SoundInsightN°25

Bonds

Equities

Review 2024 & Outlook 2025

The year 2024 brought surprising growth in the U.S. economy and impressive gains in equity markets, while the shift in interest rates provided an extra boost. But what lies ahead for 2025? In this inaugural edition of SoundInsight 2025, we examine the opportunities and risks for the economy, bonds, and equities, and share how we are positioning ourselves in the current environment.

Review 2024

Economy

The year 2024 stood out for its unexpectedly strong economic growth in the United States. At the beginning of the year, the Federal Reserve (Fed) projected real economic growth of 1.4%, but by year-end, that figure was revised upward to 2.5%. This performance underscores the resilience of the U.S. economy in the aftermath of the pandemic. Despite significantly higher interest rates, growth continued, once again highlighting the adaptability of the world’s largest economy.

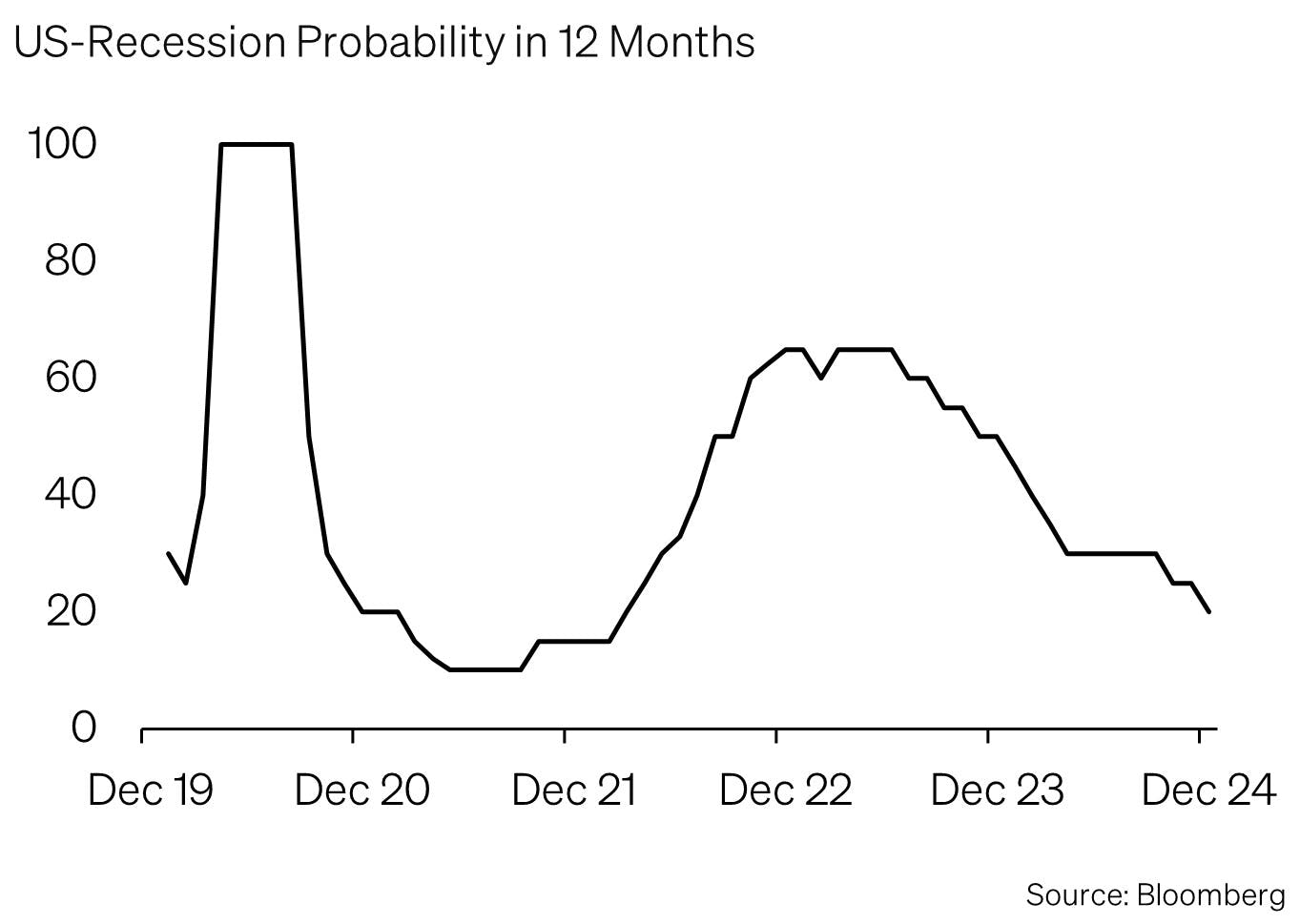

Meanwhile, the probability of a U.S. recession, at 50% at the start of the year, dropped to just 20% by year-end. In parallel, inflationary pressures continued to ease, largely in line with expectations.

