SoundInsightN°29

Bonds

Equities

Markets Shaken by Tariff Turmoil

Sweeping U.S. import tariffs announced by President Trump are causing significant disruption across global markets, posing substantial risks to worldwide economic growth. While investors are facing heightened uncertainty, the current environment also presents carefully targeted opportunities.

What happened?

On April 2, 2025, the U.S. administration under Donald Trump announced comprehensive import tariffs affecting virtually all global trade partners. An across-the-board base tariff of 10% on all imports was introduced, with significantly higher rates applied to countries holding trade surpluses.

Around 185 countries have been impacted, including unconventional examples such as uninhabited islands and micro-territories. The U.S. administration justified the measures by citing "unfair trade practices," encompassing existing tariffs, subsidies, currency manipulation, and other economic policy interventions. Notably, Russia, Belarus, and North Korea were explicitly exempted, a diplomatically noteworthy decision.

This action represents a significant shift away from the decades-old principle of free global trade, escalating geopolitical tensions and introducing substantial economic risks. Particularly concerning is the fact that the U.S. remains highly dependent on foreign capital to fund its growing national debt.

Impact on Financial Markets

The global financial response was immediate and severe. Equity markets experienced substantial declines, with global stocks losing around 9.3% in just two trading days, the steepest two-day drop since the onset of the COVID-19 pandemic. Similar market disruptions have occurred only twice in the past 25 years: during the 2008 financial crisis and the 2020 COVID-19 crisis.

Economists and financial analysts have significantly lowered their growth forecasts. The adverse impact extends beyond the U.S., threatening global economic stability, particularly if the tariffs remain for an extended period.

Markets are now factoring in prolonged trade disputes, increased inflation, and heightened uncertainty. It is the most pronounced market reaction since the onset of the pandemic, driven solely by a political trigger.

Our Assessment

The likelihood of a U.S. recession, and consequently, a global economic downturn, has risen markedly. The longer the trade conflict remains unresolved, the more pronounced the economic consequences could become.

Although the presidential order leaves room for tariff reductions if "non-reciprocal" trade agreements are revised, recent statements from Washington suggest negotiations will be challenging.

More than $7 trillion in market capitalization has already evaporated, particularly from highly valued U.S. markets, clearly indicating significant financial damage. These markets now appear particularly vulnerable to economic slowdown as European and Asian markets have also faced considerable pressure.

Of special concern: Previously projected earnings growth exceeding 10% for U.S. companies in 2025 now appears increasingly unrealistic due to rising costs and declining margins. Any downward revision of these expectations would likely exert further pressure on U.S. equities.

Simultaneously, risks in credit markets, especially the high-yield segment, have increased. However, unlike previous crises, panic has not yet set in, suggesting that markets have not fully priced in the potential severity of a recession.

SoundCapital: Strongly Positioned with a Focus on Opportunities

Amid this challenging environment, SoundCapital’s portfolio positioning has proven effectively diversified. We have intentionally underweighted credit risks and tactically increased exposure to high quality with longer-duration bonds, an approach now paying off given declining interest rate expectations and increased risk aversion.

An overweight in the Swiss market adds stability, as Switzerland remains a recognized safe haven, and the strength of the Swiss franc reduces the impact on portfolio performance.

Within equities, our strategy emphasizes defensive sectors like utilities, which have shown greater resilience. Recent tactical adjustments include:

- Reducing exposure to U.S. mid-cap stocks due to heightened economic sensitivity.,

- Increasing allocation to U.S. "low-volatility stocks" to mitigate market volatility and prioritize business stability.,

- Shifting parts of the global equity exposure toward quality dividend strategies, focusing on stable income and value-driven investments.

In alternative investments, we maintain a strong emphasis on diversification and resilience. Alongside gold, which has significantly appreciated since early in the year, we exclusively employ non-correlated strategies, providing additional portfolio stabilization.

While current market volatility inevitably affects portfolios, our positions remain solid on a relative basis. Our clear quality orientation, flexible asset allocation, and broad diversification equip us to effectively manage risks and capitalize selectively on market opportunities.

What Investors Should Consider Now

In uncertain times, diversification is paramount. Historical market data clearly illustrates that periods of heightened volatility and extreme investor anxiety often precede substantial returns.

