SoundInsightN°12

Bonds

Equities

Central Banks entering Home Stretch?

Financial markets responded with euphoria to declining inflation rates. So far, a simultaneous slowdown in the global economy keeps investors unbothered. The disparity between market expectations and central bank guidance once again poses potential tension.

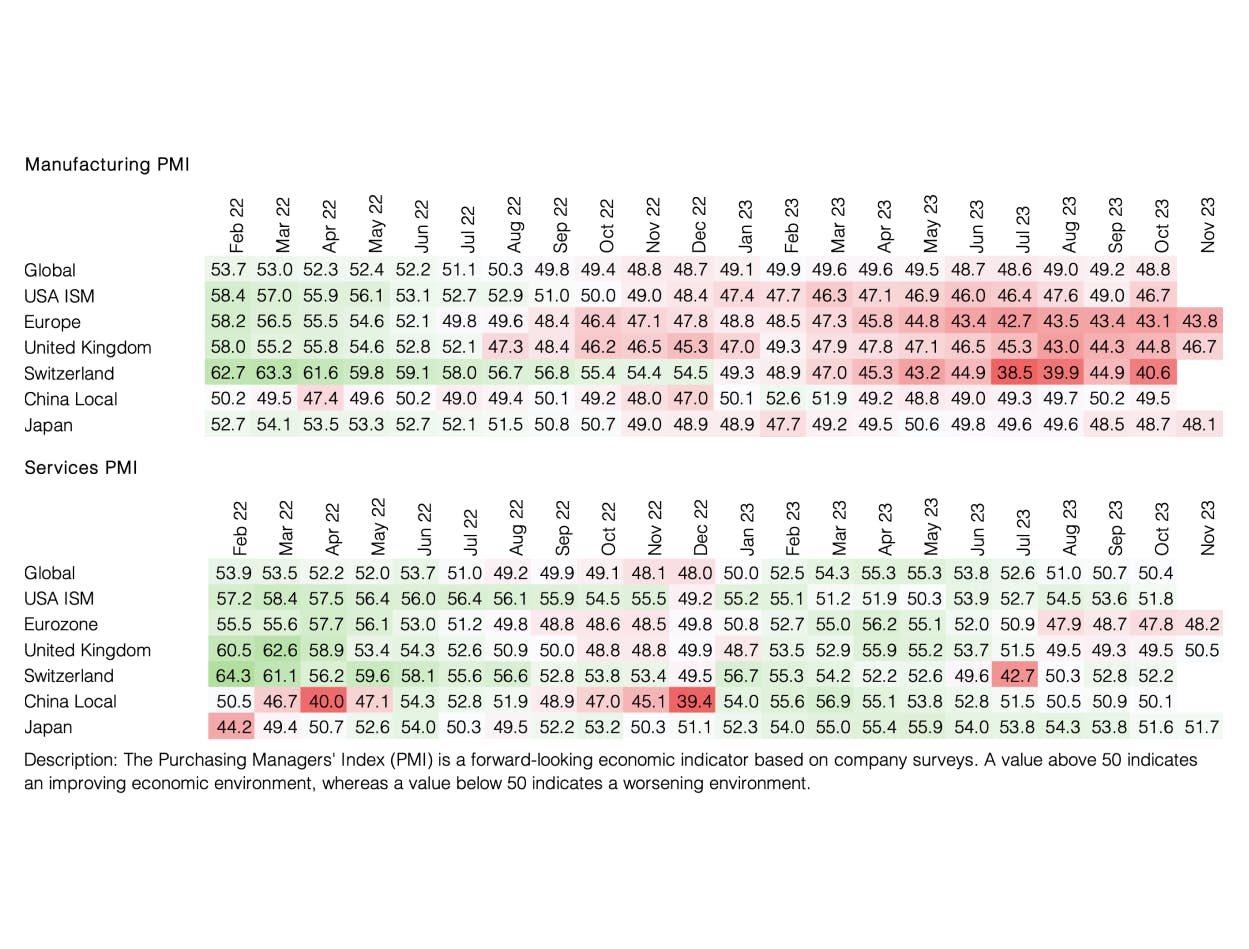

The majority of economic data releases in the past month have sent a clear signal: The global economy is cooling down, and the central banks' battle against stubbornly high inflation appears to be successful.