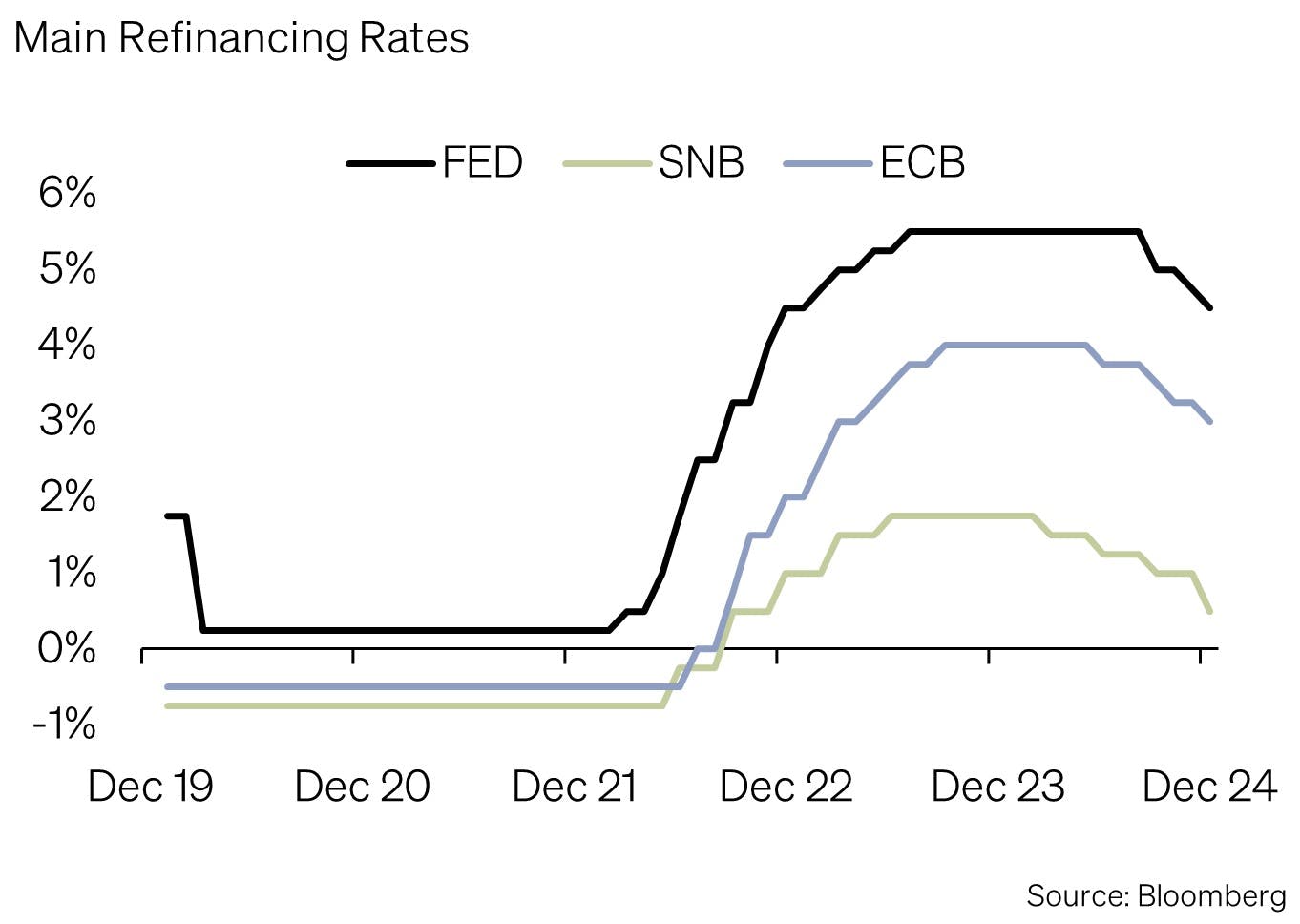

Another milestone of the year was the long-awaited shift in central bank interest-rate policies. The Swiss National Bank (SNB) lowered its rates in four increments, amounting to a surprising 1.25% reduction. Meanwhile, the European Central Bank (ECB) also cut its key rates in four steps by 1%. In the United States, the Federal Reserve (Fed) lowered rates in three steps, totaling a 1% reduction. These monetary policy easing measures provided the markets with tangible support and gave a positive boost to economic growth.

Fixed Income

The bond market in 2024 benefited from two key factors: the onset of the interest-rate pivot and a declining likelihood of recession. Central bank rate cuts lowered yields and thus boosted bond prices while credit spreads fell as concerns about a potential economic downturn subsided.

