SoundInsightN°14

Bonds

Equities

Interest rate cuts under review

In recent months, market participants have been gaining confidence in upcoming interest rate cuts. However, macroeconomic data forces central banks to maintain a continued stance of restrictive monetary policy.

It has been nearly two years since the Federal Reserve adopted a restrictive monetary policy course due to a significant rise in inflation. The era of zero interest rates ended. Over the past 24 months, interest rates have been increased at a historically unprecedented pace and lifted to a target range of 5.25% to 5.50%. While the battle against inflation has been a challenging one, it has been successful so far thanks to the drastic measures taken.

With growing confidence that inflation is receding, market participants have begun to anticipate the timing of a shift in monetary policy. Investors are confident that easing will start soon and are looking for lower interest rates going forward. In our outlook for 2024, we have already pointed out that the market expects significantly more interest rate cuts this year than central banks have been communicating. Accordingly, recently released positive economic data out of the US served as a reality check regarding the future course of monetary policy.

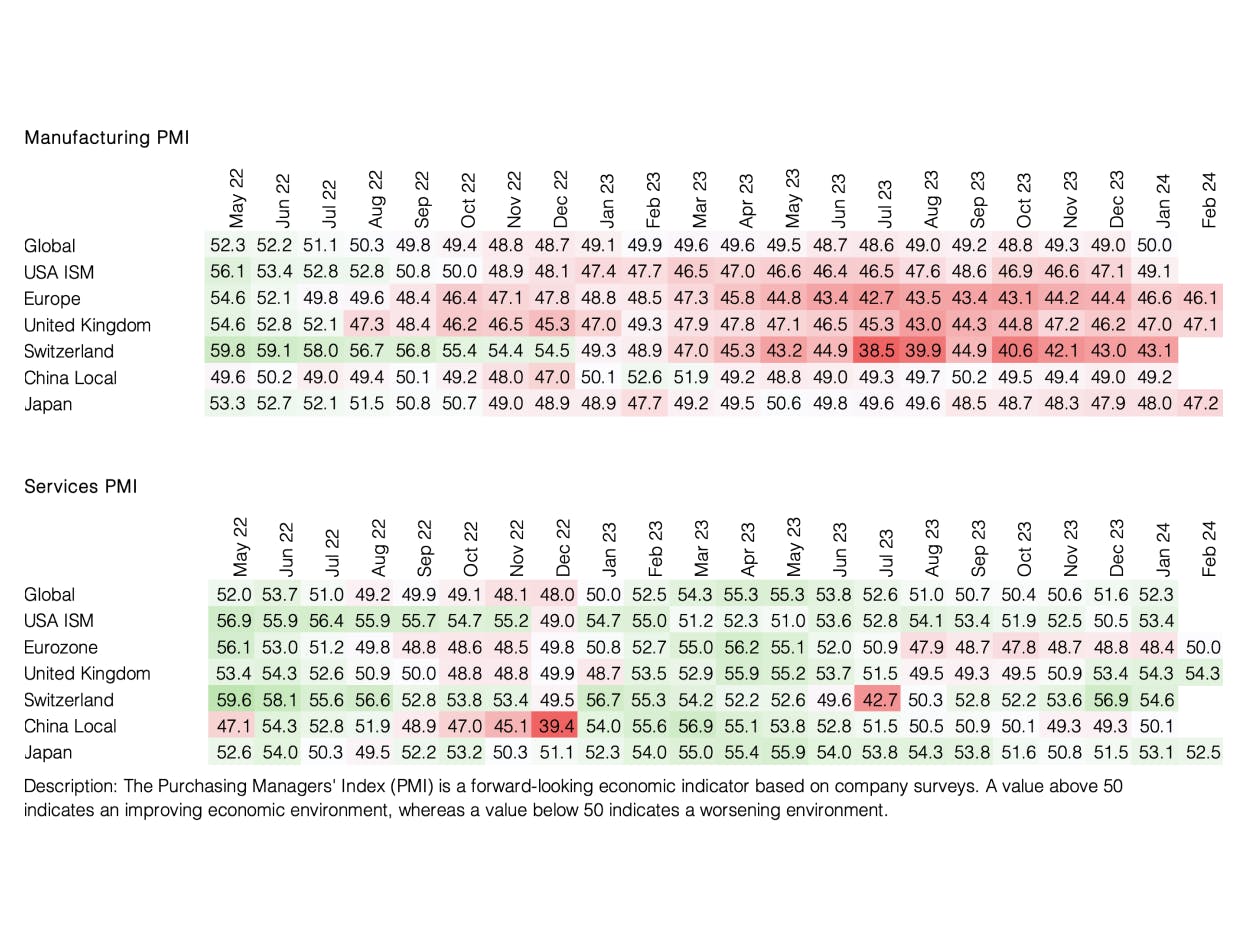

Despite carrying the burden of high interest rates for some time now, the US economy continues to show resilience. In addition to a robust labor market and a surprisingly stable residential property market, both the manufacturing and services sectors have seen positive developments in purchasing manager sentiment. In addition, consumer prices rose much more than expected in January, while core inflation also exceeded forecasts. Given this set of data, interest rate cuts by the central banks appear unlikely in the near future. As a result, significant shifts have occurred in the bond market since the beginning of the year. At the start of 2024, the market expected both the Fed and the ECB to cut interest rates six times totaling 1.5%. Initially, the first rate cut was anticipated for March. However, strong economic reality has pushed back these expectations to June, with only four interest rate cuts left for the current year. Concerns about continuous inflationary growth persist, and Chairman Powell emphasized that he would like to see more signs of sustainably lower inflation before considering rate cuts.

