SoundInsightN°16

Bonds

Equities

Difficult Decisions for the Fed

Last month once again showcased the rapid pace of global financial markets. The latest inflation data has diminished the Fed's confidence in imminent interest rate cuts.

In the last issue of Sound Invest, we covered the Swiss National Bank's unexpected interest rate cut. At the time, we highlighted our perspective that US interest rate policy was still marked by significant uncertainties about upcoming rate cuts. In the past weeks, inflation has continued to trend unfavorably for monetary authorities. Recent inflation data indicates that expectations for an imminent policy shift may have been premature. Despite mid-year interest rate cuts being hinted during the last official Fed meeting, the Fed took a step back and now emphasizes its reliance on more convincing data for future policy decisions.

It appears that last year's playbook of “higher for longer” is repeating itself. Initially, six interest rate cuts by the Fed were anticipated at the beginning of this year, but forecasts have since been revised down to just two, with the first cut rescheduled from June to November. This adjustment was mainly due to higher-than-expected US inflation data, which has temporarily cast doubt on the previously observed downward trend.

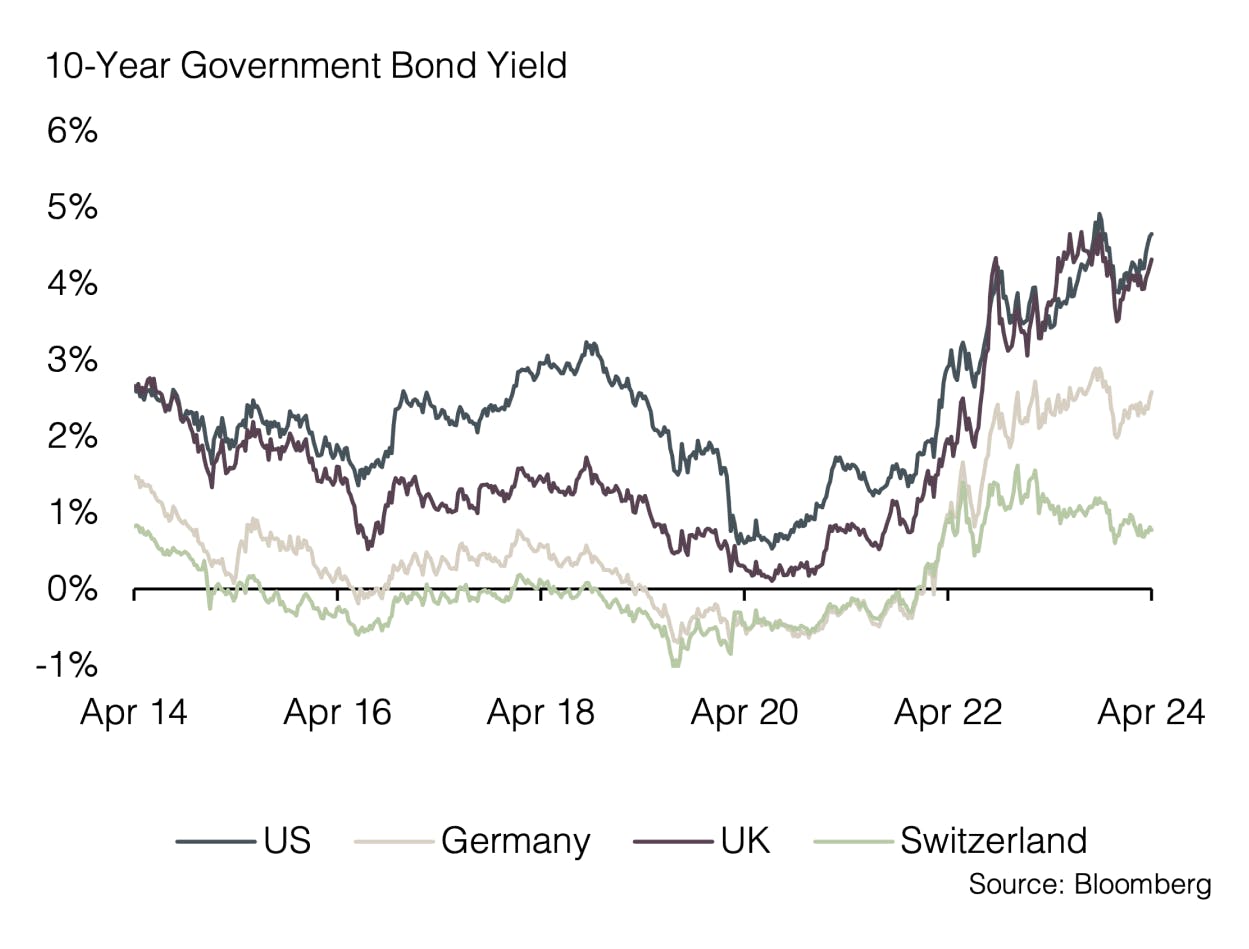

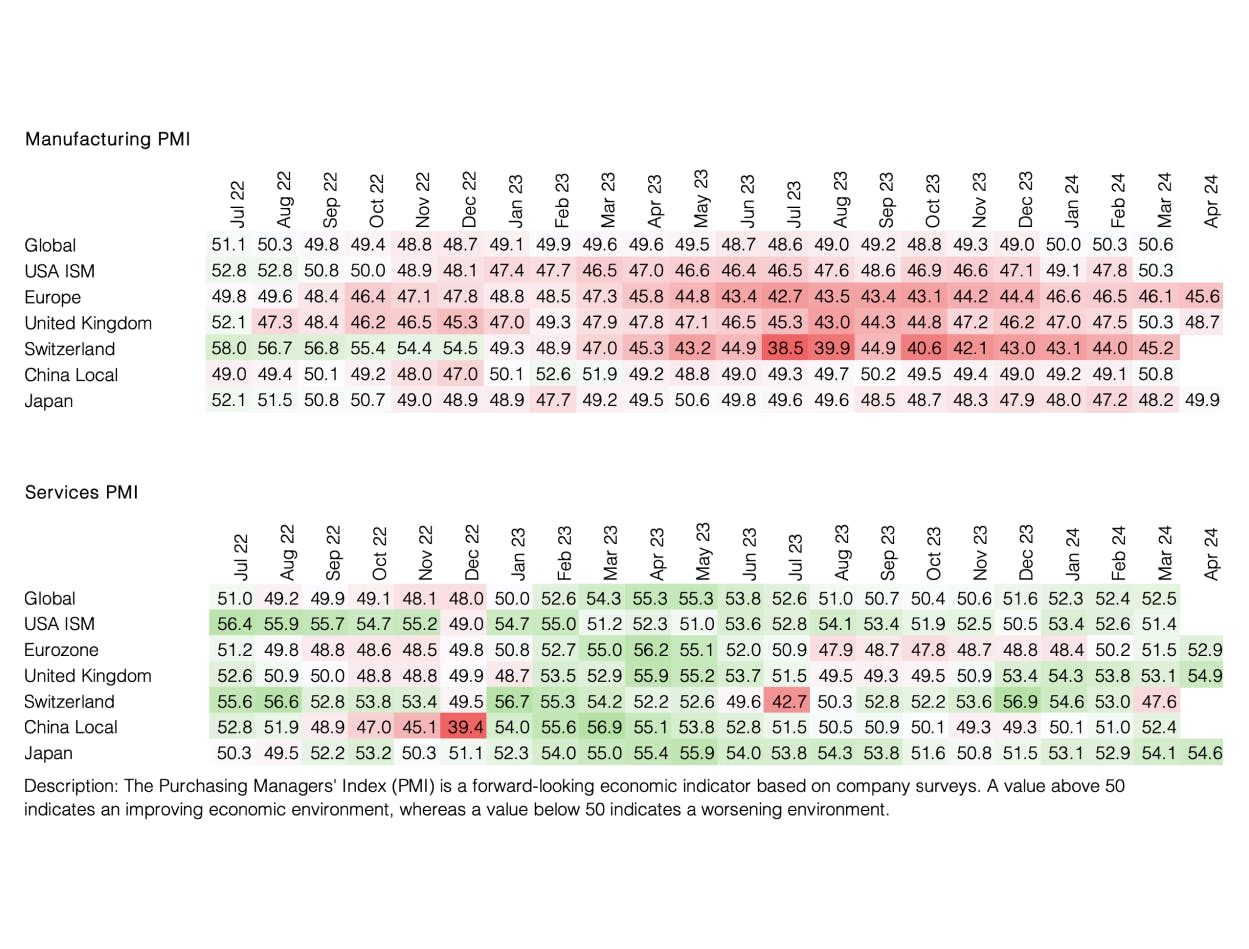

Additionally, the global purchasing managers' indices for both manufacturing and services have shown slight improvements over the past three months, indicating a strengthening economic recovery. This provides the Fed with an additional reason to avoid premature conclusions. In contrast, despite US developments, expectations for the ECB in Europe have shifted only minimally. According to market participants, the first of three anticipated rate cuts is still expected in June. The persistent inflation trajectory combined with a variety of strong economic data releases have significantly increased interest rates across the maturity spectrum, lifting the entire curve by 0.5%. In other words, expectations for two rate cuts were fully eliminated. The move was particularly felt by investors who positioned themselves at the long end of the yield curve.

