SoundInsightN°5

Bonds

Equities

Economy at a crossroads

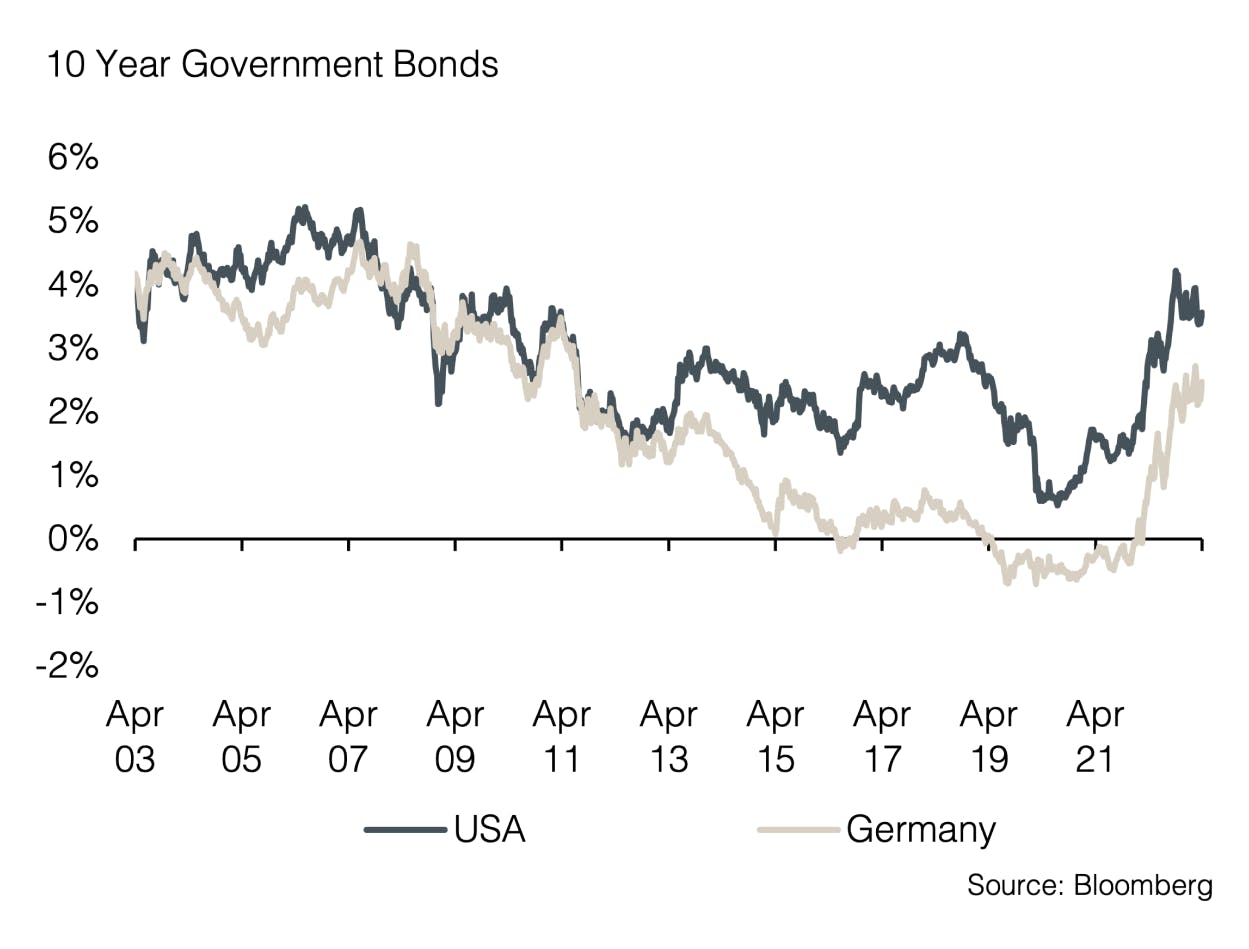

The highest interest rate level since 2008 is taking its toll on the financial sector. Further effects of the current central bank tightening cycle are likely to be felt over the coming months.

Higher interest rates generally result in decreasing money supply, more expensive financing, declining investments, reduced consumption, and thus an economic contraction. This is the roadmap of central banks, which still aim to curb inflation. Although the negative economic effects of tightening interest rates are well-known to economists, opinions are currently divided on how much the interest rate hikes of the past 12 months will impact the global economy.