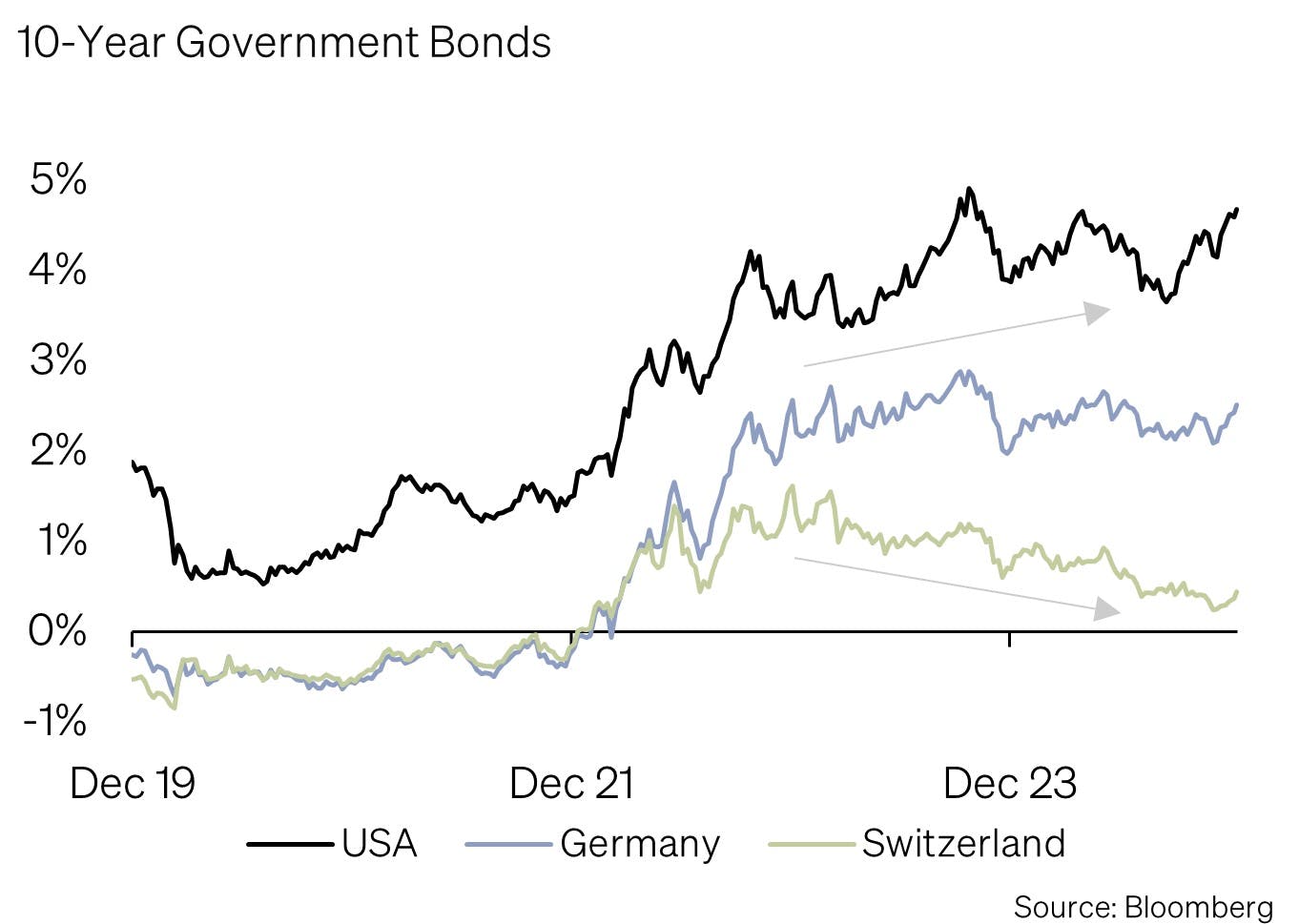

Despite the generally positive trend, developments varied significantly by region, shaped by each central bank’s forecasts and actions. The Swiss National Bank (SNB) surprised markets in March with an early rate cut and again in December by lowering rates by 0.5%. These moves led to an exceptionally strong year for Swiss bonds. As a result, the CHF bond market is now edging closer to a “risk without return” environment, creating new challenges for investors.

In contrast, the Federal Reserve (Fed) remained more cautious considering persistently high inflation. While markets had priced in six rate cuts for 2024 as of December 2023, only four materialized. This restraint caused yields on 10-year U.S. Treasuries to rise in 2024 despite falling short-term rates. Nevertheless, given their already high coupon rates of over 4%, U.S. bonds still posted slightly positive total returns.

Overall, regional interest-rate discrepancies defined the bond market in 2024, underlining how strongly market performance depends on the monetary policy course set by individual central banks.

