SoundInsightN°10

Bonds

Equities

Higher for longer – interest rate pivot postponed

In the Federal Reserve's outlook, the prediction of a "soft landing" for the economy is gaining traction. However, Chair Jerome Powell is in denial about the Fed’s soft-landing forecast.

Despite a wide range of challenges, the US economy remains resilient. Thus far, significant interest rate hikes, the collapse of the Silicon Valley Bank, as well as the deadlock over the US government's debt ceiling have left minimal marks on economic growth.

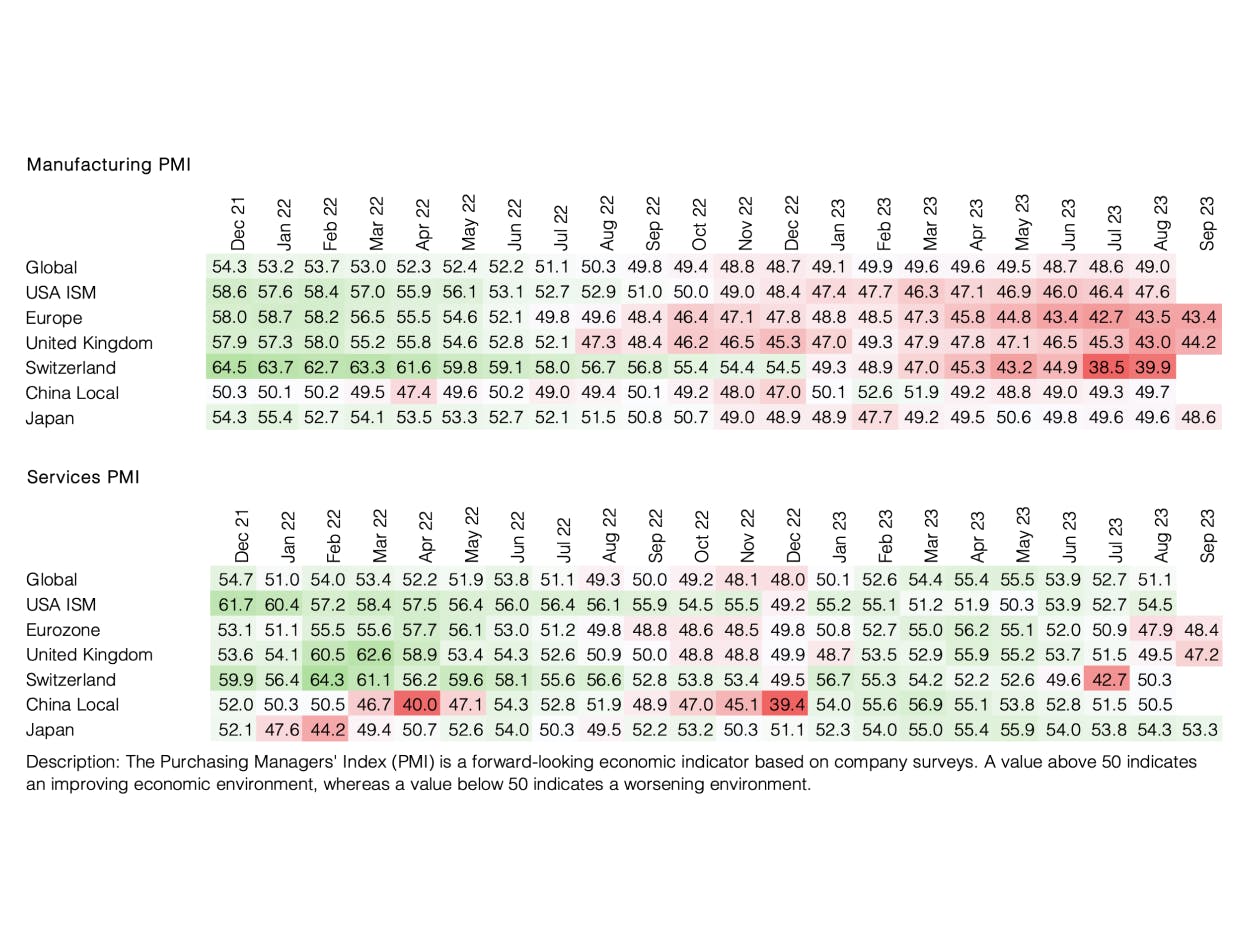

Indeed, Federal Reserve officials are increasingly confident in their ability to curb inflation without provoking a recession or a rise in unemployment. We view this as a trend-following assessment, as the Fed's own forecast was notably more cautious just three months ago. In their recently released quarterly outlook, the Federal Reserve raised its growth projections for 2024 from 1.1% to 1.5%, lowered the expected unemployment rate for 2024 from 4.5% to 4.1%, while sticking to an unchanged inflation expectation of 2.5%. In other words, despite raising interest rates even higher, policymakers now anticipate better economic growth and almost unchanged employment levels. To us, this is a contradictory scenario, especially considering historical patterns and significantly higher levels of debt across the economy.

