SoundInsightN°7

Bonds

Equities

Focus on the labor market

Despite declining inflation, central banks persistently continue to raise interest rates. In doing so, they increasingly focus on the tight labor market.

Professional investors were unequivocal in their opinions at the end of last year: the significant increase in interest rates would gradually impact the economy and trigger a recession going forward. Consequently, investors adopted a defensive stance in their portfolios. However, at the beginning of this year, global stock markets exhibited a robust recovery. Even disruptions in a fragile financial system, such as the collapse of three US regional banks and the UBS takeover of Credit Suisse, resulted in temporary losses only. Particularly, major US technology companies thrived as the conviction grew that they would benefit the most from the expanding significance of artificial intelligence. This stock market resurgence presented a challenge for many defensively positioned investors, forcing them to change their allocations. The decrease in cash holdings since the start of the year indicates an improved risk sentiment among investors. Additionally, the decline in inflation likely contributed to this positive shift. In the US, the headline inflation rate has dropped from its peak of 9.1% in June 2022 to 4%.

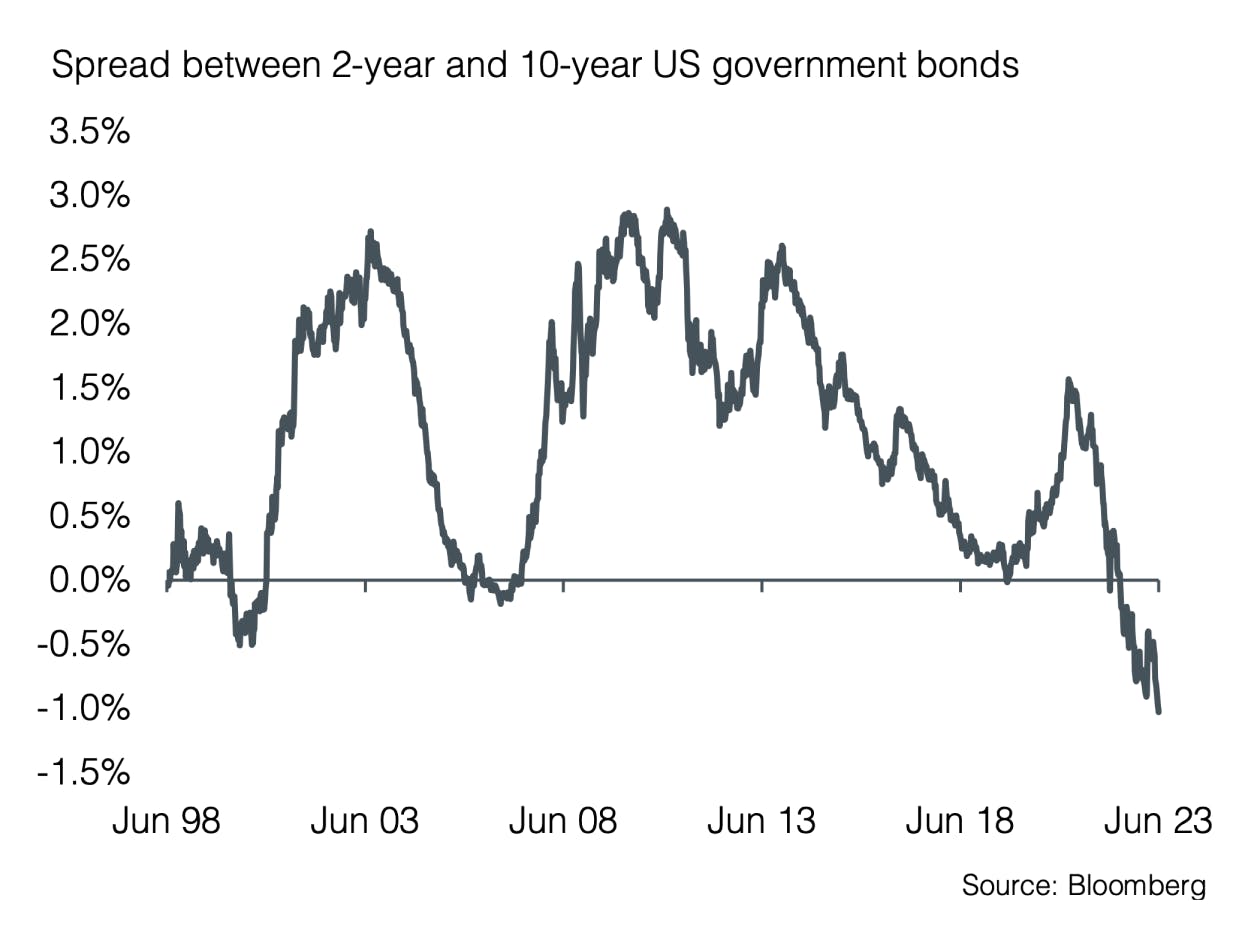

Central banks currently show limited optimism regarding the effectiveness of their efforts to combat inflation. While the Federal Reserve refrained from raising interest rates in June for the first time in over a year, it surprised the market by announcing two more rate hikes before the end of the year. Central banks are increasingly shifting their attention towards the labor market. Given historically low unemployment rates, the labor market continues to display resilience. Furthermore, the prevalence of numerous job openings signifies an ongoing shortage of workers, partly due to the lingering effects of the pandemic. This concern among central banks stems from the fear that wage growth will persist, thereby keeping the core inflation rate elevated. The core inflation rate in the US reached its peak of 6.6% last September but has only experienced a slight decline to 5.3% since then, persisting at a stubbornly high level.

