SoundInsightN°3

Bonds

Equities

Back in the summer of 69

U.S. payrolls expose the central bank's dilemma: A strong labor market means strong consumers, which makes a monetary policy pivot unlikely.

Exciting news for the US labor market: last month saw the creation of a staggering 517,000 new jobs, surpassing economists' expectations by a large margin. Deviations from the consensus on such a scale were unheard of prior to the COVID pandemic. It is clear that the labor market is still struggling with the aftershocks of the lockdown, which makes forecasting a challenge.

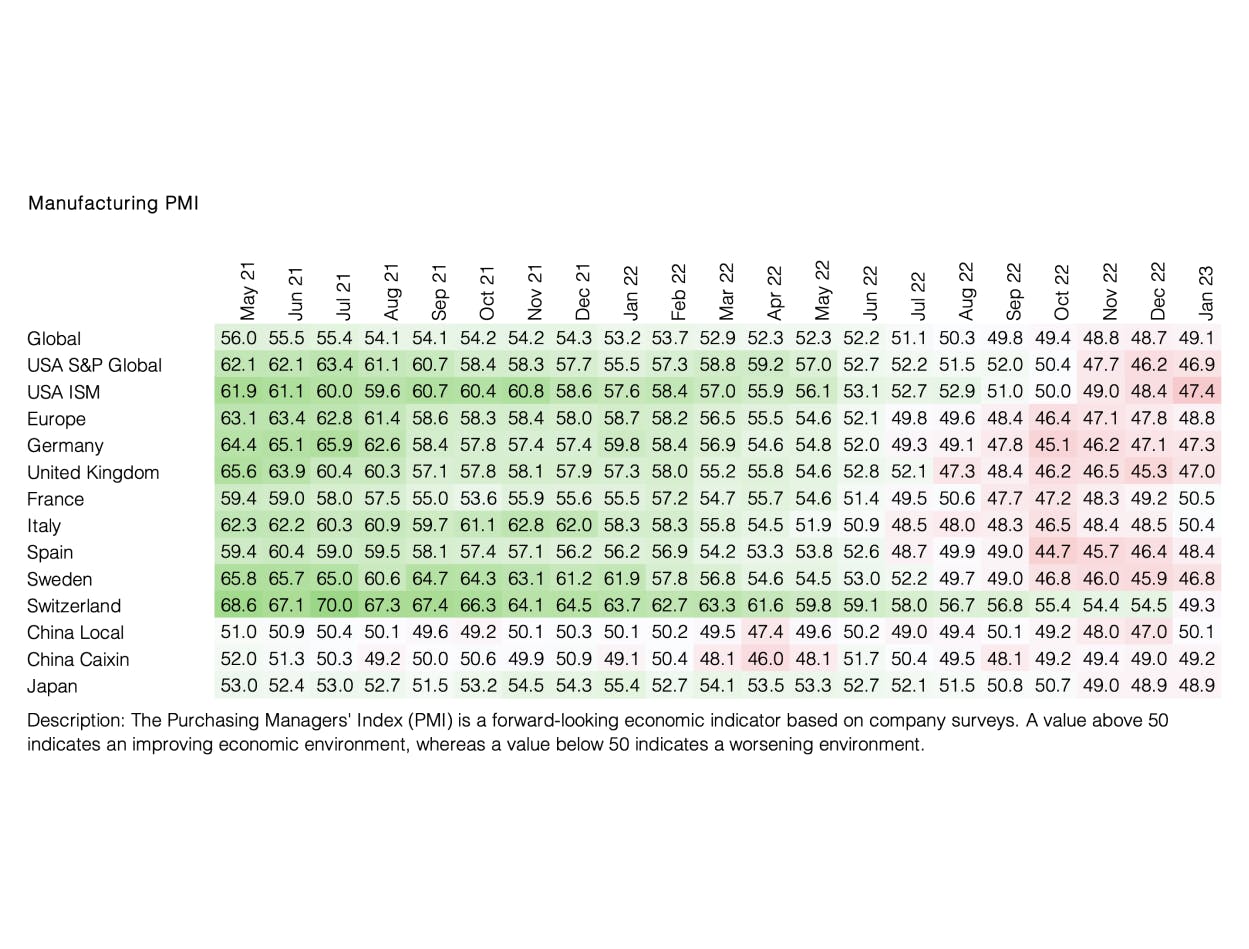

Nevertheless, the creation of new jobs has led to a reduction of the US unemployment rate to just 3.4%, which is the lowest level since the summer of 1969. A strong labor market is also translating into a boost for US consumers. The University of Michigan Consumer Sentiment Index, a leading indicator, has risen to its highest level in a year and is on an upward trajectory since mid-2022. In absolute terms, however, it is still at a low level. Moreover, just like the PMI leading indicators, the negative trend seems to have been reversed for the time being. Retail sales in the US confirm the healthier consumer sentiment. They are rising three times as fast as in the last two economic cycles, reflecting higher prices and growing demand. Except for the pandemic, a 3% increase, as in January, was only achieved once in 2001. Thus, retail sales have increased nearly 31% since the end of 2020, reaching a new high just three months after hitting a low.

