SoundInsightN°1

Bonds

Equities

From Inflation to Recession

Last year was one of the most difficult years in the history of asset management. In many respects, the past events will resonate into the coming year, promising challenging financial markets in 2023.

In terms of superlatives, 2022 is unlikely to be surpassed anytime soon. The fluid transition from the COVID crisis to war and inflation has turned financial markets extraordinarily volatile and provided the weakest investment returns in decades.

However, the last year started on a positive note: A normalization of the global economy through declining infections suggested that discussions about COVID would soon give way to the usual real economic issues. In fact, COVID was soon no longer on top of our minds, but not for the expected reasons. On February 24, 2022, Russia invaded Ukraine, creating the greatest challenge to the international peace order since World War II. Already strained supply chains were further disrupted by a wide range of sanctions. Moreover, protectionist trade restrictions accentuated an already tense situation, which ultimately led to a global outbreak of inflation.

Asset Returns in 2022

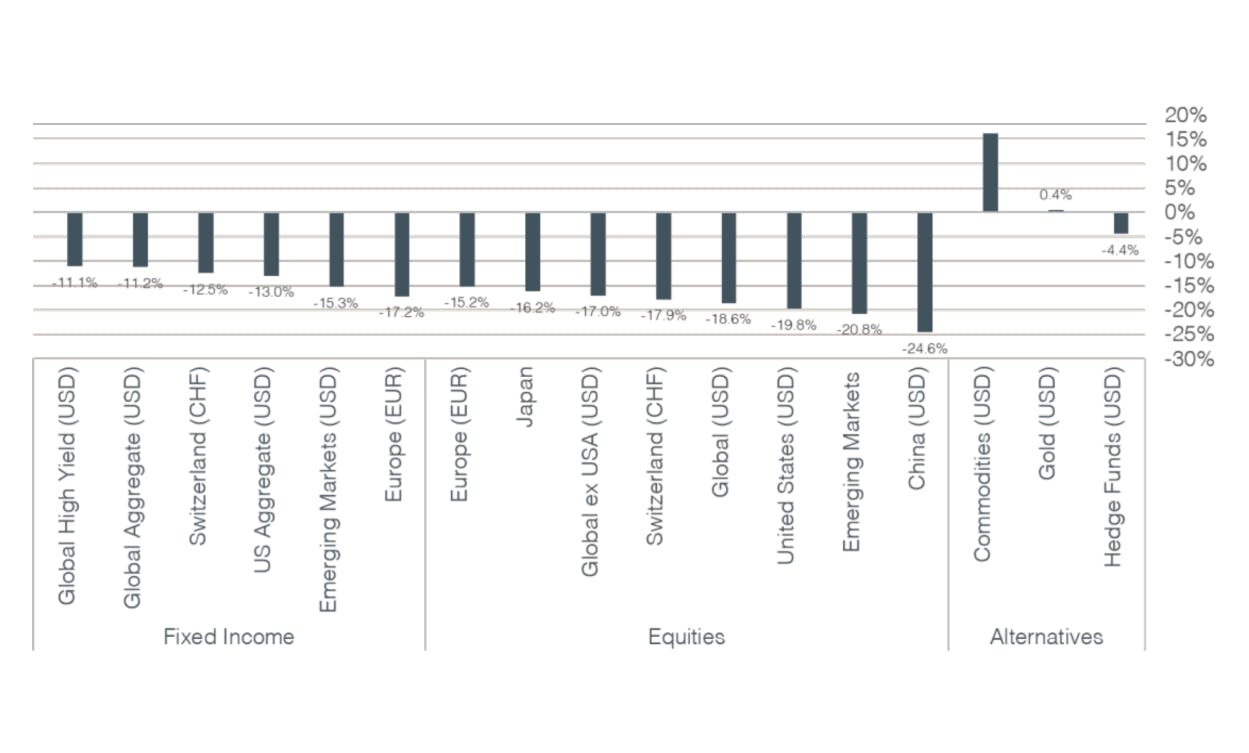

Except for some areas of the commodity market, all asset classes were negatively affected by sharply higher rates caused by central bank tightening. From an investor's point of view, there were almost no possibilities to minimize losses, despite solid diversification.

In historical comparison, losses across the fixed income space were particularly exceptional. The shift away from loose monetary policy to fight inflation was followed by double-digit negative returns across the board. On top of that, it is the second consecutive negative year for bonds after 2021.

In equities, massively higher interest rates impacted valuations, pushing down growth-sensitive sectors in particular. Except for the energy space, which emerged as a major beneficiary from the war-triggered power crisis, all sectors showed negative returns. On a regional level, price gains were very limited to only a few markets, such as the UK.