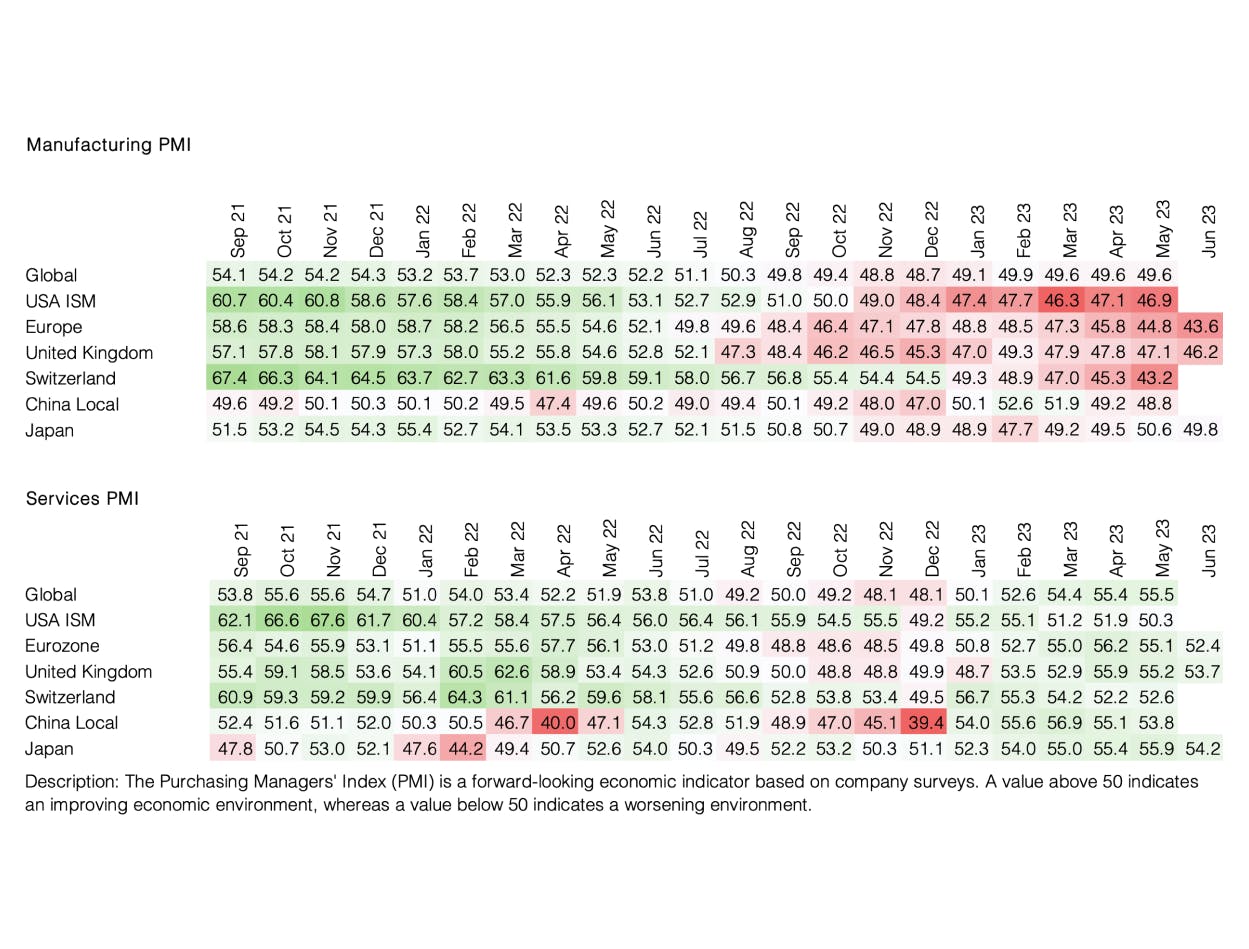

The labor market, however, acts as a lagging economic indicator due to the time it takes for hiring and layoffs. Given the current tight labor market, companies may hesitate to let go of employees. This situation poses the risk that central banks, impacted by the stable labor market, may feel compelled to raise and maintain interest rates at high levels to reach their 2% inflation target, despite weakening economic prospects. The economic slowdown is already evident when taking a closer look at the declining purchasing manager indexes of the manufacturing sector. As a significant portion of interest rate increases occurred in the second half of last year, there is a possibility that the full impact of these rate hikes will only be felt in the coming months. The UK serves as a cautionary example, with the Bank of England facing the need to significantly raise interest rates due to persistent core inflation, even as they anticipate a substantial economic downturn. On top, households are increasingly facing financial pressure from rising mortgage rates and higher cost of living.