The current situation presents a challenge for central banks attempting to bring down inflation. Market participants who had anticipated interest rate cuts in the second half of the year may have been overly optimistic. As a result, the expected Fed’s target rate at year-end has increased from 4.25% to over 5% since mid-January, suggesting a shift towards more restrictive monetary policy. In other words, the market is now giving a little more credence to the continuously restrictive monetary authorities.

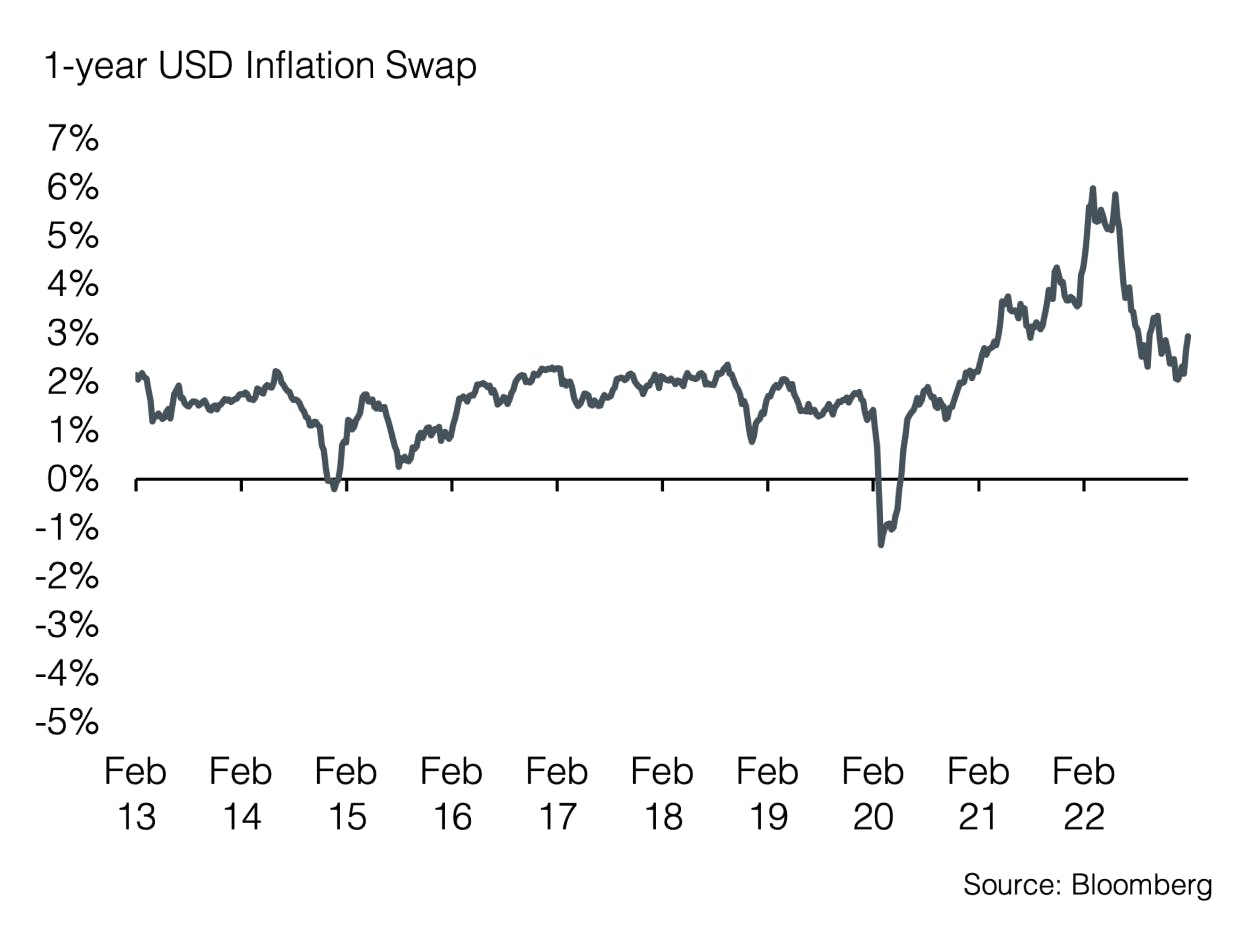

Inflation remains a pressing concern, as the increase in producer prices in January surpassed economists' expectations. On top of that, December's figures have been revised upward. A decline in inflation in the near future appears unrealistic, and in conjunction with strong retail sales, the probability increases that central banks will keep key interest rates higher for longer than the market anticipates.