In the first part of this Sound Invest issue, we analyze 2022 in more detail and put investment returns in a historical context. In the second part, despite currently low visibility, we show where investors need to look for opportunities and how we are positioning ourselves for the coming year.

Sound Capital Asset Allocation 2022

Fixed Income

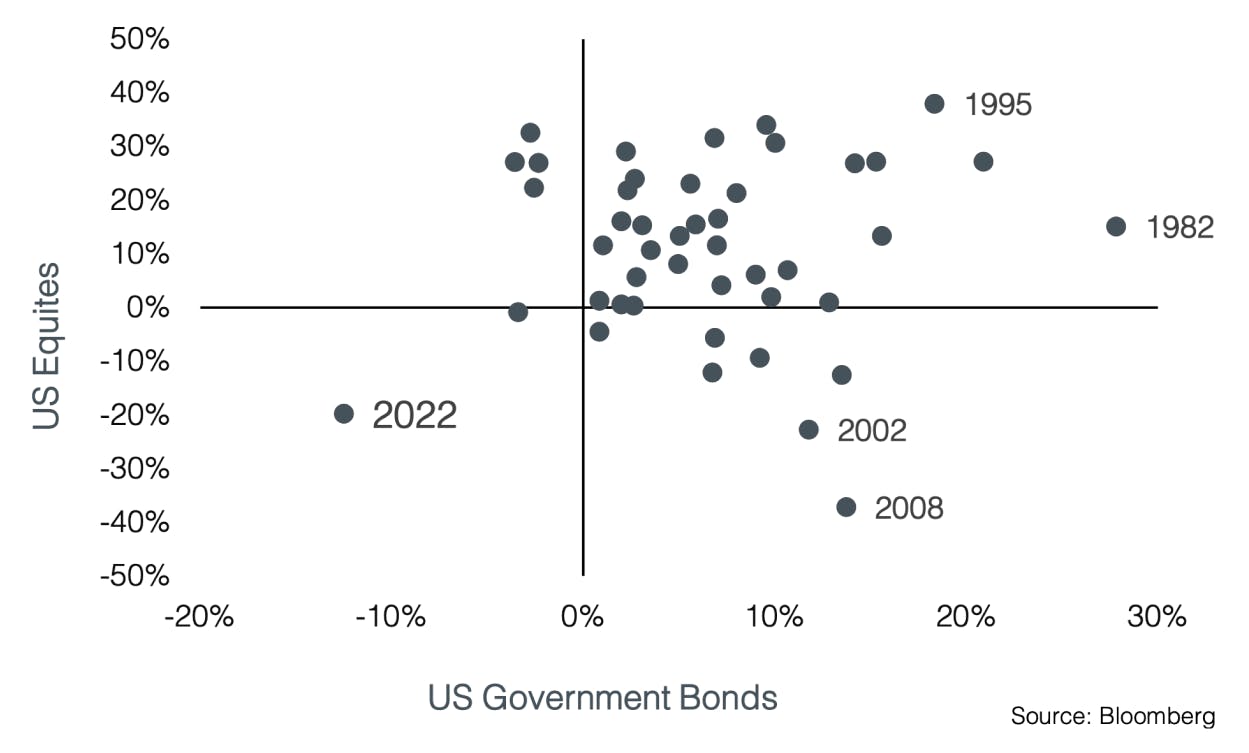

A look at the two major investment categories, equities and bonds, shows just how extraordinary investment returns were in 2022. Never in the last 50 years has there been a year in which both areas suffered comparably. Historically, government bonds have served as a safe haven when stock markets were in turmoil. As shown in the chart below, the dotcom bubble (2002) and the global financial crisis (2008) are good examples of the usually negative correlation of equities and bonds.

