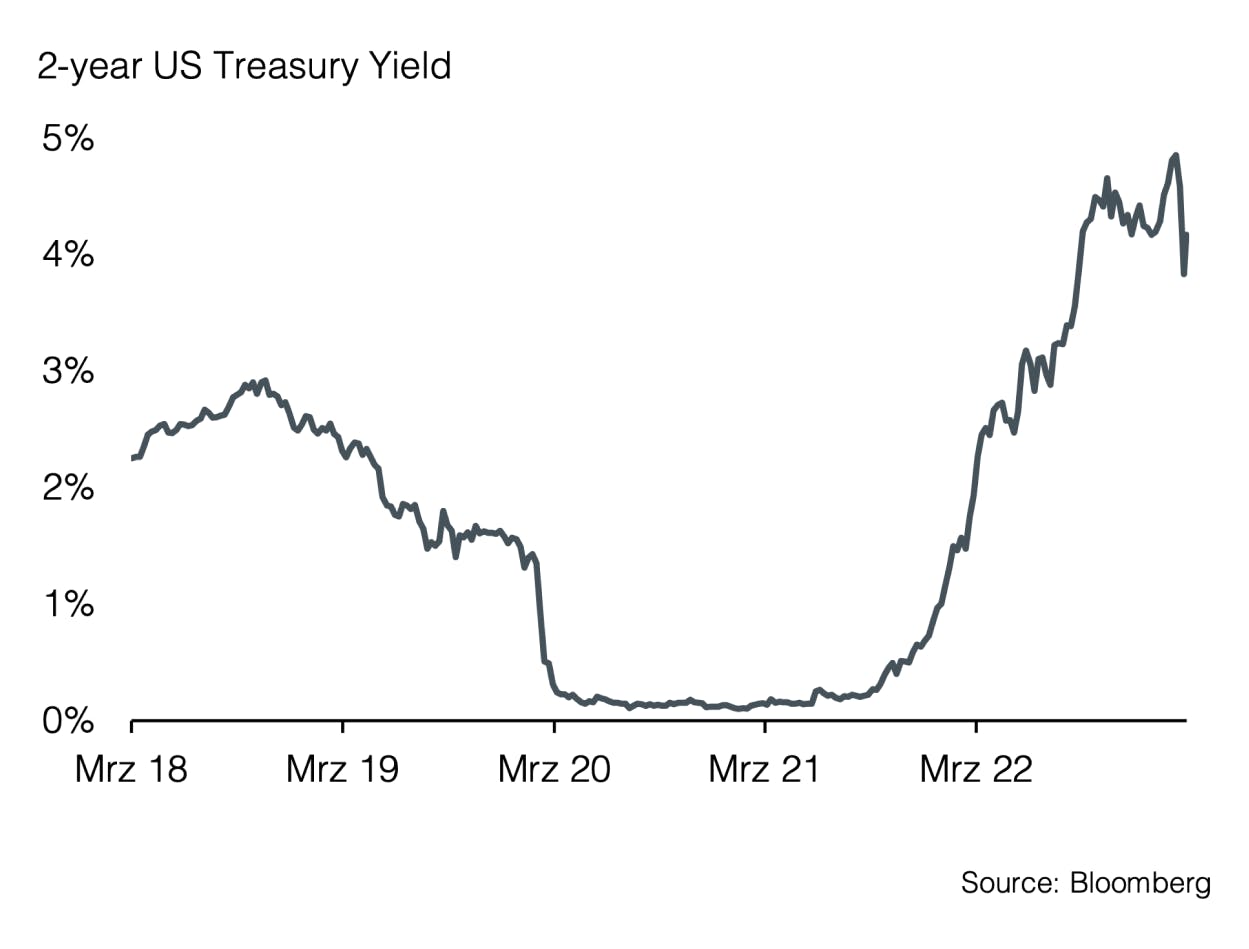

A little more than a week ago, the content of this Sound Invest would have been quite different. Almost all macroeconomic data exceeded analysts' expectations and pointed to continued persistent inflation. Hence, the interest rate expectations derived from the FED and ECB monetary policy were subsequently adjusted sharply upward by the market. At the beginning of March, the expected US key interest rate for the end of the year reached 5.75%, a level unseen for more than 20 years.

