SoundInsightN°26

Bonds

Equities

Trump, Rates & AI Correction

With Donald Trump’s inauguration as the 47th President of the United States, significant shifts in global politics are on the horizon. Right from the start of his term, numerous executive orders have been enacted which are aligned with his key campaign themes: immigration, deregulation, and energy policy. The new administration has now announced specific trade tariffs, which are expected to have a significant impact on the markets.

Despite these political uncertainties, financial markets have kicked off the new year on a positive note. However, attention is increasingly focused on the high valuations in the technology sector, particularly in artificial intelligence (AI). The latest version of DeepSeek, a Chinese competitor to OpenAI, has demonstrated that powerful AI models can be developed more efficiently and cost-effectively than previously expected—potentially bad news for Nvidia and its peers.

U.S. Job Market Remains Strong Despite Monetary Policy Uncertainty

In December, the U.S. economy added 256,000 new jobs, significantly exceeding expectations of 165,000. This momentum continues to indicate a robust labor market. As a result, some economists have adjusted their interest rate forecasts: while the majority still anticipate rate cuts, a minority now see potential for rate hikes later this year due to the strong economic outlook.

Inflation Trends: Diverging Paths in the U.S. and Europe

In the U.S., producer and consumer prices rose more moderately than expected, leading to a decline in short-term USD interest rates. As a result, markets are currently pricing in two rate cuts by the Federal Reserve for 2025. Europe presents a different picture: Inflation in Germany unexpectedly picked up, pushing EUR interest rates higher compared to the start of the year. However, markets still anticipate up to three more rate cuts by the European Central Bank (ECB) by the end of 2025.

A Possible Turning Point in Leading Economic Indicators

The latest Purchasing Managers’ Index (PMI) data for the manufacturing sector in both the U.S. and Europe indicate a positive trend. This could suggest that economic conditions in these regions are stabilizing, potentially signaling a turning point. If this trend continues, it may support a sustained economic recovery in the medium term. For now, our indicators remain neutral.

Bonds - Trump and Monetary Policy: Pressure on the Fed?

Donald Trump has once again reaffirmed his preference for lower interest rates. During his previous term, he frequently pressured the Federal Reserve. However, markets have so far remained unfazed—the Fed kept rates unchanged at its January meeting, emphasizing that controlling inflation remains its top priority.

One of the key economic challenges during Trump’s presidency will likely be the soaring U.S. debt burden. The country’s interest expense now exceeds $2.4 billion per day, surpassing the entire U.S. defense budget for the first time.

