SoundInsightN°2

Bonds

Equities

Central banks face a credibility issue

An increasing gap between market expectations and official predictions from central banks shows declining trust in monetary policymakers.

The Federal Reserve's official communication at the December 2022 meeting was clear: interest rates will continue to rise in 2023. The so-called "dot plot," which graphically represents the committee's rate projection, forecasts a key interest rate of 5.125% at the end of this year. Not a single voting member expects unchanged or even lower interest rates during the year. If the committee has its way, another 3-4 interest rate hikes of 0.25% each will follow over the next 8 meetings.

However, the expectations of market participants, as seen in the derivatives market, differ significantly from the forecasts of the Federal Reserve. At the end of the year, interest rates are expected to remain unchanged at 4.25%, compared to the current level. While higher interest rates are expected in the middle of the year, rate cuts of the same magnitude are already priced in thereafter. This creates tension. Thus, the market disagrees with the Federal Reserve and does not believe in the official projections.

This is not surprising, as in early 2022, monetary policymakers had guided for rates of 0.75% for the end of 2022, which was priced into the market at the time. As we know now, interest rates rose by a much higher magnitude to 4.25%.

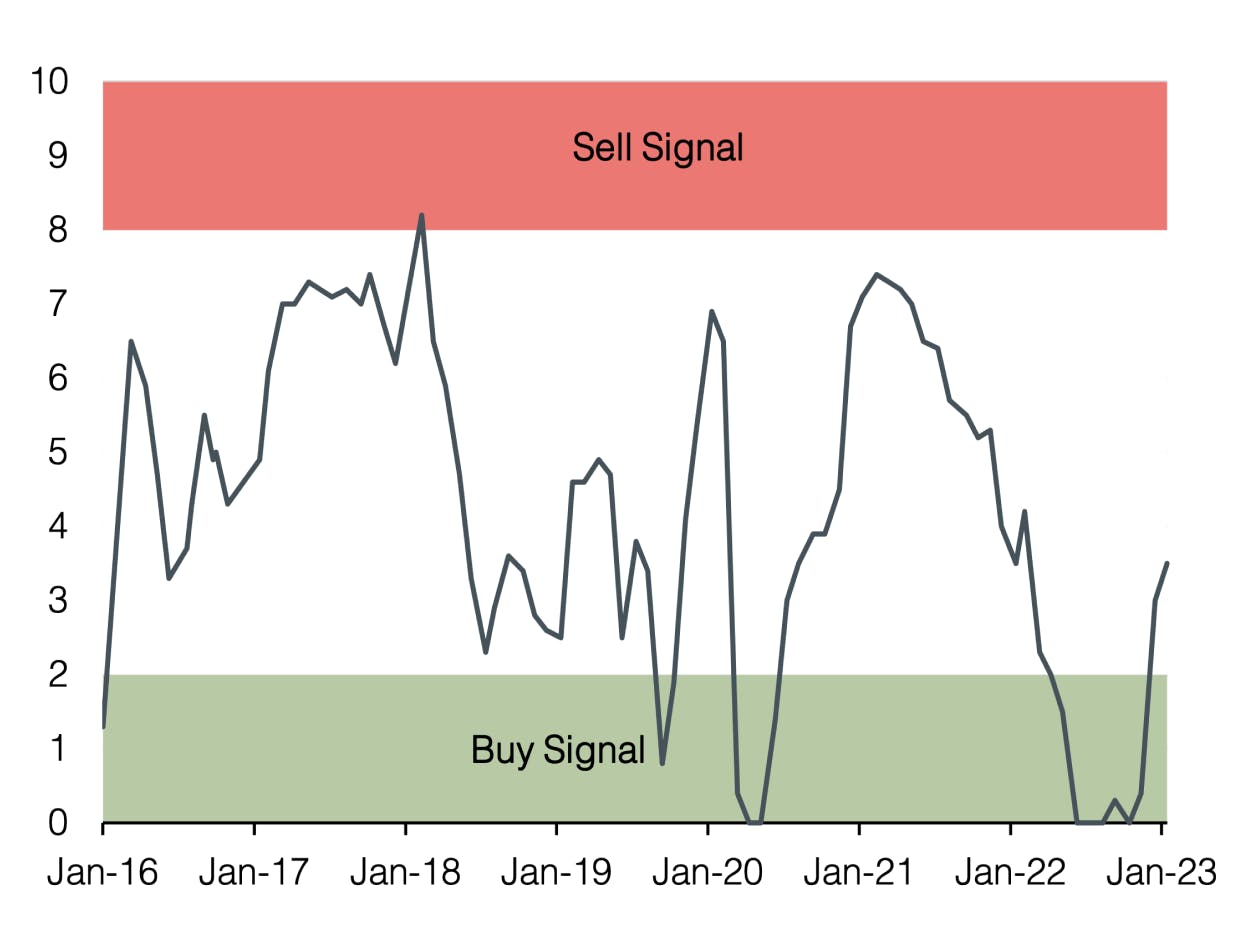

The issue of diverging interest rate expectations between the market and monetary authorities is not new and has been addressed in previous Sound Invest publications. Central banks as prisoners of financial markets were last seen in late summer 2019. Back then, an inverted US yield curve was decisive in the pressure on central banks. Fearing a recession and severe market dislocations, the central bank complied with the market's pressure and lowered key interest rates to provide relief. However, the pandemic followed shortly thereafter, which pushed this remarkable situation somewhat into an insignificant past.

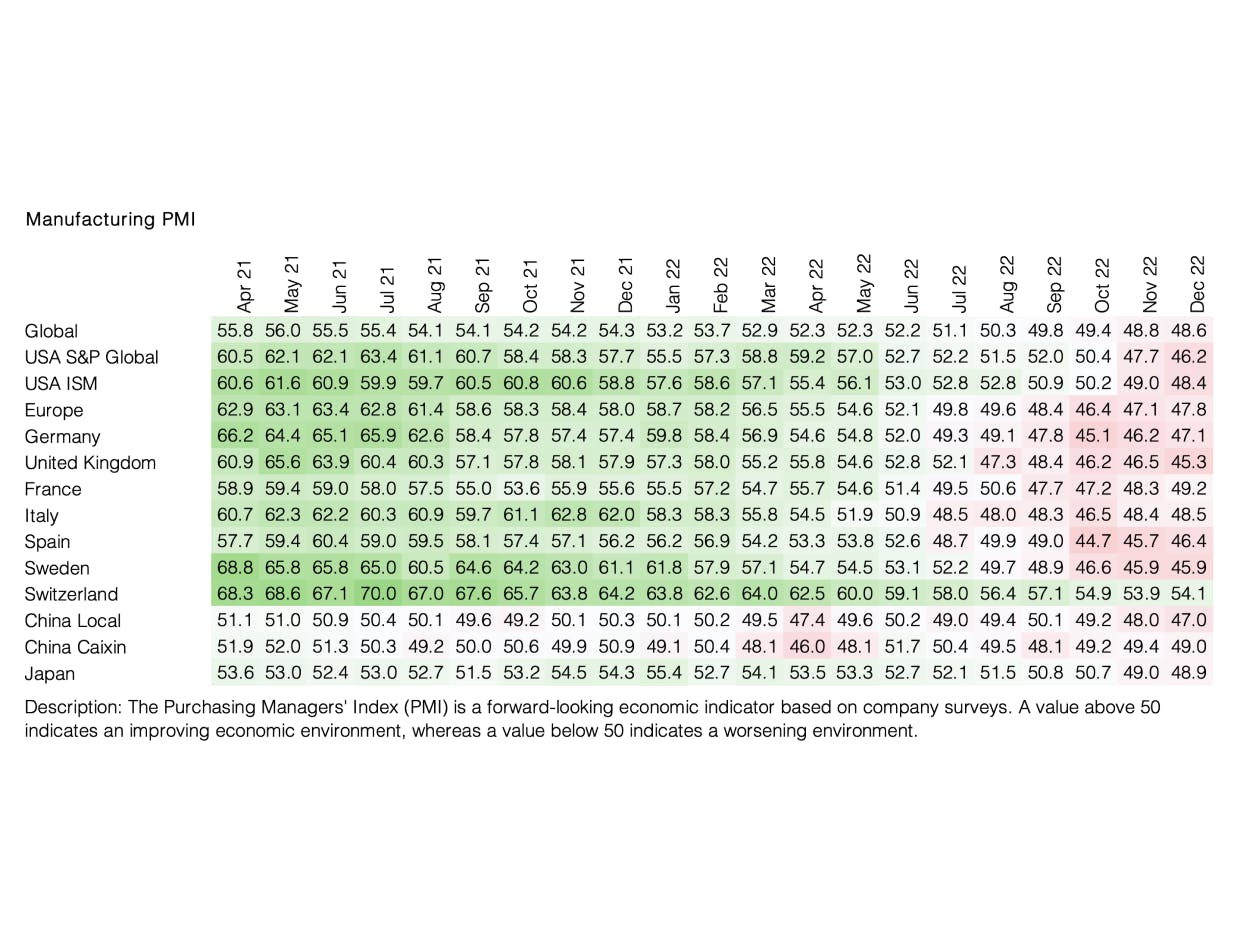

However, the current situation is only partially comparable to 2019, as there were no signs of inflation back then. Nevertheless, there are parallels. The market sees the growing danger of a recession and, despite the inflationary environment, expects monetary authorities to try and rescue the economy once again. Thus, in 2023, either the central banks or the market participants will be wrong. Which expectations come true will probably depend on the further development of inflation.