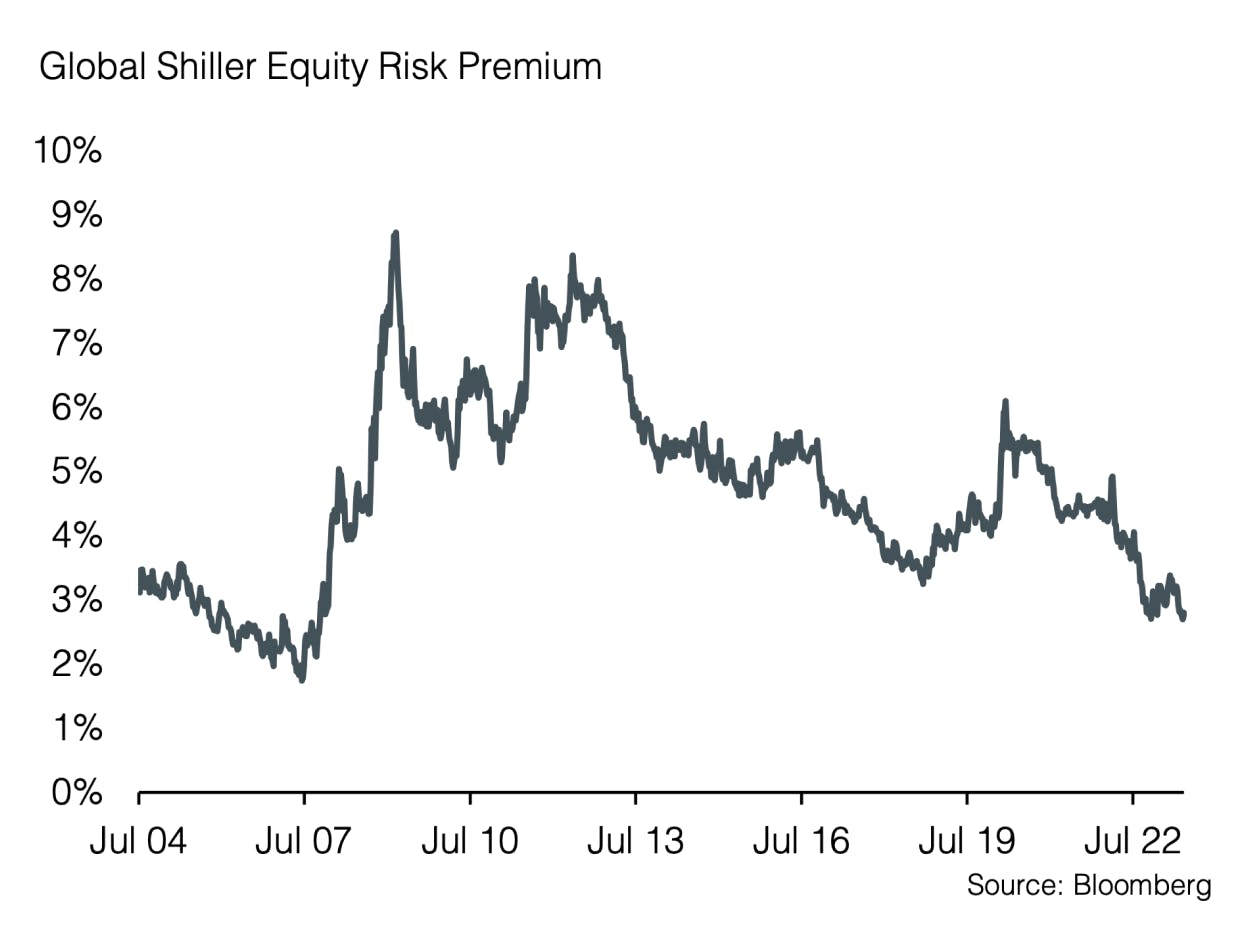

Global stock markets only partially reflect these risks. Despite this year's strong market performance of up to 13% for global equities, corporate earnings remain stagnant, leading to elevated valuations of the stock markets. Current valuations have surpassed the long-term average, which historically went hand in hand with periods of economic expansion and rising corporate profits. However, neither of these conditions is currently met. Additionally, return contributions for the current year are concentrated in a few technology sector stocks. At the same time, stock market volatility as measured by the VIX