SoundInsightN°15

Bonds

Equities

Tidal changes

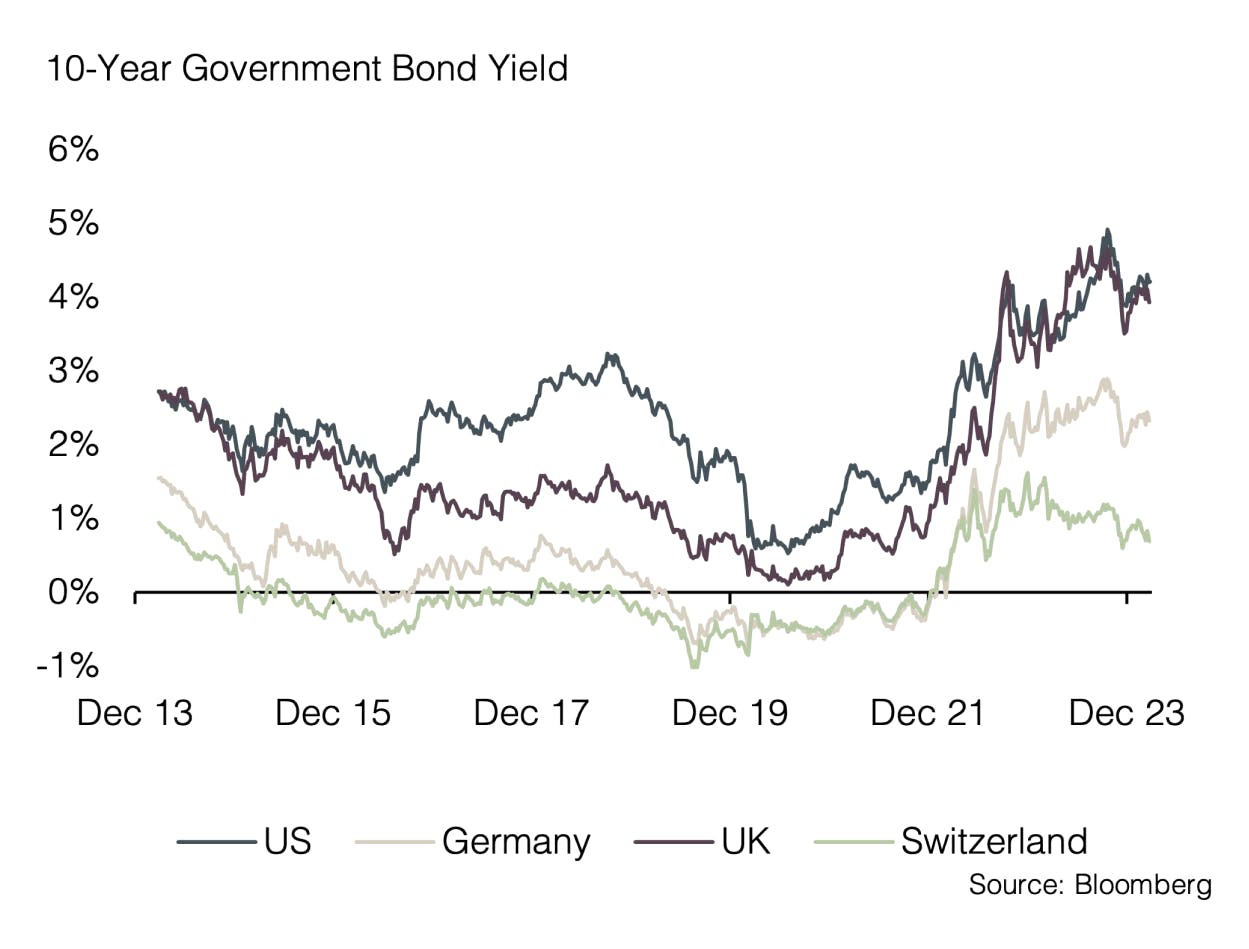

The Swiss National Bank unexpectedly lowered benchmark interest rates by 0.25% this month, marking Switzerland as the first G10 nation to initiate the long-awaited interest rate pivot, earlier than anticipated.

Last week proved pivotal regarding future monetary policy. Several central banks announced their interest rate decisions and published forecasts for the upcoming months.

