SoundInsightN°9

Bonds

Equities

China's real estate market in focus again

While the western world shines with unexpectedly positive corporate and economic data, there are signs that China’s growth engine is increasingly faltering.

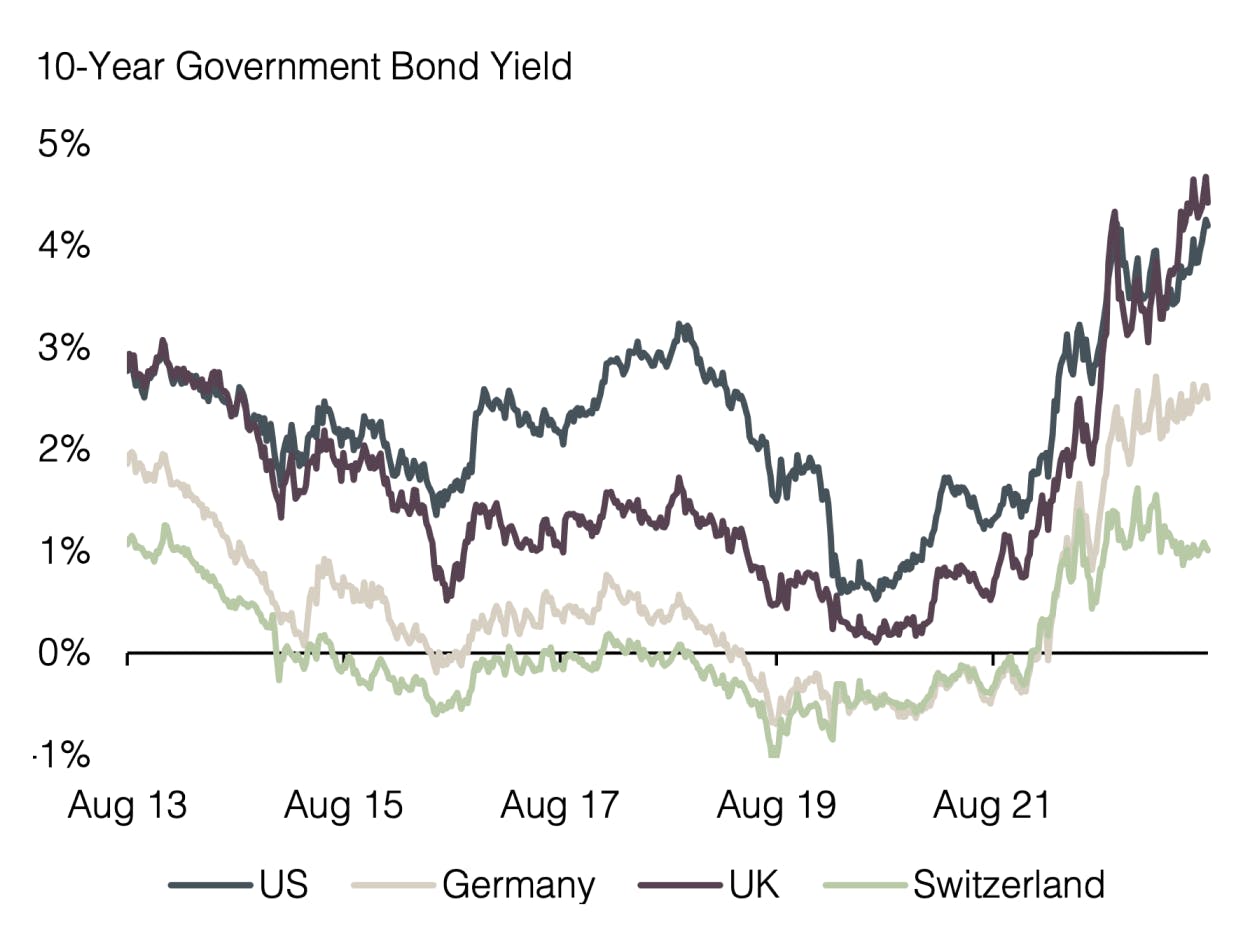

In August, for the fourth consecutive month, long-term USD interest rates have increased compared to the previous month. As a result, US government bonds lost ground and are now showing a negative performance since the beginning of the year. 10-year US government bond yields approached 4.35%, the highest level since 2007. A combination of positive corporate earnings and better-than-expected economic data has increased the likelihood of a soft landing for the US economy. On the other hand, the rise in long-term inflation expectations also suggests that market participants anticipate a prolonged period of inflation above the central banks' target of 2% due to robust economic growth.

The latest interest rate hikes by the Federal Reserve and the European Central Bank of 0.25% each came as no surprise. However, it’s worth highlighting that the outlook for future monetary policy has remained restrictive. Nonetheless, market participants anticipate that the current interest rate cycle is completed. However, the increase in long-term interest rates also reflects that the market had anticipated lower rates prematurely, a trend that has been evident throughout the current year. Consequently, fewer interest rate cuts for the year 2024 are now being priced in.