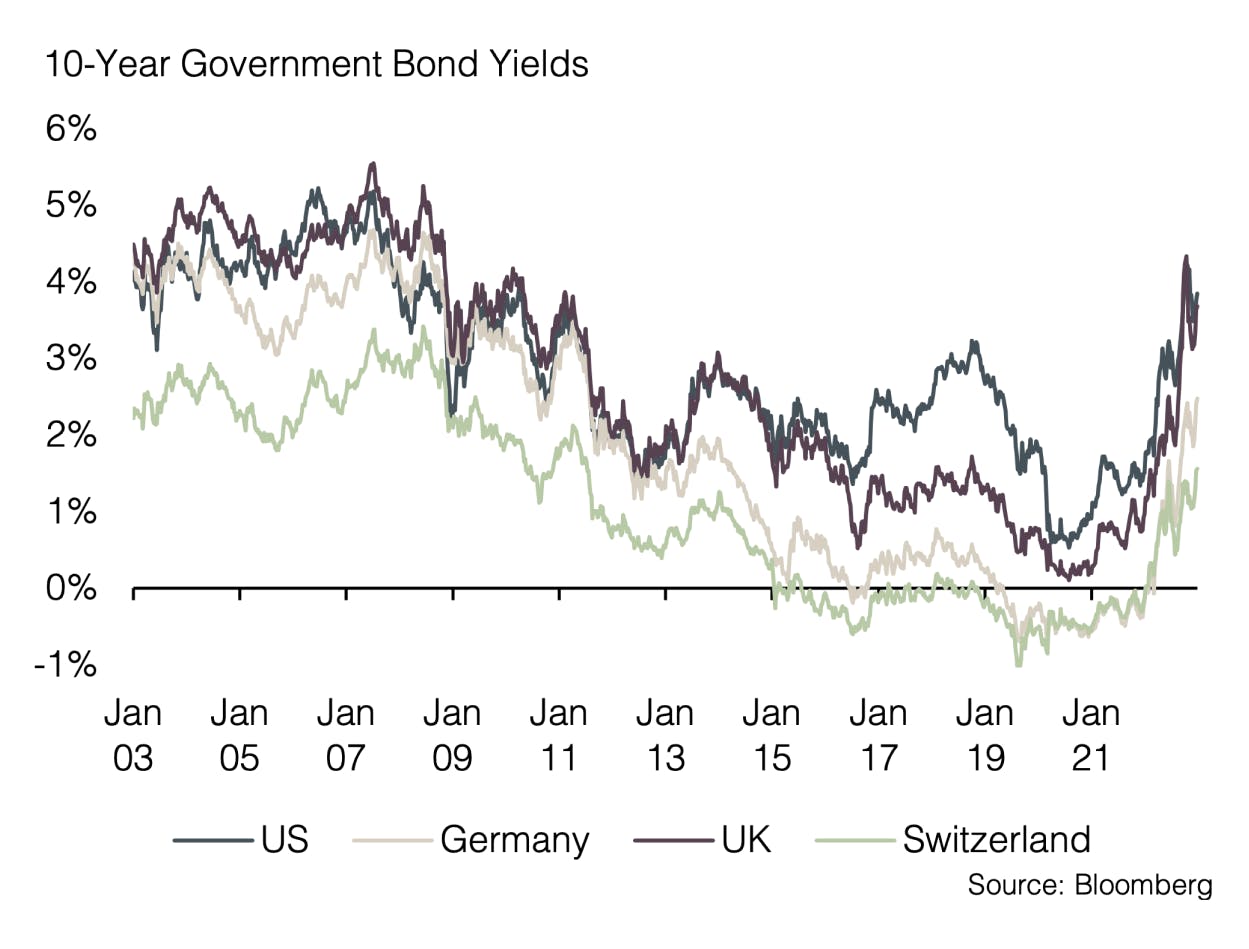

The combination of double-digit negative returns on bonds and equities led to the most negative returns in over 100 years, especially for balanced strategies. The reason for the unusual losses in the bond market likely reveals the biggest mistake investors made in 2022. At the beginning of the year, market participants expected a turnaround in monetary policy but massively underestimated the dynamics of inflation. For 2022, the market anticipated three interest rate hikes by the Fed to bring rates back to 0.75%, while only a single rate hike to a still-negative -0.4% was expected from the ECB. The reality was vastly different: extraordinarily large interest rate hikes by the Fed brought rates to 4.25%, and the ECB raised rates to 2%, significantly higher than expected. It is worth noting that major central banks began the tightening path from zero or even negative interest rates, leading to an extreme base effect and causing the largest percentage interest rate increase in the history of financial markets.

At the beginning of the year, we started with an underweight position in bonds, focusing on short maturities and underweighting government bonds. This was a good decision in relative terms, but in absolute terms, there were no profitable areas in the fixed income space. While we correctly assessed the direction, we significantly underestimated the extent of interest rate shifts. Attractive yields in emerging markets could not sufficiently compensate investors, mainly due to developments in China (real estate crisis, COVID lockdowns). Over the course of the year, higher interest rates and rising credit spreads led to a neutral and, by year-end, overweight positioning in fixed-income investments. Our underweight in government bonds was gradually reduced, with a clear focus on quality, avoiding riskier areas of the fixed income market. We also accounted for regional differences in monetary policy, as the Fed reacted more quickly and decisively to high inflation, while Europe still has some catching up to do.

