SoundInsightN°21

Bonds

Equities

The Big Pivot

The long-anticipated shift in US interest rate policy has finally materialized. Following over two years of rising and historically elevated rates, a double rate cut now signals a pivotal moment, carrying substantial implications for capital markets.

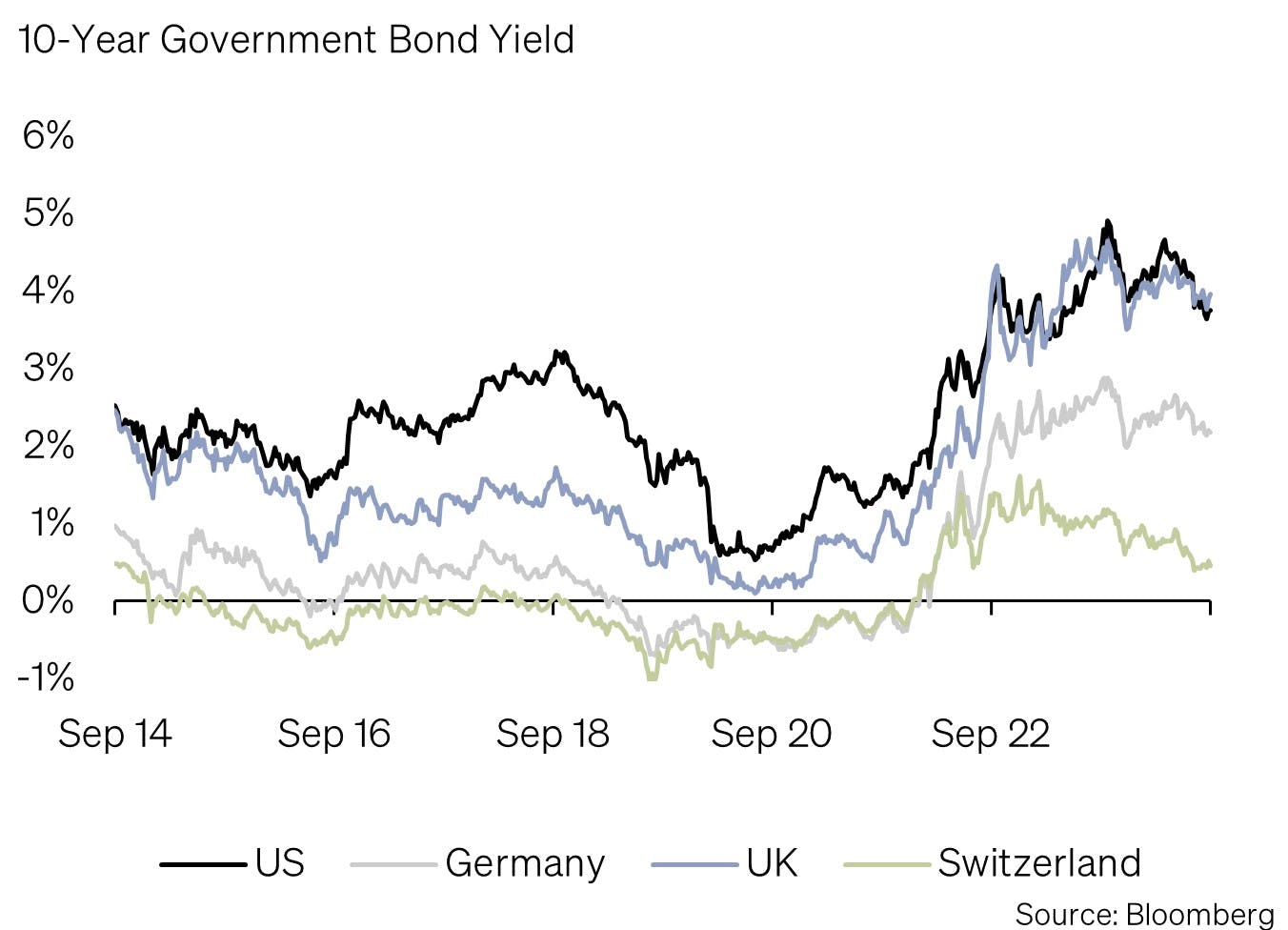

At the beginning of 2023, the US market anticipated an interest rate reversal by year-end. However, strong economic growth and persistently high inflation shifted expect-ations. The Federal Reserve continued rai-sing rates until July 2023, ultimately holding the benchmark rate steady at 5.5% - the highest level since 2001. With the release of the Fed's cautious economic outlook in the September Beige Book, clear signs of an impending policy shift emerged. None-theless, the Federal Reserve surprised many by implementing a 0.5% rate cut this month, equivalent to two standard 0.25% reductions. Out of 113 economists surveyed, only nine had predicted such a move.

