SoundInsightN°22

Bonds

Equities

From Headwind to Tailwind

Global stock markets reached new highs in October, while the default probabilities for U.S. corporate bonds hit record lows. This positive momentum is being driven by expectations of lower interest rates and rising corporate profits.

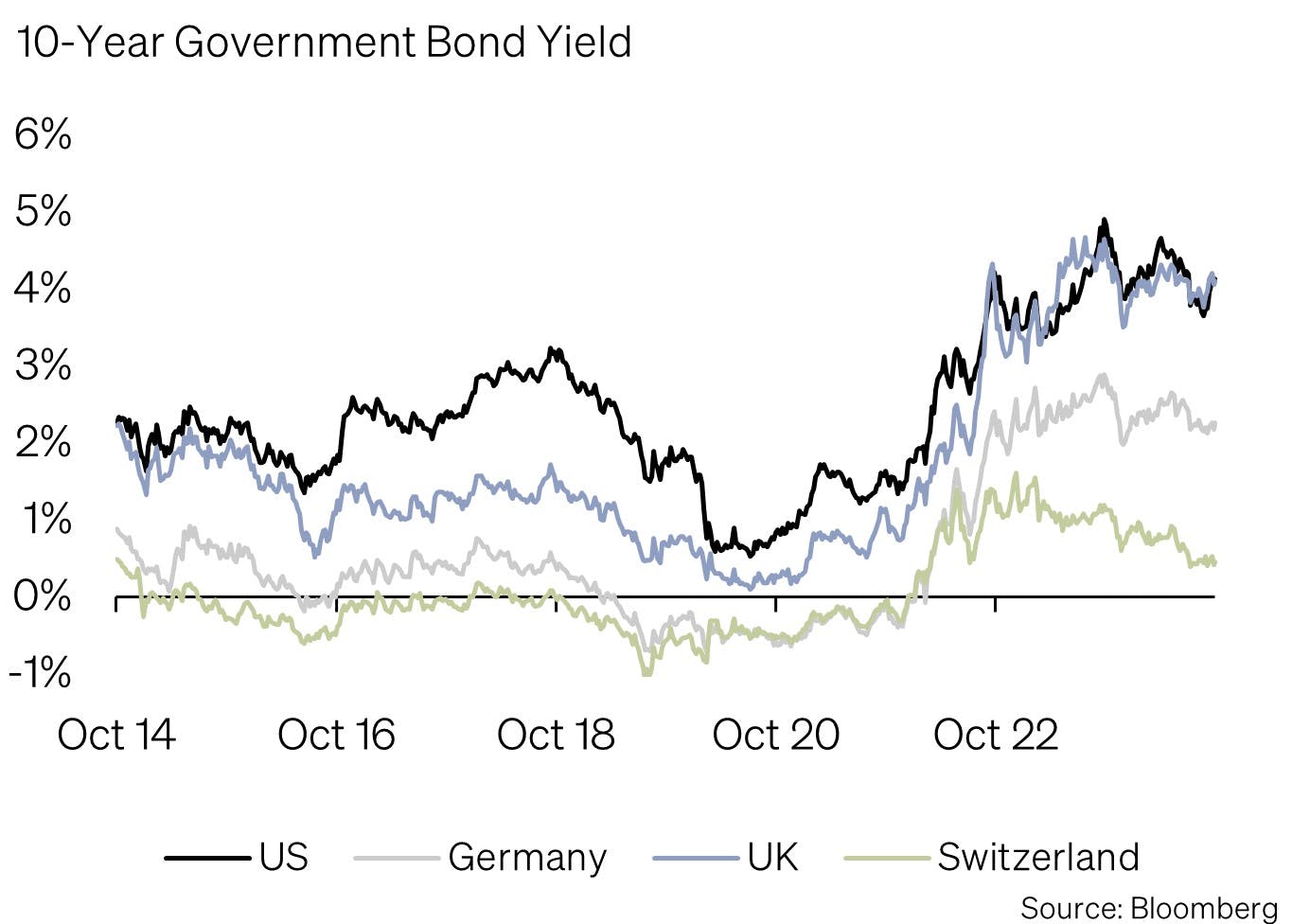

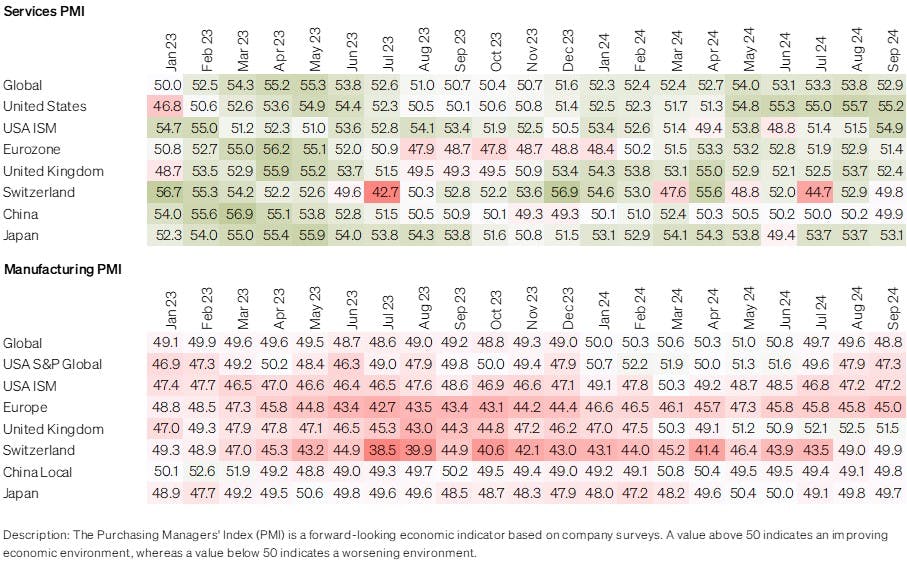

Investors have plenty to celebrate this year. In the aftermath of the pandemic, inflation acted as a significant headwind for stocks and bonds. However, as inflation has been trending down recently and the central banks started to ease monetary policy, it is now turning into a crucial tailwind. Although the Consumer Price Index (CPI) for September came in slightly above expectations at 2.4%, it remains below the levels typically seen during previous interest rate-cutting cycles. Furthermore, when looking at the past 25 years, inflation has now returned below the average for that period.

This cooling of consumer prices creates room for a more accommodative monetary policy, while also fostering improved corporate fundamentals. Particularly within the S&P 500, net margins have been recovering since their low point at the end of 2022, with many analysts forecasting positive margin growth through 2025.

