SoundInsightN°19

Bonds

Equities

Monetary Policy as a Balancing Act

The Federal Reserve faces the challenging task of bringing inflation back to its target level of 2% while simultaneously stabilizing economic growth. Recent macroeconomic data suggest that a change in interest rate policy is imminent.

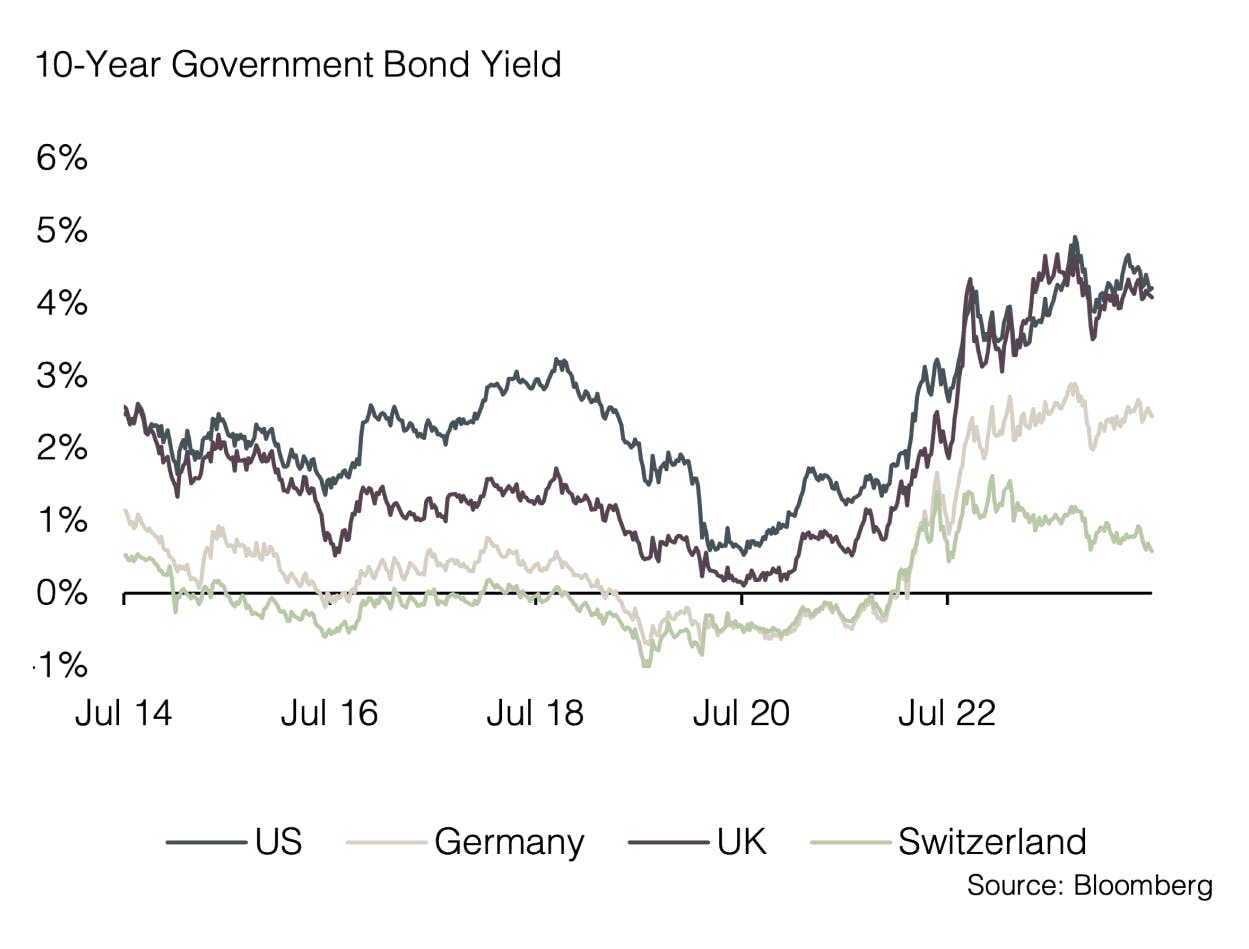

In the aftermath of the pandemic, the Federal Reserve faced the highest inflation since the early 80s. In response, interest rates were rapidly raised from 0% to 5.5%. The unprecedented tightening of monetary policy slowed the strong economic growth that was triggered by government stimulus and pandemic-related catch-up effects, bringing inflation under control. In the past, an economic "soft landing," where the central bank tightens monetary policy without triggering a recession, was successfully achieved only once in the 90s. Thus, market participants are trying to assess whether a “soft landing” can be accomplished in the current market environment.