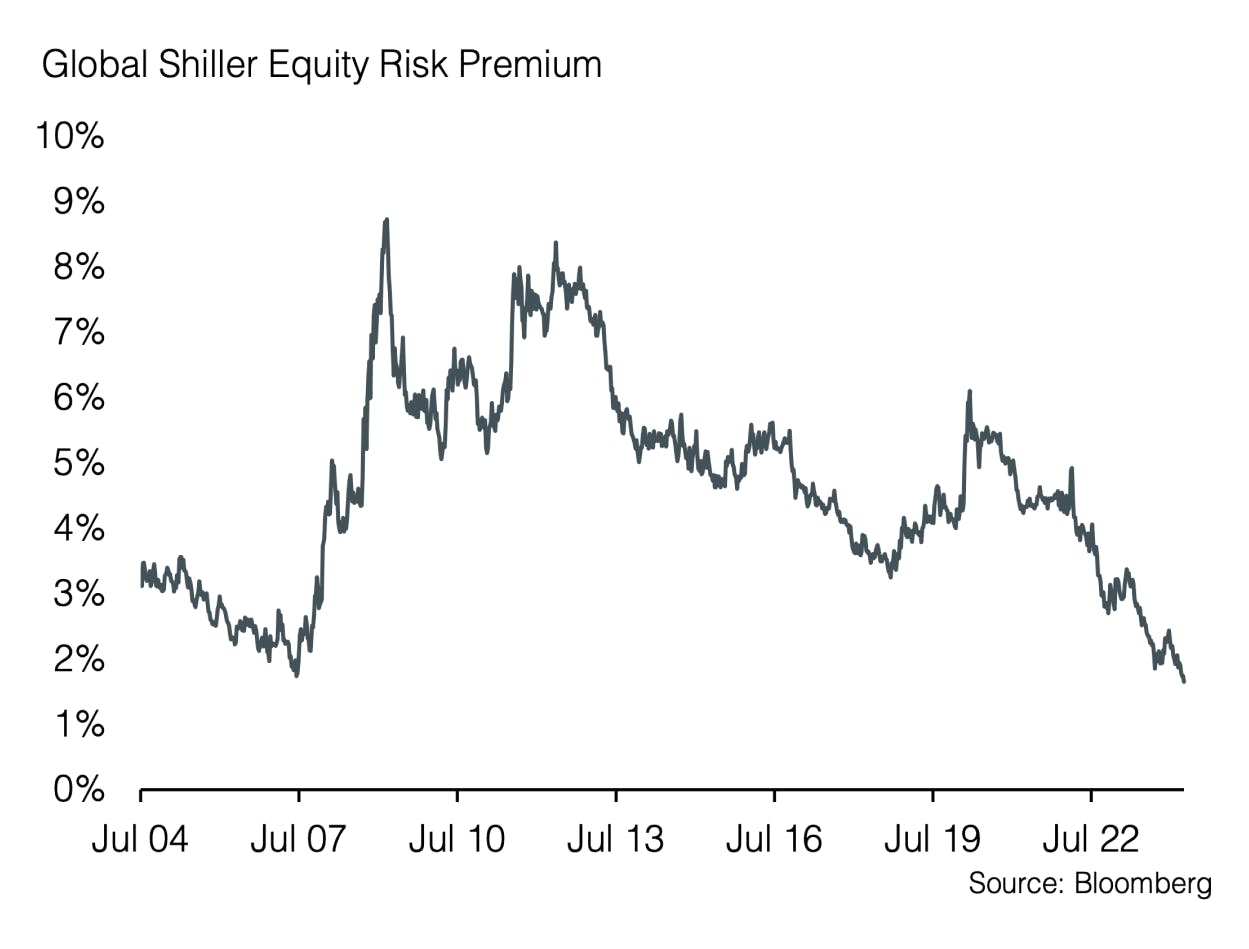

The US stock market, especially the Nasdaq 100, all reacted negatively. After being up over 10% just a few weeks ago, the Nasdaq 100 nearly wiped out all of its gains for the year, being up only 1.9%. The correction sparked a surge in market volatility which touched a six-month high.