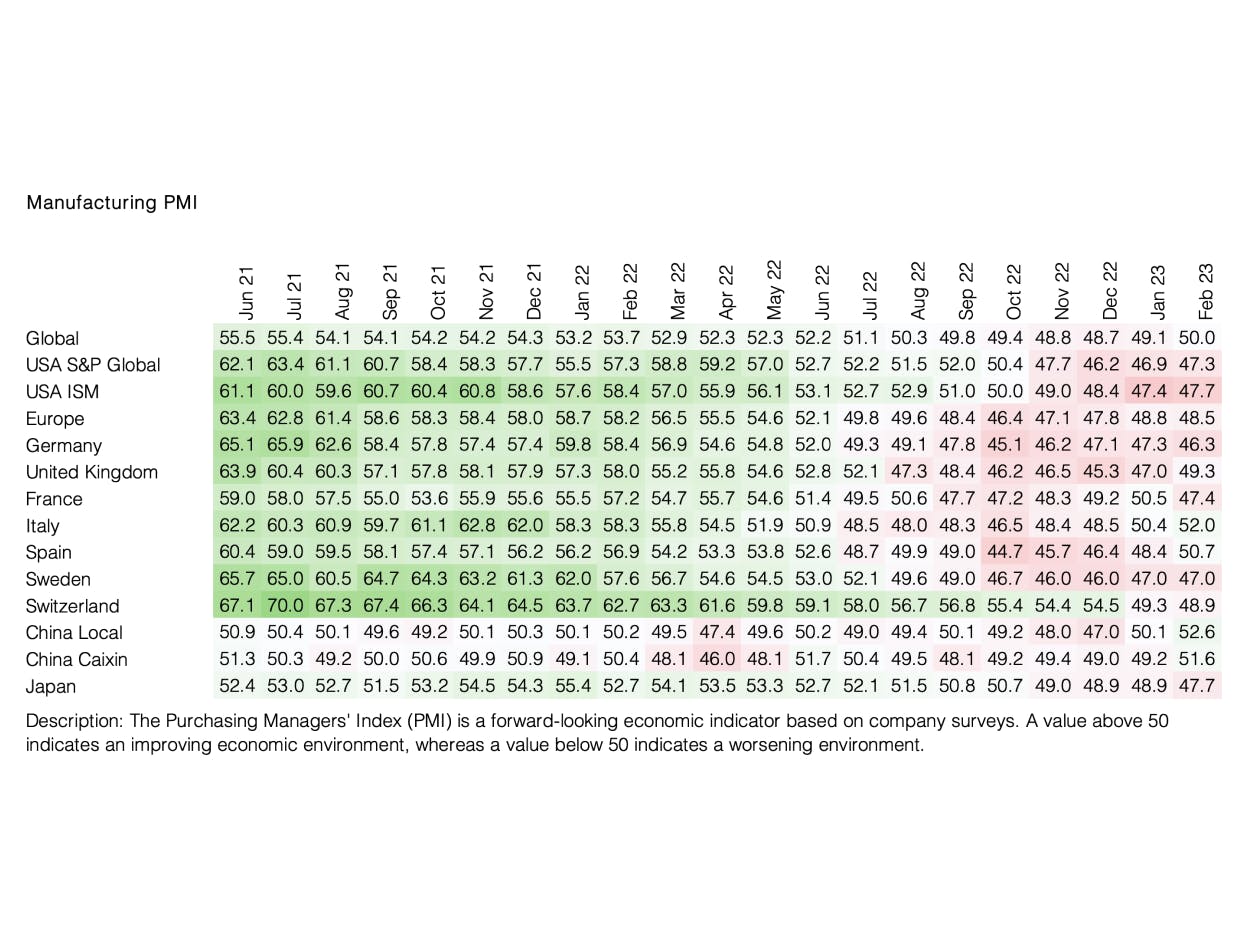

US inflation has been on a downward trajectory since June 2022, about three months after the beginning of interest rate tightening. In March, inflation measured over a year eased to 5%, its lowest level since May 2021. However, the main driver during that period was the oil price, which fell by almost 40%. If we exclude food and energy prices from the measurement, there is a persistent core inflation that has remained almost unchanged at over 5.5% since 2022. Interestingly, last month, headline inflation in the US fell below core inflation. Looking at Europe, this development is even more striking, as core inflation has been steadily rising since 2021, in contrast to shrinking headline inflation. It is thus clear that the task of central banks in terms of fighting inflation is not yet fully completed. Nevertheless, numerous leading indicators point to a downturn in the economy, which suggests that the last interest rate hike from the Federal Reserve in the current cycle is likely to take place in May.