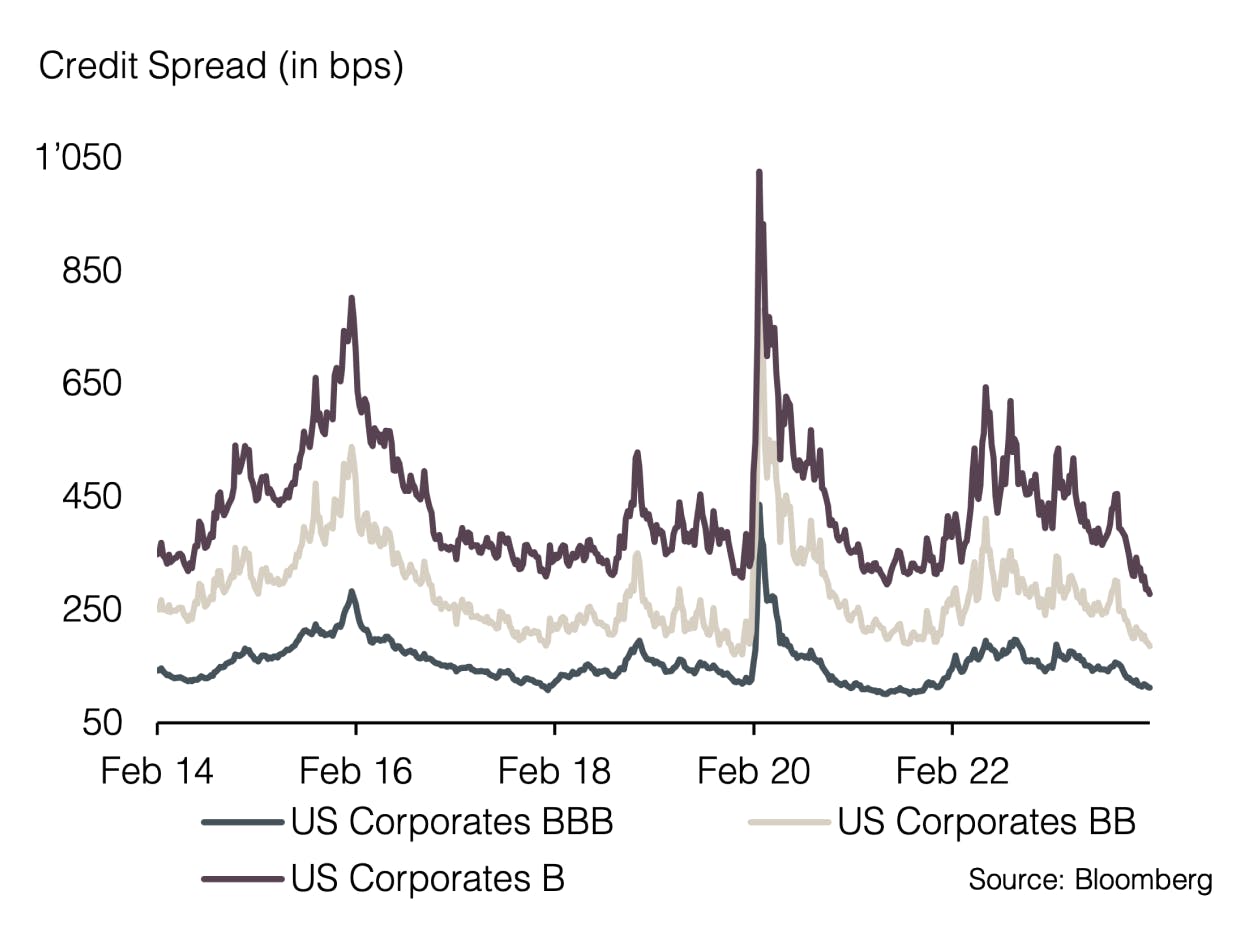

Thus, expectations of rate cuts have been put under review, leading to a jump in interest rates for both the Euro and the US Dollar across all maturities. For fixed-income investments, this led to losses since the beginning of 2024. However, the last quarter of 2023 clearly showed how quickly the window of opportunity to lock in higher interest rates can close. Therefore, we consider the current interest rate levels, especially for USD denominated investments, as attractive and recommend investors to opt for longer maturities.