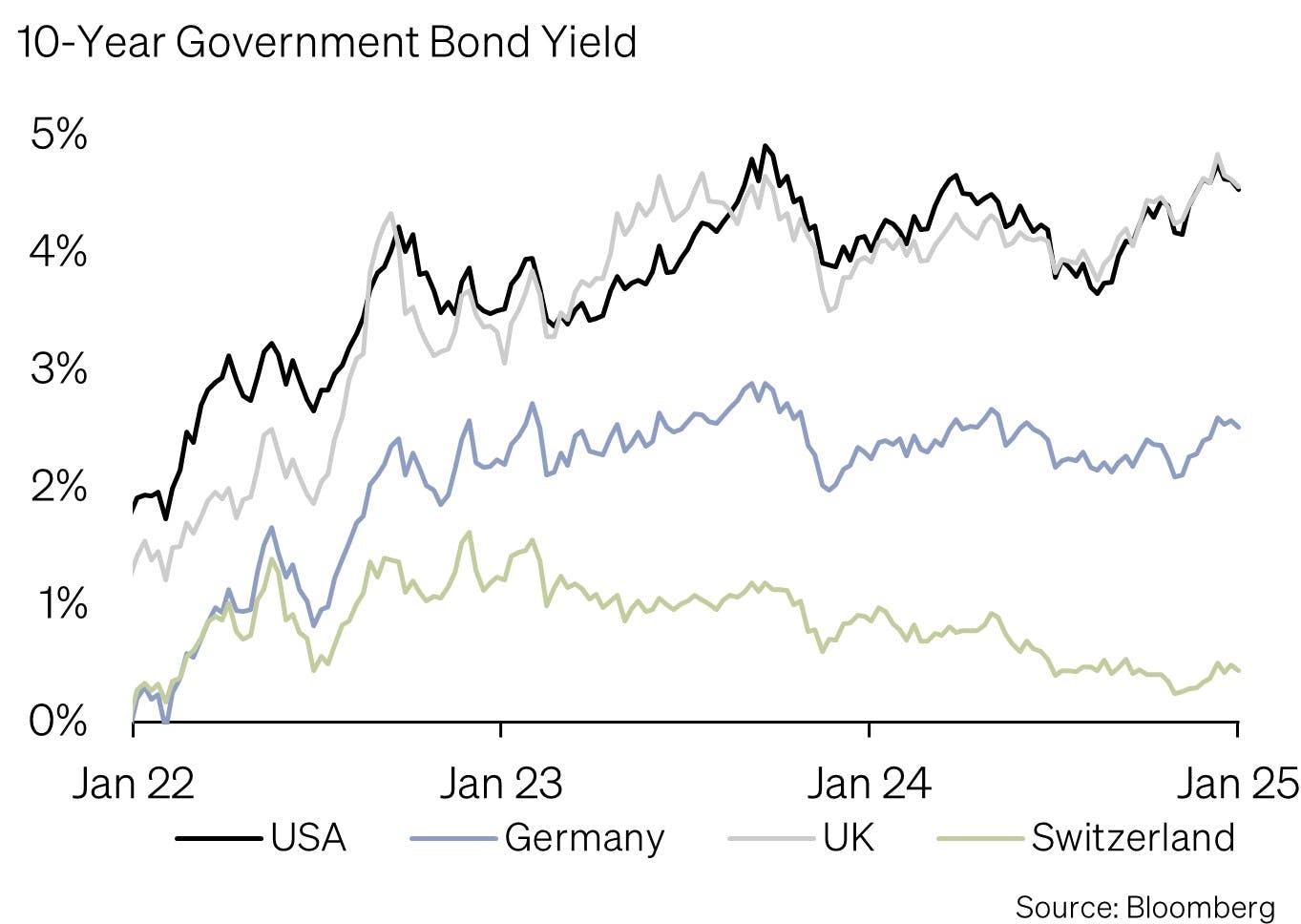

However, bond yields will ultimately depend on the Fed’s actual policy decisions, not political rhetoric. As long as inflationary pressures in the U.S. persist, the Fed's ability to cut rates remains limited, and the interest rate differential between the U.S. and Europe is likely to remain significant. We maintain a neutral stance on bonds, with a preference for high-quality U.S. bonds with longer maturities.

Equities - Tech Sector Under Pressure: Is DeepSeek a Game-Changer?

The stock market started 2025 with strong gains, largely fueled by AI-driven growth. While major tech companies benefited, smaller software firms and specialized semiconductor manufacturers also attracted significant capital flows.

However, by the end of the month, market risk became more apparent: The launch of the latest model of DeepSeek—a Chinese AI platform competing with OpenAI—triggered a major valuation correction. DeepSeek operates on a far more cost-effective infrastructure while delivering performance comparable to leading Western models from OpenAI, Google, and Meta. This development has raised concerns about the dominance of U.S. tech giants and the viability of their massive AI investments.