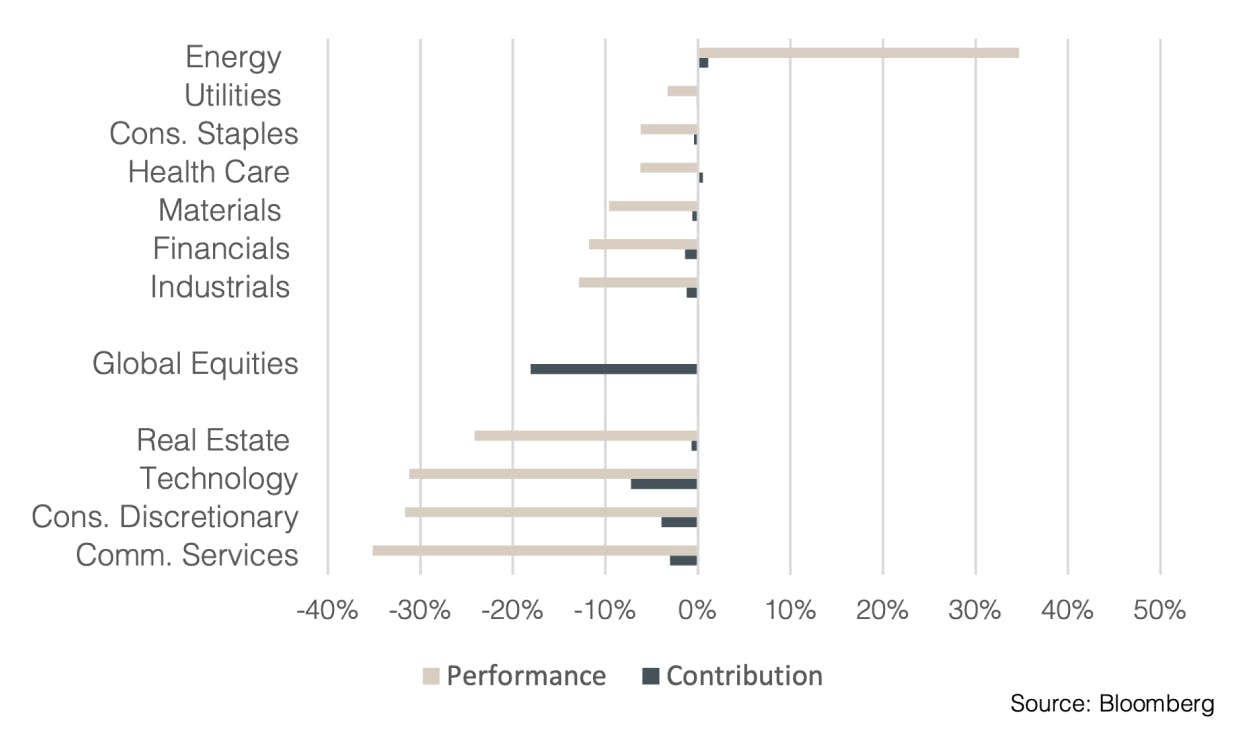

Equities

Rising interest rates also set the tone for equities last year, marking a fundamental change or regime shift. Years of zero interest rate policy and increasingly aggressive investors were supported by a massive increase in liquidity. Over the past few years, this fueled fast-growing sectors like technology, communications, and consumer cyclicals. With the technology sector making up nearly a quarter of global equity capitalization at the beginning of the year, the most interest rate-sensitive part of the equity market came under heavy pressure. Around 40% of last year's losses can be attributed to the technology sector. When adding the cyclical consumer goods and communications sectors, these weakest areas accounted for roughly 80% of the negative total equity market returns in 2022. Very similar to 2021, 30% of global equity returns came from just six US companies (Alphabet, Apple, Meta, Microsoft, Nvidia, Tesla), but with a negative contribution this time. The energy sector, on the other hand, saw massive gains of nearly 35%, but as it represents only about 3% of global market capitalization, it contributed just 1.1% to global equity returns.