This double rate cut caught many market participants off guard and ignited wide-spread debate. Federal Reserve Chairman Jay Powell addressed the reasoning behind the decision during a press conference. Historically, cuts of this magnitude have been tied to recessionary periods (e.g., the dot-com bubble, the Lehman crisis, and the COVID-19 pandemic). However, the current inflationary environment is different.

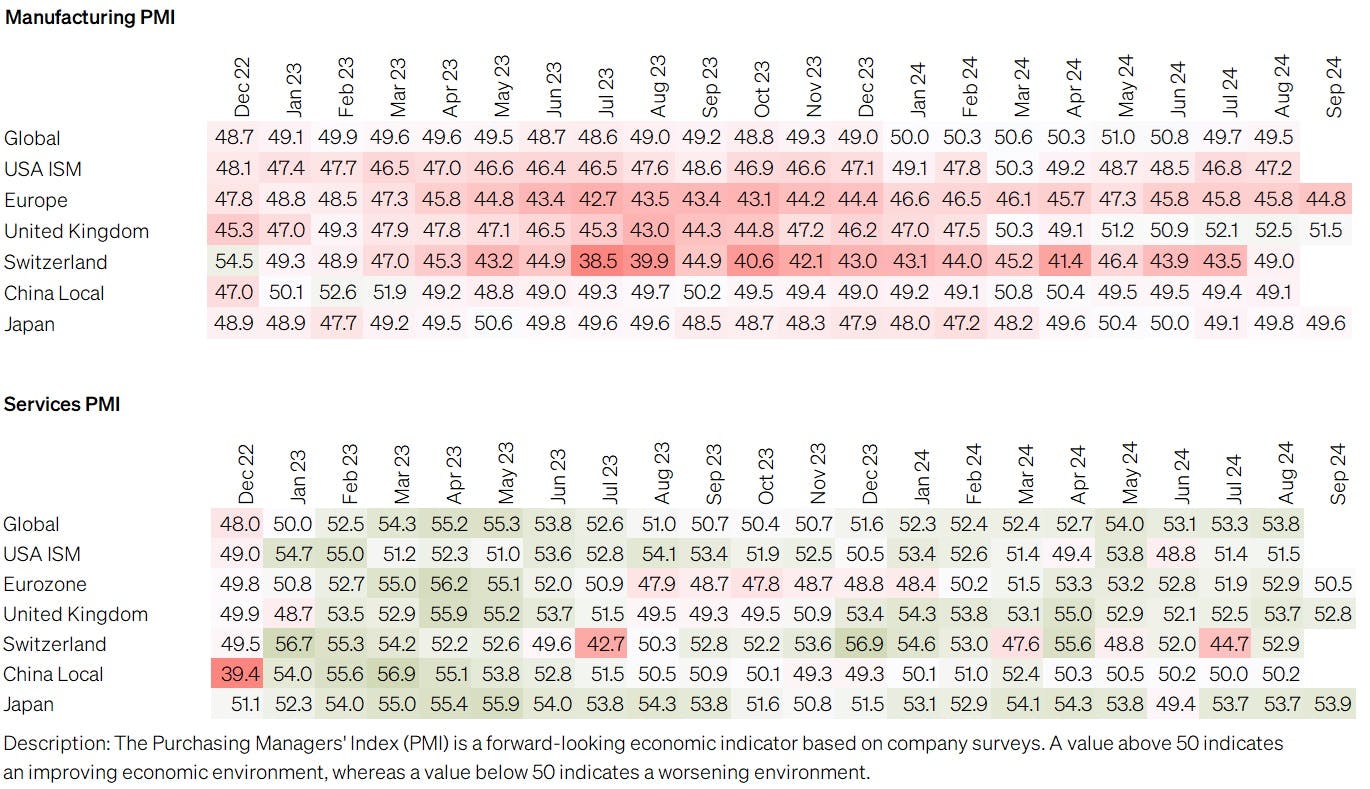

Despite the rate cut, the official forecasts released alongside the decision do not suggest an impending recession. Inflation appears to be under control, and the labor market is stabilizing. This view is shared by many economists, with expected recession risk for the US over the next year dropping from 50% at the start of the year to 30%.