Then events came to a head: Apparently flawed risk management at Silicon Valley Bank (SVB) led to the second largest bank failure in US history. Although relatively unknown outside the US, SVB was one of the 20 largest US commercial banks, with total assets of USD 209 billion. Nearly half of US venture capital technology and healthcare companies were doing business with SVB. Continuously rising interest rates put pressure on the value of risk capital invested in bonds, triggering a crisis of confidence, followed by a bank run. Within 48 hours, depositors got bailed out by the FDIC (Federal Deposit Insurance Corporation), with all creditors' deposits (including uninsured) of more than USD 150 billion guaranteed by the government. At the same time, two other institutions, Silvergate and Signature Bank, became insolvent and their deposits were also immediately guaranteed by the FDIC in the same manner.

The drastic situation put the entire regional banking sector in the USA under massive pressure and did not stop at the large US financial institutions, as their stocks also suffered heavy losses. From a European perspective, the events were already eclipsed in the following week. With Credit Suisse, a globally far more relevant institution got under pressure. While a "too big to fail" institution like CS is subject to much stricter capital and liquidity requirements, a collapse in its share price and a sharp rise in its credit default swaps, coupled with increasing international political pressure, forced the Swiss financial market regulator to smooth the waters with a forced takeover by rival UBS. In the transaction, the SNB granted a total of CHF 200 billion in additional liquidity guarantees and the Swiss Confederation issued a loss guarantee totaling CHF 9 billion. On top of that, the conversion of subordinated CS bonds created an additional CHF 16 billion in core capital. With the Swiss Confederation, one of the world's most solvent sovereigns intervened and, in our view, created the important basis for a lasting calm in the market. However, the fact that this crisis of confidence was only solved with government support is unlikely to help investor sentiment.