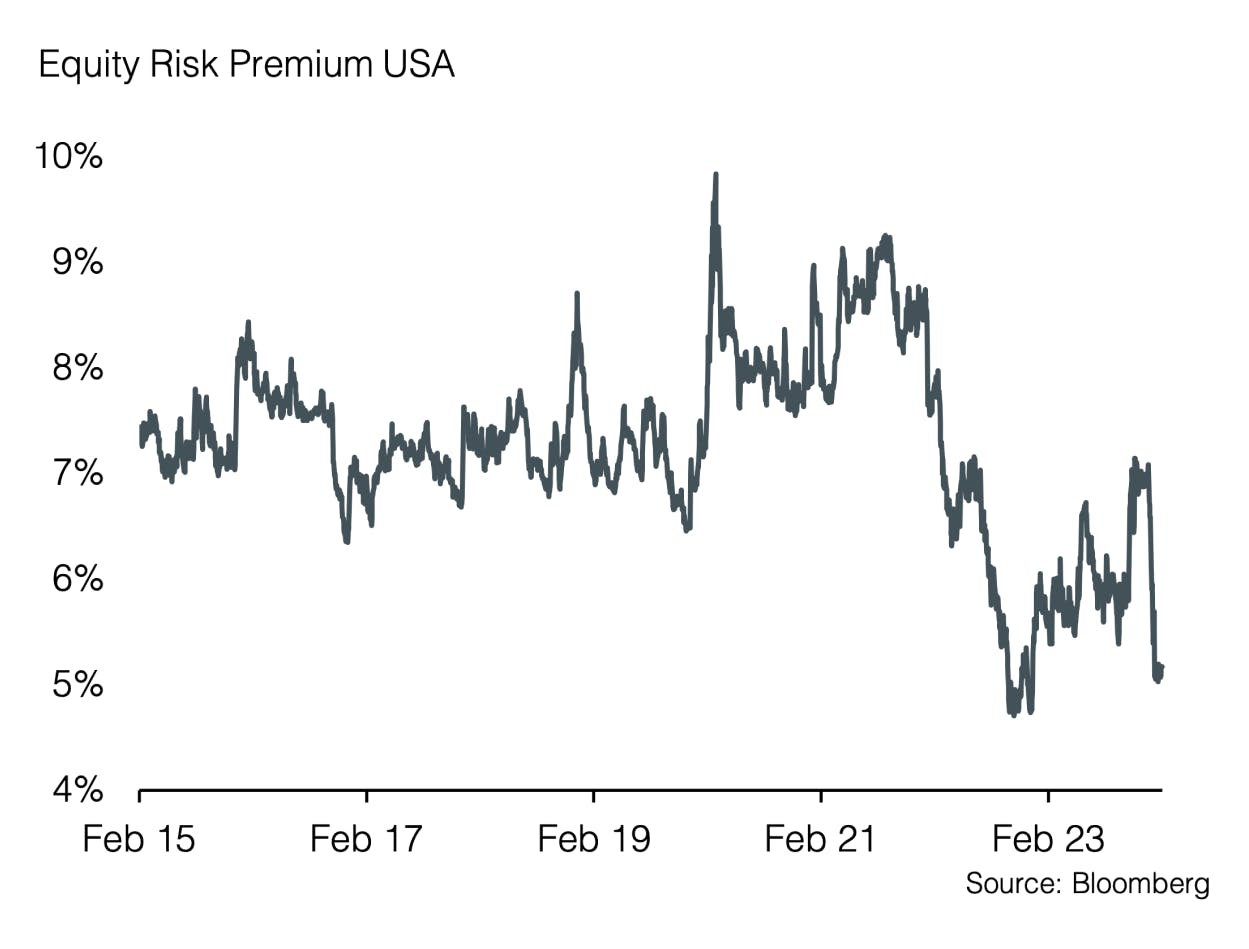

The stock market experienced an incredibly positive start to 2024, with a similar dynamic as in the prevailing year. Once again, the 'magnificent seven,' whose performance was driven by very solid corporate results, were the main driver of equity returns. Upcoming developments around artificial intelligence remain one of the reasons for the robust performance of technology stocks, which propelled the global market to a new all-time high in February.