Equities

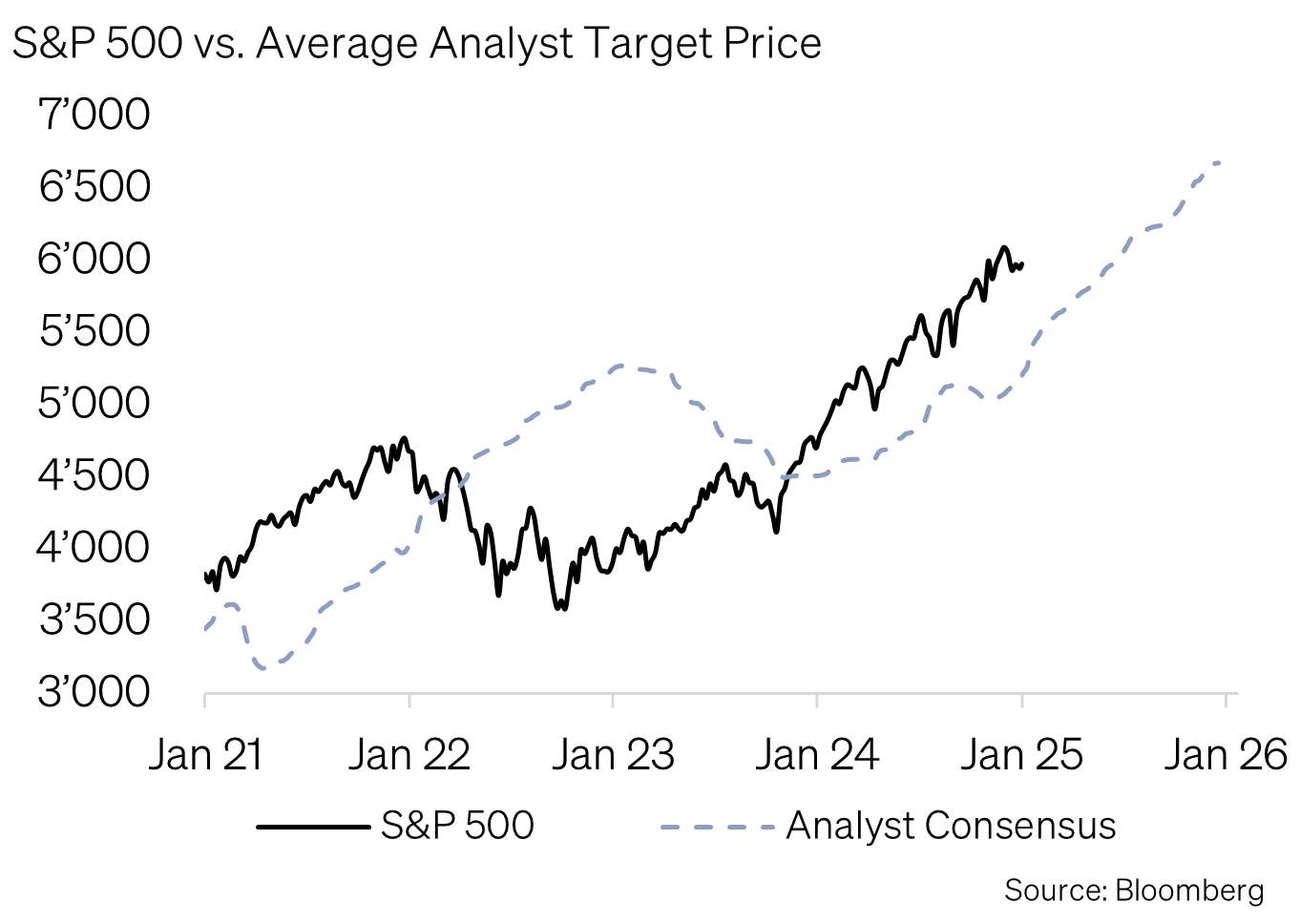

The year 2024 once again brought major surprises to global equity markets, especially in the United States. At the end of 2023, many analysts adopted a cautious stance in their forecasts, following a remarkable stock market performance with gains exceeding 25%. The consensus prediction for the S&P 500 stood at an average of 4,584 points. Yet, the index closed 2024 at nearly 5,900 points, posting another gain of over 25% and surpassing even the boldest expectations.

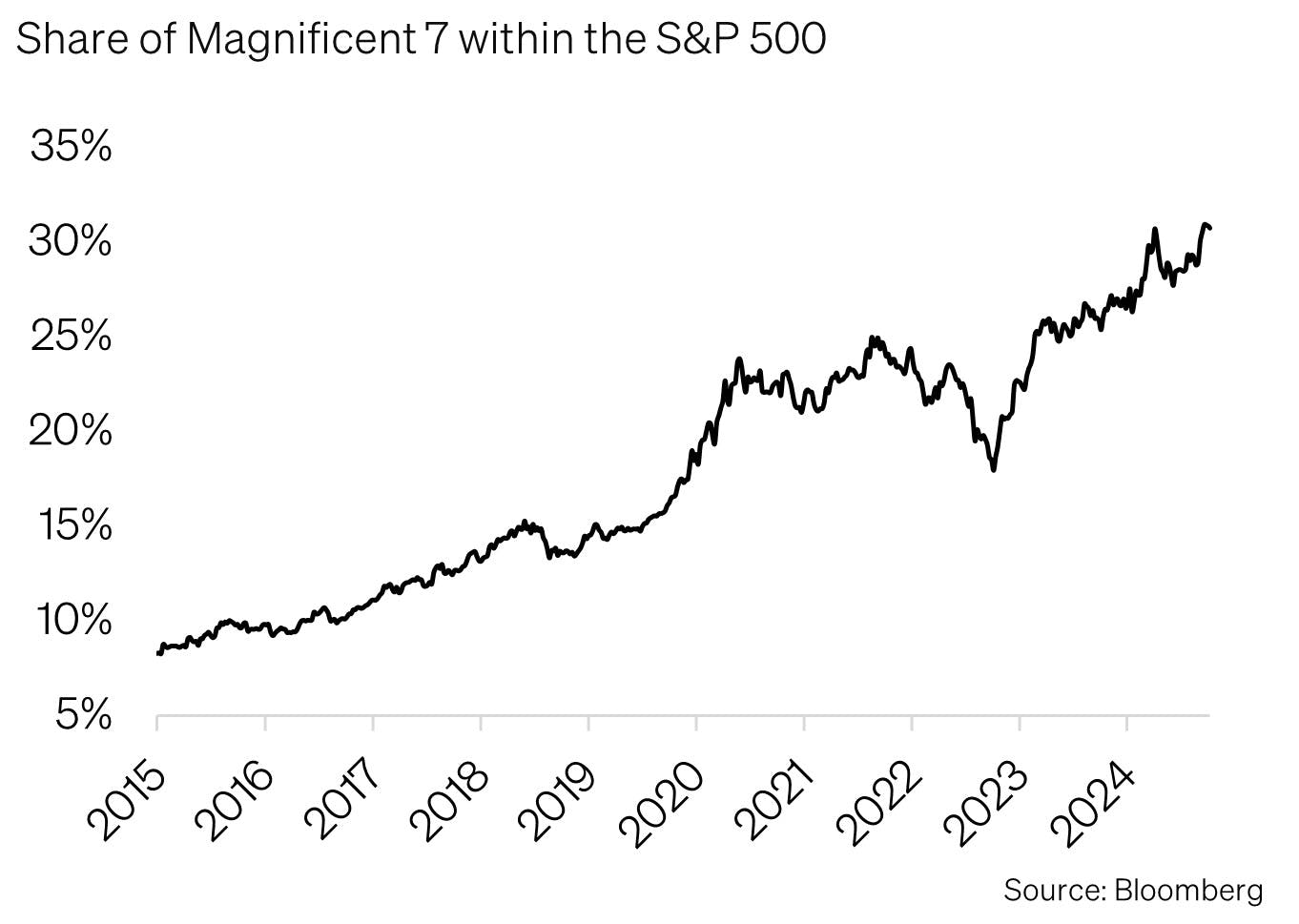

This extraordinary performance was supported by a robust economic environment and sharply rising corporate earnings. In addition, growing enthusiasm around artificial intelligence drove massive gains for the so-called “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, Tesla). Political factors also played a key role: Donald Trump’s election victory and his proposed tax cuts and business-friendly measures gave the markets an extra boost.