Moreover, there are divergences in expectations regarding inflation. The Fed sees an inflation rate of 3.1% over the coming year, while the market assumes 2.0%. Even if inflation turns out to be declining and less problematic, it will determine the market's course for the rest of the year. A reason to be cautious: If market participants are right, inflation is under control. However, lower interest rates are already priced into the market. A euphoric reaction to a Fed rate change is therefore unlikely. The situation is different if the Committee's expectation comes true: If interest rates rise more than expected or stay at elevated levels, this could temporarily lead to high volatility or even market disruptions.

In terms of inflation, we continue to focus on wage developments. Renowned economists have highlighted several times that the key to fighting inflation is lower wages. Wages fall as unemployment rises, and rising unemployment is the result of a recession. As a consequence, the effective fight against inflation might only be achieved at the cost of a recession.

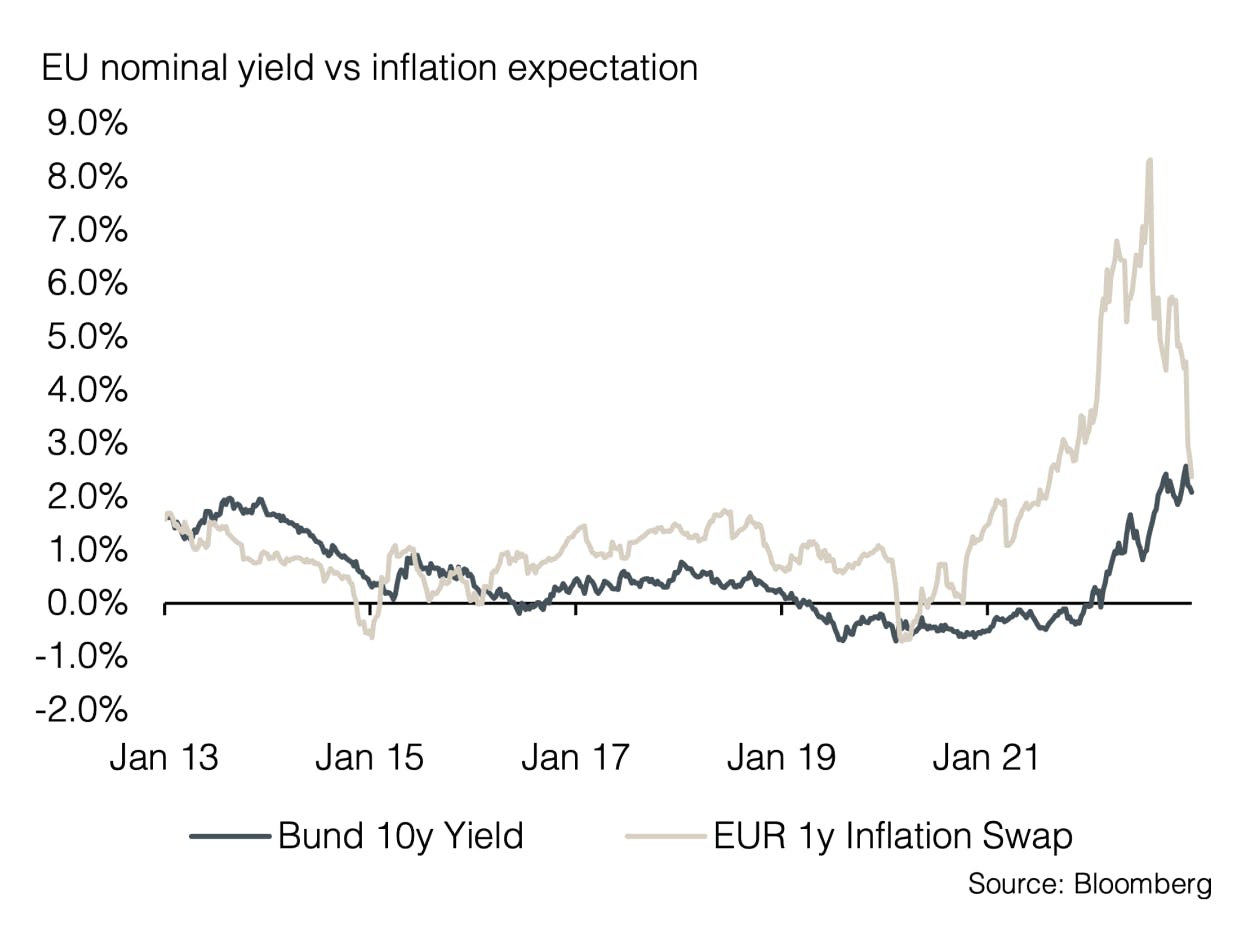

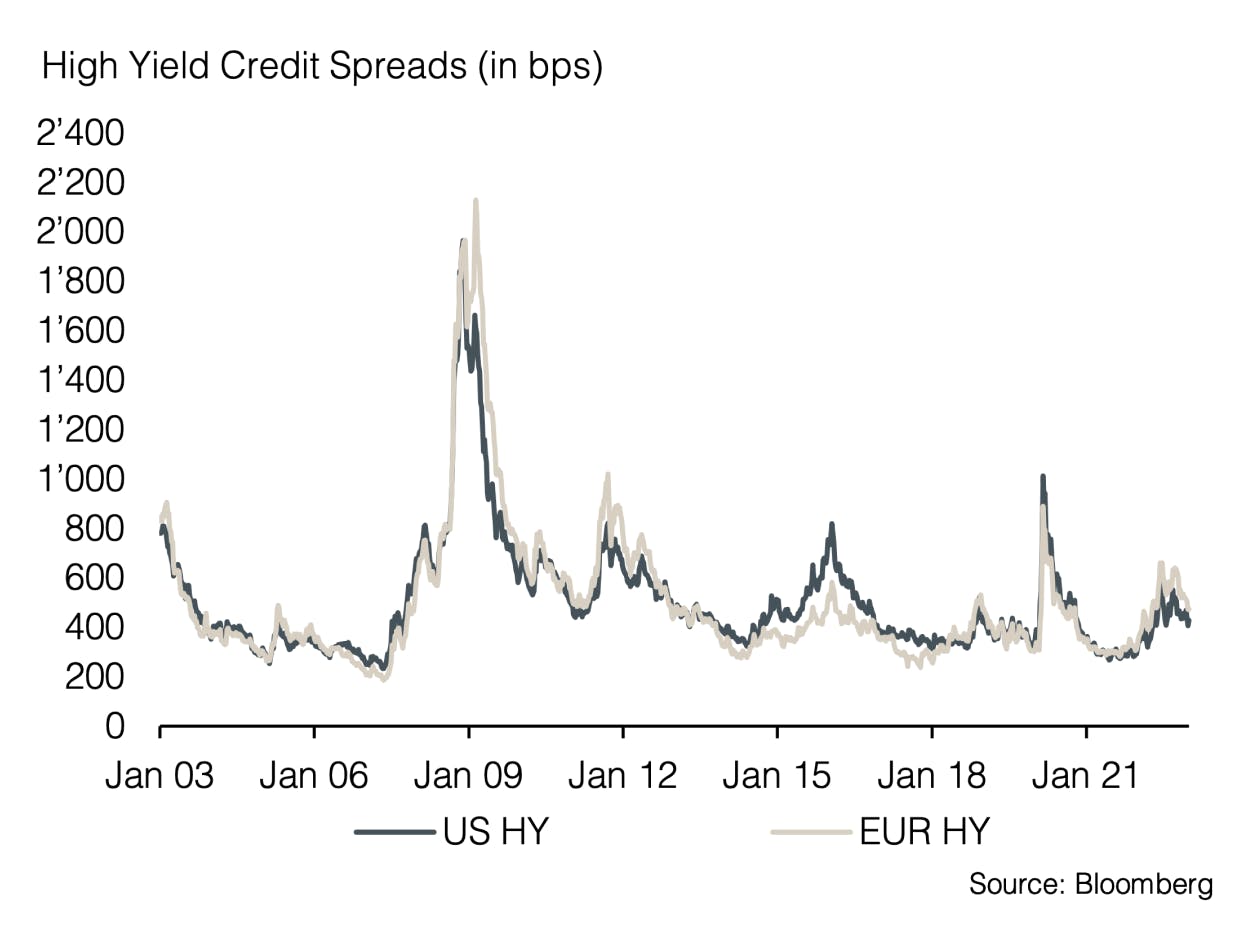

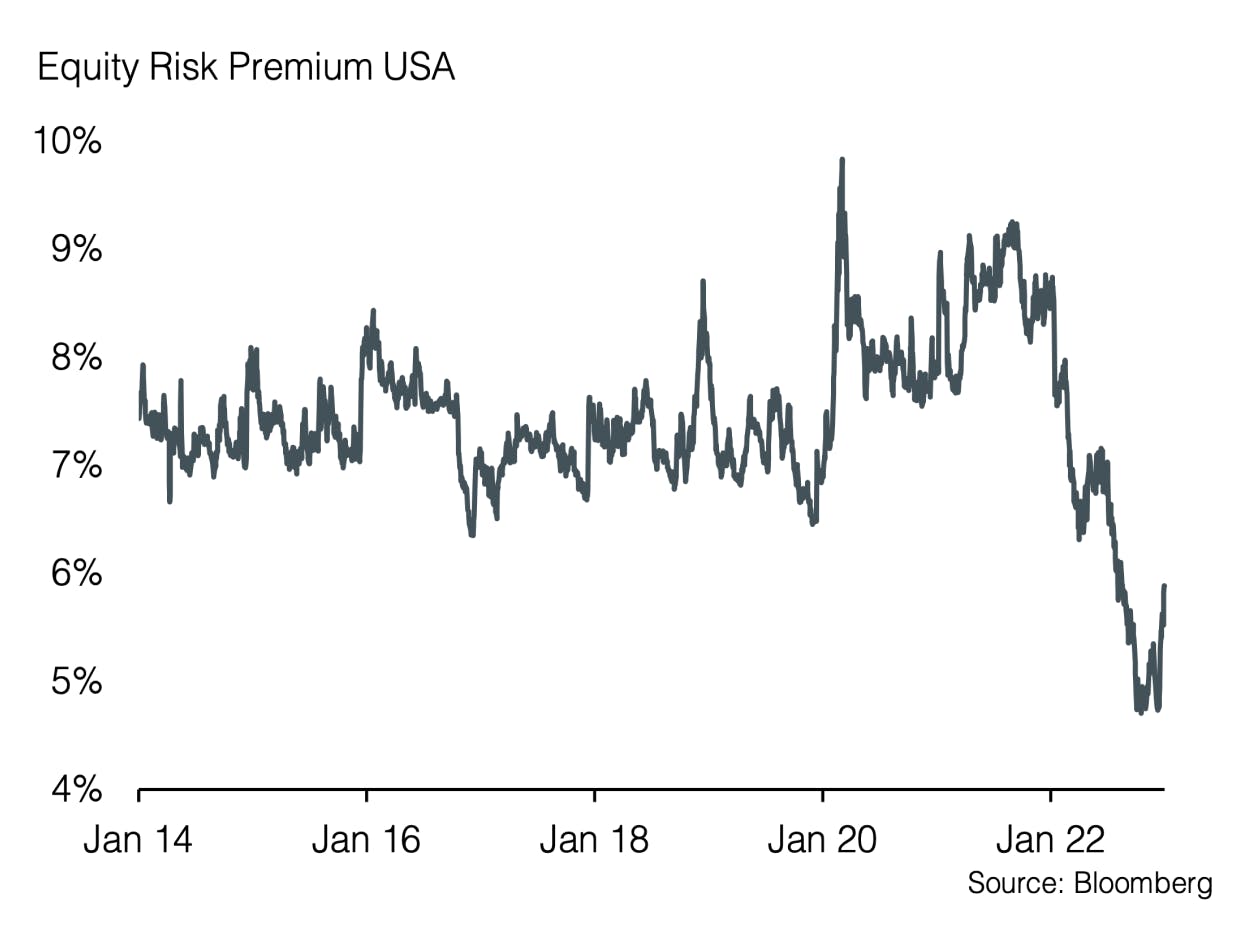

In the view of the Investment Committee, the increased risk of recession is not yet sufficiently reflected in financial markets. For example, corporate earnings are expected to grow by 4% in 2023, despite a slowdown in economic growth. We therefore maintain an unchanged tactical underweight in equities, favoring companies with stable cash flows and dividends as well as the healthcare sector. In the fixed income space, we focus on high-quality and government bonds, recommending a higher weighting in USD and GBP markets given superior real yields.

Appendix

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research