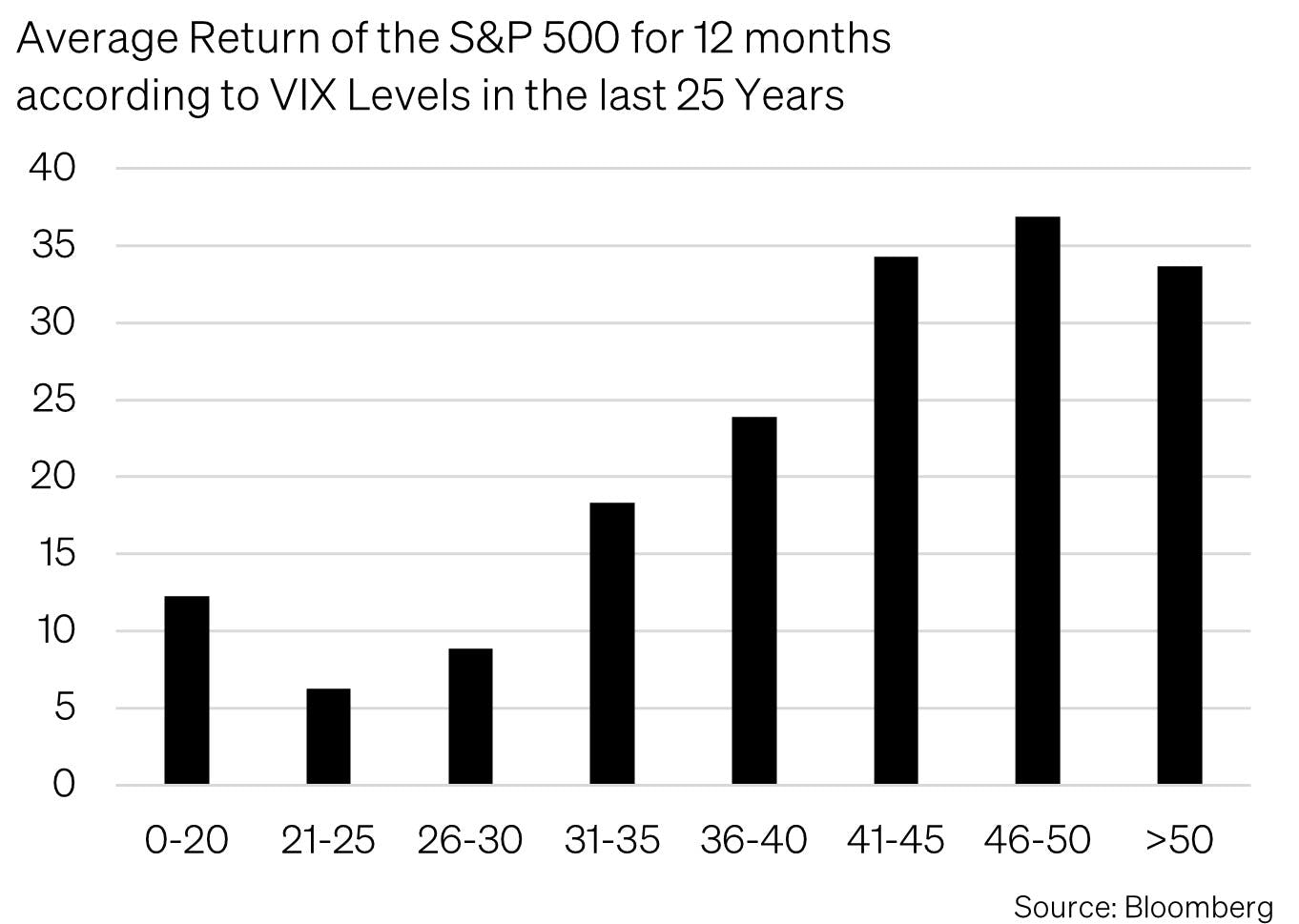

The chart below demonstrates average 12-month returns relative to the VIX Index level at the point of investment. The key takeaway: periods of elevated volatility historically indicate higher returns in the subsequent year. The higher the VIX, the stronger the subsequent average returns, providing a compelling rationale against impulsive selling or hedging during market turmoil.

Historical examples of robust market rebounds following periods of extreme uncertainty include:

- March 9, 2009 (VIX at 49.68): +40% within 3 months.

- March 23, 2020 (VIX at 61.59): +39.9% within 3 months.

Lessons from the Past 25 Years:

- Investors selling during panics frequently miss critical turning points in the market.

- Selling, when VIX exceeds 40, typically results in significant missed opportunities.

- Investors who remained invested during volatility spikes (VIX >40) earned an average return of +16.1% over the following six months, whereas those shifting to cash missed approximately 230% in total returns over the entire period.

High VIX Levels: Historically Attractive Entry Points

- Average 6-month return when VIX > 40: +16%

- Average 12-month return when VIX > 40: +31.8%

Conclusion: Stay Calm and Identify Opportunities

Panic is rarely a prudent guide. Maintaining composure during market turbulence often leads to long-term rewards. While political trade disputes typically fuel short-term volatility, they frequently pave the way for a recovery, once tensions ease.

Given current conditions, a defensive portfolio stance emphasizing quality, stability, and diversification remains prudent.

Investor vigilance in the coming weeks will be crucial, as market dynamics will significantly depend on international responses, whether escalating tensions or initiating negotiations.

Ultimately, current market conditions offer significant opportunities, particularly for disciplined investors who keep long-term return objectives firmly in view.

Appendix & Disclaimer

SoundInsights is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials

Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong. - Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with SoundInsights. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by SoundCapital (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2025 SoundCapital. All rights reserved.

Datasource: Bloomberg, BofA ML Research