SoundInsightN°8

Bonds

Equities

Final Stretch for Central-Bank Tightening

Lowest US inflation since spring 2021 paves the way for what is expected to be the Fed’s last rate hike in the current cycle.

The US continues to experience a decline in inflation, with June reporting the lowest figure since 2021 at approximately 3%. A noteworthy aspect of this development is the persistent core inflation, excluding food and energy, which has significantly dropped to 4.8% year-over-year, a more substantial decrease than anticipated by economists. This suggests that the impact of the preceding 500 basis points of interest rate hikes is gradually materializing, potentially paving the way for a final interest rate hike by the Federal Reserve at the end of this month.

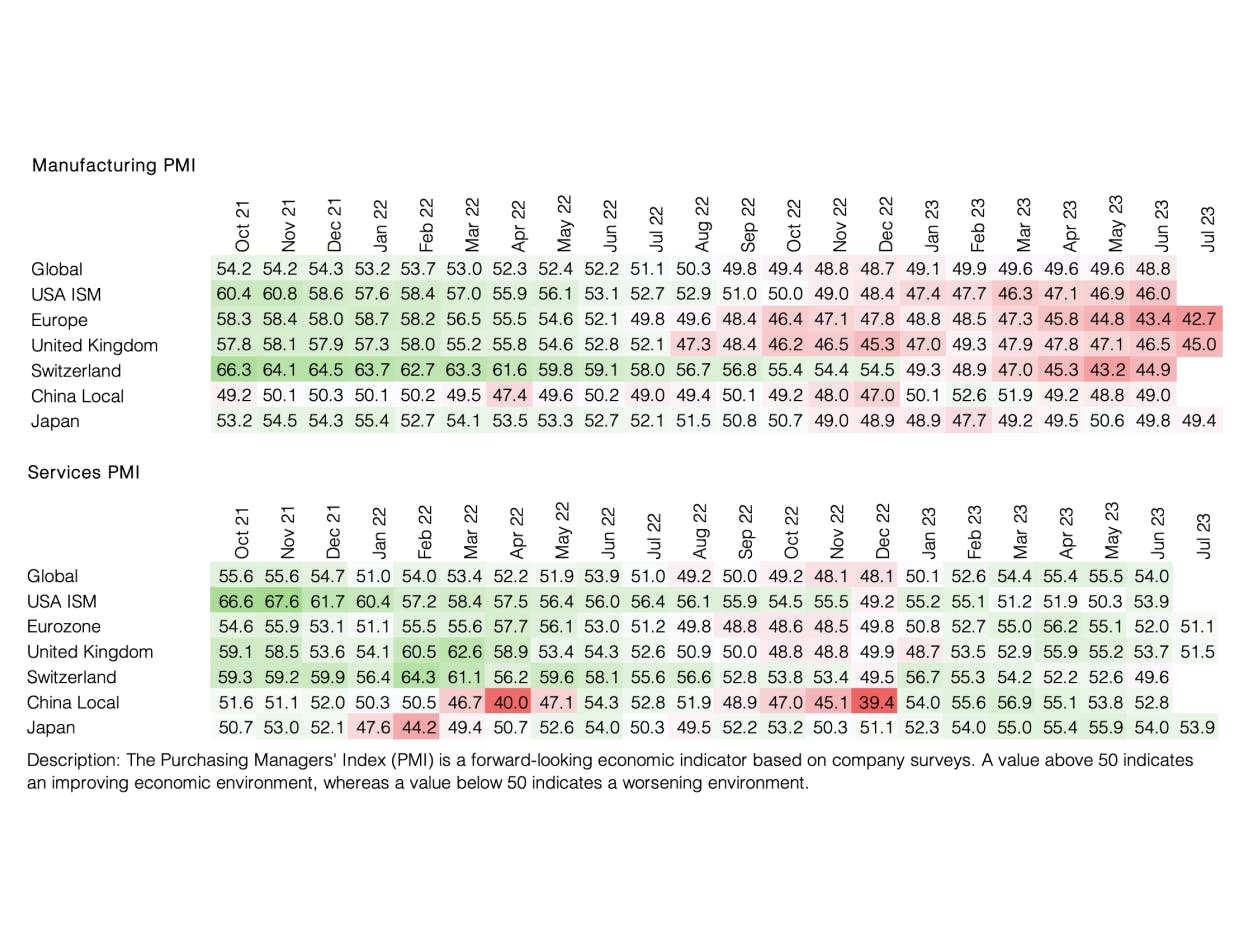

Analysts observe a disinflationary trend in the current data, coupled with an economic slowdown. Bloomberg's projections indicate that inflation in the US is expected to fluctuate between 0.2% and 0.3% monthly until the end of the year, inching closer to the Federal Reserve's 2% annual target. However, the journey towards achieving this target is likely to be challenging. Estimates indicate that the Consumer Price Index will witness a 3.4% year-on-year increase in July and a 3.6% rise in August, attributed to a less favorable base effect compared to June. Nonetheless, overall inflation for 2023 is predicted to remain slightly above 3%.

