SoundInsightN°20

Bonds

Equities

Price stability gives way to full employment

Inflation appears to be under control, entering the Federal Reserve's target range last month. With the economic momentum slowing, the central bank focus shifts to its second mandate: supporting full employment.

The start of August was anything but promising. An unexpectedly weak US jobs report triggered a sell-off in international markets. The message was clear: restrictive monetary policy of recent years is taking effect, albeit with a delay. As a result, markets called for swift action from the Federal Reserve. While one to two rate cuts in November and December this year were considered appropriate as of July, a single labor market data print suddenly led to expectations of five rate cuts in the remaining three meetings of this year.

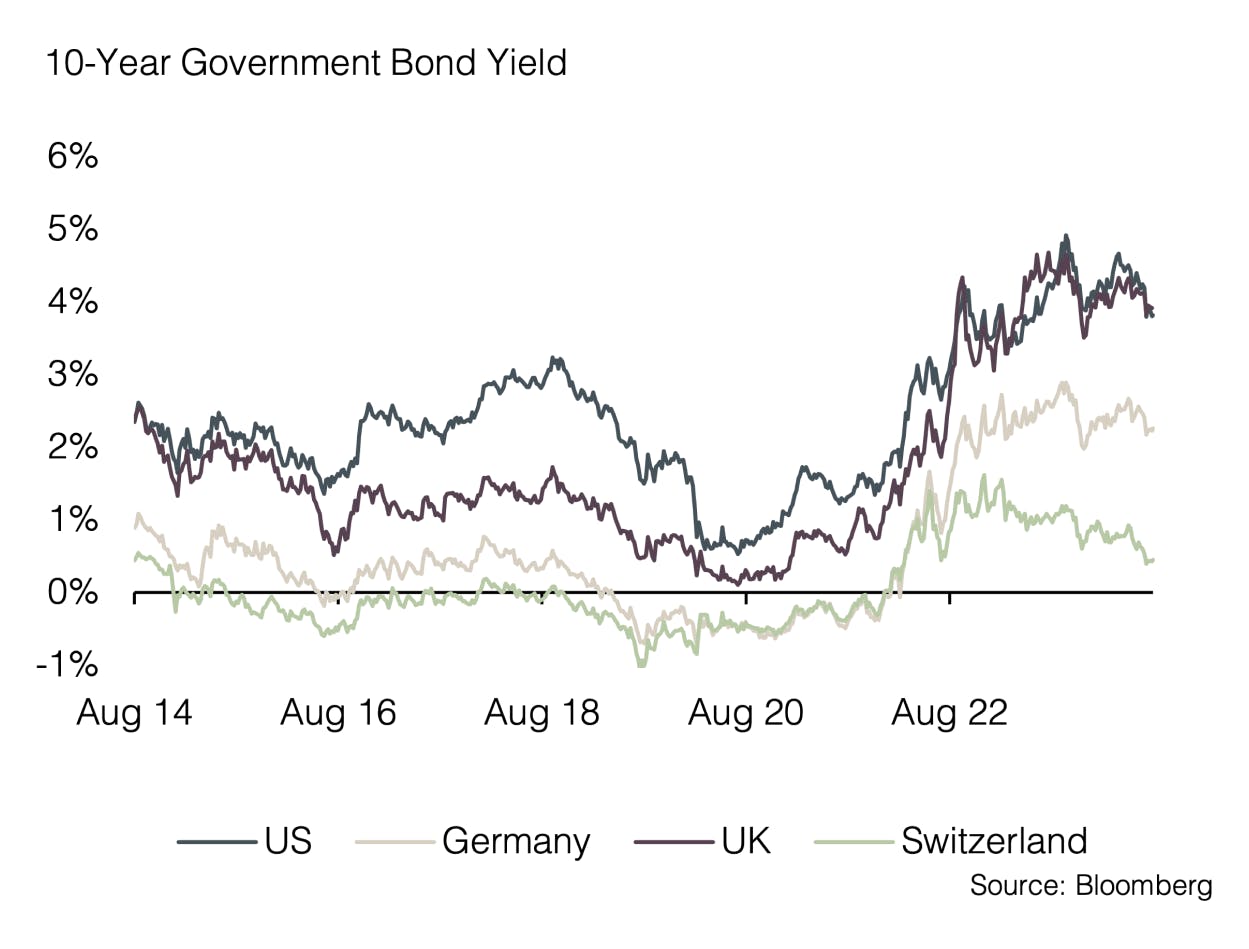

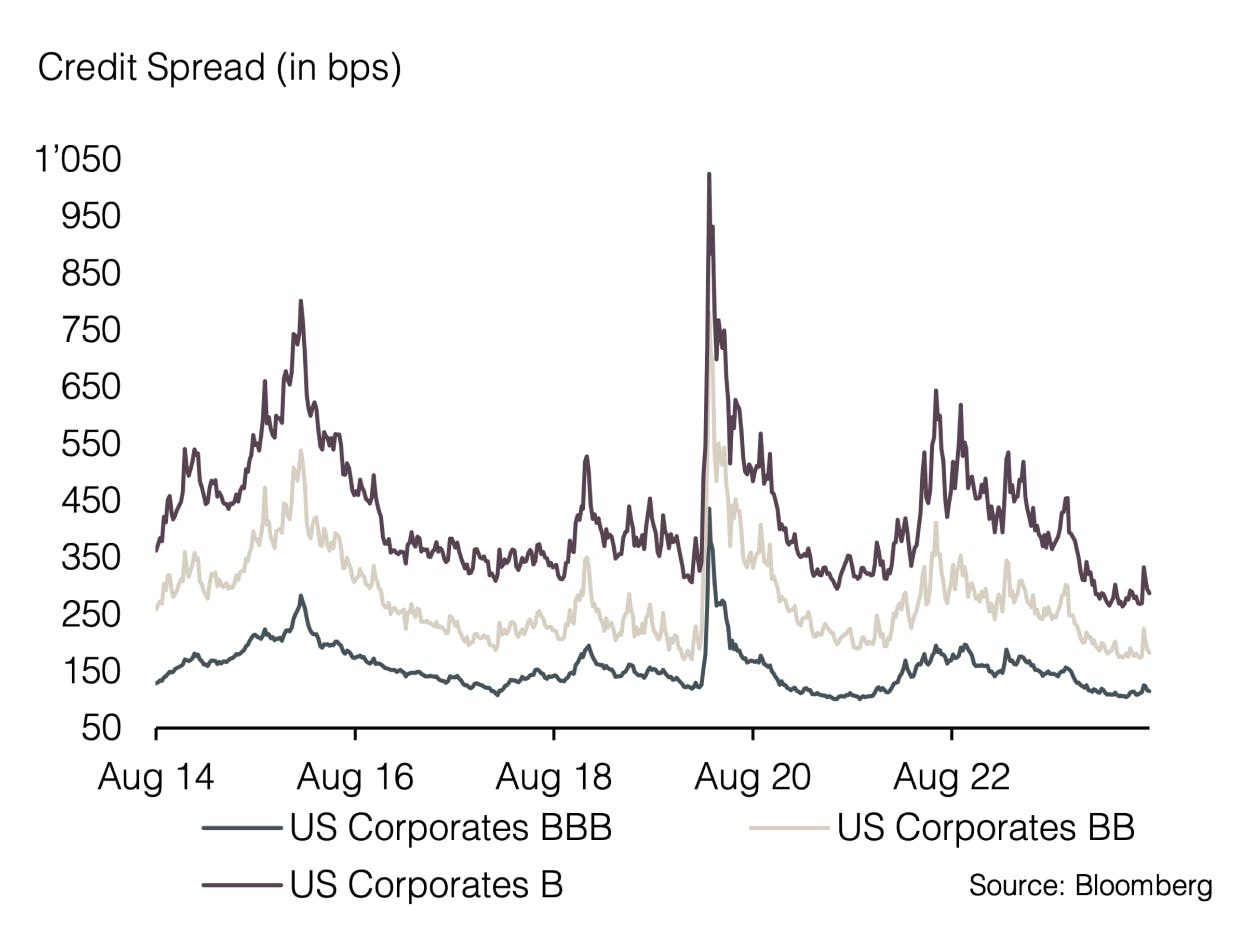

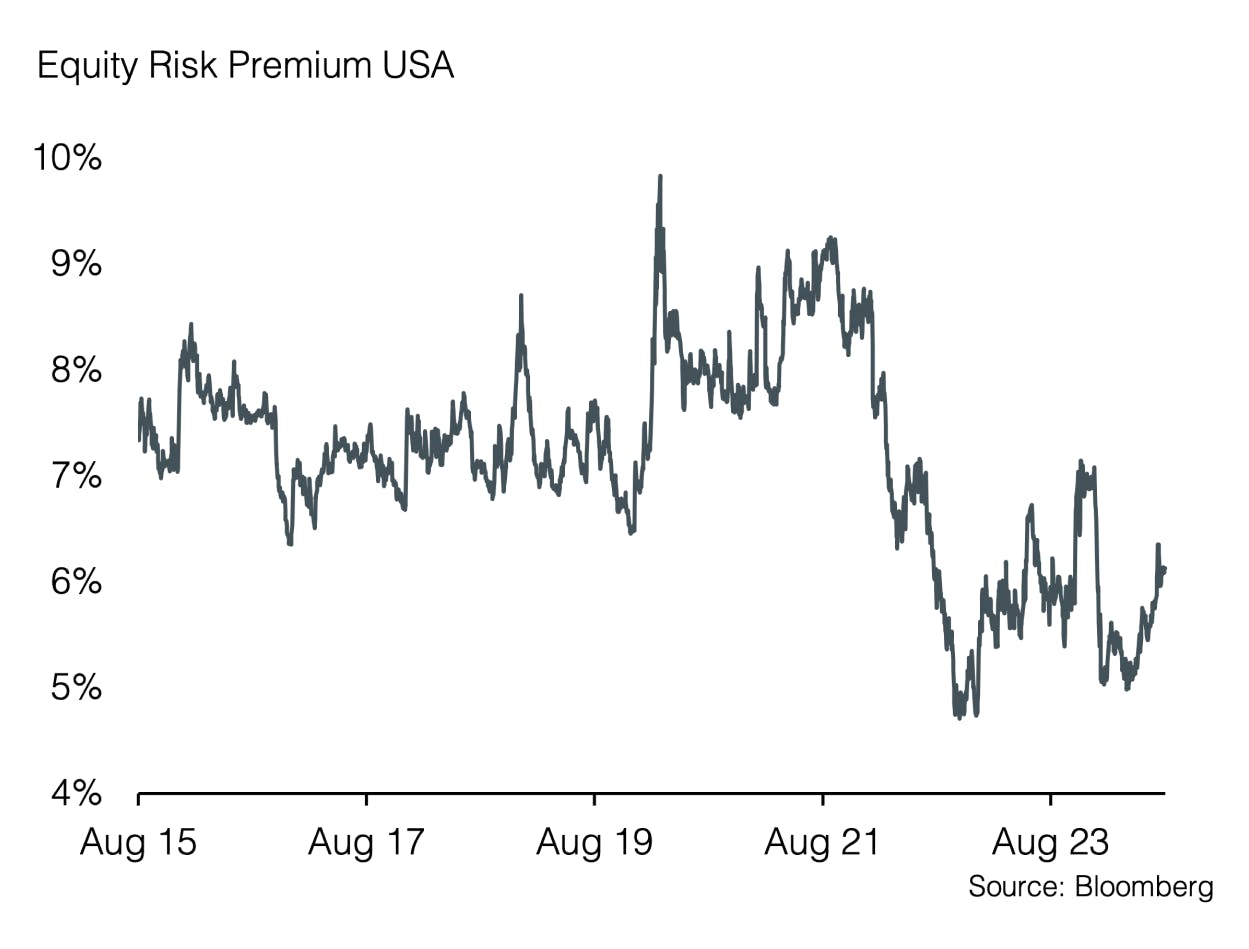

This caused significant disruption across interest rate markets. In the USD/JPY carry trade, where investors borrow in a low-yielding currency (JPY) and invest in a higher-yielding currency (USD), a wave of mass liquidations occurred. Consequently, the Japanese stock market experienced its largest sell-off since 1987. Global equity markets quickly lost more than half of their yearly gains, and the previously stable market suddenly appeared very fragile. However, a closer look at volatility revealed that the correction also had technical aspects: while short-term volatility spiked to its highest level since the pandemic, expected volatility over six months only increased slightly, reaching just below the average of the last four years. As a result, the recovery was swift. It took less than 10 trading days for the losses to be recovered, and equity markets have already climbed higher since the beginning of August. For those who don't follow markets closely, the recent turbulence may have gone unnoticed. However, from our perspective, these developments send a clear message. In the May edition of "Sound Invest", our headline was "Bad News is Good News." This was accurate in an environment of high inflation, where central banks were striving to rein in economic momentum. But with the macroeconomic data of recent months, the battle against inflation seems to be nearing its end. As a result, the other part of the central banks' dual mandate - full employment - is likely to take center stage.