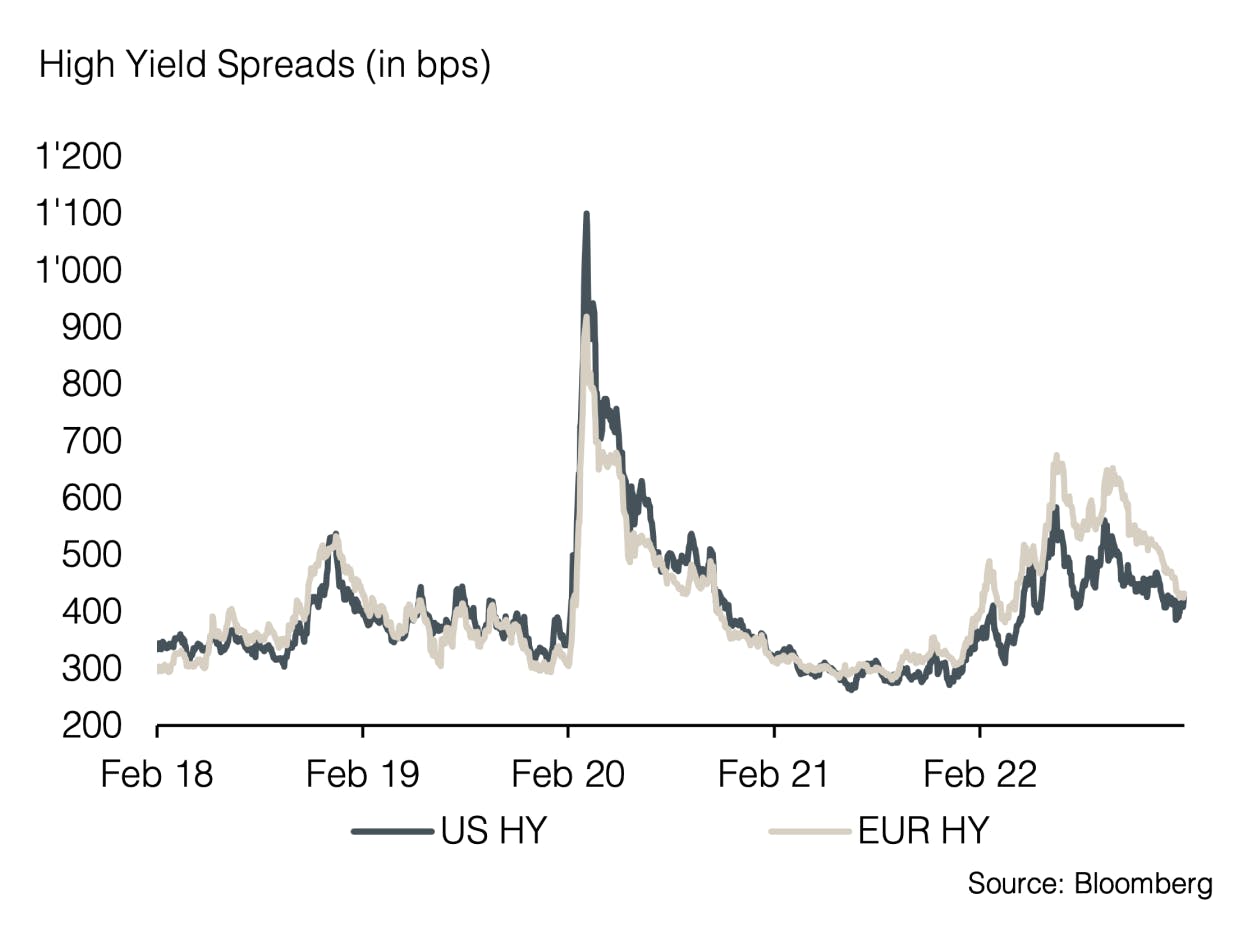

As a result, short-term interest rates have reached new highs in the current cycle. German government bonds maturing 12 months from today are yielding just under 3%, their highest level since 2008. The same tenor in the US is yielding just under 5%. The volatile market environment for bonds is likely to persist due to the ongoing uncertainty about inflation. Considering rising interest rates and lower credit spreads, we maintain a neutral assessment of bonds. We favor high-quality borrowers, while avoiding high credit risks. Opportunities to increase the exposure to government bonds with longer maturities are likely to emerge in the coming weeks.