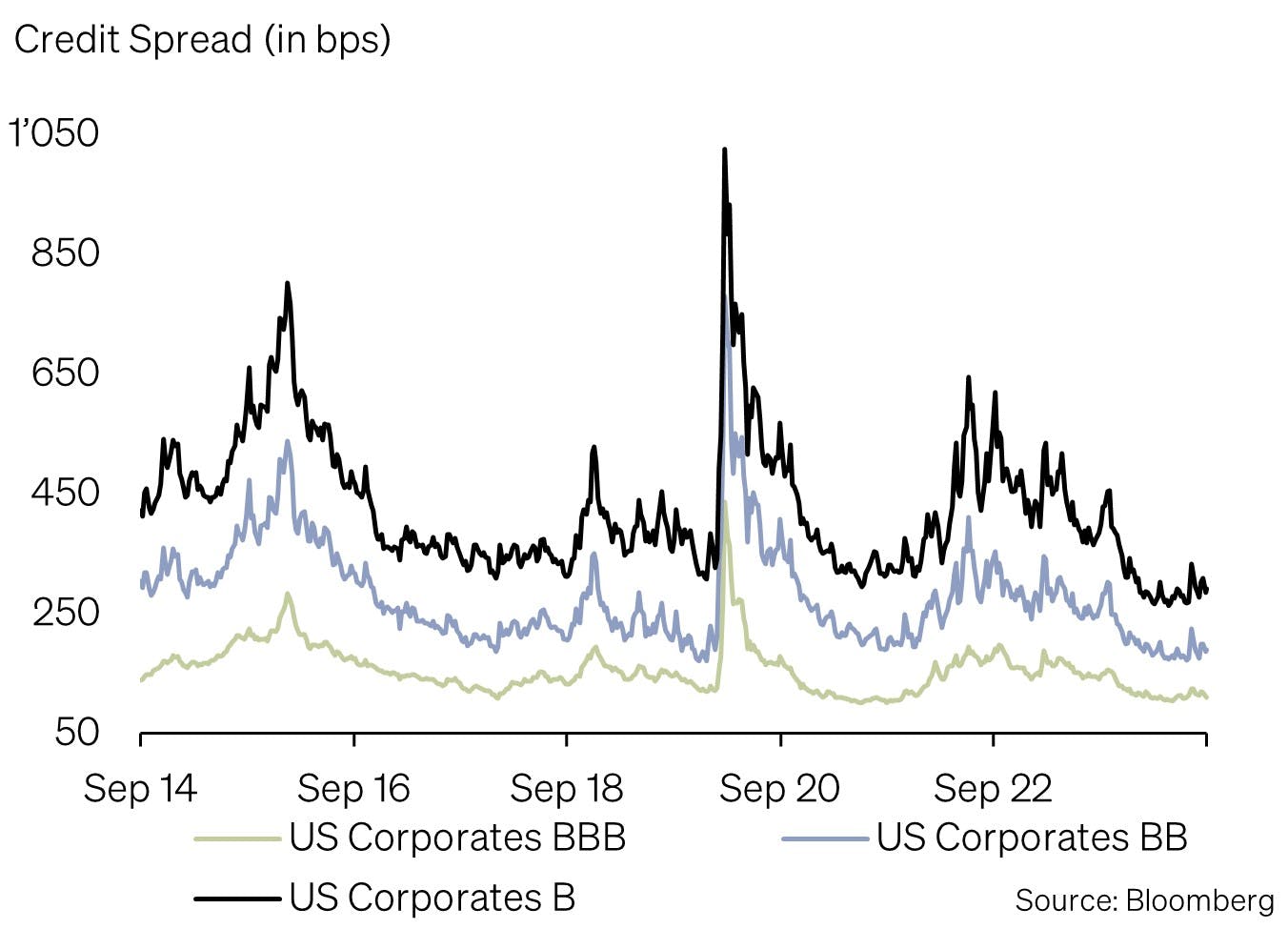

With the magnitude of this rate cut, the Federal Reserve is signaling a proactive approach to mitigating the risk of a significant economic slowdown, ideally addressing it before it becomes a larger issue. The markets have already priced in expectations for up to eight additional rate cuts by the end of 2025. As a result, businesses are already benefiting from lower borrowing costs, and default probabilities remain at historically low levels, providing crucial support, particularly for capital-intensive sectors.

