SoundInsightN°27

Bonds

Equities

A Dynamic Start to the Year

The financial markets kicked off the new year with a blend of stability and uncertainty. While U.S. inflation exceeded expectations, leading to an adjustment in monetary policy expectations, the economy remains resilient, despite early signs of a slowdown and rising uncertainty surrounding Donald Trump.

The U.S. retail sector is sending mixed signals, yet investors are benefitting: Bonds and equities have delivered positive returns since the beginning of the year. Europe has emerged as a surprising outperformer, while U.S. stocks have lagged global markets. Meanwhile, China is showing early signs of a recovery, particularly in the technology sector.

Economy: Inflation Remains the Dominant Topic

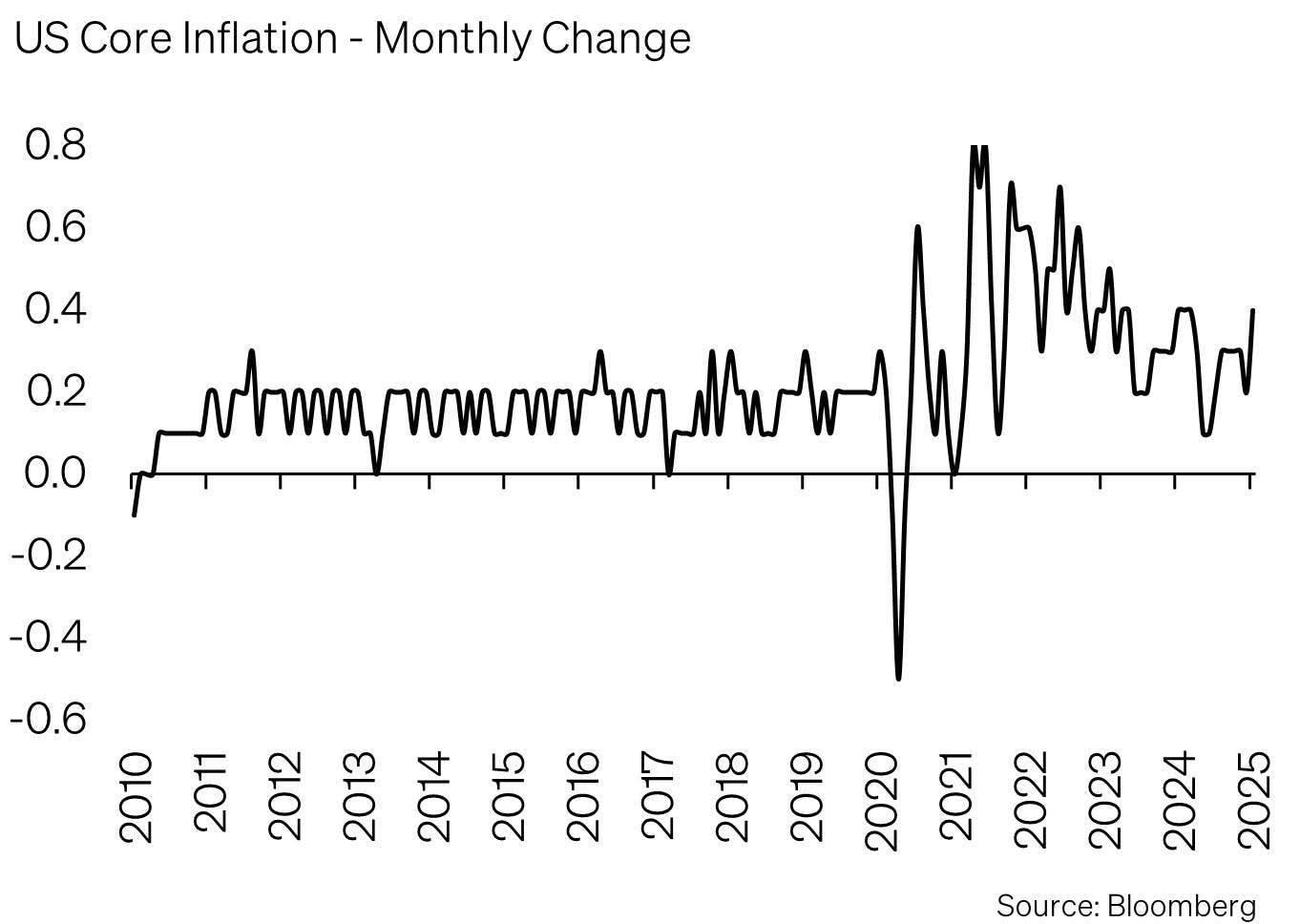

Inflation continues to be the central topic in financial markets. Following a stronger-than-expected rise in U.S. consumer prices in January, investors revised their expectations regarding the Federal Reserve’s interest rate policy.