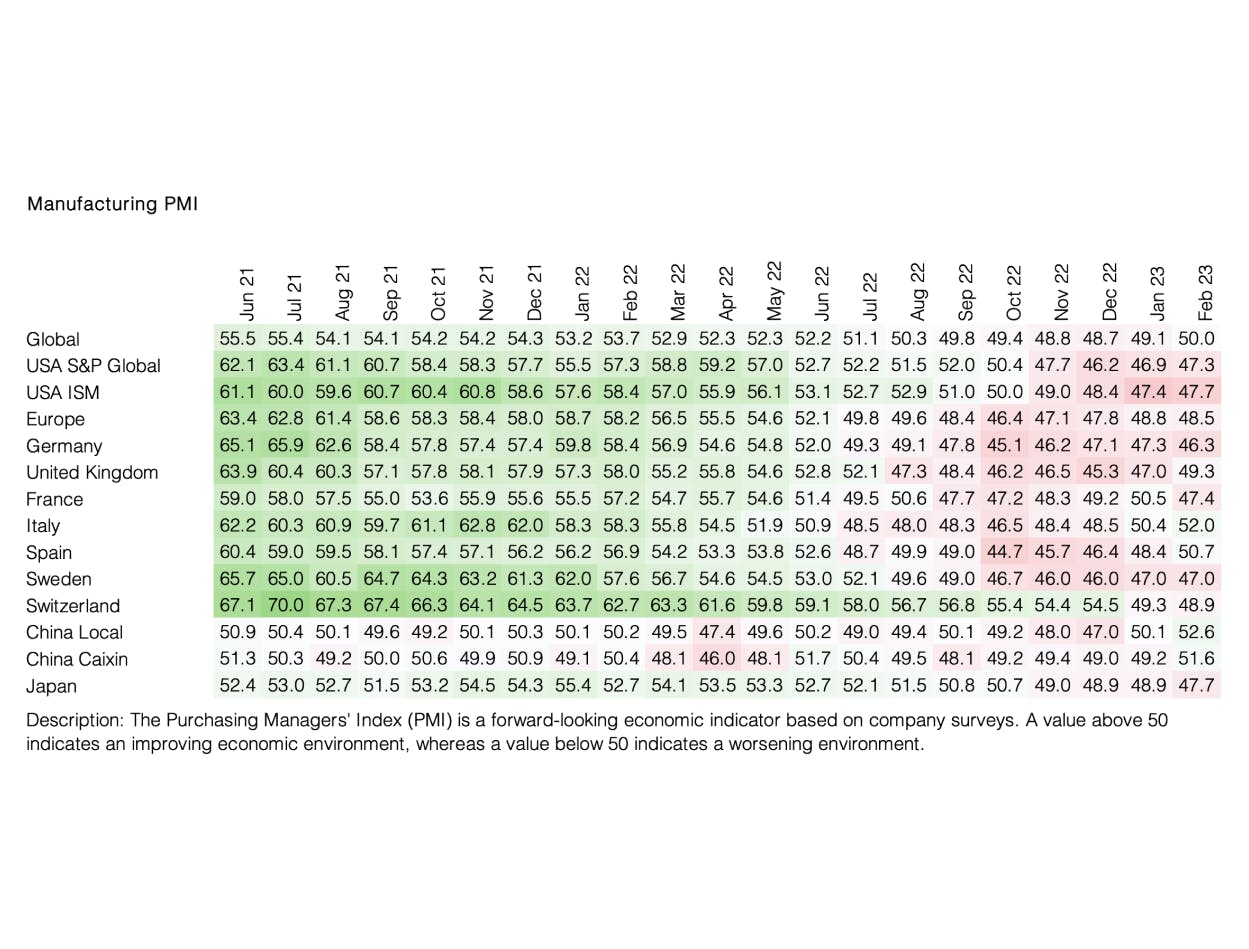

Recent developments show that central banks have reached their monetary goal or might have already exceeded it. Generally, banking crises are followed by stricter lending standards and a lower risk appetite among companies and investors. In the US, SMEs are likely to be hit hardest, as they are most dependent on lending from regional banks. US small businesses account for nearly two-thirds of jobs in America, so the reduced availability of credit is likely to lead to an increase in unemployment. While there will be a lag before these effects reach the economy, inflationary pressures are likely to ease as a result. This is clearly reflected in market developments: the Fed's expected key interest rate at year-end fell from 5.5% to 4% last week. Not surprisingly, US inflation expectations for the next 12 months fell to 2.4%.