For over a year, investors have been unsuccessfully positioning themselves for a shift in monetary policy. Mainly due to a robust US economy and persistent inflation, rate cuts have not materialized so far. However, with the Swiss National Bank's (SNB) unexpected interest rate cut this month, the long-awaited monetary policy pivot is finally here. The SNB cited reduced inflationary pressures and the appreciation of the Swiss franc as reasons for its decision. Switzerland's inflation has remained below 2% for several months, reaffirming the SNB's course of action.

In Japan, the Bank of Japan (BOJ) became the last nation to end its negative interest rate policy. Despite the first interest rate hike in 17 years, Japan's monetary policy remains very loose by international standards.

In the US, interest rates remained unchanged in March, but the Federal Reserve (Fed) released its highly anticipated "Dot Plot," reflecting the committee's interest rate expectations. During the press conference, Chair Jerome Powell reiterated expectations that US interest rates are likely to decline by mid-year. This marks a significant development for financial markets. Assuming inflation continues to normalize, interest rate cuts from the Fed and the European Central Bank (ECB) are thus highly likely by mid-year. Both central banks are currently anticipated to carry out three interest rate cuts by the end of the year. As expected, equity markets cheered to the looser monetary policy. Consequently, global stocks had their best week of the year, gaining almost 1.8% in USD terms.

In our view, the Swiss National Bank's interest rate cut, considering inflation and the strong Swiss franc, is justified and reasonable. However, when looking at the United States, doubts persist about whether interest rate cuts can be effectively realized soon.

In the US, inflation measured by personal consumption expenditures excluding energy and food remains well above the Fed's target of 2%. The notable increase in January was particularly striking. According to Bloomberg estimates, February numbers are likely to remain elevated.