Examining the data from the past few months reveals that, after minimal progress at the beginning of the year, inflation has now steadily declined over the last three months. US consumer prices for June once again printed below economists' expectations. The significant drop in shelter costs, which had previously proven to be very persistent and a strong driver of core inflation, was particularly well received. Examining the U.S. labor market, recently released data shows a slowdown in job creation. Furthermore, wage growth seems to be moderating. The unemployment rate rose to 4.1%, the highest level in more than two and a half years, already reaching the Fed's forecast for the end of 2024.

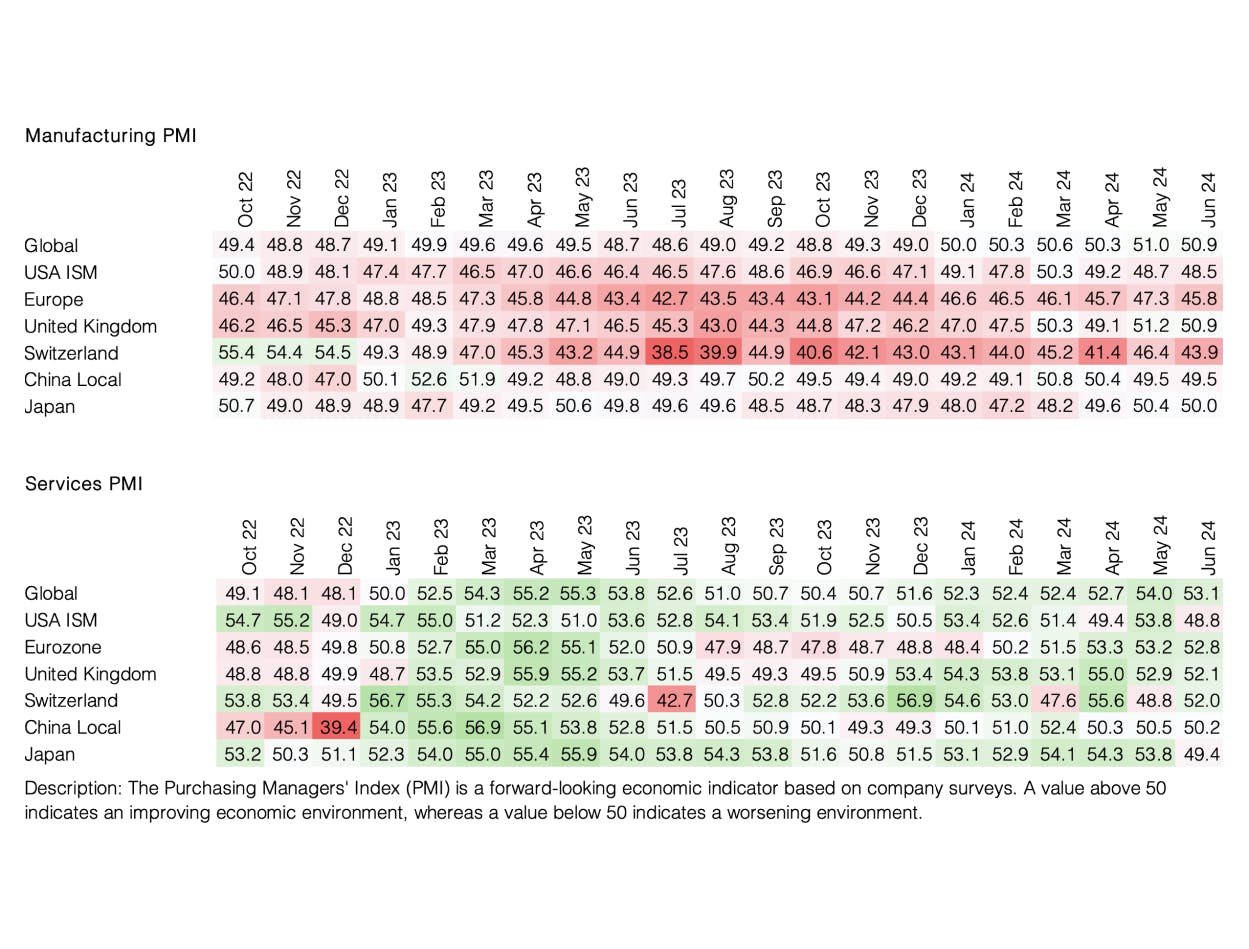

Overall, economic momentum is slightly weakening. The leading US purchasing managers' indices printed weaker than expected, with both the manufacturing and services sectors falling below the neutral value of 50. Additionally, there has been an increase in delinquencies on credit card debt, and the savings of US households, apart from the very wealthy ones, are largely depleted.