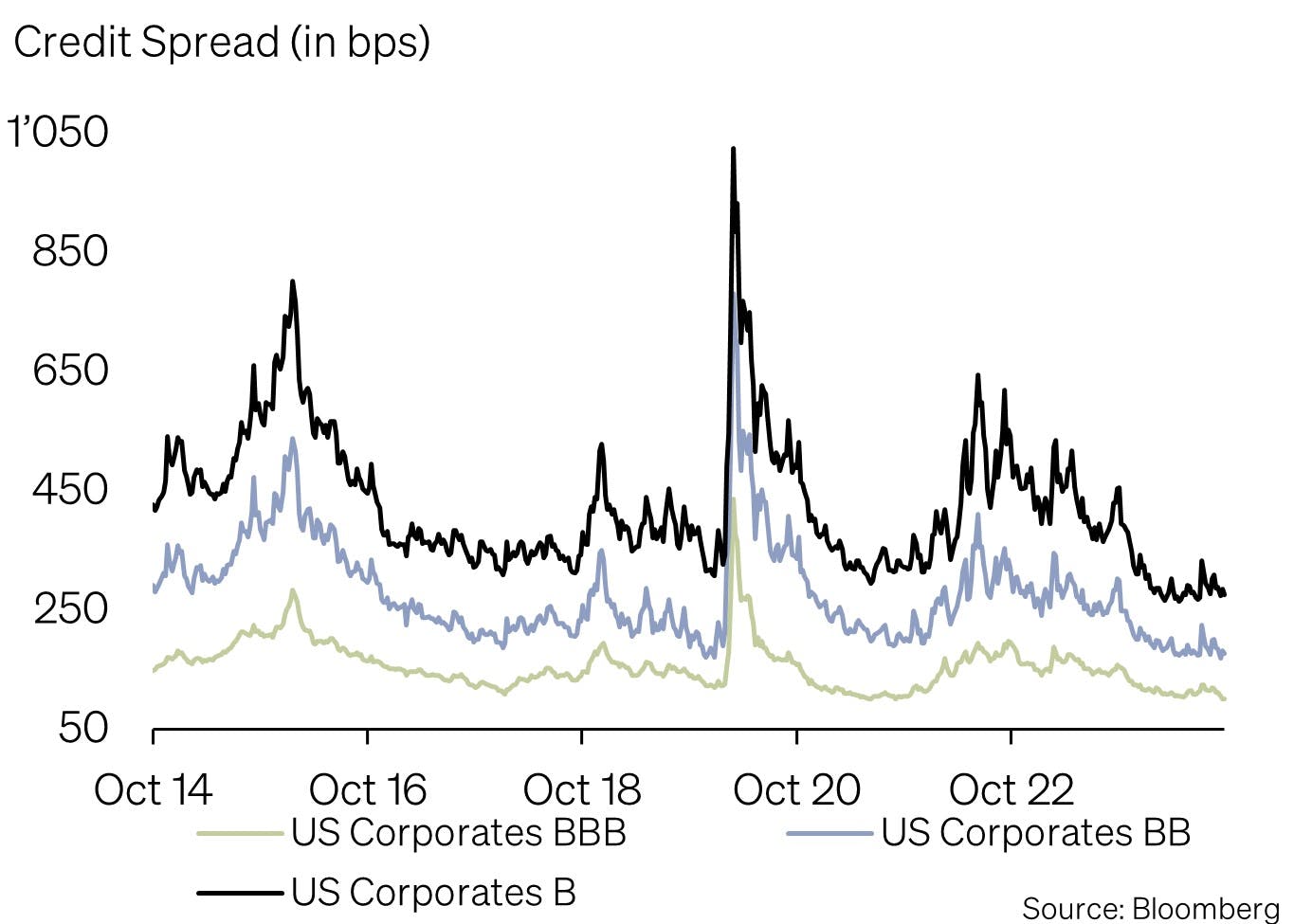

The bond markets are also sending positive signals. Declining interest rates are providing smaller companies with greater opportunities to strengthen their balance sheets. As a result, credit spreads for high-quality U.S. corporate bonds have fallen to their lowest levels since 2005.