However, the fact that the market is being dominated by just a few stocks while trading near record levels has historically been a sign of some complacency to macroeconomic data. The S&P 500 is trading more than 1.5 standard deviations above the long-term average forward price-earnings ratio, indicating that many of the expected positive developments are already priced in.

Appendix

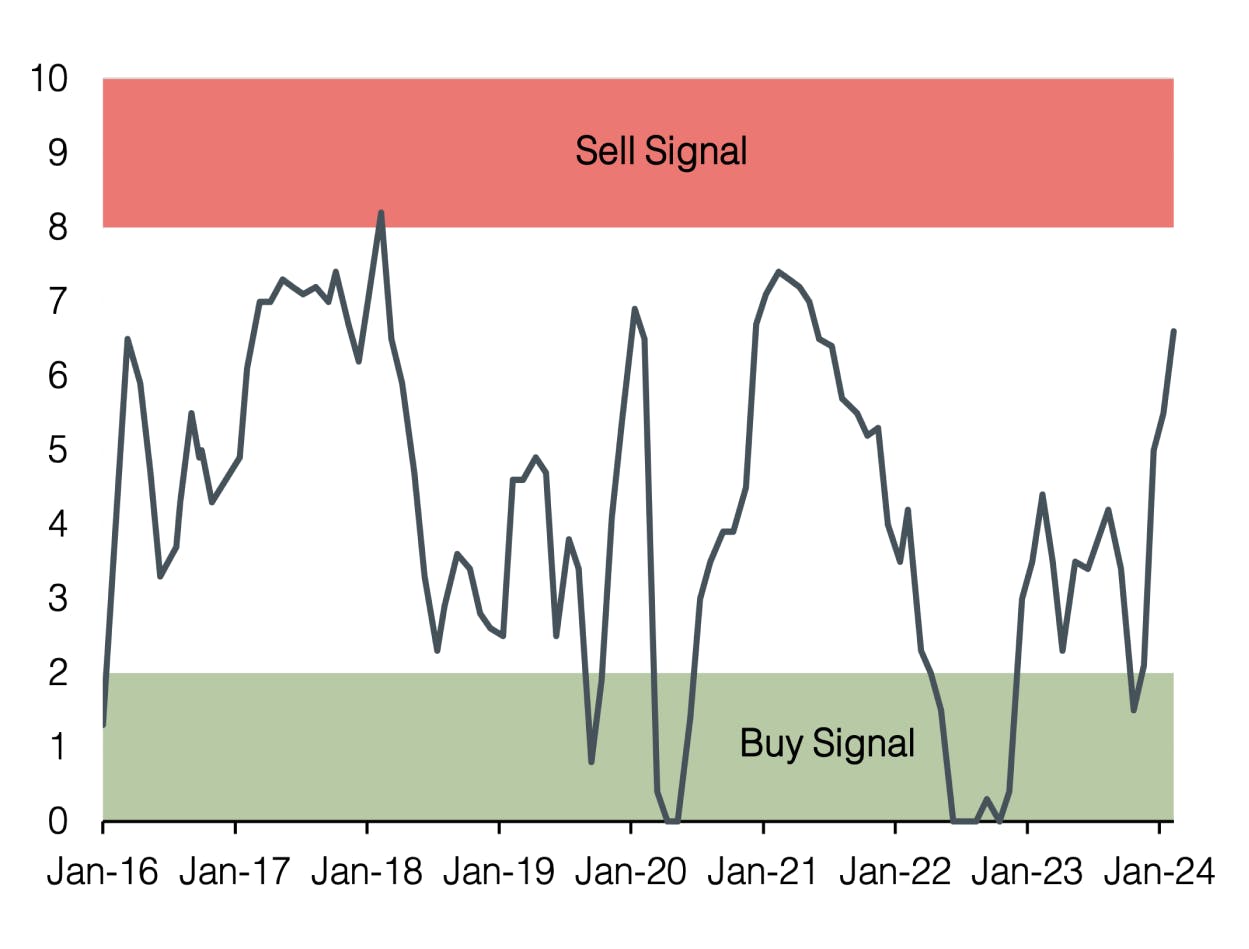

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research