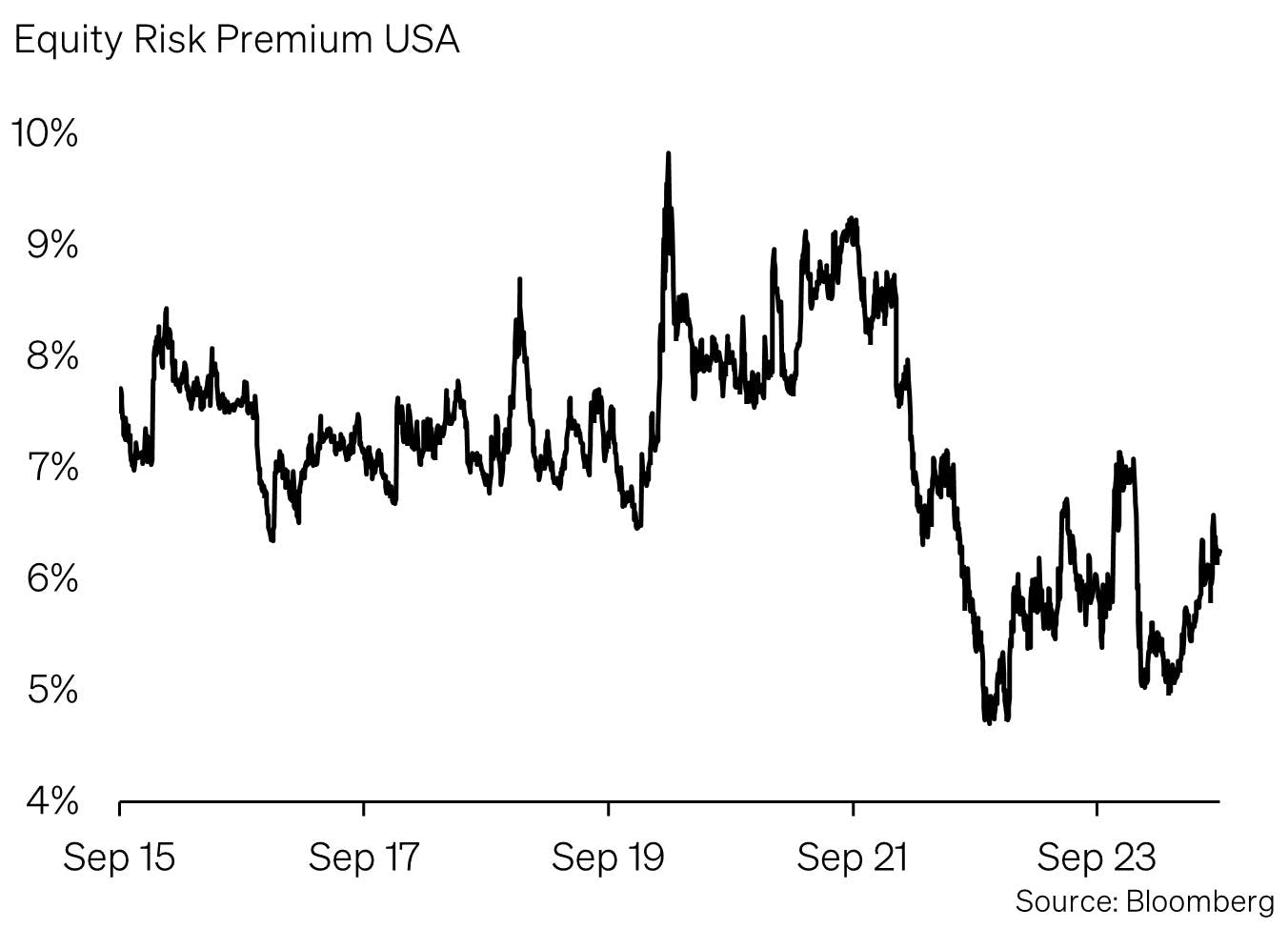

These developments suggest a favorable backdrop for equities and higher-risk assets. Analysts are projecting broad-based earnings growth for S&P 500 companies in the coming year. While major tech stocks have driven much of the growth and returns in recent quarters, a significant portion of 2025’s earnings growth is expected to come from sectors outside of technology and communication. Hence, for value stocks, which experienced no growth this year, analysts are forecasting a growth surge of over 10% in 2025.