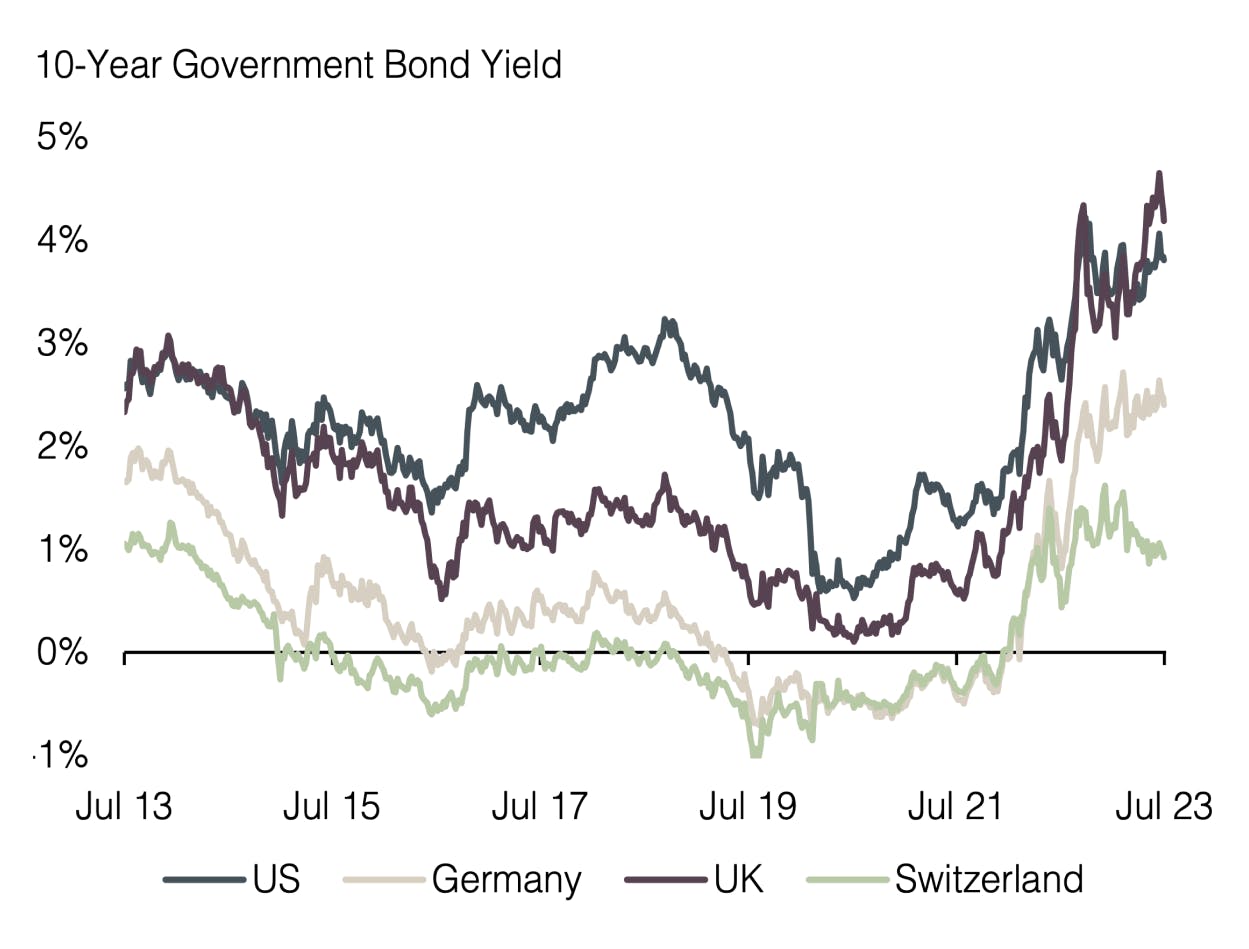

The market expects the Federal Reserve to hike one last time by the end of this month, while the European Central Bank (ECB) is poised to add two more interest rate hikes before year-end. This indicates a potential convergence of international monetary policies in the coming months. Although the Federal Reserve has made considerable progress in its efforts to fight inflation, central bank policy rates are expected to continue climbing across other global regions until year-end. This anticipation has led to a narrowing interest rate differential between US dollar-denominated investments and other assets. The interest rate spread between a 1-year USD government bond compared to a 1-year German government bond has halved in recent months, contributing to a weakening US dollar. Hence, a declining USD could potentially exert inflationary pressure on the US, being a net-importing country.