By contrast, European markets delivered far more moderate returns. Concerns about faltering economic growth and potential U.S. tariffs weighed on sentiment. The MSCI Europe gained only about 9%, while the Swiss Performance Index (SPI) advanced by a modest 6%.

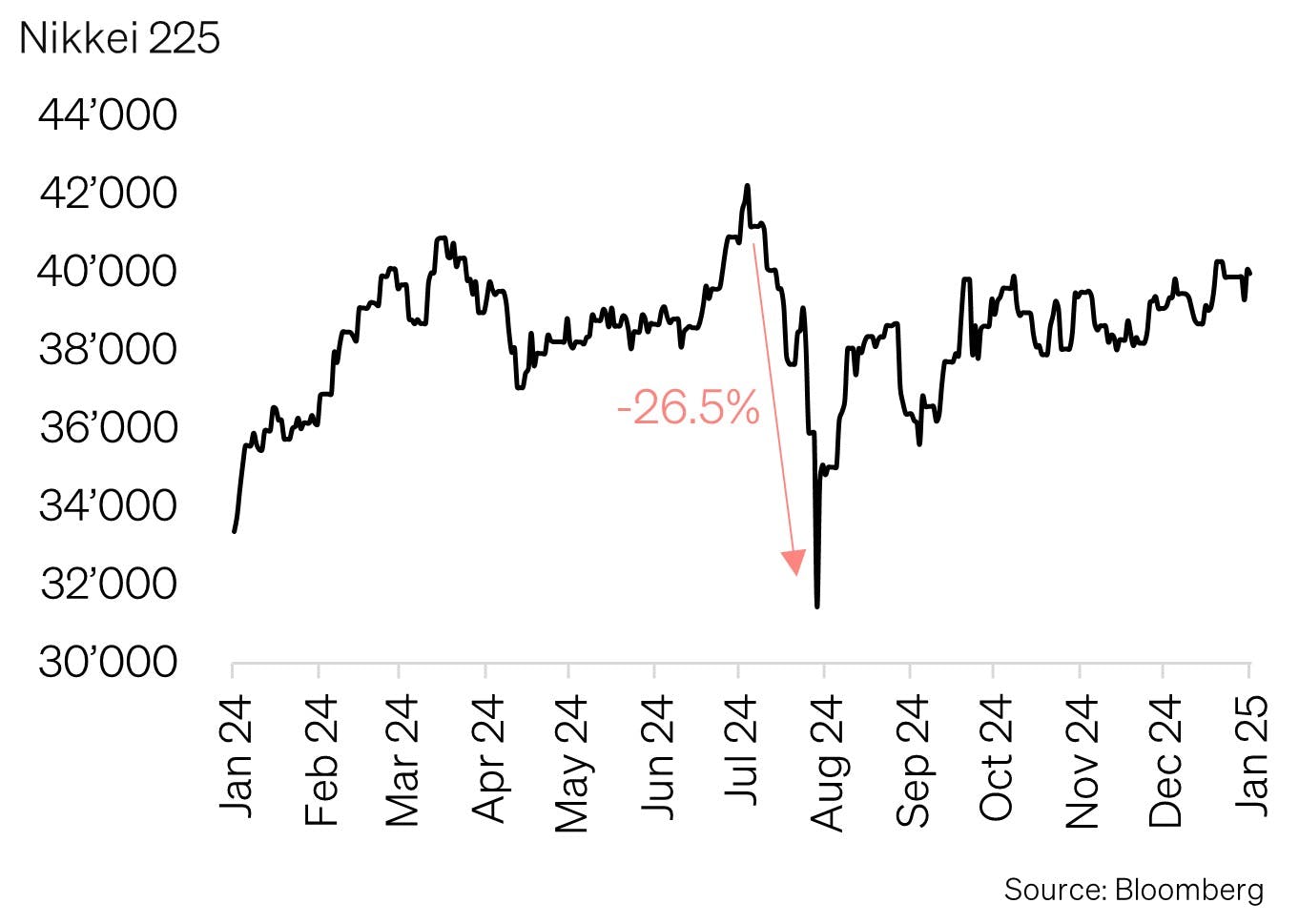

Still, 2024 was not without turmoil for equities. The Japanese stock market, in particular, briefly pulled global equity markets downward. In August, the world’s second-largest stock market slumped by more than 25%, triggered by uncertainties over interest rates. Fortunately, it managed to recover by year-end, closing with gains of over 20%. However, this volatility highlighted how fragile some of the recent market advances might be.

Emerging markets posted mixed results and generally struggled to keep pace with developed markets. While the MSCI Emerging Markets rose by only around 8%, China emerged as a bright spot with a gain of more than 20%, following a series of disappointing years.