As a result, markets are currently pricing in an optimistic outlook: a stabilizing US economy aided by rate cuts, historically low credit spreads, cheaper financing for companies, and double-digit earnings growth. However, the August jobs report and several leading indicators suggest that potential disappointments cannot be ruled out. Given these factors, we are maintaining a neutral allocation between bonds and equities. Sensitivity to economic data will remain elevated ahead of the US elections, making a focus on quality and stability within portfolios a prudent strategy.

Appendix

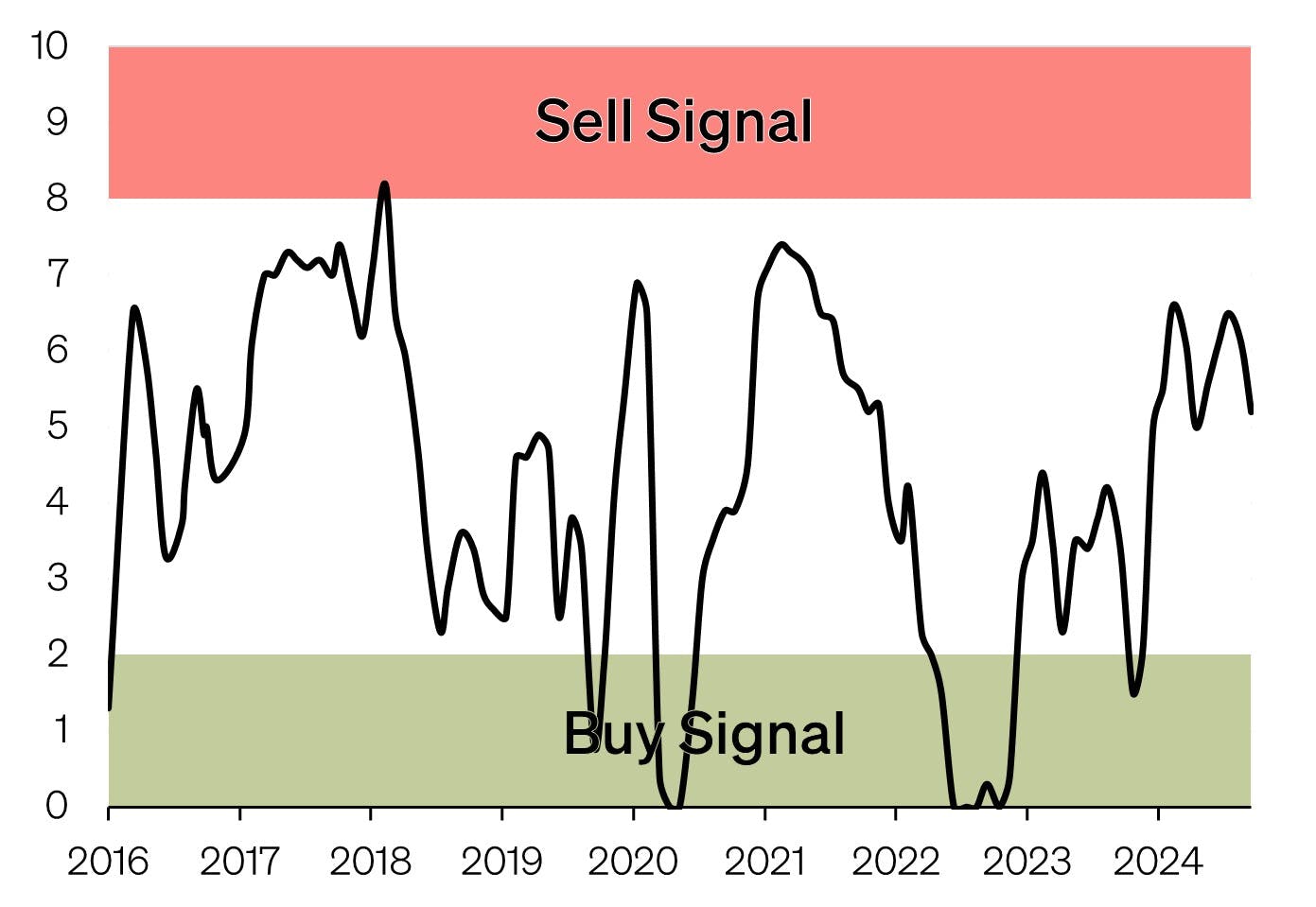

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2024 Sound Capital Ltd. All rights reserved.

Datasource: Bloomberg, BofA ML Research