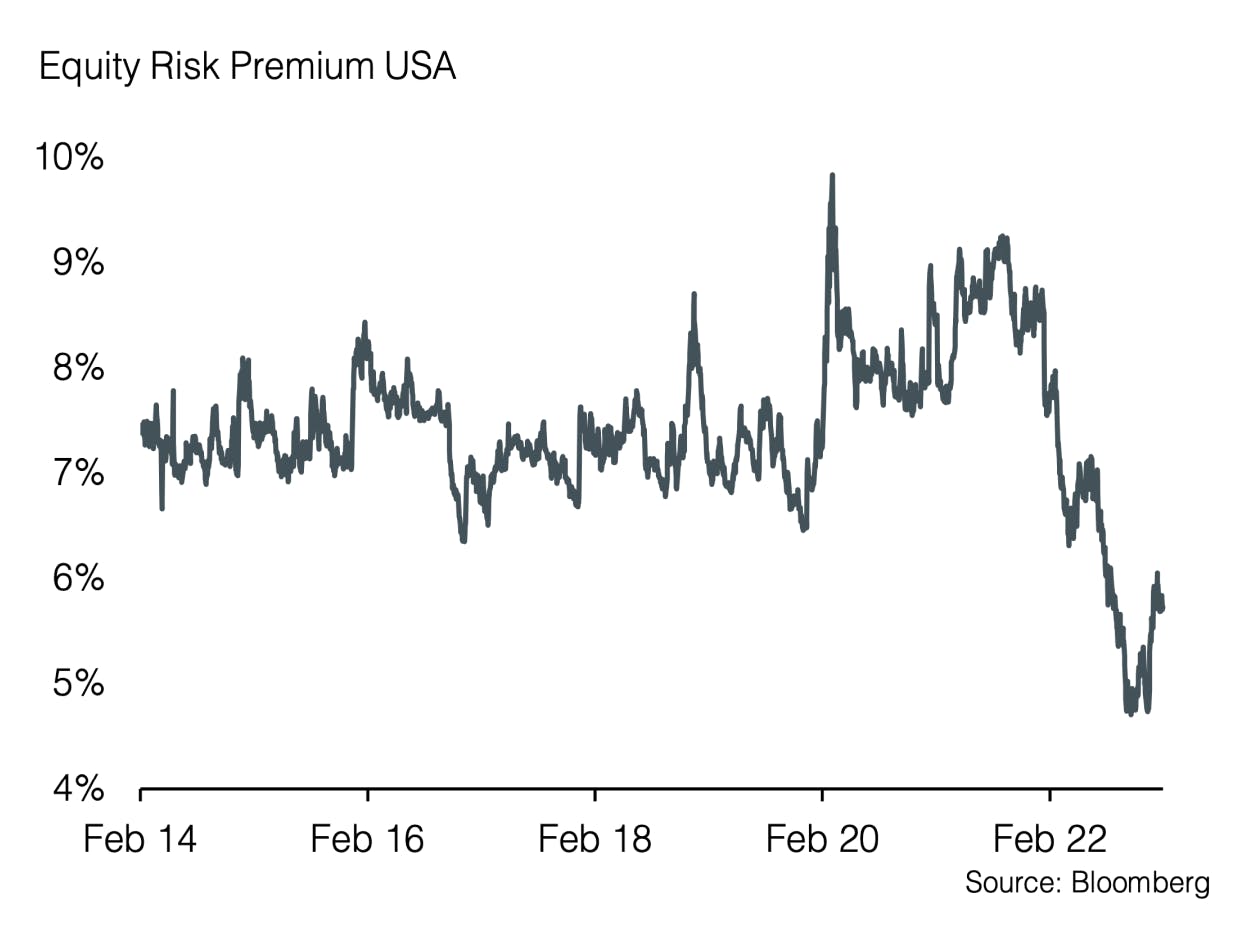

The predominantly positive start of stock markets since the beginning of the year is only partly justified in our view. Although equities have seen strong gains since early 2023, the monetary environment has deteriorated and tightened somewhat. On the company level, quarterly results for Q4 2022 indicate flattening momentum as the number of companies that exceeded analysts' expectations decreased and earnings growth declined. As a consequence of falling earnings expectations and rising share prices, the market is experiencing an increase in equity valuations. The unattractive equity risk premium also indicates that there is little fundamental justification for further upside potential. Therefore, we remain underweight equities. Furthermore, we have downgraded healthcare from overweight to neutral after a strong outperformance last year. On a regional level, we have reassessed Europe as neutral, mainly due to the valuation differential to the rest of the markets.