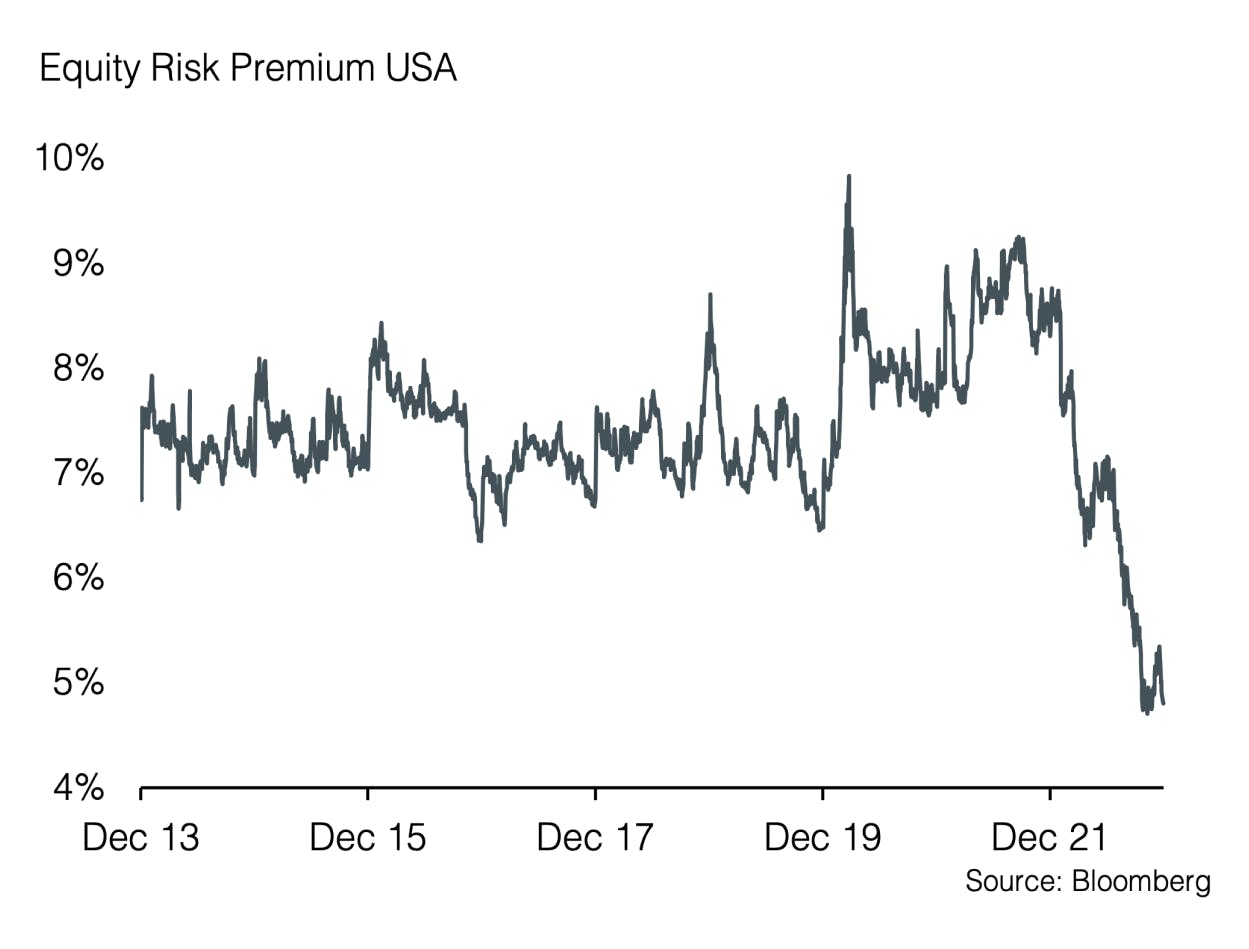

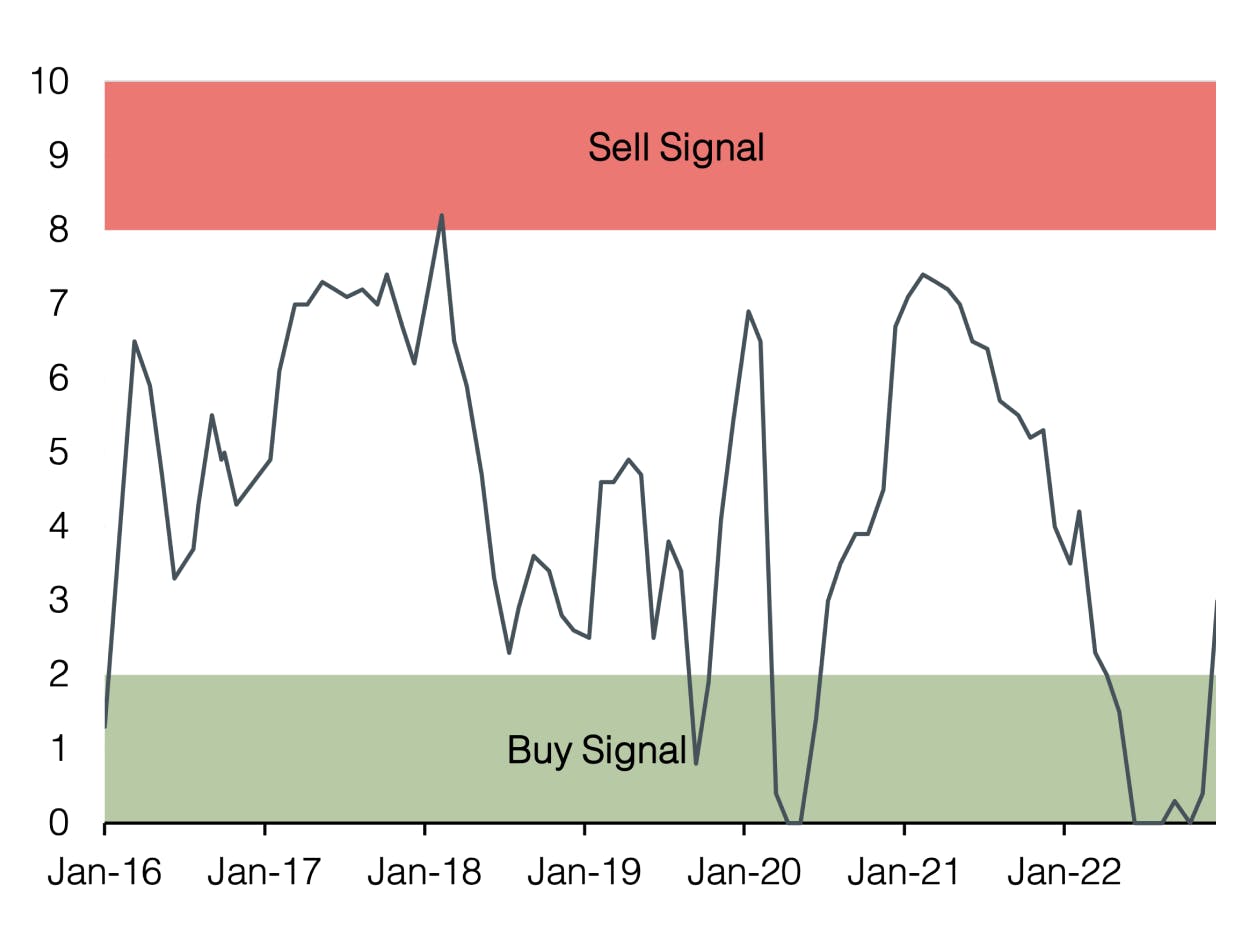

We started the year with a neutral equity positioning and remained neutral until mid-December. Like many investors, we were caught off guard at the beginning of the year by the outbreak of war in Eastern Europe. The resulting bottlenecks in global supply chains and the surge in inflation led to a shift towards a more defensive equity allocation. By the end of the year, we implemented an equity underweight, driven by very low equity risk premiums and improved sentiment as indicated by our contrarian risk index.

Alternative Investments

While double-digit negative returns were almost inevitable across major investment categories, alternative investments performed well in portfolios. We began the year with an overweight position in non-correlated investments, one of the few areas where positive returns were possible. The positive diversification effect of carefully selected alternative investments was reflected mainly in reduced portfolio volatility. However, with high interest rates in USD and GBP capital markets offering attractive returns in risk-free investments, we reduced our overweight in alternative investments in favor of bonds toward the end of the year.

Outlook 2023

Festverzinsliche Anlagen

- Positive money market returns

- Focus on high quality issuers

- Gradual increase of duration risk

- Volatility provides opportunities

The good news first: statistics point to a positive year in 2023, especially in the US. Since the start of common data recording, there have only been three instances where a negative year for treasuries was followed by further losses the next year: 1955-56, 1958-59, and now 2021-22. Statistically, there has never been three consecutive years of losses. Positive, interest-bearing money market investments also offer support. Risk-free rates in EUR, CHF, USD, and GBP are at their highest levels since 2008. This marks a regime change, as some investors were facing negative interest rates just months ago. Furthermore, rising interest rates mean that investors across asset classes are better compensated for potential risks.