The US economy has shown resilience, particularly in terms of the labor market, which left central bankers with no choice but to continue the steepest tightening path in modern history. However, current events in the financial sector show that the economy is operating in a fragile state in which the negative consequences of high interest rates can quickly spiral out of control. Since the impact of rising interest will arrive with a lag, it is not surprising that the global economy is currently at a crossroads, about a year after the start of the current tightening cycle.

In its recently published study, the International Monetary Fund (IMF) reduced the growth outlook for the global economy and estimated that in the medium term the world economy is unlikely to return to the growth rates that prevailed before the pandemic. The institution, based in Washington, D.C., stated that global growth of about 3% can be expected in five years. This corresponds to the lowest medium-term forecast in an IMF report since 1990. The publication also reaffirms that in addition to monetary tightening, new concerns about financial stability are likely to have a negative impact on growth. This is already evident when observing declining credit volumes.

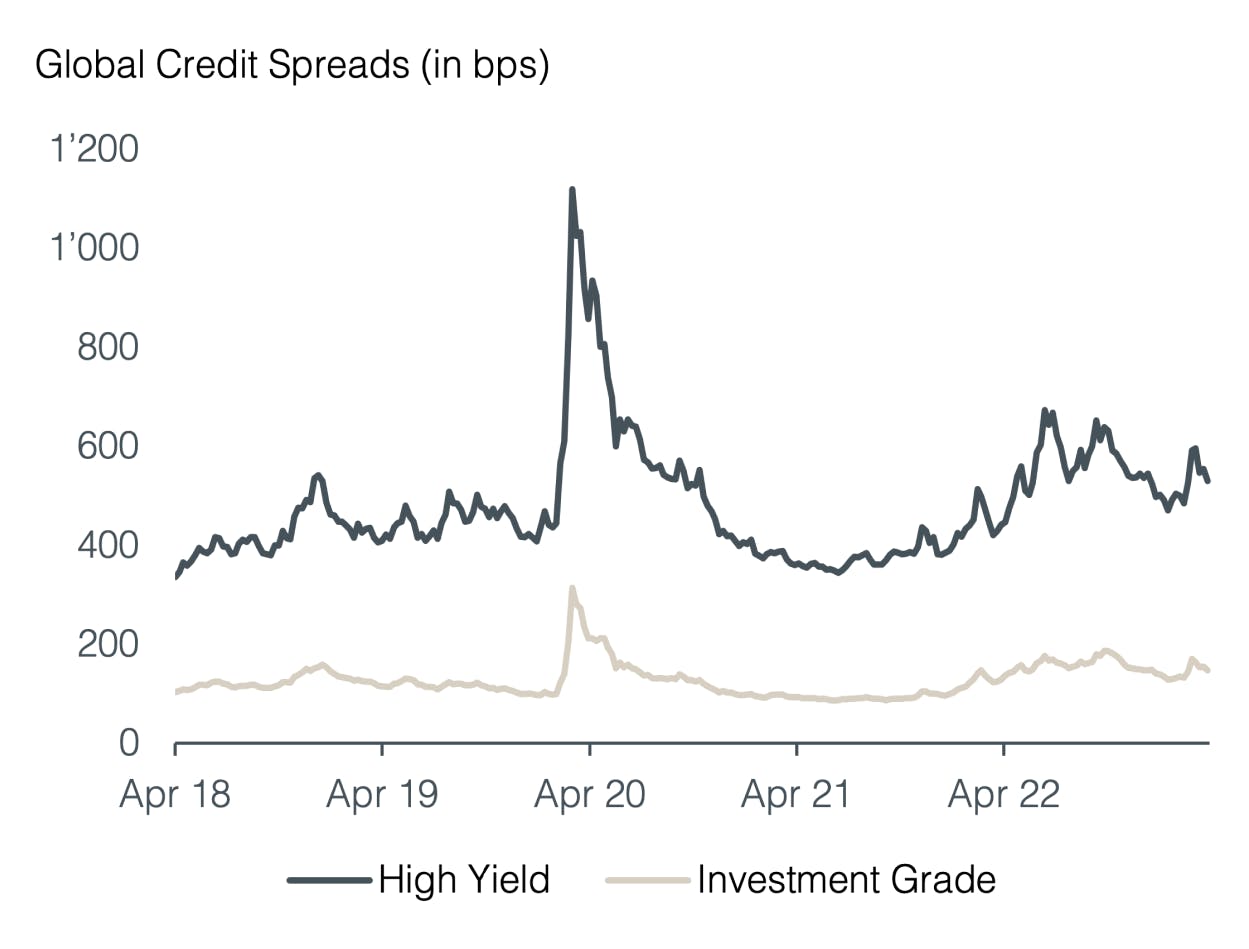

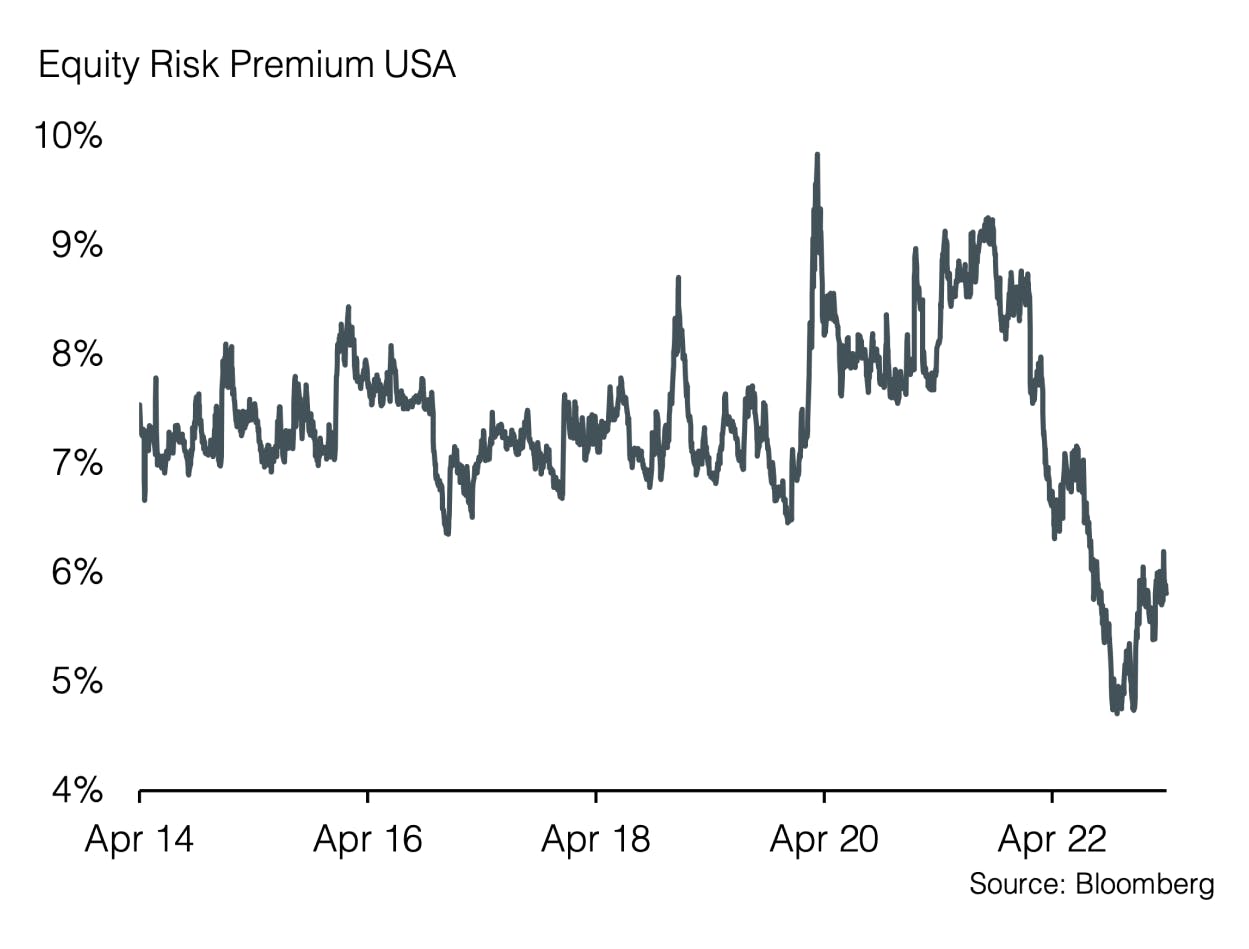

As expected, US banks have already tightened lending conditions. In Europe, bank lending has decreased for three consecutive months, which typically only occurs during times of a severe economic downturn. While credit availability is currently falling, the effects of this are being felt with a time lag. Leading indicators in the manufacturing sector already suggest that the labor market is likely to cool down in the coming months. A significant increase in jobless claims would be the missing puzzle piece in successfully getting inflation under control. However, these effects are expected to be accompanied by lower corporate profits and consequently a recession. According to estimates from Bloomberg Economics, the probability of a US recession this year is 100%.