A recurring theme was the dominance of large-cap growth stocks. By year’s end, the “Magnificent Seven” represented over 30% of the S&P 500, a remarkable level of concentration, especially considering that figure was still in single digits just ten years ago. Such a heavy weighting carries significant concentration risk, which could impact markets going forward.

Outlook 2025

Economy

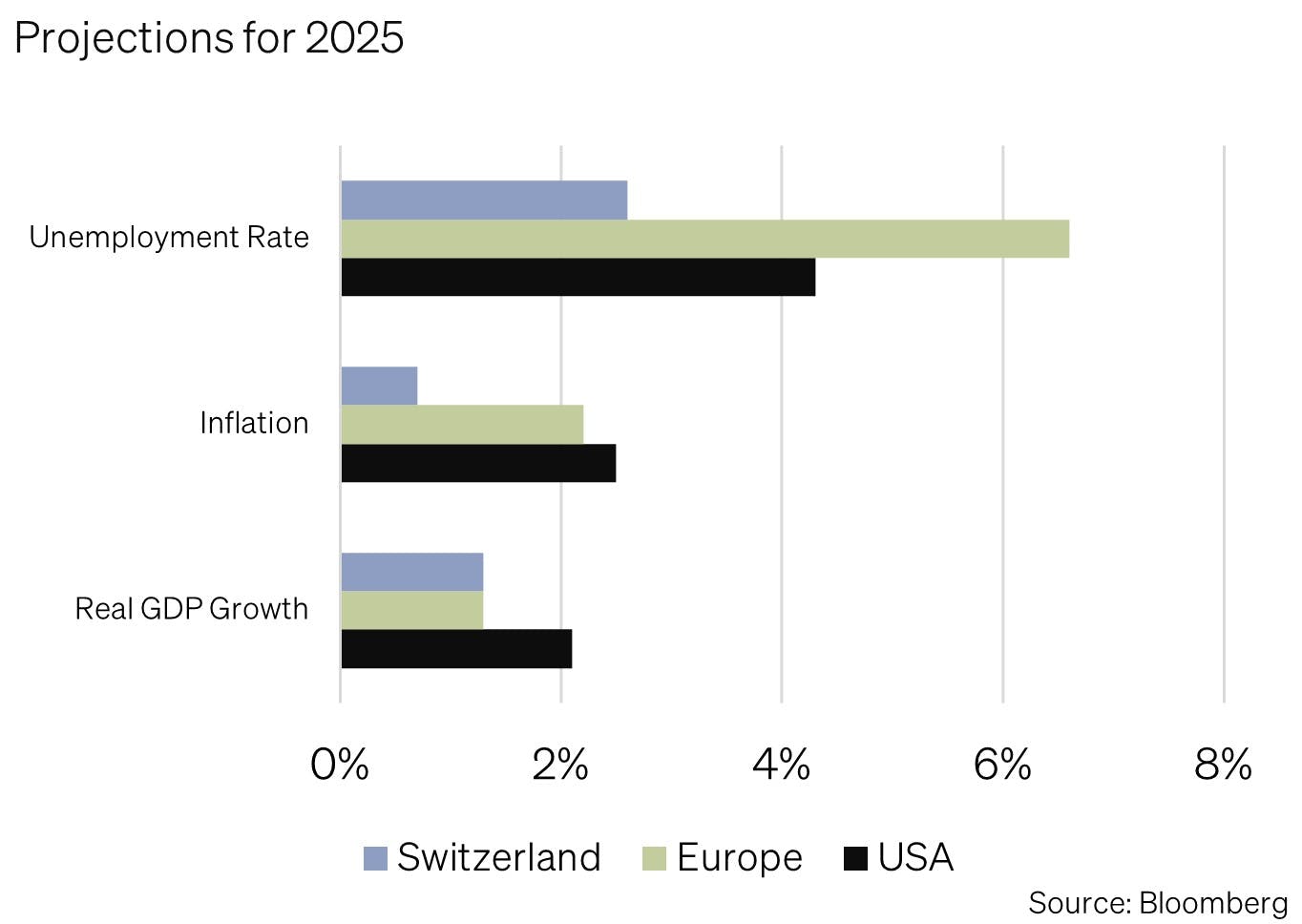

The outlook for the global economy in 2025 is decidedly mixed. Slower growth in the United States and protectionist measures, such as new tariffs on Chinese goods, could dampen global momentum. At the same time, there is hope for regional recoveries, particularly in Europe.

In the U.S., economic growth is expected to taper off to around 2.1%. This reflects a weakening labor market and more cautious consumer spending. Fiscal policy is under close scrutiny, as the costs of servicing high levels of government debt continue to rise and may become a focal point in the year ahead.

Europe, by contrast, is poised for a mild rebound in 2025. Projected growth of around 1% would slightly exceed 2024’s figures. Europe’s industrial sector could benefit from a Chinese stimulus package designed to bolster that country’s economy, which would in turn boost demand for European exports. However, the Trump administration’s trade policies remain a source of uncertainty: high tariffs could weigh on global trade and stoke renewed inflationary pressures.

Outside the U.S., declining inflation rates, rising real wages and lower interest rates could provide tailwinds for many economies by strengthening both consumer and investor sentiment. Yet, the overall environment remains fragile. In particular, U.S. trade policy and the challenges posed by America’s growing national debt could pose significant risks to the global economy in 2025.