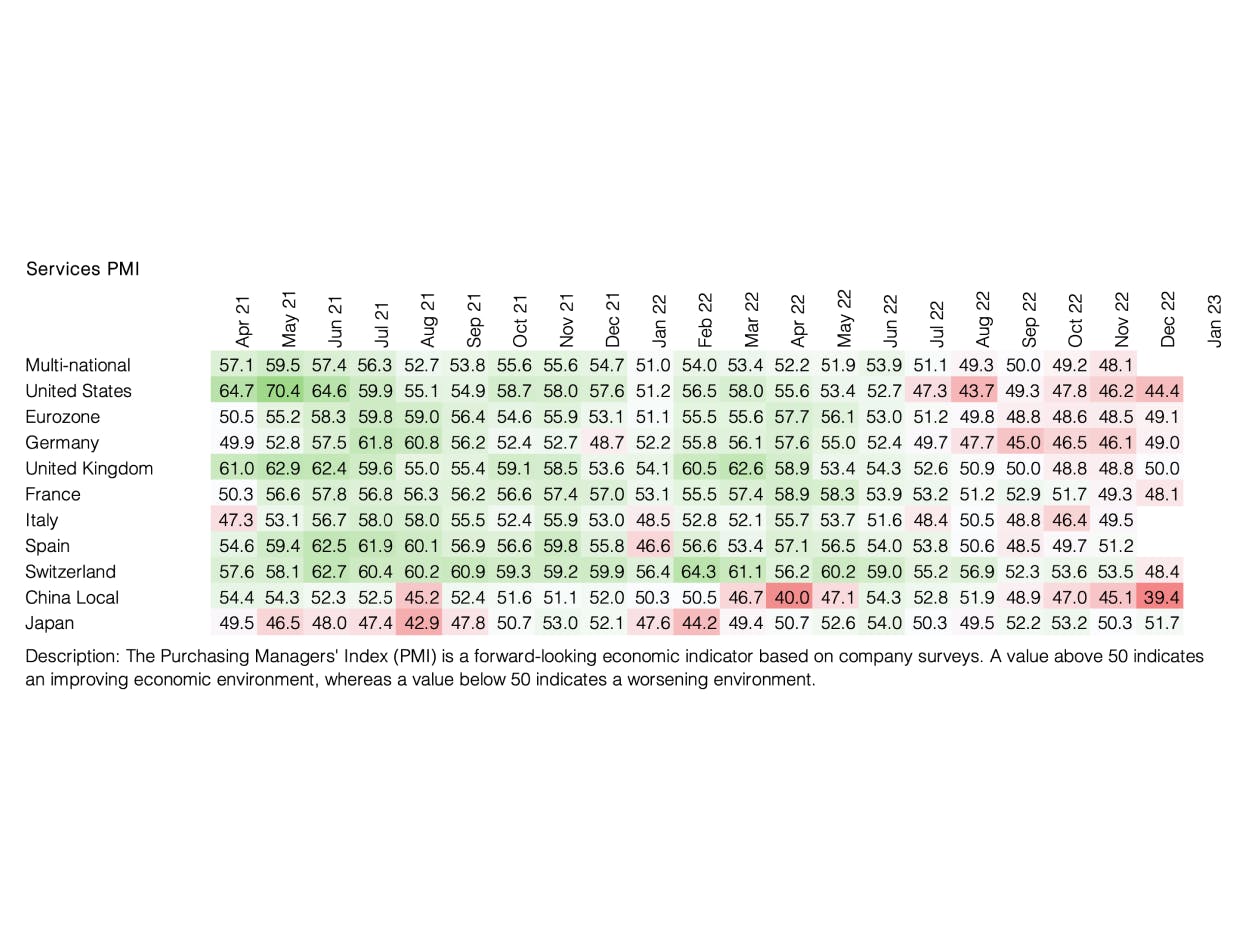

While central banks haven't fully completed their tightening of monetary policy, the size and frequency of interest rate hikes in the next 12 months are likely to be much lower than last year. The ECB may need to catch up with the Fed in this regard. It's reasonable to expect the macroeconomic effects of higher interest rates will only start to be felt in 2023. Central banks are still compelled to tighten monetary policy due to inflation, and an end or even a reversal of rate hikes is unlikely until inflation normalizes. This may only happen with a sharp decline in economic output or a recession. Thus, it wouldn't be surprising if this tightening cycle lasts longer than necessary. "From inflation to recession" is a probable scenario for the coming year, which is already reflected by inverted yield curves that, in the past, have almost always been followed by positive returns for high-quality bonds.