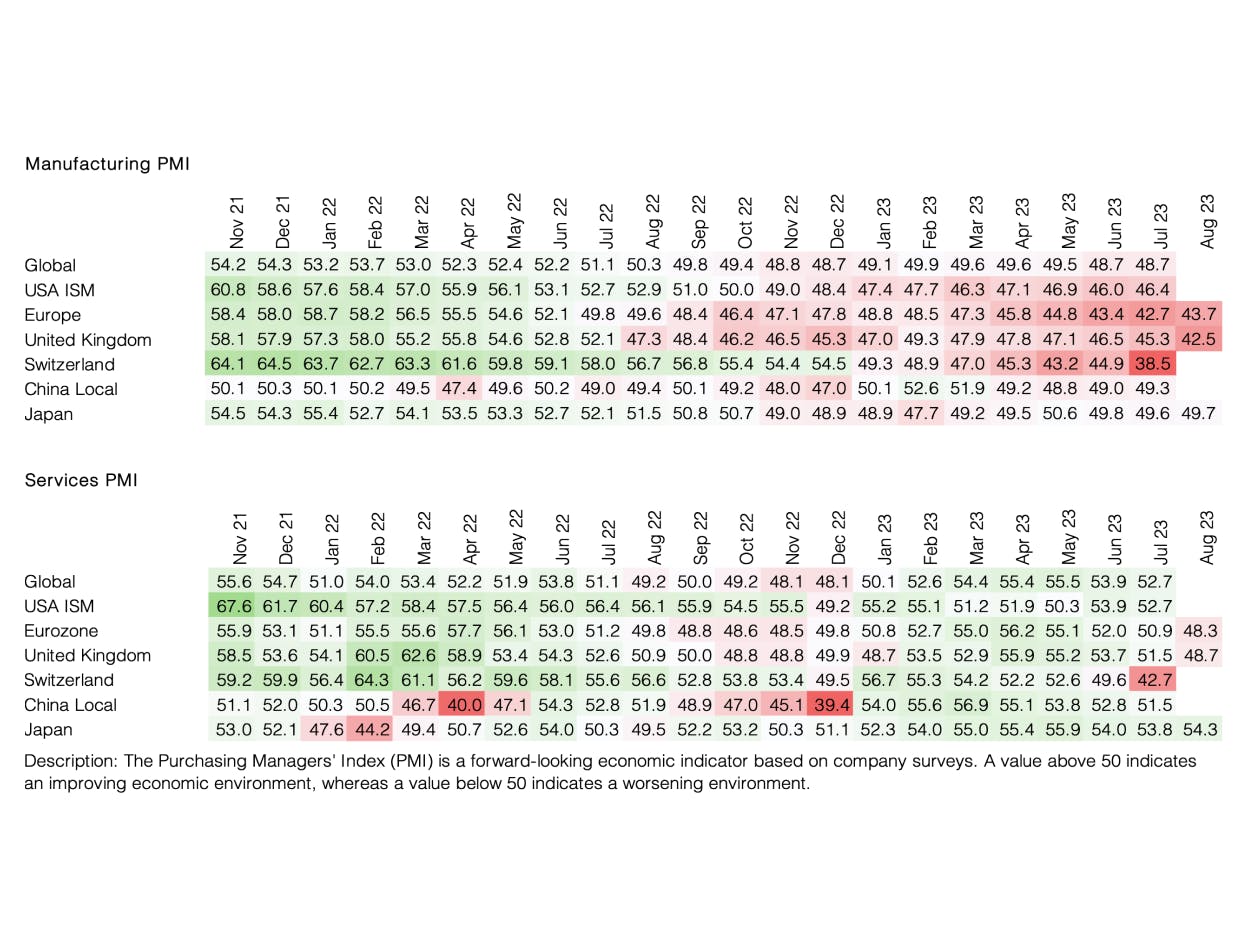

In contrast to the past two months, fixed income market development is now leaving negative traces on stock markets as well. The equity markets are experiencing their weakest month since September 2022. Although recently released US economic data showed a strong increase in demand for durable goods, one-off effects in the aerospace sector have been the main driver, diluting the overall data set. Retail sales have also pleasantly surprised, and the labor market remains very robust. Due to higher real interest rates, the equity market risk premium has fallen even further, remaining the primary argument for a limited return potential going forward. The Chinese stock market is causing the greatest concerns for now. Chinese equities have underperformed for some time, and negative headlines are emerging continuously.

Once again, the trigger can be found in the real estate sector of the world's second-largest economy, which has been in a serious crisis for some time. Recently, the highly indebted Chinese real estate conglomerate China Evergrande filed for chapter 15 bankruptcy protection in the US due to its large debt burden, rendering it unable to meet its financial obligations. According to the rating agency S&P, more than 50 Chinese real estate developers have defaulted on payments or failed to meet their obligations in the past three years. China Evergrande is considered one of the most heavily indebted real estate companies globally, with liabilities exceeding $300 billion. Economic measures taken by the Chinese government thus far suggest that they anticipate a longer deleveraging process and are willingly accepting the associated pain. It is not unlikely that further defaults will follow, weakening the entire Chinese economy. Although China's banking system is largely shielded from international financial markets, the already faltering Chinese economy could still have negative global repercussions.

A completely different picture emerges across the US real estate market. Despite rising interest rates, the market has surprised with sustained price increases and stable demand since the beginning of the year. Nevertheless, rising rates are increasingly kicking in: the highest mortgage rates in over 20 years stand alongside property prices that have reached historic highs. As a result, the costs of mortgage payments when buying real estate have reached their highest share of borrowers' incomes since the 1980s. It only seems a matter of time until a correction in the US real estate market occurs due to the new interest rate landscape.

Historically, such comparable housing market situations have been accompanied by a weakening economy. Therefore, we are sticking to our strategic focus and using the higher interest rates to lock in attractive yields for the longer term. Our emphasis remains on high-quality corporate bonds and government bonds. We continue to underweight equities. Within equities, we now consider the healthcare sector as attractive due to its defensive characteristics and solid growth prospects.

Appendix

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research