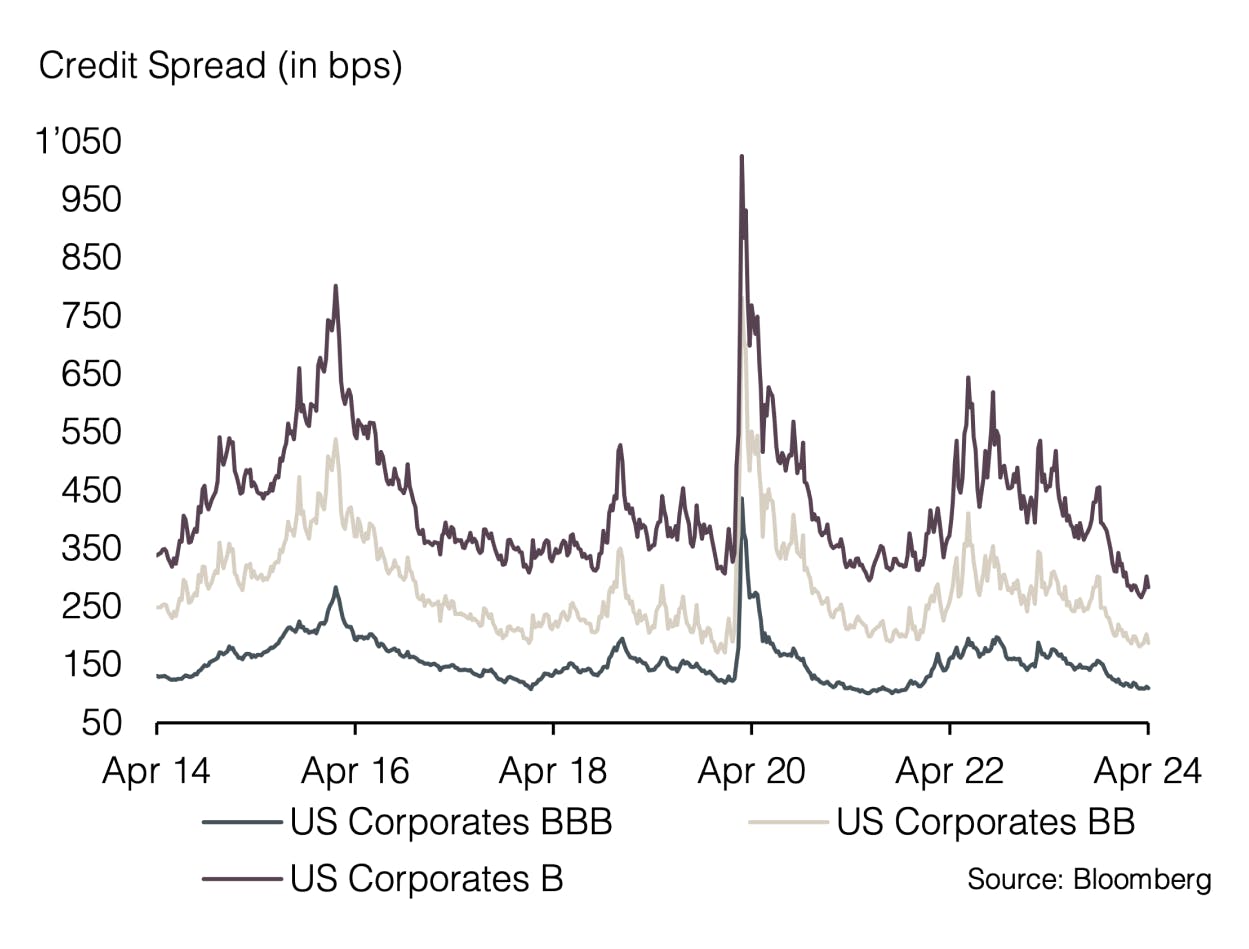

In response to the latest developments, we’ve adjusted our tactical positioning slightly. In the fixed income space, the current conditions present an unfavorable risk-return profile for longer-dated CHF bonds, prompting us to shift towards shorter-dated maturities. However, for USD denominated bonds, we still see attractive real yields that justify a slightly extended duration in our portfolio.