One of the most reliable economic leading indicators in the United States, the ISM Manufacturing Purchasing Managers' Index, fell to 46.7 points last month, significantly missing economists' expectations of 49 points. In addition to the purchasing manager report, the acceleration of unit labor costs, the creation of new jobs, as well as the change in durable goods orders, also missed the expectation of economists. As a result, the overall number of positive economic surprises in the U.S., one of the main reasons for continuously high interest rates, has been consistently declining since peaking back in July. The overall softening trend in the economy was confirmed by the latest release of inflation data, which continues to trend lower faster than expected.

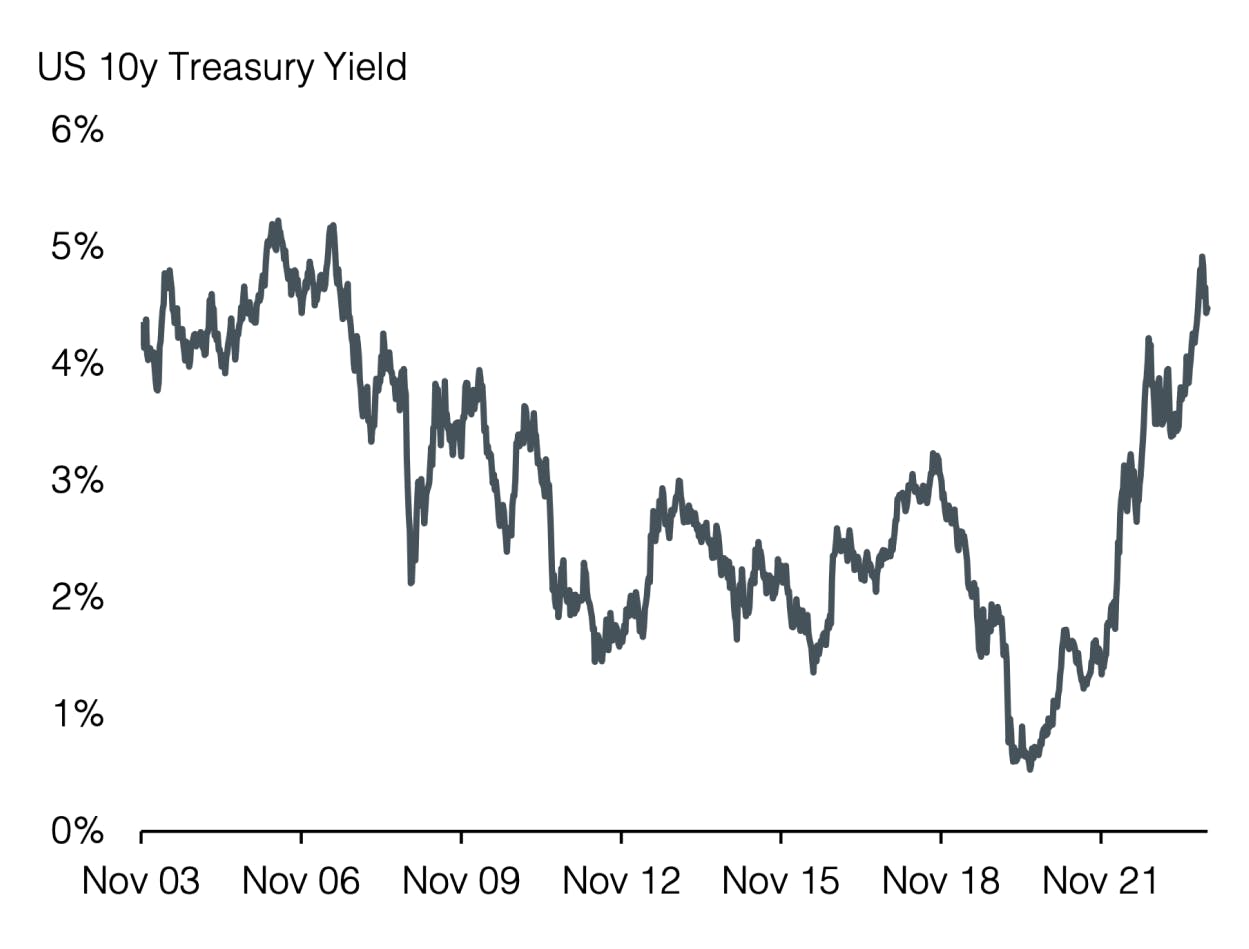

Consequently, investors now see central banks approaching the home stretch, with no further interest rate hikes expected in the current cycle. The focus is now shifting towards the first interest rate cuts, expected as early as May 2024. However, a sudden change in direction with regards to monetary policy is not on the menu for central bank officials. "My colleagues and I are pleased with the progress, but we expect that the process of sustainably lowering inflation to 2 percent is far from complete," said Jerome Powell at the beginning of the month. The positive development regarding inflation led to strong gains in both bond and equity markets. Due to significantly lower interest rates and a drop in inflation expectations, global bond markets experienced their strongest monthly increase in over 25 years. Equities, meanwhile, recorded the biggest monthly gain in three years. Unlike the earlier part of the year, gains in the equity space were broadly supported across sectors and styles and not solely carried by a few large companies.