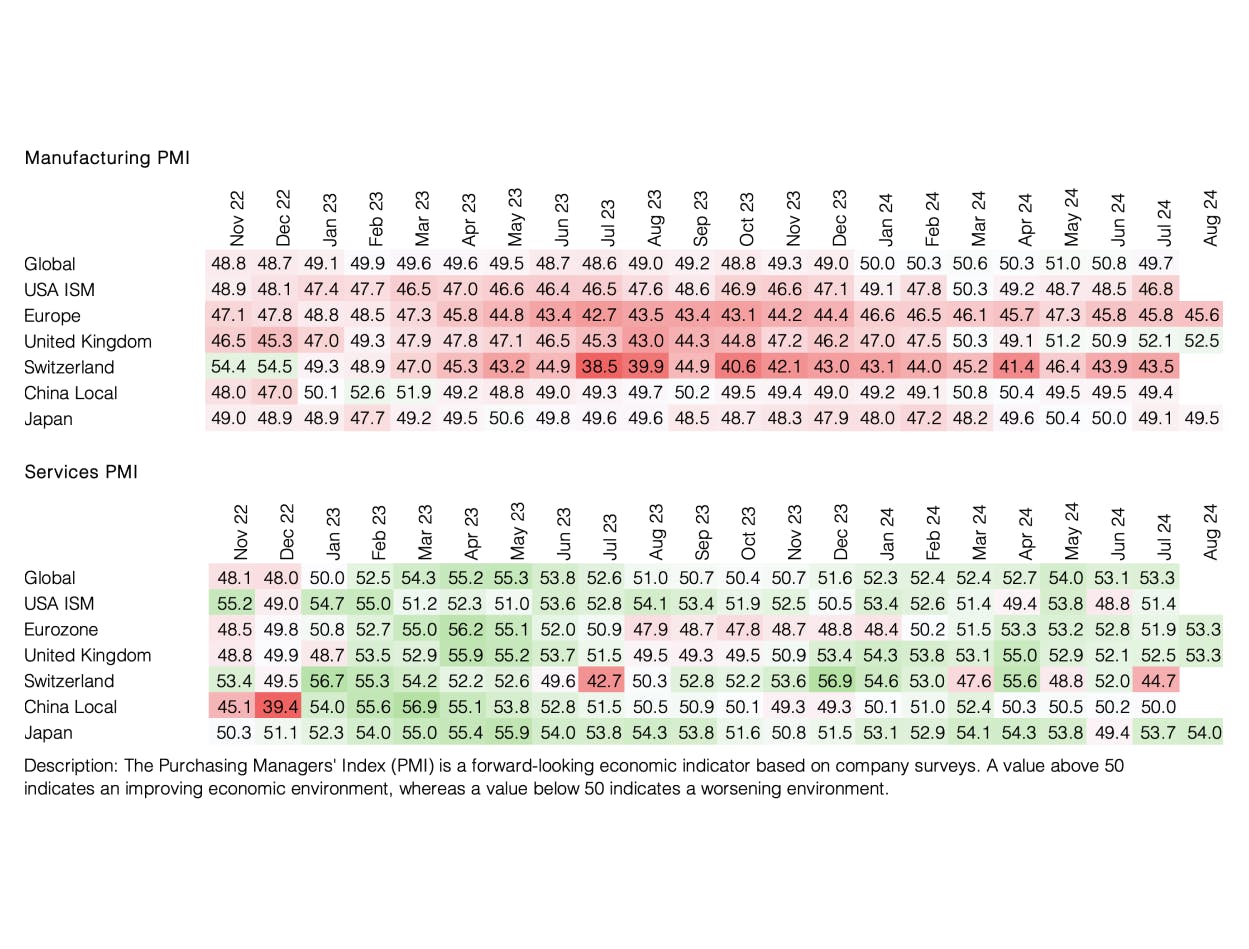

This also signals a regime shift: bad news may now indeed be interpreted as such. However, the current data does not reflect an economy that would justify the volatility seen at the beginning of the month. While there are clear signs of a slowdown, this is exactly what central banks intended. There is sufficient evidence to suggest that a soft landing for the economy is a realistic scenario. It now seems that the stage is set for gradual rate cuts in the US as well, which would improve the investment environment. Nonetheless, sensitivity to negative macroeconomic surprises is likely to increase, potentially leading to heightened volatility in the coming weeks.