The increasing visibility regarding a successful fight against inflation confirms our preference for long-dated government bonds and investment-grade corporate bonds. We are taking advantage of the attractive interest rate environment to further extend the maturities. High-quality bonds are also expected to regain their diversifying effect in the face of an economic slowdown. However, regional differences for USD, GBP, EUR, and CHF persist. From our perspective, credit spreads are likely to rise, which is why we continue to recommend a defensive positioning regarding credit risks. Equities remain underweight. We are taking the strong outperformance of US equities as an opportunity to reduce the region and thus also the associated high allocation to technology stocks. An additional reason for underweighting US equities is to reduce concentration risks, as around 87% of the total contribution to upside performance in the first quarter came from only 10 companies.

Appendix

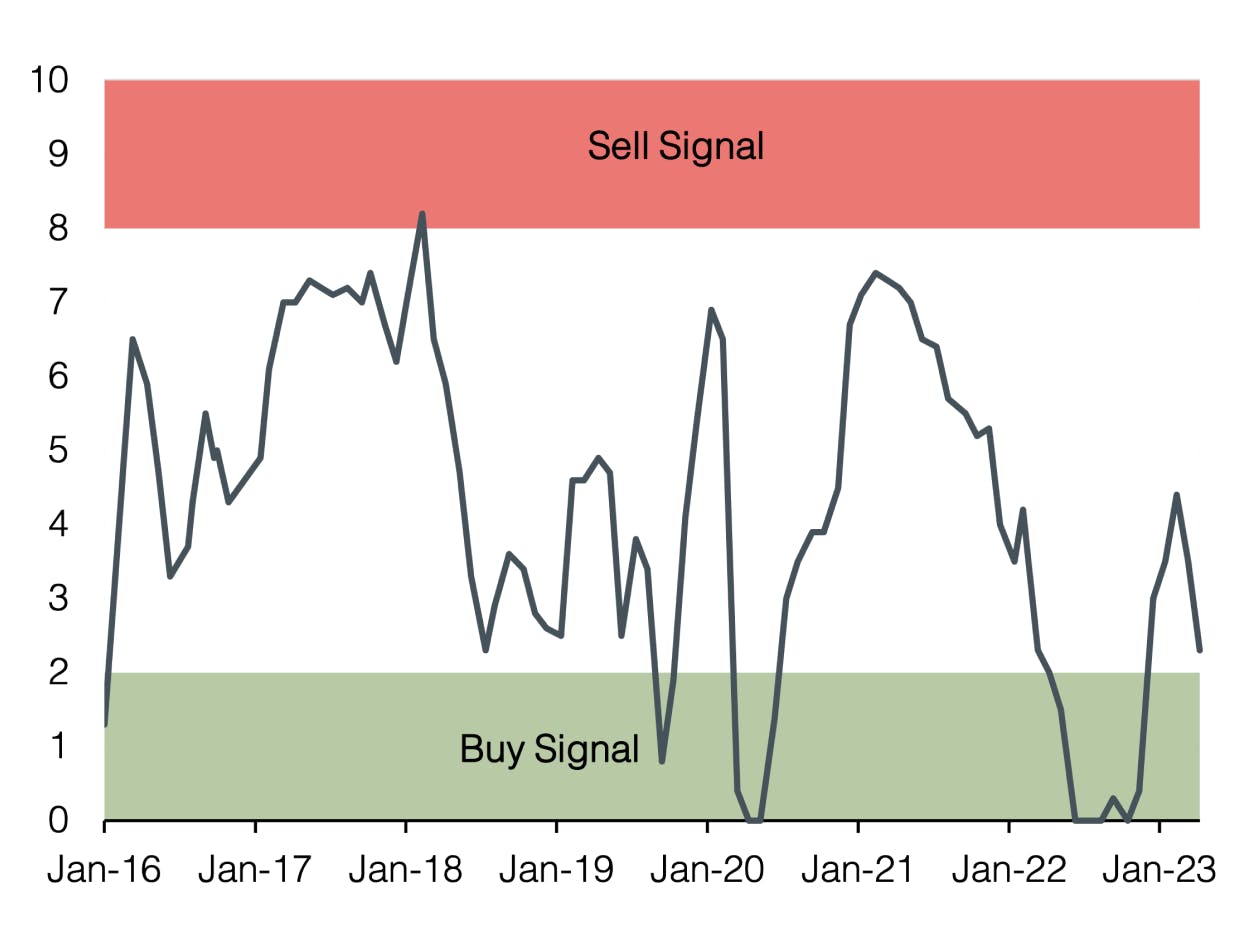

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research