Volatility Index has reached the lowest level since the beginning of the pandemic. We see this as a sign that equity markets have only partially priced in the challenges mentioned.

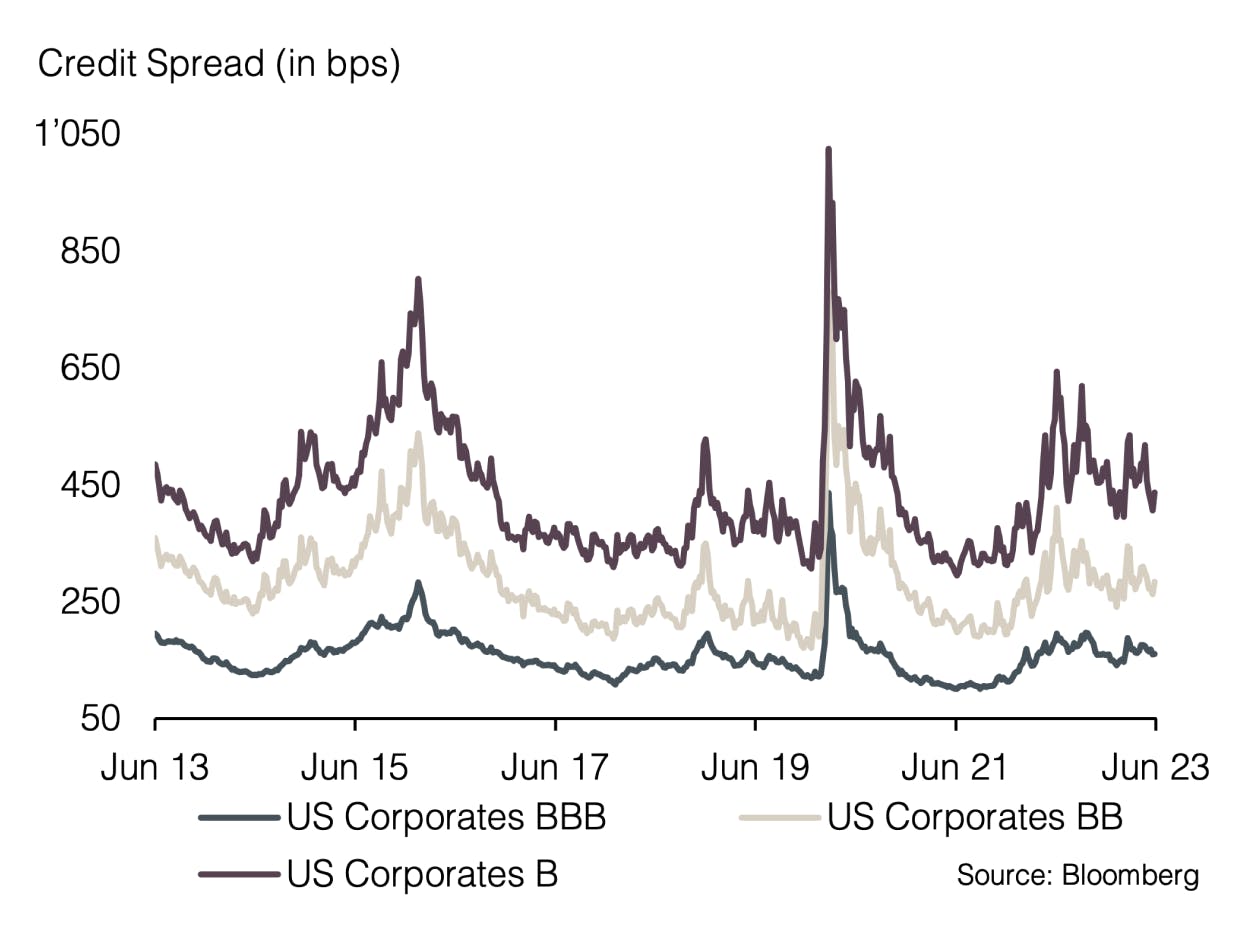

Therefore, we maintain a defensive positioning by slightly underweighting our equity allocation. We continue to implement this by underweighting US equities. As central bank-controlled interest rates approach their peak levels, our preference remains with long-term government bonds and high-quality corporate bonds. We continue to avoid high-yield bonds as price levels do not appear attractive after a significant spread tightening.