This environment aligns with our current positioning, which we left unchanged in August. We continue to favor longer maturities for issuers with solid credit ratings and avoid high-yield exposure in the bond market. In the equity space, we believe that expensively valued sectors such as technology and communication are more vulnerable to corrections. Accordingly, on a regional basis, we continue to prefer the Swiss stock market, and in terms of sectors, we focus on consumer staples and energy.

Appendix

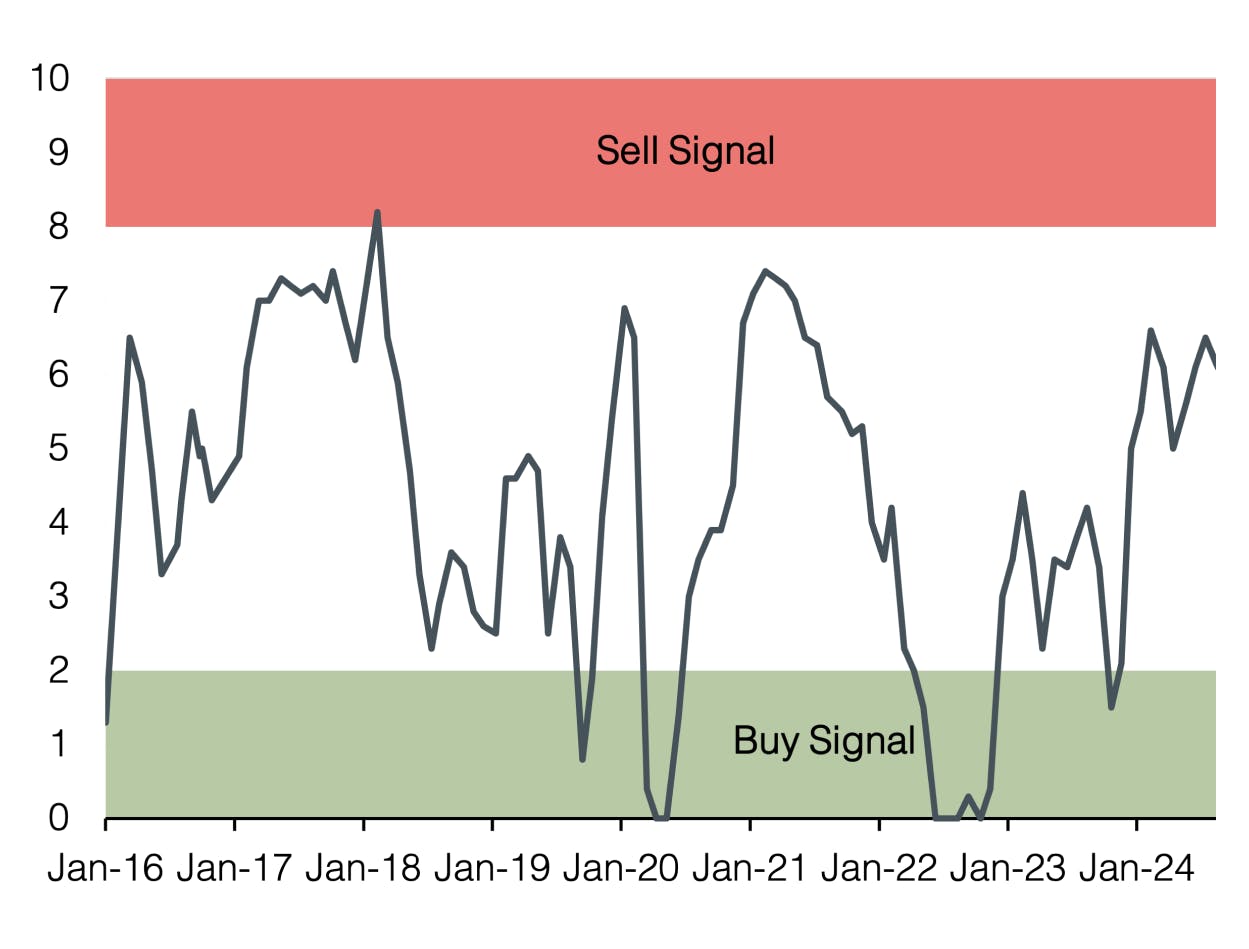

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research