While we see the decline in inflation as a positive development, the reason for it needs a closer analysis. Partially negative leading indicators and a declining U.S. consumption are currently accompanied by a slightly rising unemployment rate. Hence, there are reasons for doubt if the often-mentioned "soft landing" of the economy will pan out or whether high interest rates will ultimately trigger a recession.

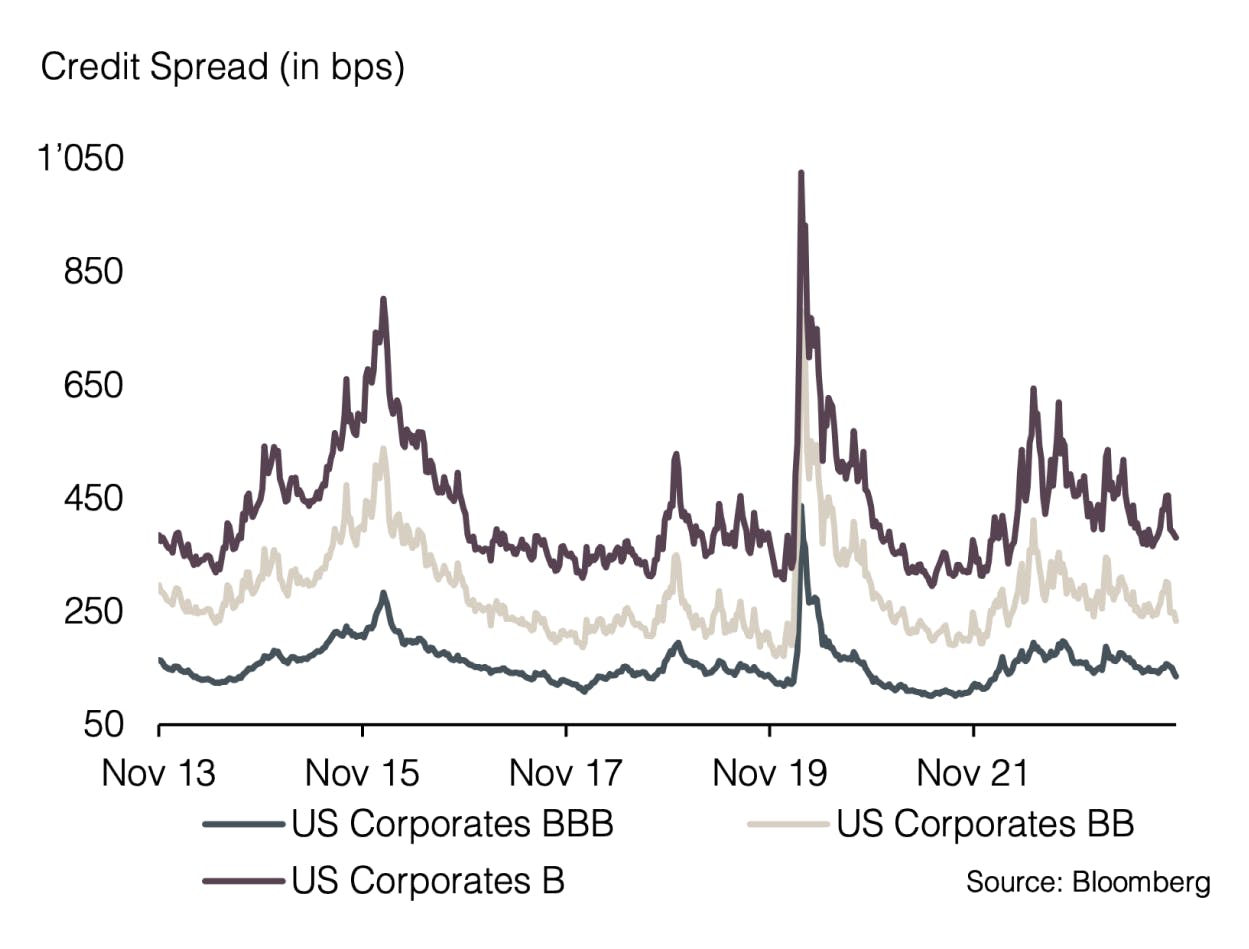

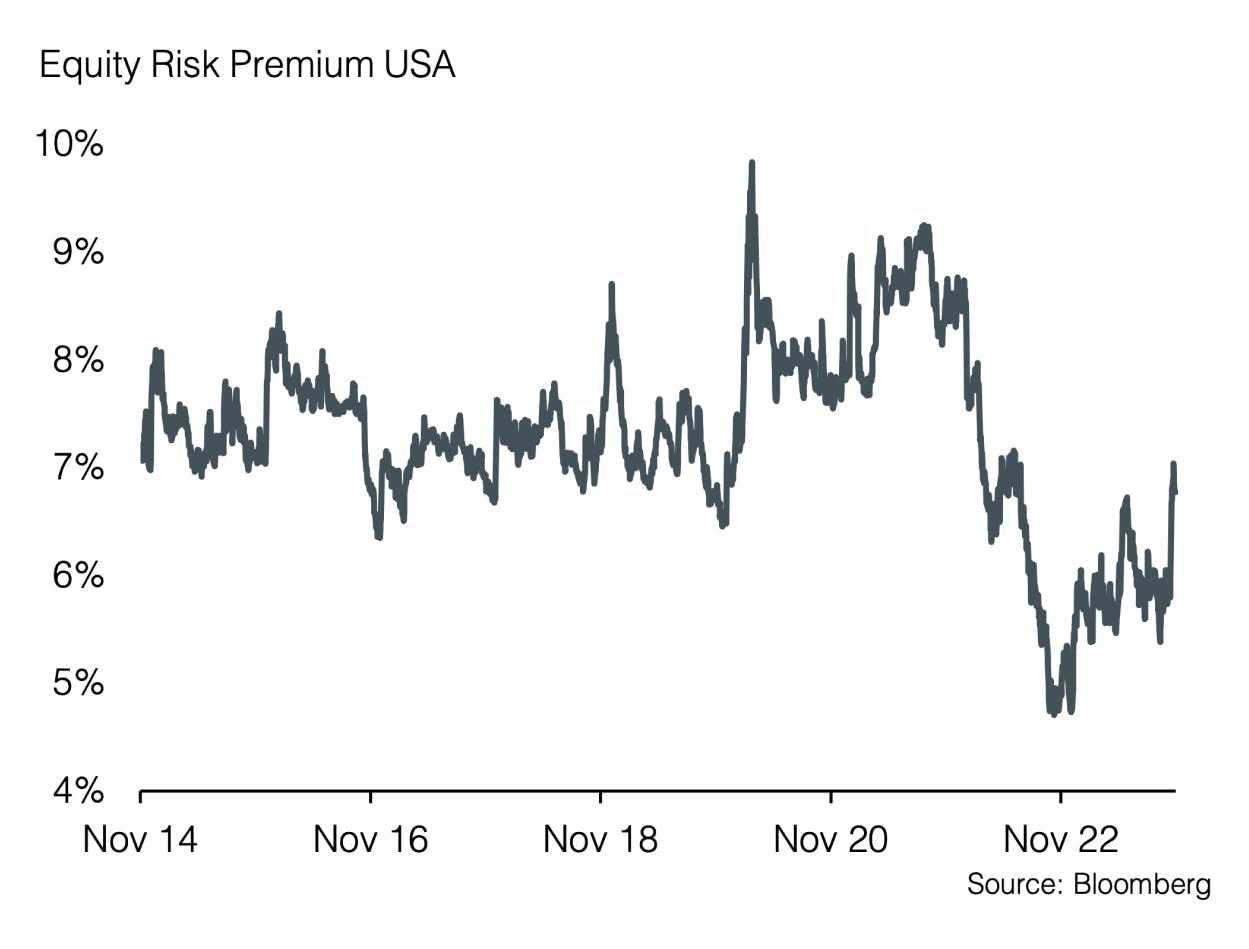

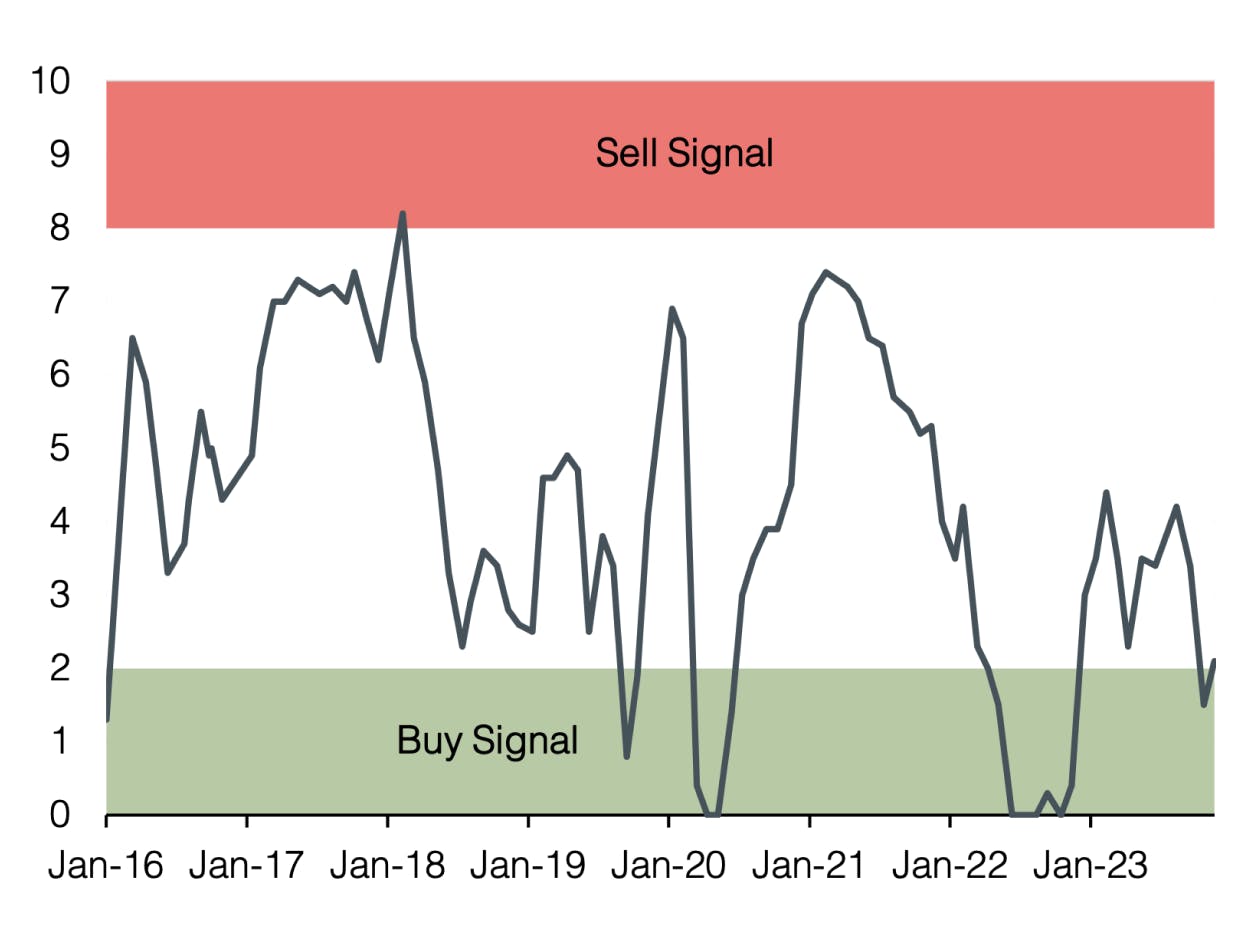

In the fixed income space, the current market development confirms our view, as we continue to recommend long-duration bonds from high-quality issuers. Due to unattractive credit spreads, we are avoiding the high-yield bond space for now. Emerging market bonds with investment grade credit ratings have lost attractiveness due to lower credit spreads and are now being reclassified to neutral. In the equity space, we were able to benefit from having increased the equity allocation last month. However, the risk index's buy signal has lately been neutralized by an improved sentiment. However, due to slight improvements in the equity risk premium as well as some leading indicators, the equity allocation remains at a neutral level. Within the neutral equity allocation, a cautious approach is warranted from our perspective. Therefore, we recommend focusing on companies with solid dividend growth, attractive valuation, and low leverage. We upgrade the consumer staples sector to overweight and downgrade the healthcare sector to neutral.

Appendix

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research