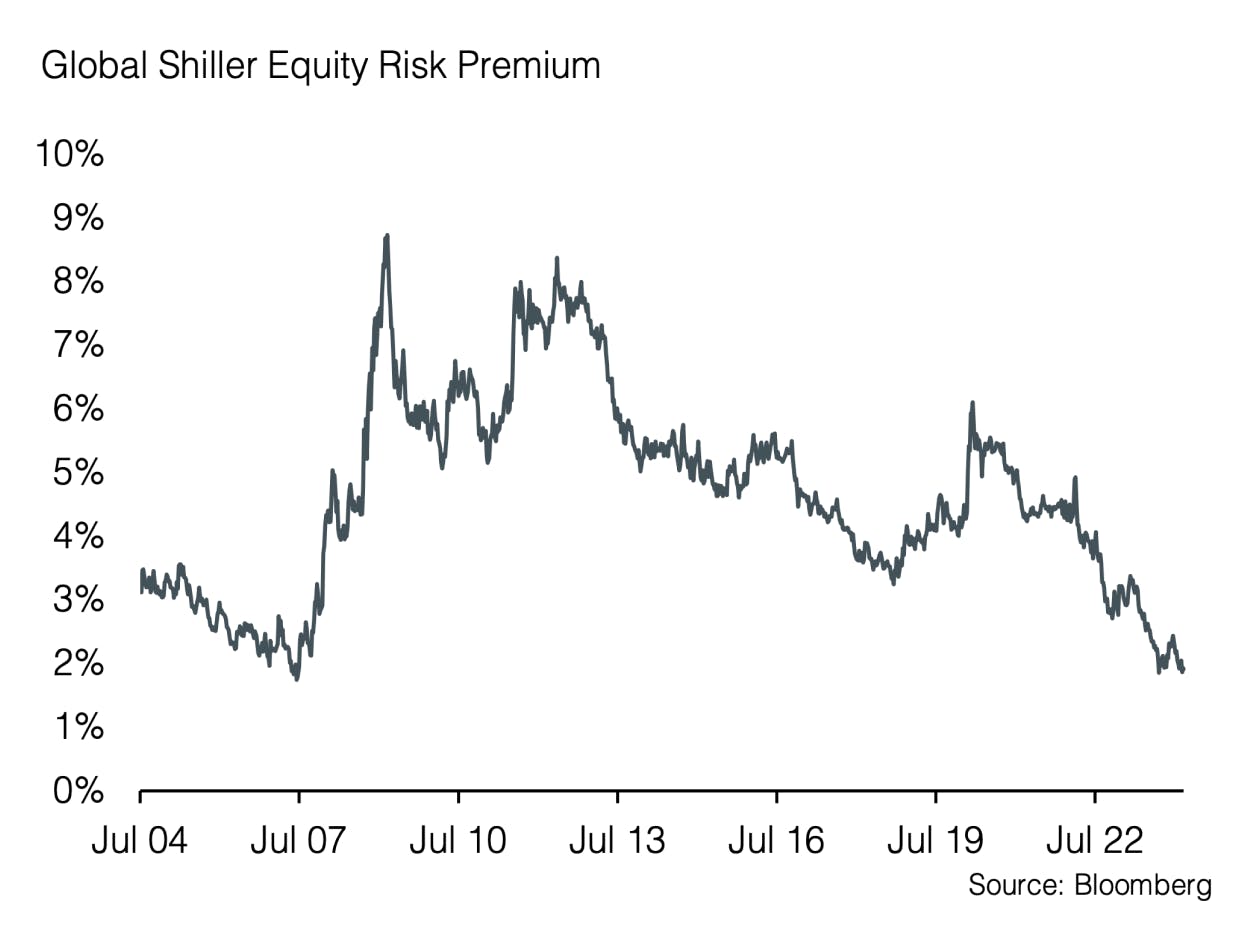

At the same time, earnings estimates for US companies still indicate extraordinarily strong economic growth. According to analysts, profits are expected to increase by over 10% this year. These expectations are also driven by a potential surge in productivity expected to be triggered by the use of artificial intelligence.

In our view, a continuously strong economic momentum, coupled with a slight increase in inflation, does not warrant a looser monetary policy by the FED. It remains to be seen whether earnings estimates prove to be too optimistic and if the US economy loses some momentum. Initial signs can be observed in the labor market, which showed rising unemployment alongside declining wage pressures.