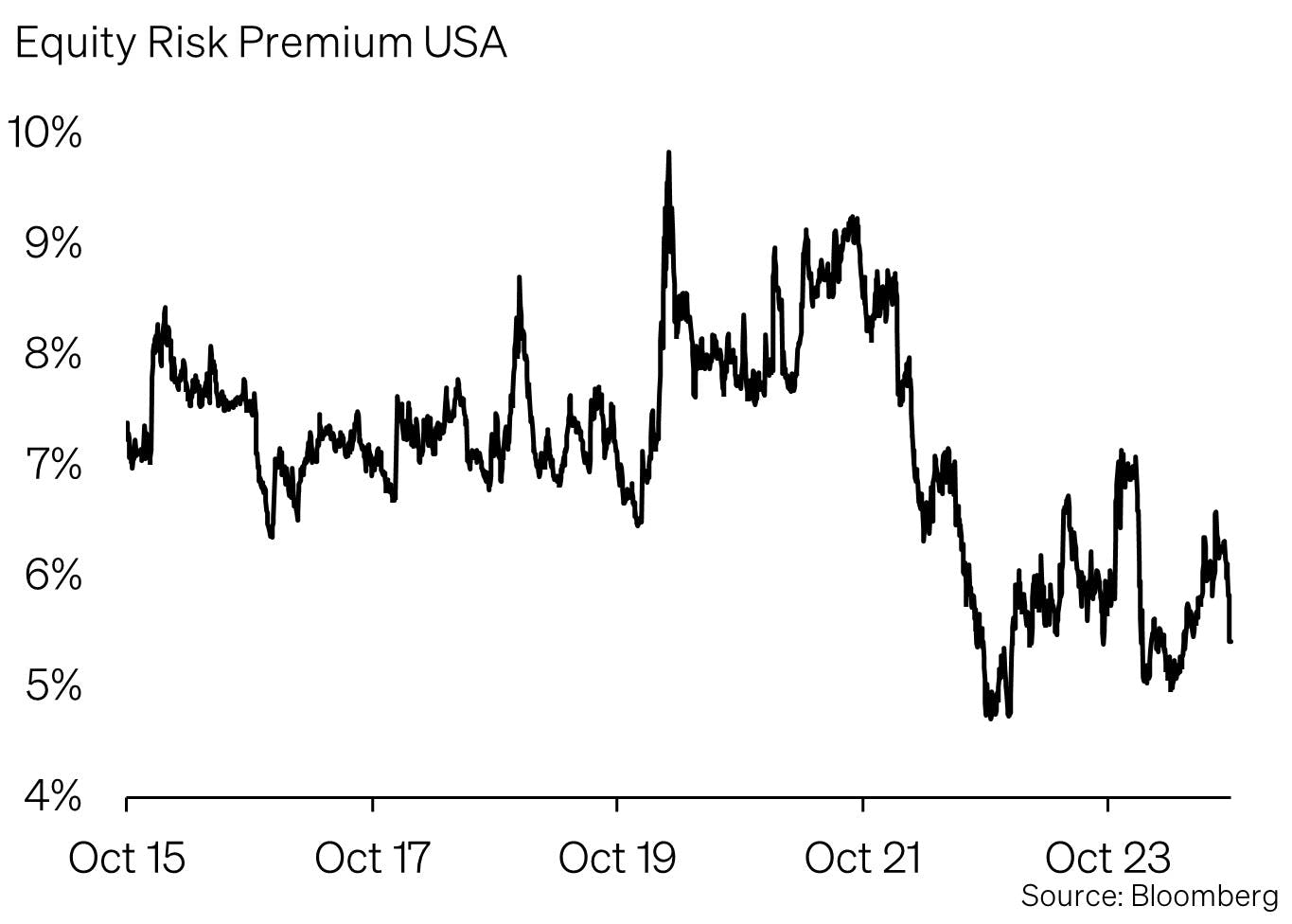

The current record highs in the stock market and record lows in credit spreads reflect that many positive developments, especially due to falling interest rates, have already been priced in. This is also evident in analysts' expectations for the coming quarters. While the current earnings reports still show a transitional phase in terms of growth, double-digit earnings growth is anticipated from the fourth quarter of 2024 through 2025.

However, in our view, an important point is often overlooked: the risk of resurgent inflation has not been fully eliminated. Factors such as economic stimulus packages (e.g., in China), geopolitical tensions (Middle East), and the upcoming U.S. elections could reignite inflation. A good indicator of this is the price of gold, which has risen by more than 30% in USD this year, outperforming stock markets. We continue to believe that gold remains a crucial component of any portfolio in this market environment.