The improved forecasts are also reflected in the dataset that was highlighted during the press conference. In a nutshell, data is signaling "higher interest rates for an extended period." The "Dot-Plot," which reflects the interest rate expectations of committee members, indicates a 2024 interest rate level of 5.1%, representing a 0.5% increase compared to the last predictions made in June. Contrary to the current market expectations, policymakers anticipate another interest rate hike this year, which would raise the benchmark rate to 5.75%. Despite this very optimistic scenario being outlined in the latest economic forecasts by policymakers, Jerome Powell clearly expressed his reservations when asked by a journalist. He refrained from committing to the statement that he expects a "soft landing" for the US economy.

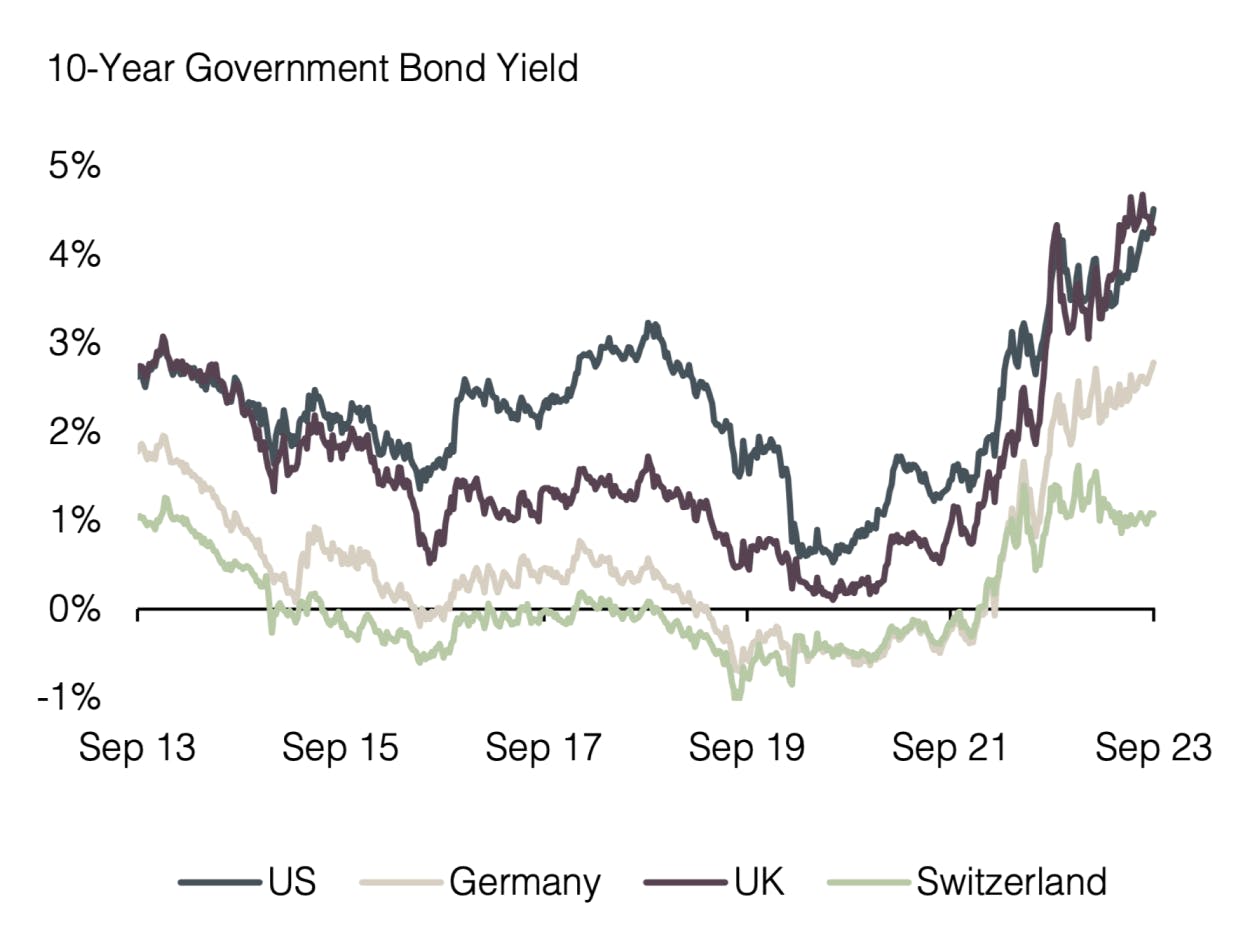

It appears that central bankers have few alternatives but to consistently maintain high interest rates to avoid triggering another wave of inflation through premature easing. Therefore, the adverse economic effects of higher interest rates are likely to have a more pronounced impact with a time lag. The latest adjustment to the Fed's forecasts has taken market participants by surprise, as the timing for the expected interest rate pivot has been pushed further into the future. Particularly noteworthy is the change in the expected interest rate level. Just six months ago, the market expected interest rates to drop to 3% by the end of 2024. Following the latest Fed meeting, it is now expected that interest rates start declining by mid-2024 but are unlikely to fall below 4%. Both bond and equity markets reacted negatively to the more restrictive monetary policy outlook.