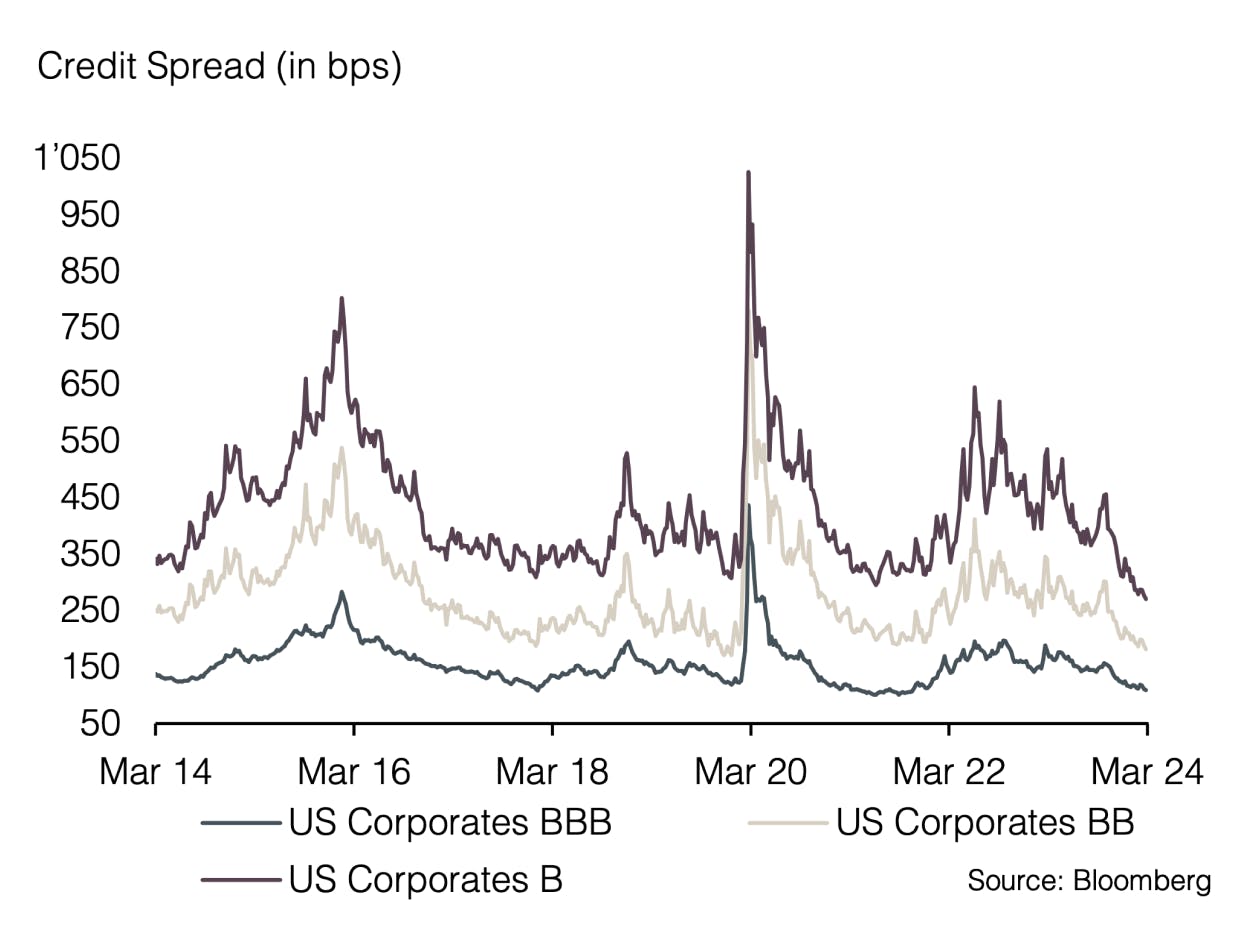

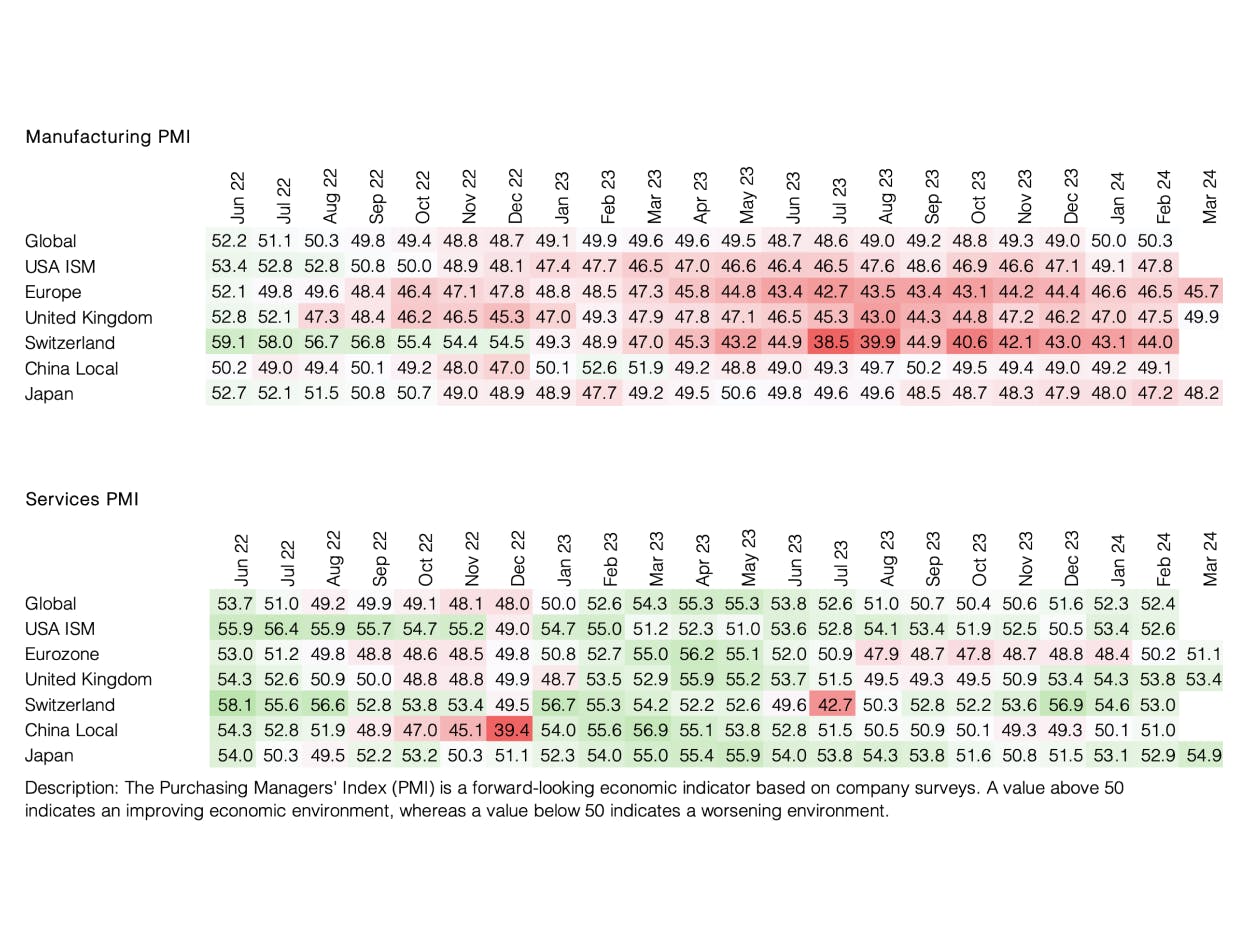

The coming months and the upcoming data releases will be crucial to get a better picture of the economic development. We maintain a neutral weighting of stocks and favor a defensive approach in terms of country and sector allocation.