Considering recent economic developments, it remains evident that central banks continue to rely on indicators such as the job market, despite their delayed reflection of the economic situation. This focus on lagging data increases the possibility of unexpected outcomes. While the likelihood of a "soft landing" for the US economy, potentially avoiding a recession, is gaining traction, worrisome signs are emerging, particularly concerning consumers. Instances of delinquencies in consumer credit, including auto leasing and credit card payments, are on the rise. Moreover, Bloomberg's estimations suggest that households with lower incomes have significantly depleted their savings.

Adding to these concerns is the upcoming end of the COVID-related student loan deferral program, scheduled for late August. This development could place an additional burden on many households' finances. Notably, US student loan debt exceeded a staggering $1.75 trillion in 2022, making it the second-largest form of consumer debt after real estate mortgages. President Joe Biden's plan to forgive up to $20,000 in federal student loan debt for eligible borrowers was rejected by the US Supreme Court at the end of June. Consequently, interest on student loans will resume on September 1, 2023, affecting approximately 44 million individuals, a quarter of the American workforce.

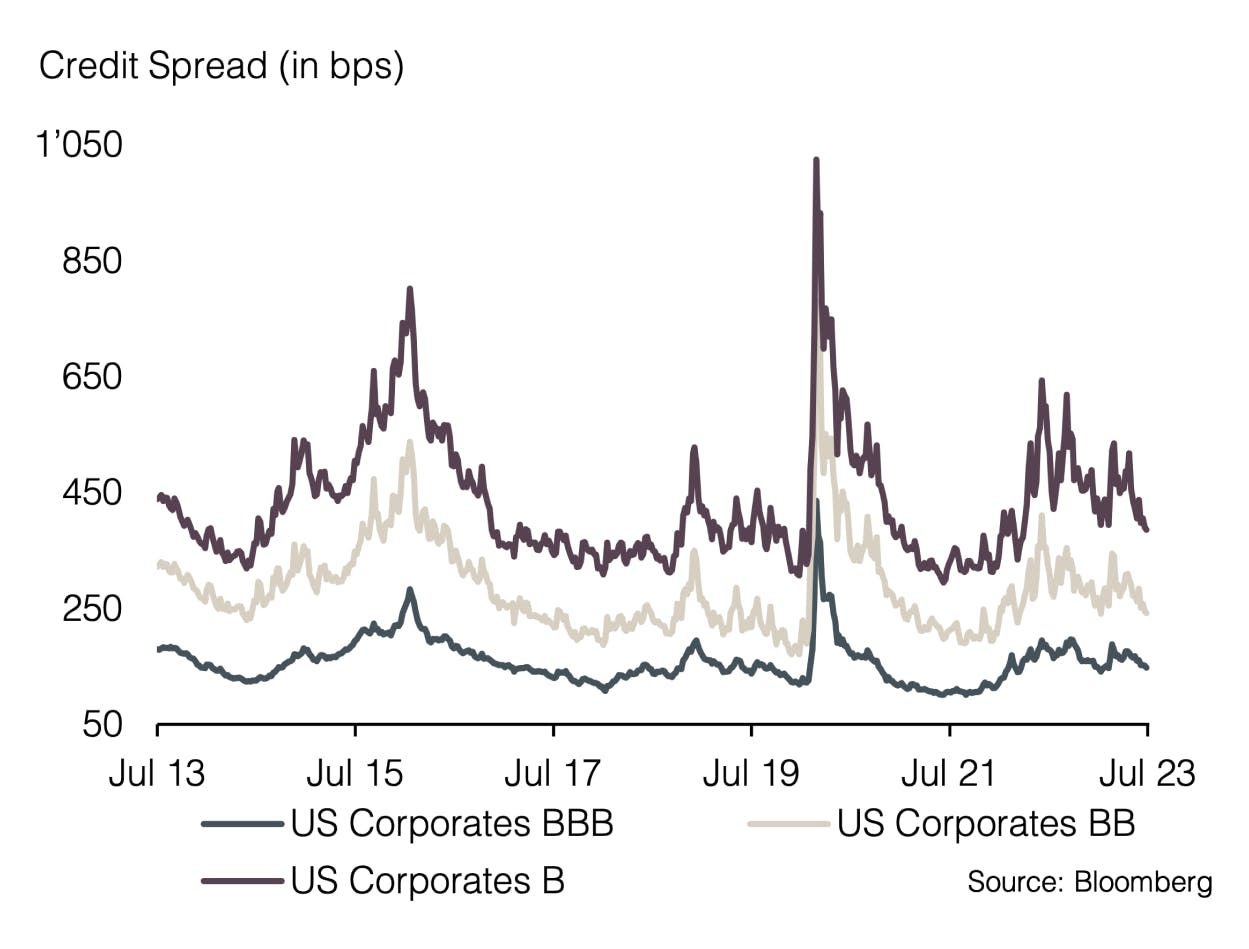

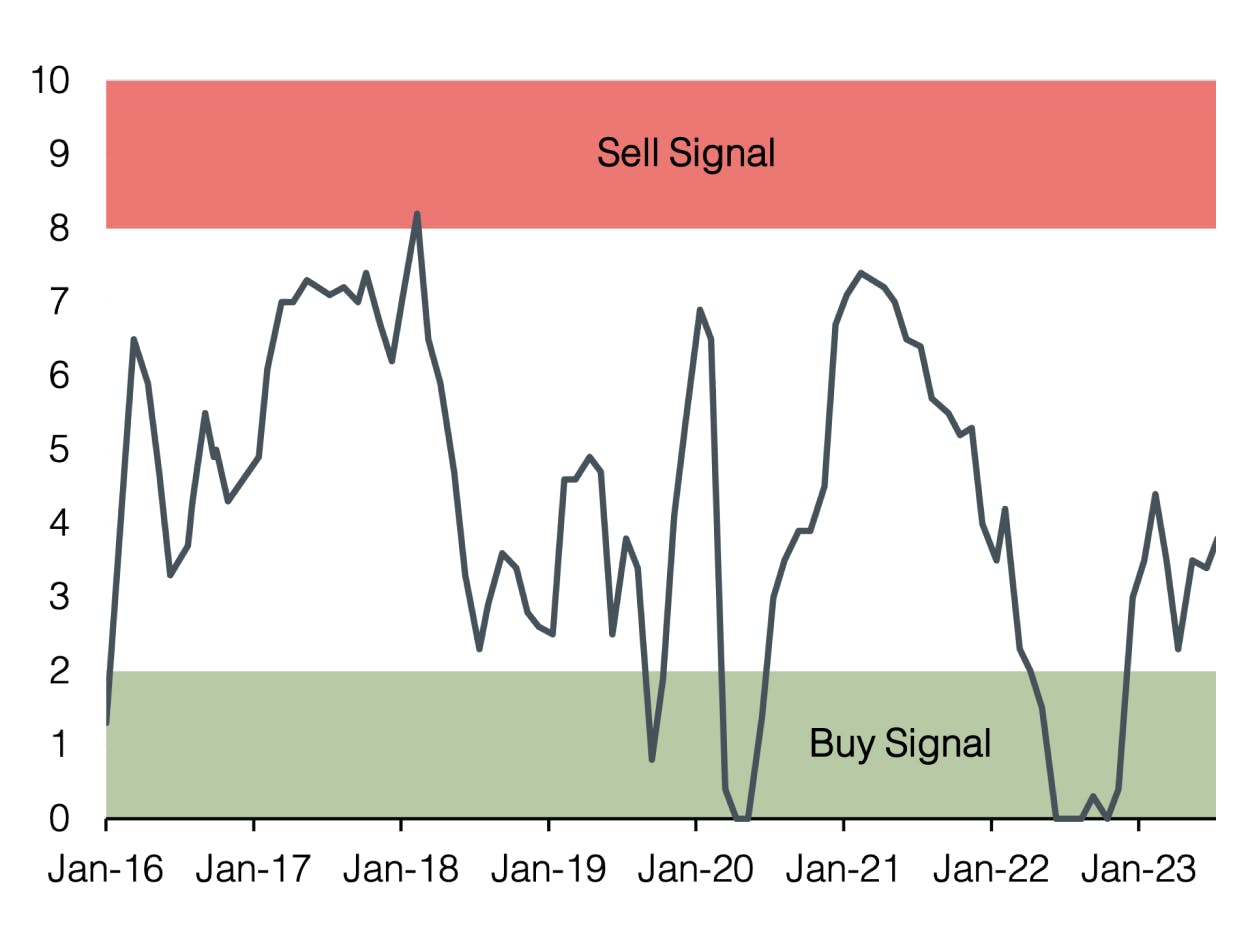

While these effects may impact the economy with a delay, we concur with Bloomberg economists that the macroeconomic environment is poised for negative developments in the coming months. As a result, adopting a cautious positioning is prudent, and the prevailing low volatility in the stock market presents a favorable opportunity for implementing hedging strategies. Our investment approach retains a neutral allocation to bonds while maintaining an underweight position in the equity space. Given the increasing visibility on inflation and short-term interest rates, we are seizing the moment to reduce alternative investments and prioritize liquidity. This strategic shift is motivated by the stable yield and low volatility that liquidity provides, affording us enhanced flexibility to capitalize on upcoming market opportunities amidst the current economic climate.

Appendix

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research