In the equity space, we maintain our preference for high quality. We’ve upgraded the US stock market from 'Underweight' to 'Neutral,' reflecting a cautiously optimistic stance due to the recent market correction and the consistently high quality observed in corporate earnings released over the last days. On the other hand, we've downgraded emerging markets to 'Underweight' following weaker fundamental data and disappointing corporate results.

These adjustments also mirror the recent economic developments, which have increased the chances of a 'No-Landing' scenario in the US, meaning the economy is more likely to avoid a downturn despite tight monetary policy.

Appendix

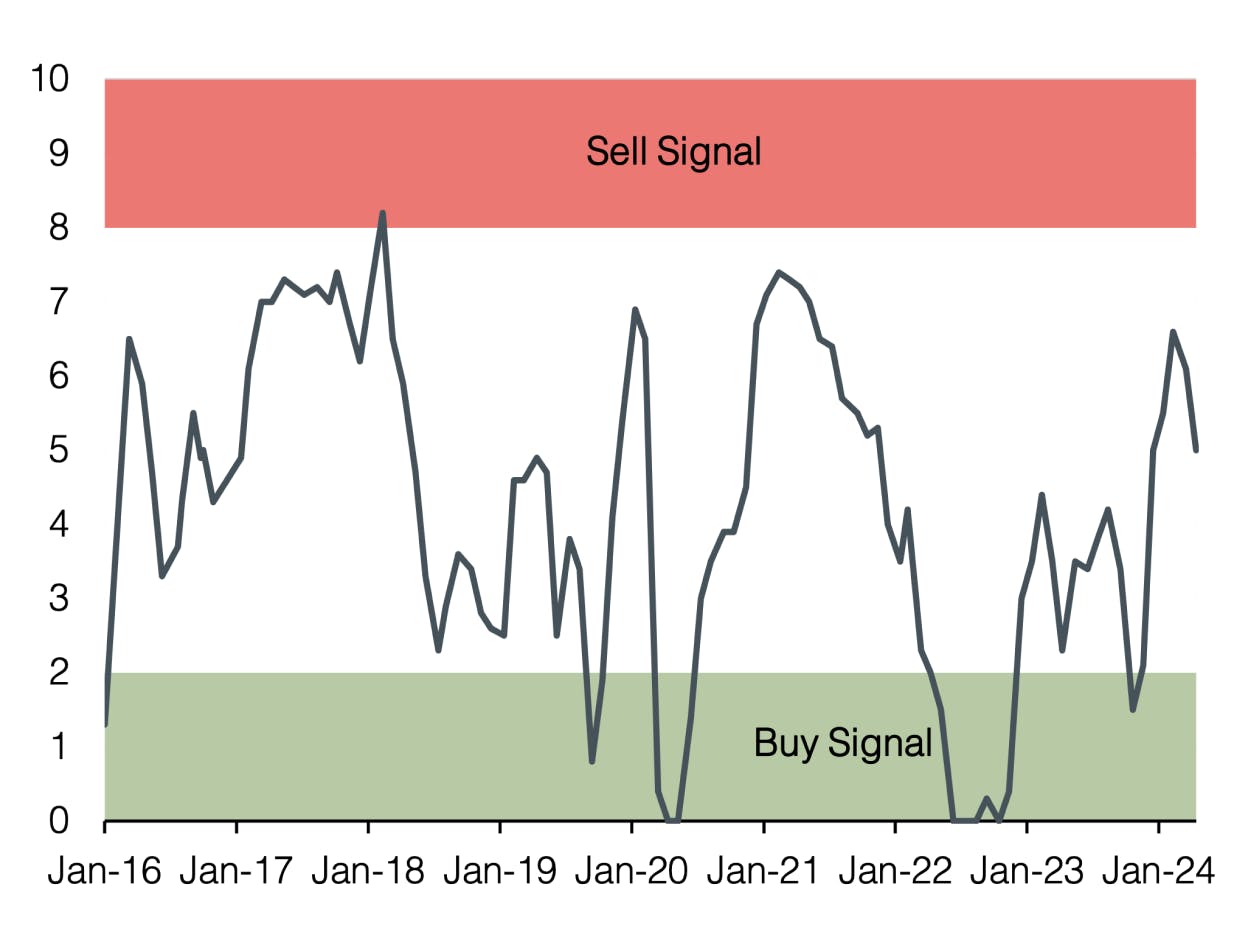

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research