Appendix

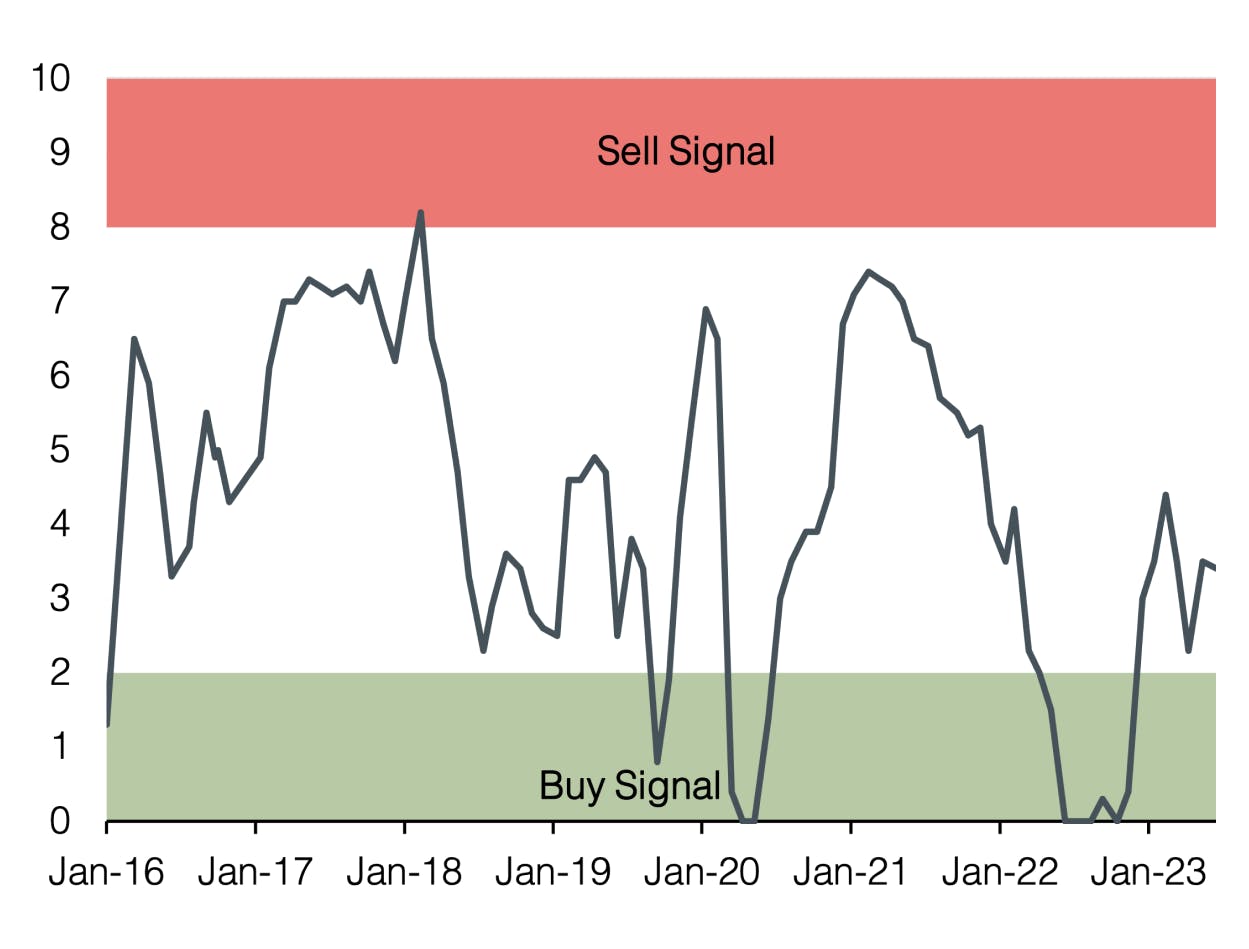

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research