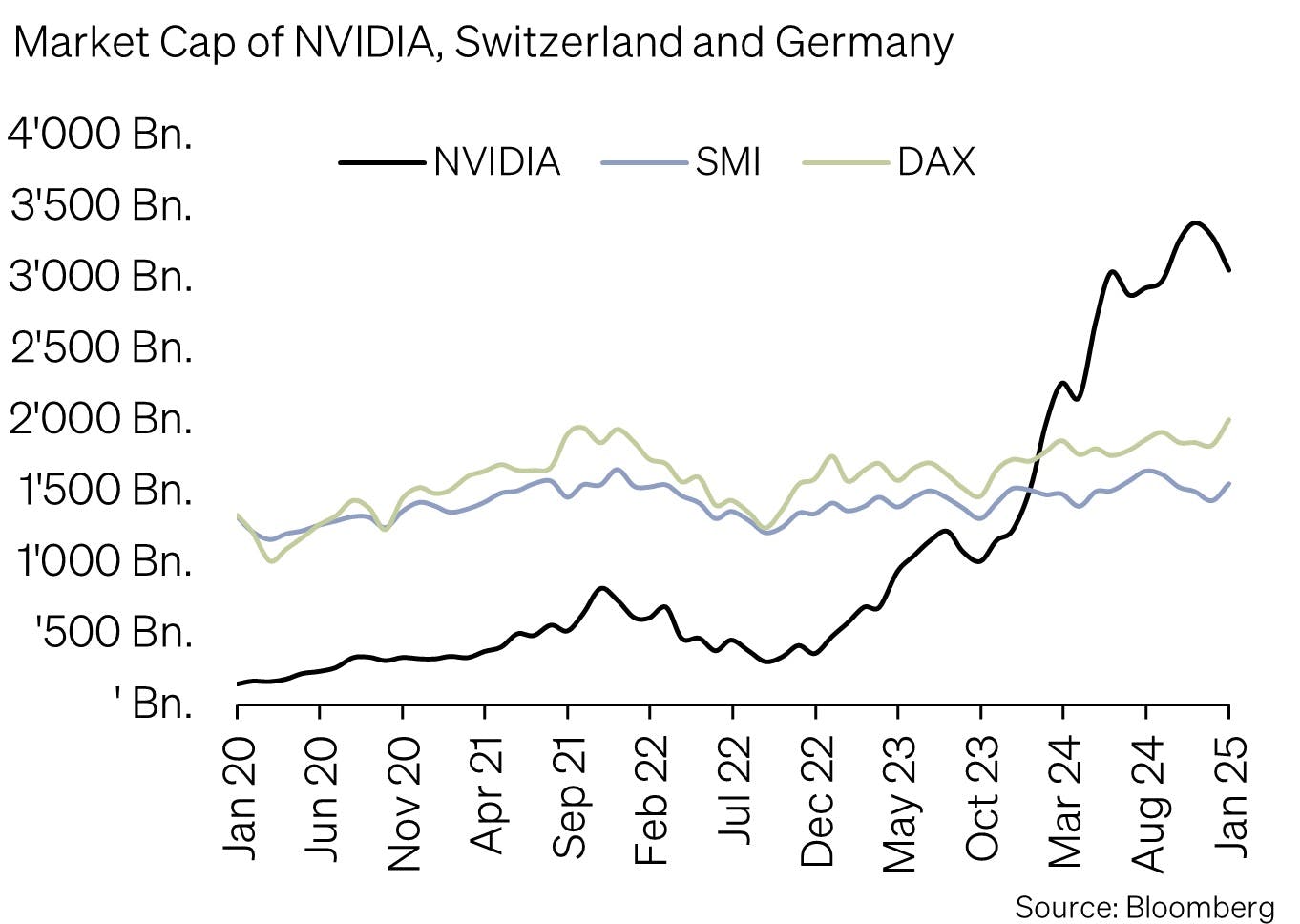

One striking example: Nvidia lost $589 billion in market capitalization in a single trading session, the largest market value loss for any company in history. To put this into perspective, this is equivalent to Sweden’s entire annual GDP in 2023.

The importance of Nvidia to U.S. equity markets cannot be overstated: The combined market capitalization of all publicly listed companies in Germany and Switzerland is roughly equal to that of Nvidia alone.

It remains to be seen whether DeepSeek is a true game-changer, but one thing is clear: The pace of change in the AI space is accelerating, bringing rapid innovation and new solutions—an element that could ultimately be seen as a positive force for the industry.

Market Positioning

This correction highlights how many investors are overly concentrated in tech stocks. As technology shares came under pressure, investors with a more diversified portfolio fared significantly better.

We continue to favor broad diversification and see several key investment opportunities:

Rising Electricity Demand:

AI and data centers are driving energy consumption regardless of whether DeepSeek or OpenAI leads the AI race. As a result, we are increasing our exposure to utility stocks while reducing our energy sector stance to neutral.

Europe as an Investment Opportunity:

European equities are historically undervalued compared to U.S. stocks. As a result, we are lifting our underweight stance and moving to a neutral rating.

Tariffs as a Risk for Emerging Markets:

The potential for stricter U.S. trade policies under Trump leads us to underweight emerging market equities.

Swiss Equities Outperforming:

The Swiss stock market has significantly outperformed other major indices so far this year. This is primarily due to lower interest rates and the high quality of Swiss companies, which offer stable earnings growth.

We still favor Swiss equities, particularly defensive sectors and companies that underperformed in 2024. These stocks could see renewed investor interest as markets shift toward stability and attractive valuations.

Appendix

SoundInsights is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials

Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong. - Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with SoundInsights. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by SoundCapital (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2025 SoundCapital. All rights reserved.

Datasource: Bloomberg, BofA ML Research