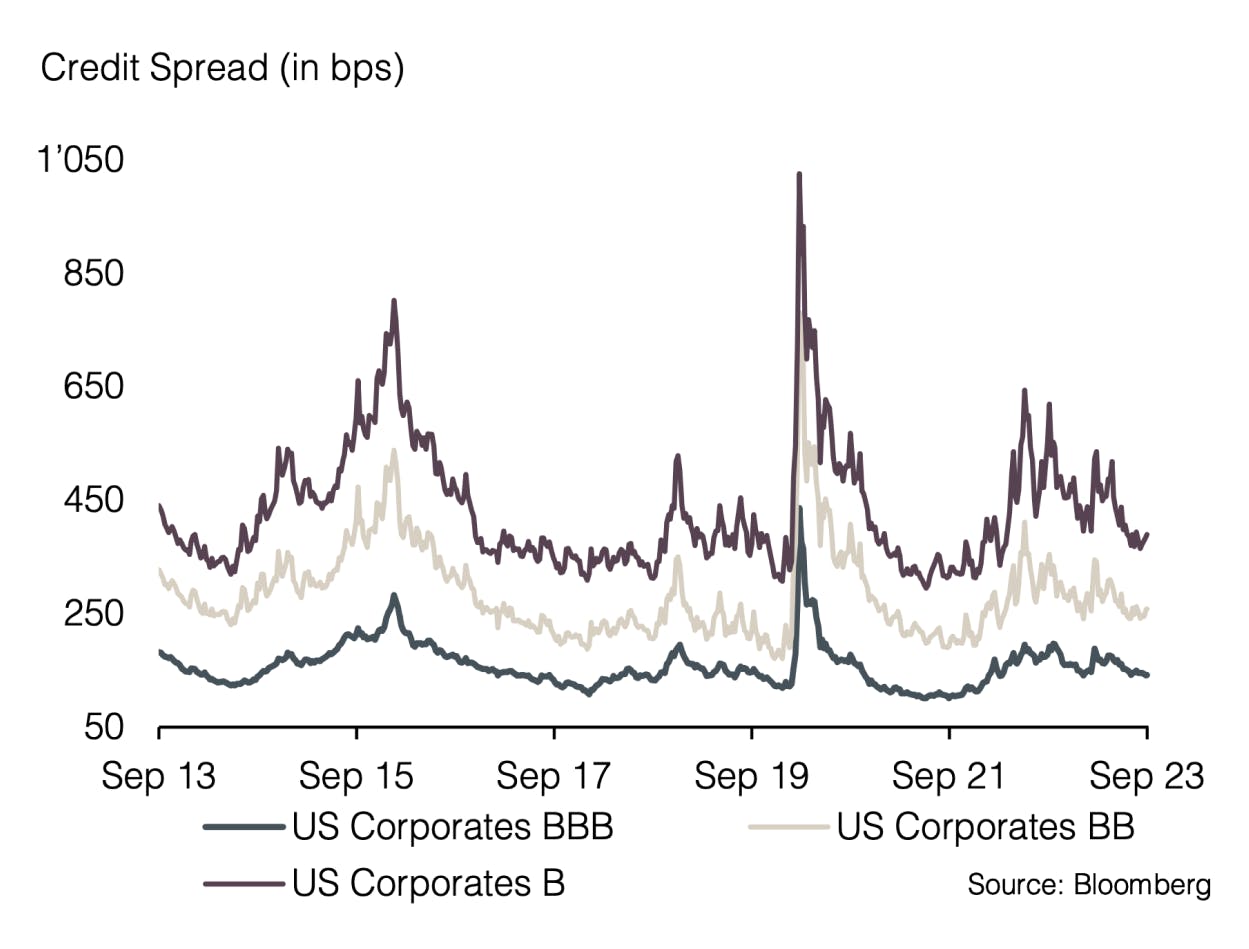

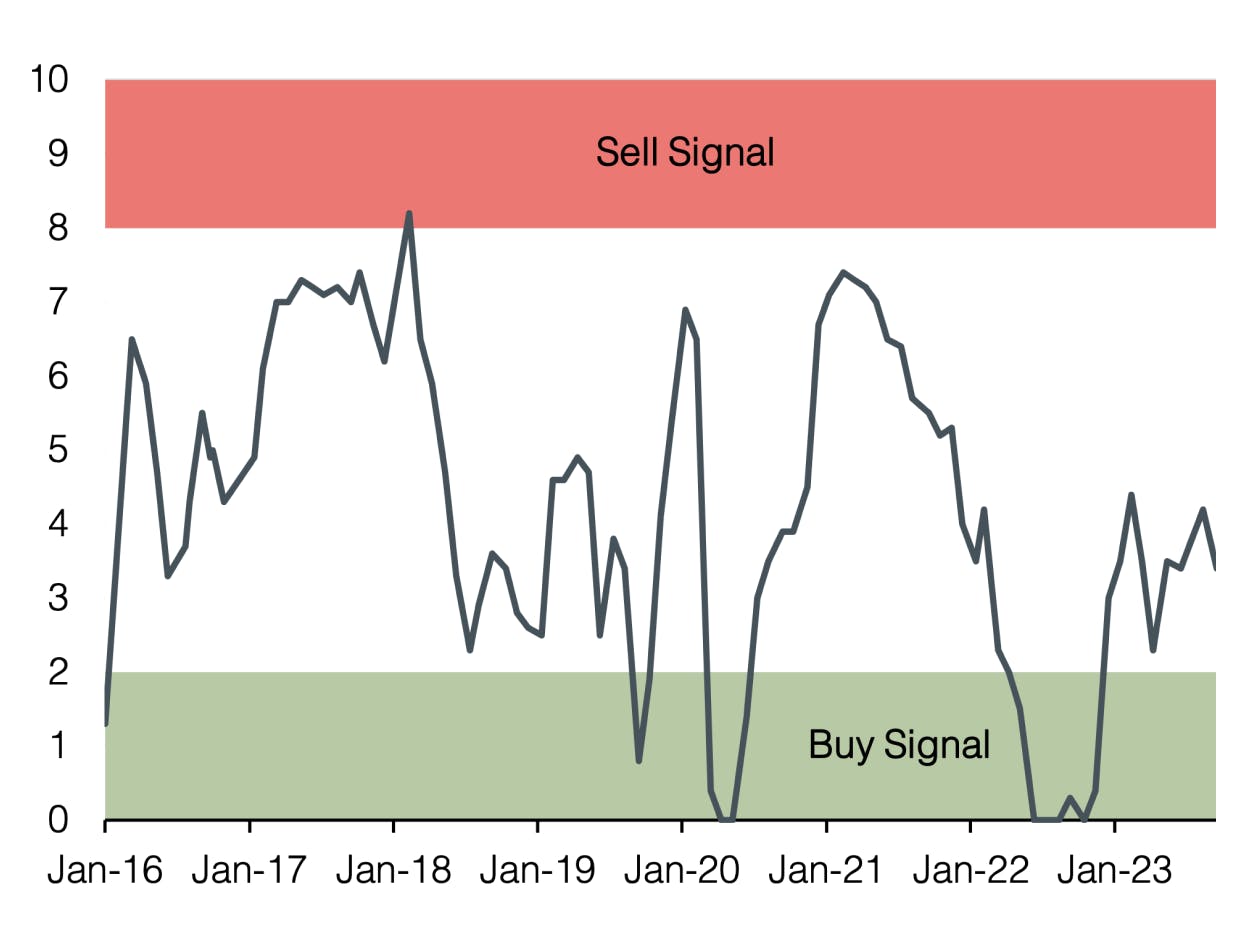

We continue to view the current interest rate levels as attractive, especially considering that some central banks, including the Swiss National Bank, consider the interest rate tightening cycle to be completed. Regarding credit spreads, we remain cautious. In the equity space, decreasing leading indicators and a low-risk premium continue to suggest an underweighting. Due to significant relative valuation disparities, we find the energy sector attractive, driven by both fundamentals and structural factors. In the realm of alternative investments, gold remains remarkably stable despite higher interest rates and a stronger US dollar. An allocation to gold provides a good diversification opportunity in the current market environment.

Appendix

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research