Fixed Income

The divergent interest-rate trends of 2024 have led to varying conditions for the bond markets in 2025. U.S. dollar–denominated bonds remain especially attractive on an international scale. Despite the Federal Reserve’s rate cuts, yields on USD bonds remain historically high. According to estimates from J.P. Morgan, quality issuers could deliver solid returns of over 5% per year in the coming years. By comparison, U.S. equities may only yield a slightly higher annual return of about 6%, but at more than double the volatility. Against this backdrop, we recommend locking in attractive yields via longer-dated bonds.

In Europe, the downtrend in interest rates is likely to persist through 2025, which should continue to support bond markets. Although yields are lower than in the U.S., they remain historically appealing. European government bonds, in particular, could benefit from the European Central Bank’s accommodative monetary policies.

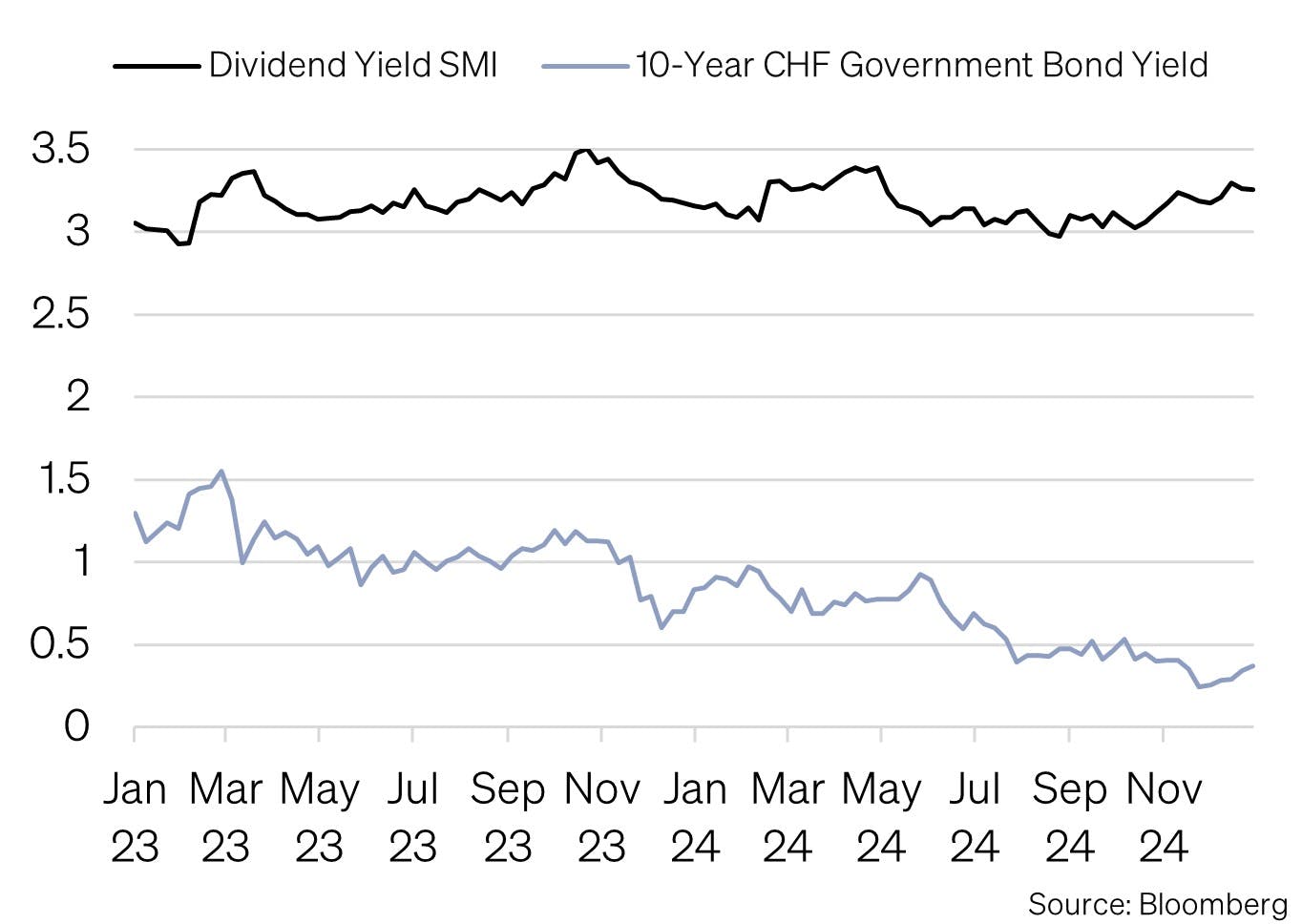

Switzerland has seen a striking development: while 10-year bonds yielded over 1.5% in 2023, that figure briefly dipped below 0.2% by December 2024. This dramatic change highlights how quickly the landscape can shift from “risk-free returns” to “return-free risk.” In view of this, we advise focusing on short-term Swiss bonds to maintain flexibility in the face of evolving market conditions.

A critical factor in 2025 is the level of credit spreads, which are hovering near historical lows. This environment fails to adequately compensate investors for credit risk. Accordingly, the mantra is “quality over yield.” We recommend underweighting subordinated and high-yield corporate bonds to minimize potential losses.