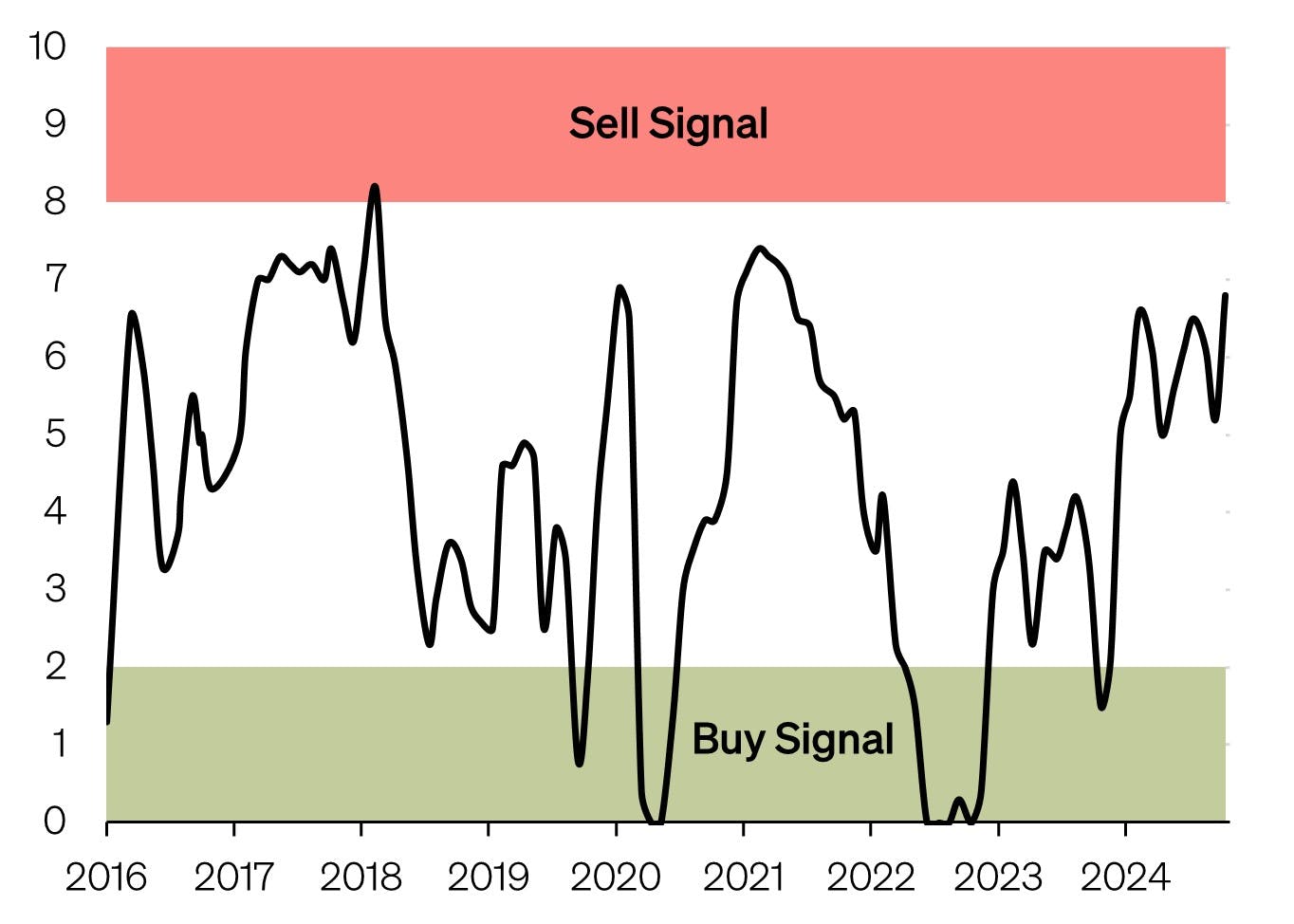

In Europe, the Purchasing Managers' Indexes (PMIs) are not aligned with market performance, especially in the industrial sector, where a downward trend is evident. As a result, we have implemented a regional underweighting for Europe. In contrast, we have raised our outlook for emerging markets to neutral. This decision is supported by attractive valuations, the U.S. interest rate cycle, and stimulus measures in China. Overall, we remain neutral on equities, even though recent market enthusiasm has pushed the risk index to its highest level in three years.

In the bond space, we continue to advocate for a cautious approach to credit risks, as we believe that the compensation for taking on additional risks is currently not sufficiently high.

Appendix

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2024 Sound Capital Ltd. All rights reserved.

Datasource: Bloomberg, BofA ML Research