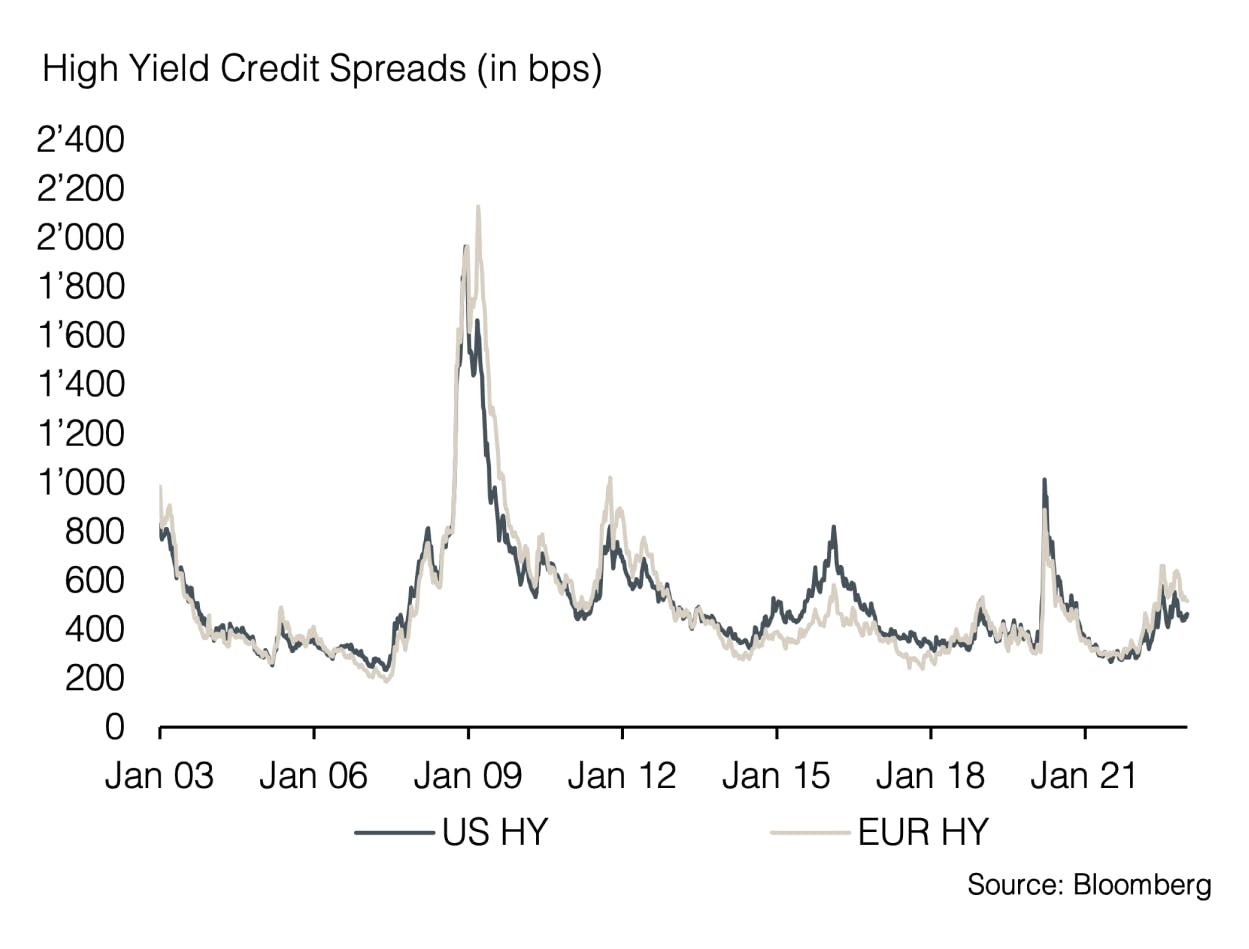

Another positive factor for the bond market is the relatively low refinancing needs globally. This means few companies will be forced to raise money at higher interest rates, particularly in the high-yield segment, which helps explain why high-yield credit spreads remain low despite a gloomy outlook. We maintain an overweight in USD and GBP bonds and a neutral weighting in CHF and EUR bonds for the current year. We will use new highs in European interest rates to gradually extend maturities of high-quality borrowers.

Aktien

- Unattractive equity risk premium

- Normalized valuations

- Overweight defensive inflation beneficiaries

- Active management is key

With the increasing probability of a US recession combined with unattractive equity risk premiums, caution and careful selection in the equity space are warranted. The normalization of high valuations in the growth sector, which has been fueled by years of extremely loose monetary policy, is likely to continue given the ongoing tightening of monetary policy. However, in our view, it is not sufficient to simply divide the equity universe into "value" and "growth" categories. What is much more important is a clear focus on quality, intrinsic value, and sustainable growth. Even in times of high inflation, there are companies that can emerge as winners due to their solid market position. Investors should remember that equities are real assets, offering good inflation protection over the long term.

We started the year with an underweight in equities and have maintained a defensive bias. Regionally, we have favored the Swiss equity market, which offers lower volatility and the advantage of a safe currency in times of market stress. From a sector perspective, we have preferred healthcare, which provides decent protection against inflation along with solid returns that are less dependent on the economic cycle. Additionally, we have focused on high-quality stocks with attractive dividend yields. These stocks typically generate steady cash flows throughout the economic cycle and are less vulnerable to an economic downturn.

In our view, the average expected price target for the global market, where analysts see 20% upside potential for the next 12 months, is overly optimistic. Several backtests confirm that these estimates tend to lag in a procyclical manner. However, it should be noted that positive surprises are possible in the current environment. For example, a resolution to the war in Eastern Europe or a full, sustained reopening of China could boost risk assets. A faster decline in inflation and a quicker end to monetary tightening could also trigger a jump in share prices. In equities, as in fixed income, statistics point to a positive return in 2023. Historically, with few exceptions, double-digit negative returns were often followed by positive years. The coming year will reveal how effective the implementation of monetary policy has been in combating inflation. We foresee a challenging first half of the year, during which visibility on inflation and economic developments should improve. This phase of high uncertainty is likely to present the greatest opportunities in the coming months.

Appendix

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research