In summary, current economic data suggest that the Fed is likely to soon increase its focus on its second mandate — promoting maximum employment — alongside its dual mandate of price stability. Interest rate forwards also reflect these expectations and now anticipate that the Fed will cut interest rates by 0.25% in September, followed by at least one more cut in November or December. Overall, confidence in a soft landing of the economy is growing in the stock market. More cyclical and interest rate-sensitive equity sectors have significantly outperformed since the release of the latest inflation data while previously dominant technology stocks have underperformed. Small caps, which have been totally out of favor by investors, jumped by more than 10% in only 5 days, with banks and real estate companies also gaining.

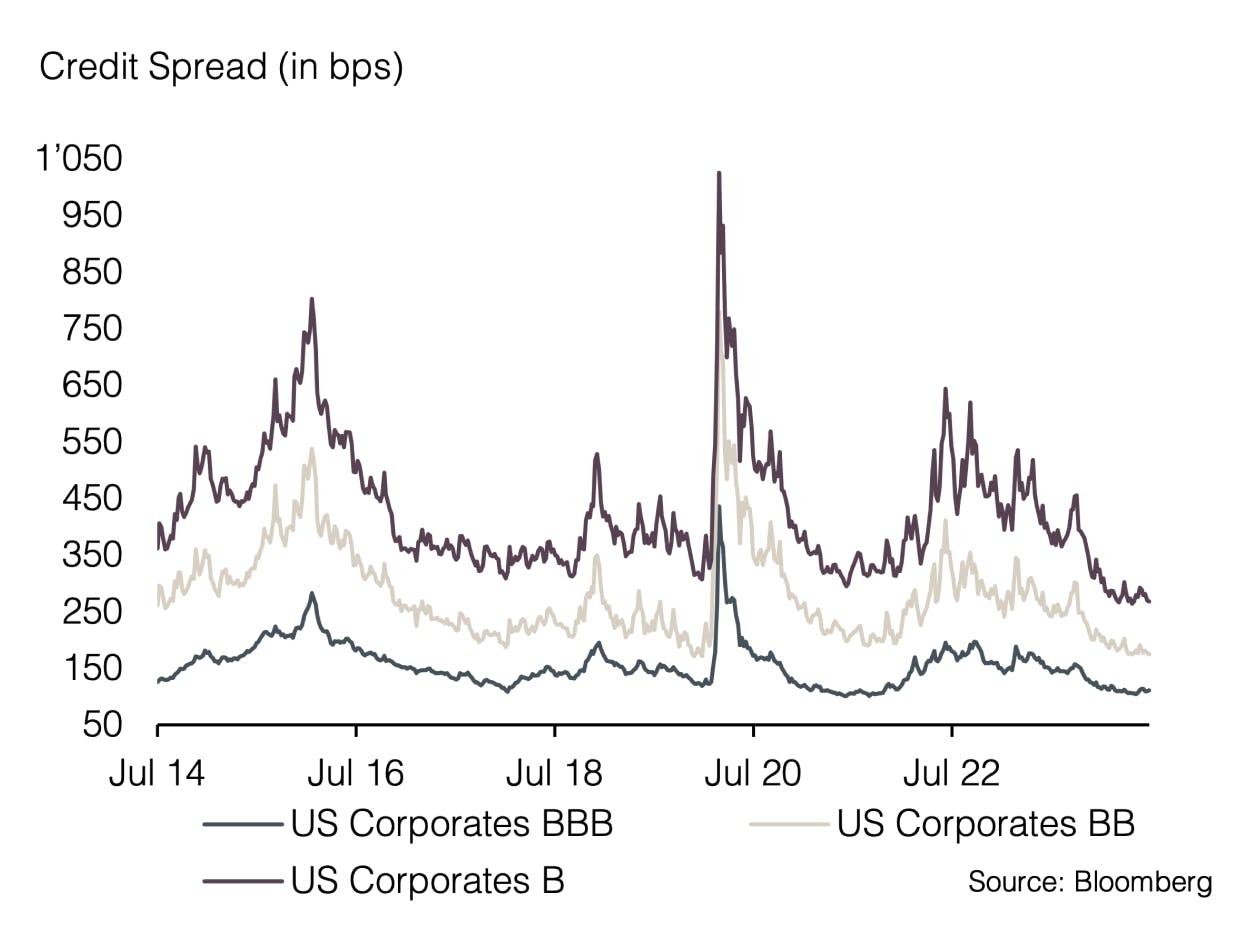

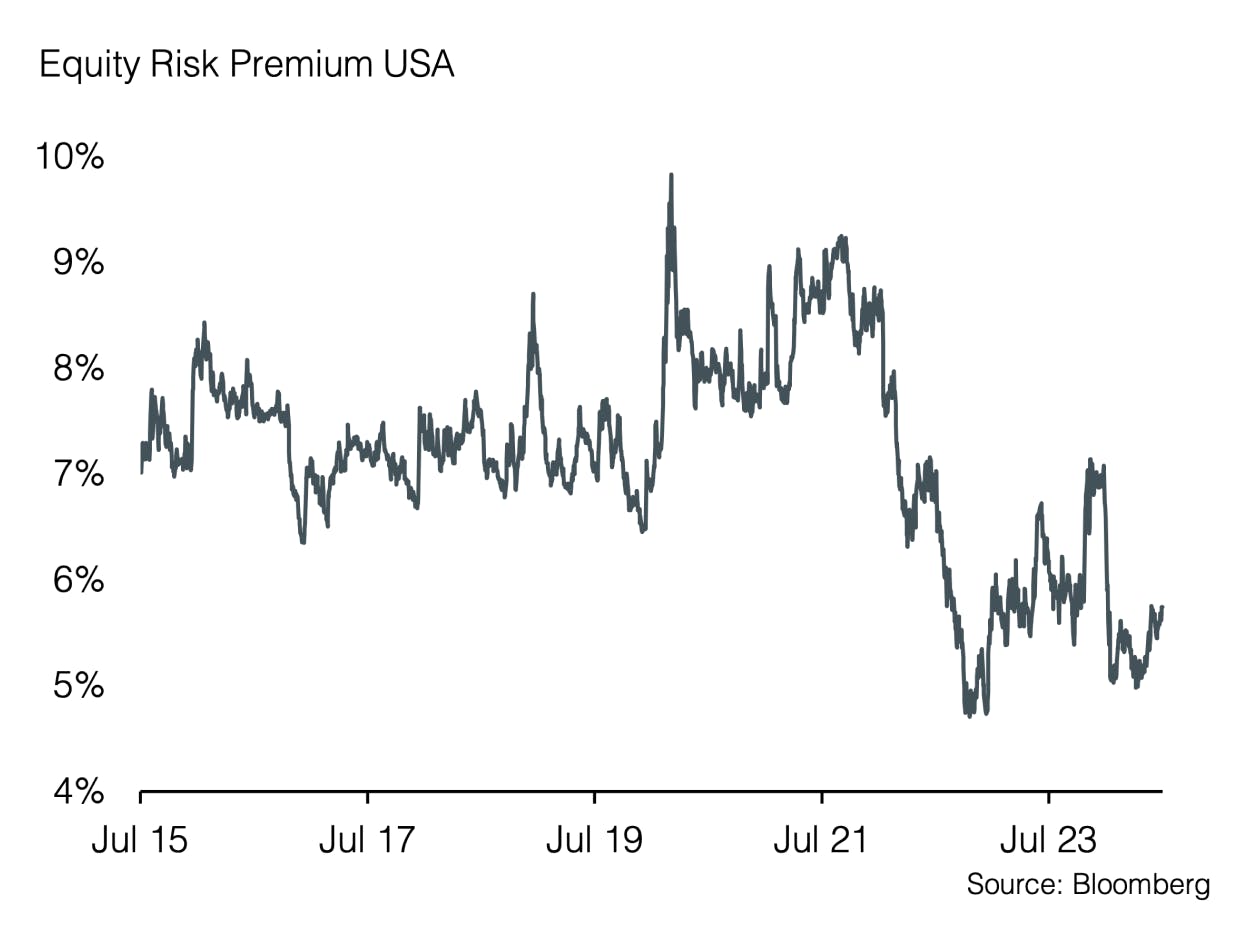

Equity prices already reflect significant investor optimism, resulting in elevated valuations and high expectations for future earnings growth. Therefore, we maintain our neutral stance towards equities and focus on high-quality companies with solid balance sheets that can perform well even during periods of slowing economic growth. Achieving a soft landing seems within reach, but history also shows that the likelihood of external shocks increases the longer rates stay high.