Appendix

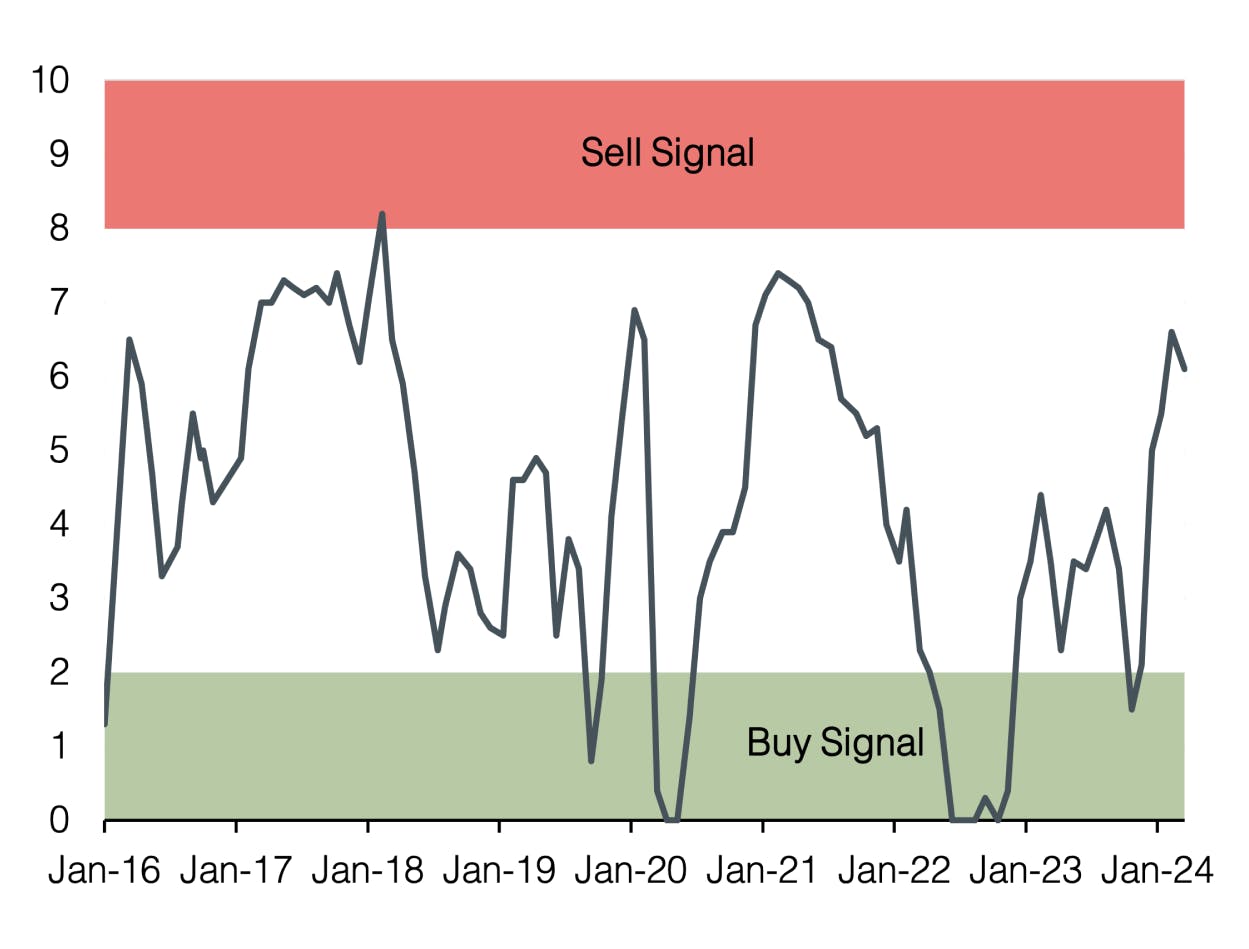

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research