At the start of the year, the next rate cut was expected in June. However, this timeline is now shifting further into autumn. There are also early signs of an economic slowdown in the U.S., particularly in the retail sector. January retail sales declined by 0.9%, a much sharper drop than anticipated. This decline follows an exceptionally strong holiday season in December. Experts suggest that looming import tariffs may have already impacted consumer behavior. Trade policy remains a key source of uncertainty, as new tariffs could drive up costs for U.S. consumers and businesses, further limiting the Fed’s policy options.

While the Fed is taking a wait-and-see approach due to inflation concerns, the European Central Bank remains on a rate-cutting path, with three additional rate cuts expected this year. Similarly, the Swiss National Bank is likely to cut rates in March. In Switzerland, price action in the fixed income market caught our attention. The yield on 10-year government bonds jumped from 0.2% in December to 0.57% currently, as last year’s fears of negative interest rates vanished.

Bond Markets: A Stable Start Amid Uncertainties

Following a volatile 2024, the bond market has seen a positive start to the year, apart from Switzerland. U.S. Treasury yields peaked at 4.8% in January before pulling back. A similar trend has been observed in the Eurozone, where yields have declined slightly.

While corporate bonds currently exhibit stable credit spreads, this could change quickly if macroeconomic uncertainties persist. High-yield bonds, in particular, carry asymmetric risks. There is limited potential for further spread tightening, whereas an expansion from these low levels has historically been sharp. Given the uncertainty surrounding the Fed’s monetary policy and an unpredictable U.S. government, investors should be cautious about taking on excessive bond risk.

Equity Markets: Europe as an Unexpected Outperformer

A surprising trend since the beginning of the year has been the strong performance of European equities. While U.S. stocks have lagged global markets, the Euro Stoxx 50 finally reached a new all-time high after 25 years. This move defies expectations, as analysts had largely projected continued U.S. market leadership in 2025. The following chart highlights the crucial role of dividends in long-term investing. While the index remains at levels similar to those of 2000, investors who reinvested their dividends have more than doubled their capital.

Despite this recent outperformance, Europe has lagged global equity markets historically. The Euro Stoxx 50’s annualized return over this period stands at 4.1%, compared to approximately 7% for the global equity market. This persistent underperformance has resulted in a valuation discount for European equities. Recently, this discount has attracted increased capital flow into Europe. A Bloomberg analysis of ETF fund flows shows that European Equity ETFs have recorded the highest percentage inflows in recent weeks. This suggests that investors are rebalancing their portfolios away from U.S.-centric allocations in favor of Europe.

China has also shown a notable turnaround. Strong corporate earnings and improving market sentiment have lifted the technology sector. The sentiment shift was further supported by DeepSeek (SoundInsights No.26). This marks a contrast to the past few years, during which Chinese equities were under pressure. However, the key question remains: Is this recovery sustainable, and will other sectors beyond technology benefit from the rebound?

Market Positioning – The Importance of Diversification

The first months of 2025 have already presented a wide range of challenges: Inflation remains stubborn, pushing rate cuts further into the future, while economic momentum in the U.S. remains intact, albeit with early signs of slowing. Over the past month, we have maintained our tactical positioning unchanged.

Artificial Intelligence – Beyond Just Technology

One of the key themes gaining traction across multiple industries this year is the growing role of artificial intelligence. AI is driving significant productivity gains, particularly in financial services, consulting, and software industries. While the focus in previous years has been primarily on large tech companies, AI applications are now increasingly benefiting other sectors. This trend, also relevant to SoundCapital, is being closely monitored as we evaluate selective investment opportunities.

Gold as a Stable Anchor in Uncertain Times

Beyond equities and bonds, gold remains a key component of our asset allocation. During periods of macroeconomic uncertainty, gold has proven to be a reliable hedge. The current combination of geopolitical risks, persistent inflation, and an uncertain monetary policy outlook continues to support stable demand for gold.

A well-diversified and selective investment strategy remains essential. Our investment philosophy remains unchanged: Quality over risk. Gold continues to serve as a stabilizing factor and a valuable addition to any portfolio. The coming months promise further intriguing developments. With SoundInsights, you’ll stay informed.

Appendix & Disclaimer

SoundInsights is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials

Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong. - Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with SoundInsights. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by SoundCapital (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2025 SoundCapital. All rights reserved.

Datasource: Bloomberg, BofA ML Research