Equities

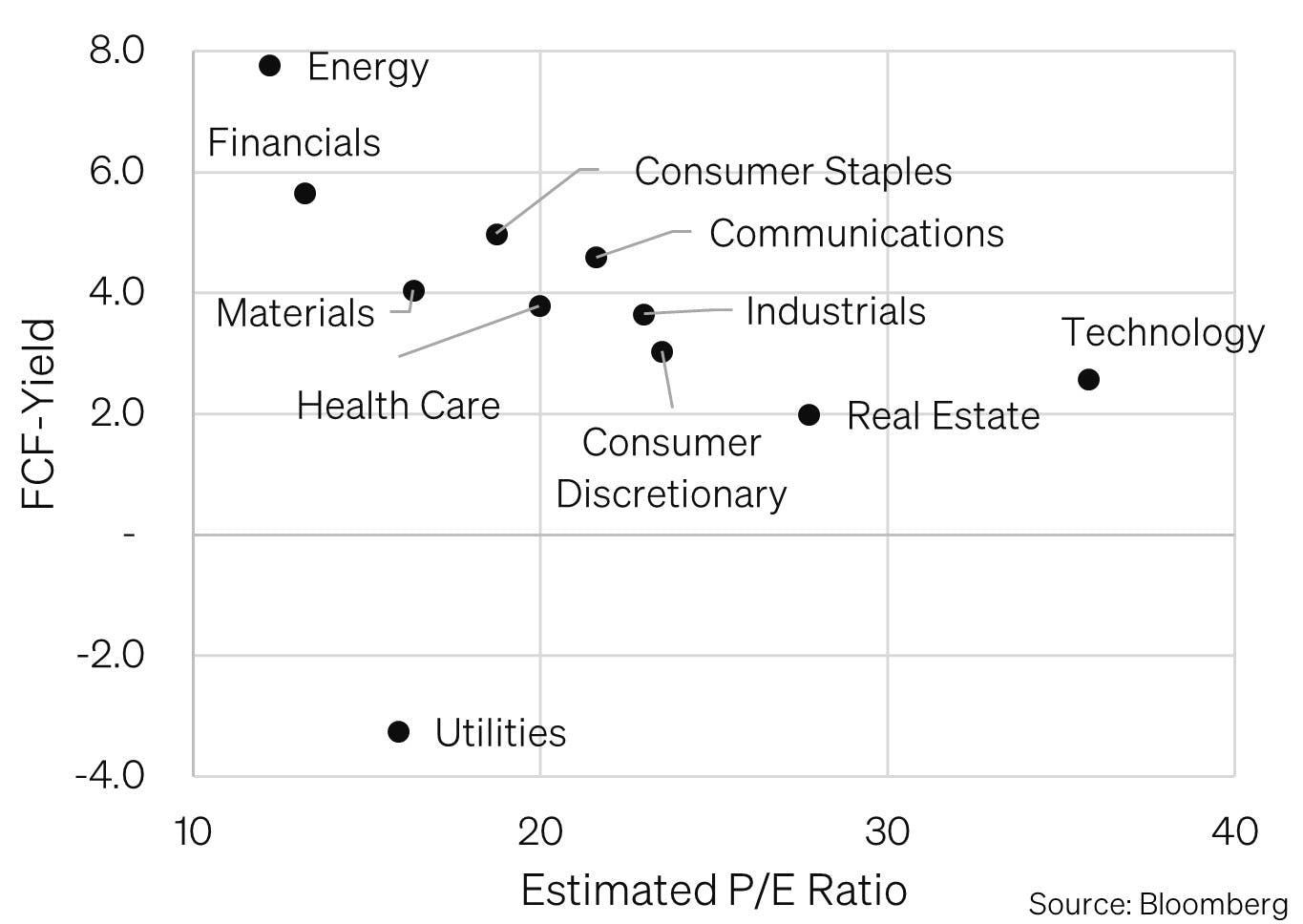

After two consecutive years of gains exceeding 20%, a phenomenon last witnessed in the 1990s during the dot-com bubble, a closer look at current valuations is warranted. Historically, the global equity market’s estimated price-to-earnings (P/E) ratio is roughly 30% above its 20-year average. Equity risk premiums are also near historic lows, underscoring today’s lofty valuations. According to analyst estimates, stocks have been pricier relative to bonds only 15% of the time over the past century.

As with bonds, regional differences matter. While U.S. equities are broadly considered expensive, especially when compared to relatively attractive U.S. bond markets, Swiss equities appear more fairly valued, especially against a nearly return-free Swiss bond market.

One ongoing concern is the rising concentration in major indexes. The ten largest stocks in the S&P 500 now represent around 38% of the entire index, significantly distorting market breadth. However, 2025 could be the year when the “Magnificent Seven” no longer drive earnings growth alone. Broader-based earnings are anticipated, which may help improve market breadth.

Behind the scenes, there are still compelling valuation opportunities, as some segments of the equity market remain anything but overvalued. Broader diversification is the key to capture undervalued opportunities. In the U.S., mid-cap companies appear particularly promising, potentially benefiting from broader earnings growth while maintaining high quality.

Switzerland remains attractive for equity investors, thanks to low interest rates and strong corporate fundamentals. In 2025, high-quality stocks with robust dividends will likely remain top of mind for CHF-based investors, adding further support to the Swiss market.

Overall, equities are expected to post positive returns again in 2025, though likely at a more modest pace than in 2024. The political transition in the U.S. could trigger increased volatility in the spring, which may open up new opportunities. Investors should be prepared to capitalize on these fluctuations with a tactical approach.

Appendix

SoundInsights is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with SoundInsights. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by SoundCapital (hereafter «SoundCapital») with the greatest of care and to the best of its knowledge and belief. However, SoundCapital does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SoundCapital.

© 2025 SoundCapital. All rights reserved.

Datasource: Bloomberg, BofA ML Research