Appendix

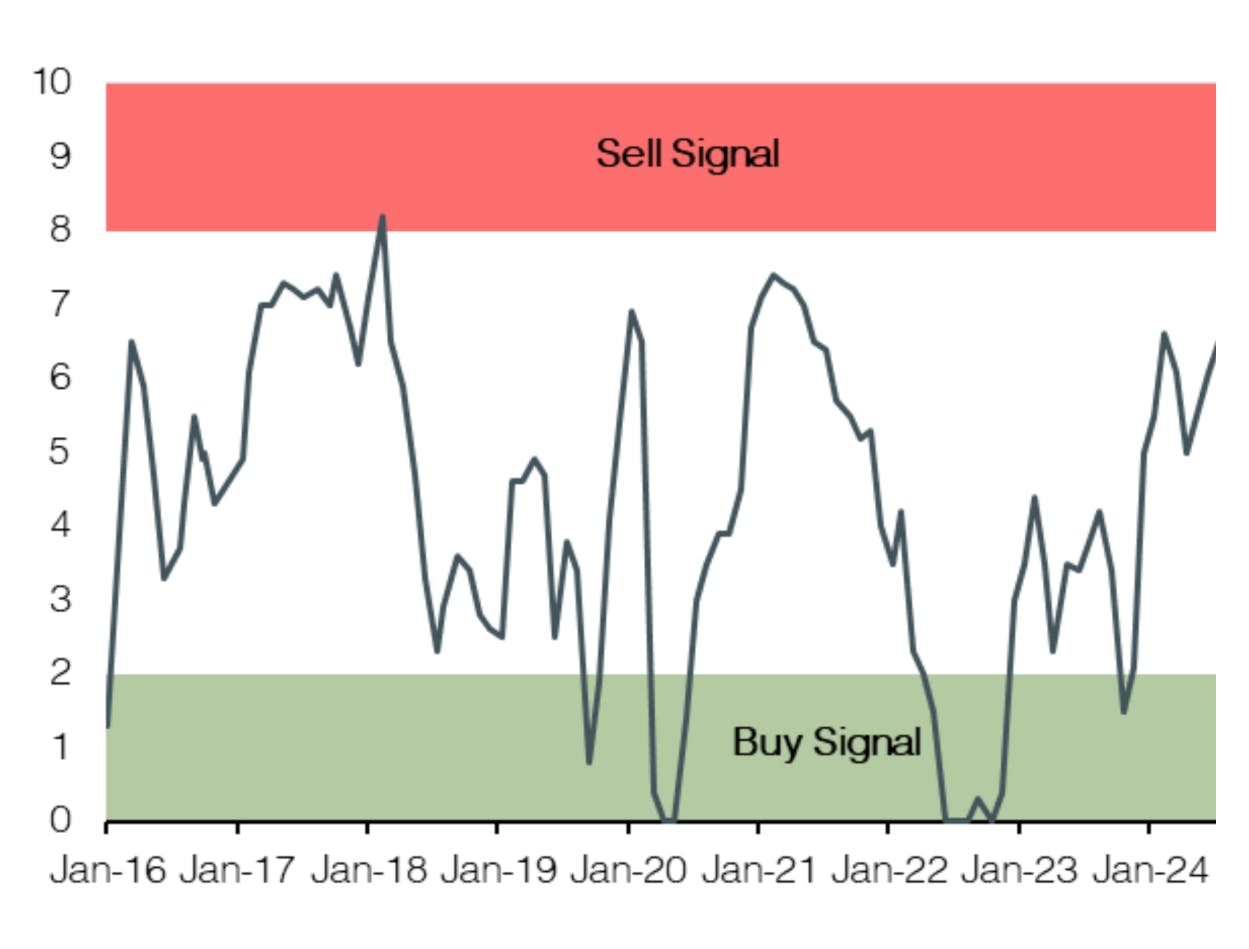

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research