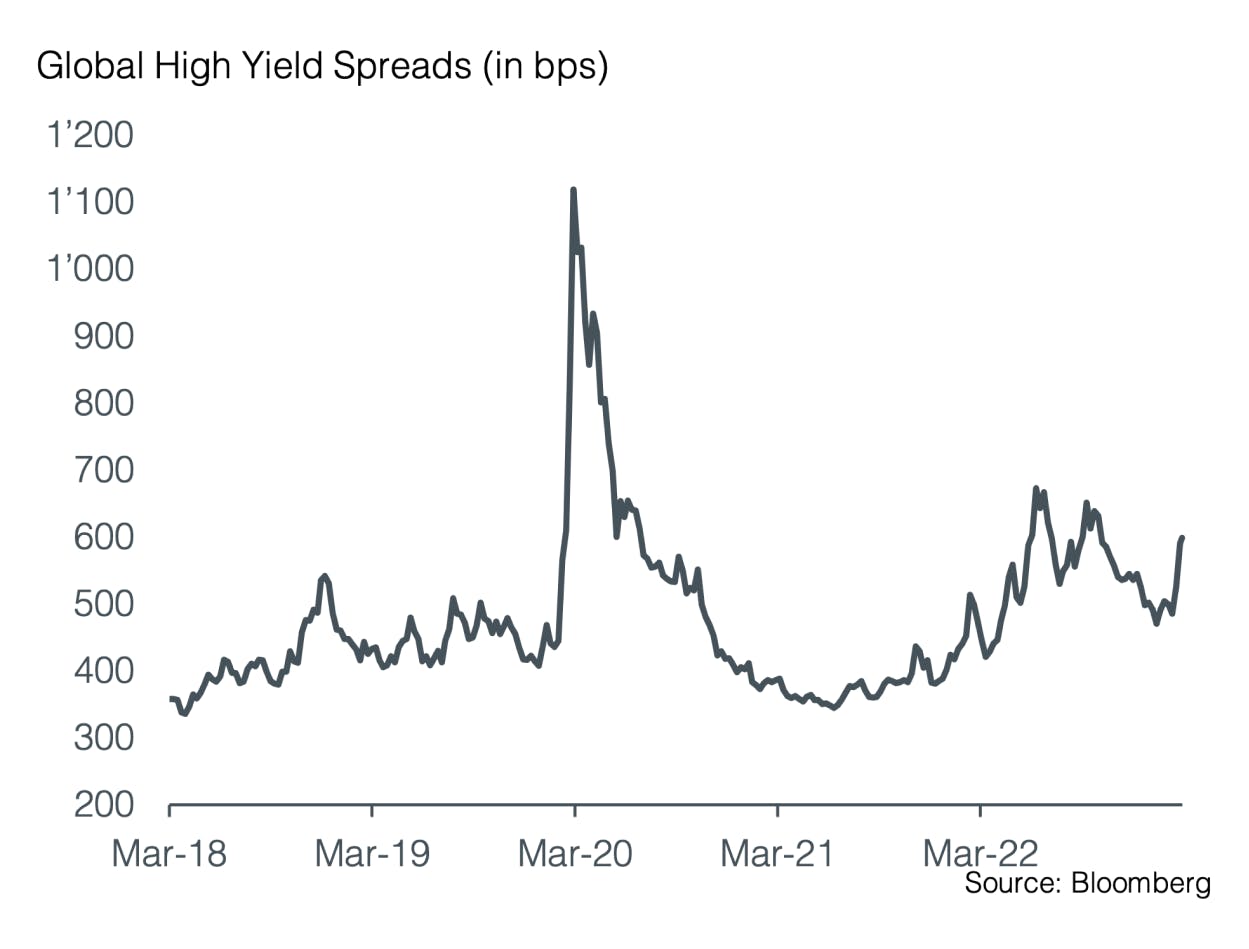

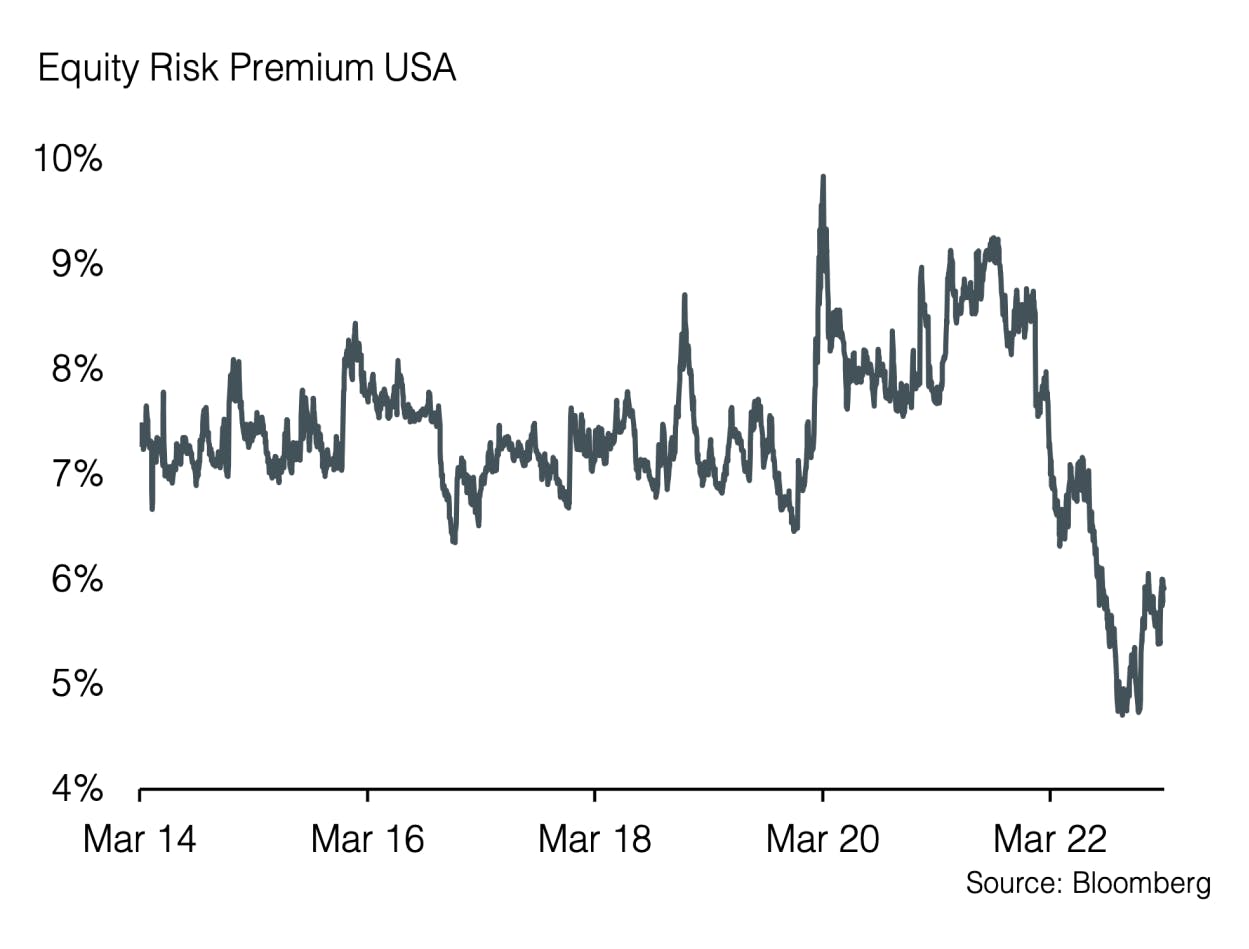

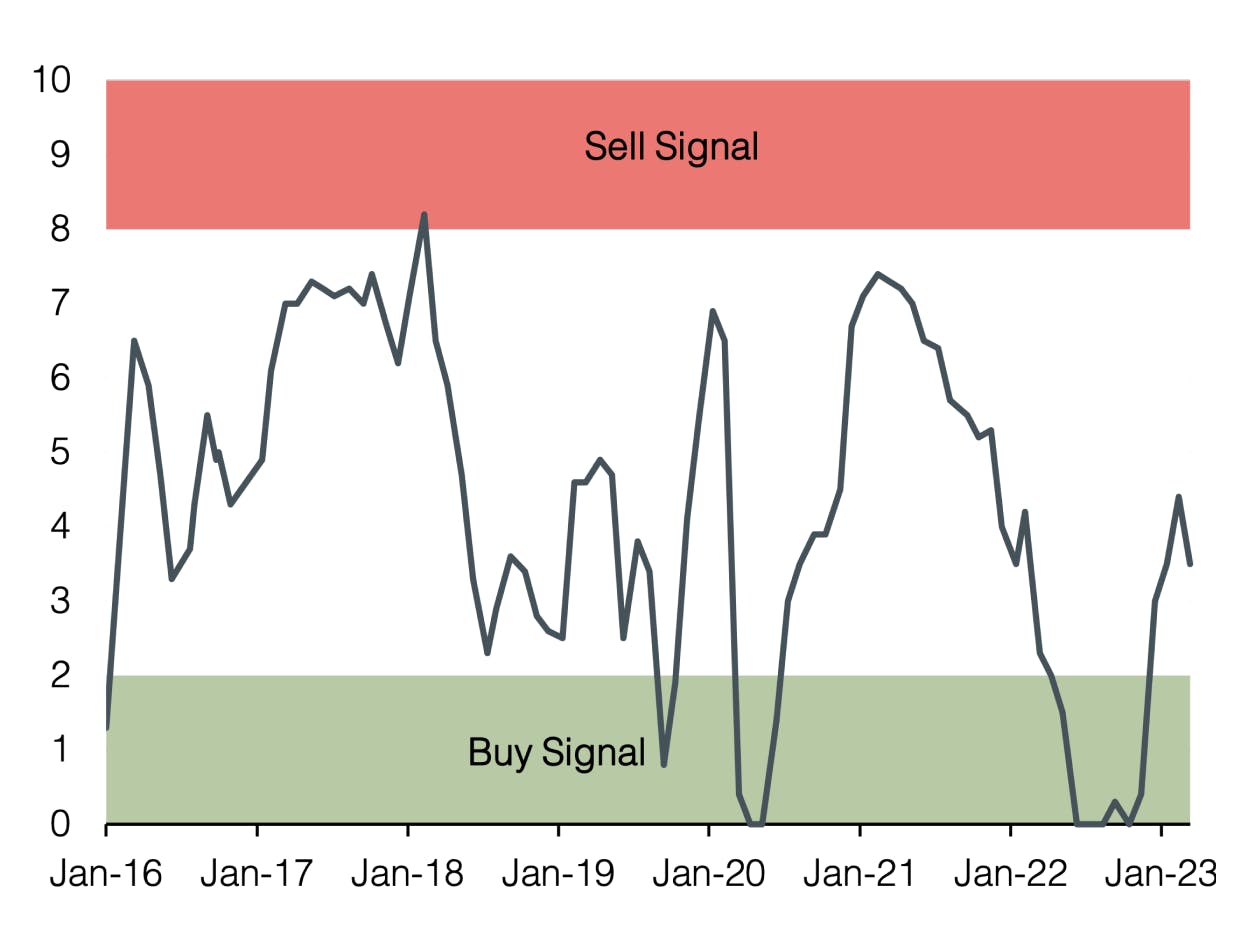

We see our current positioning confirmed and maintain a defensive allocation. We remain overweight government bonds across our fixed income allocation. In our view, rising credit spreads do not yet represent a buying opportunity for lower quality bonds. In equities, we remain underweight due to depressed risk premiums and favor defensive markets and investment styles such as Switzerland and high-dividend quality stocks.

Appendix

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research