Appendix

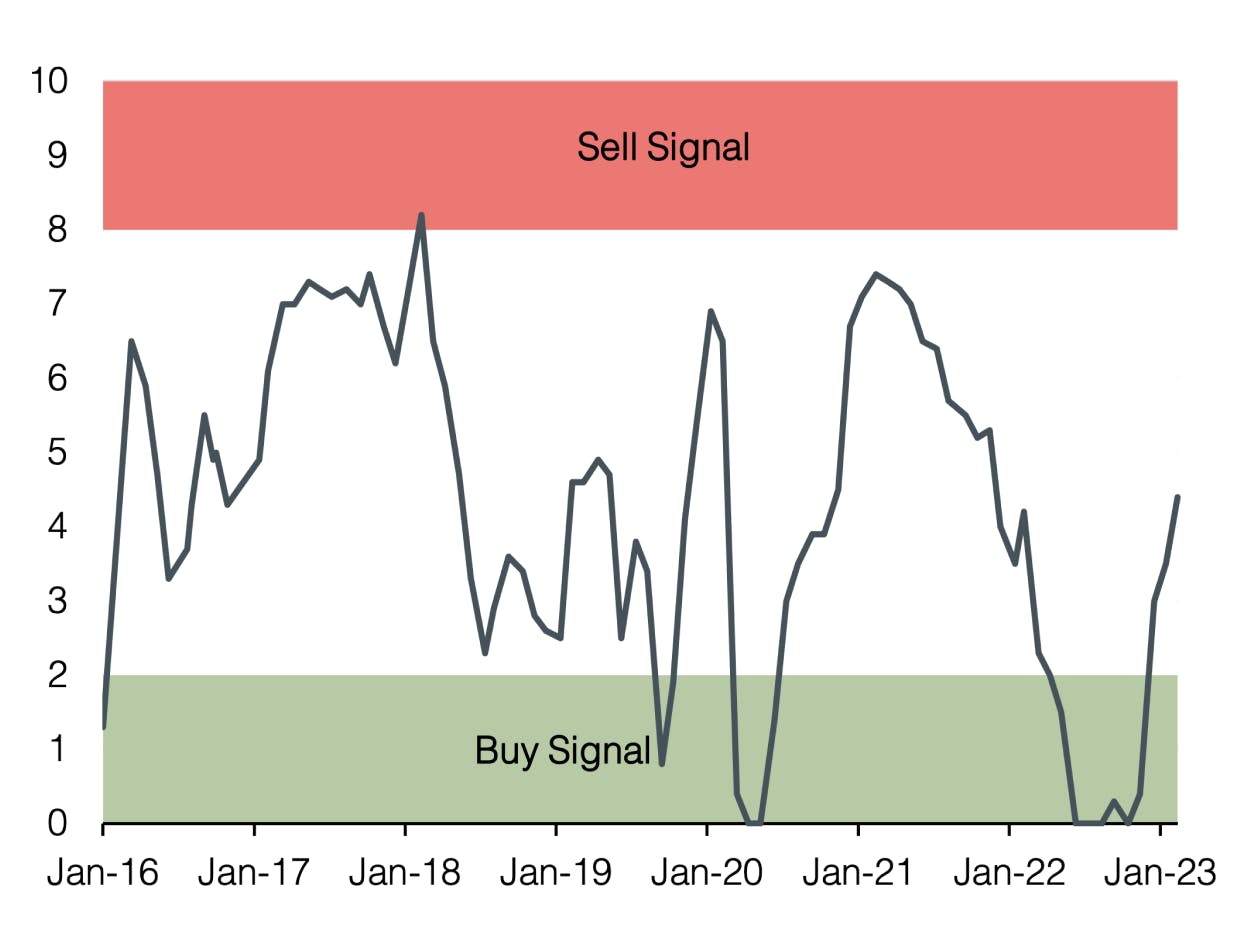

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research