SoundInsightN°6

Bonds

Equities

Lower Inflation, lower Profits & higher Equities

Global inflation continues to decline, raising hopes of an end to interest rate hikes. However, gains in the stock market are accompanied by declining corporate profits.

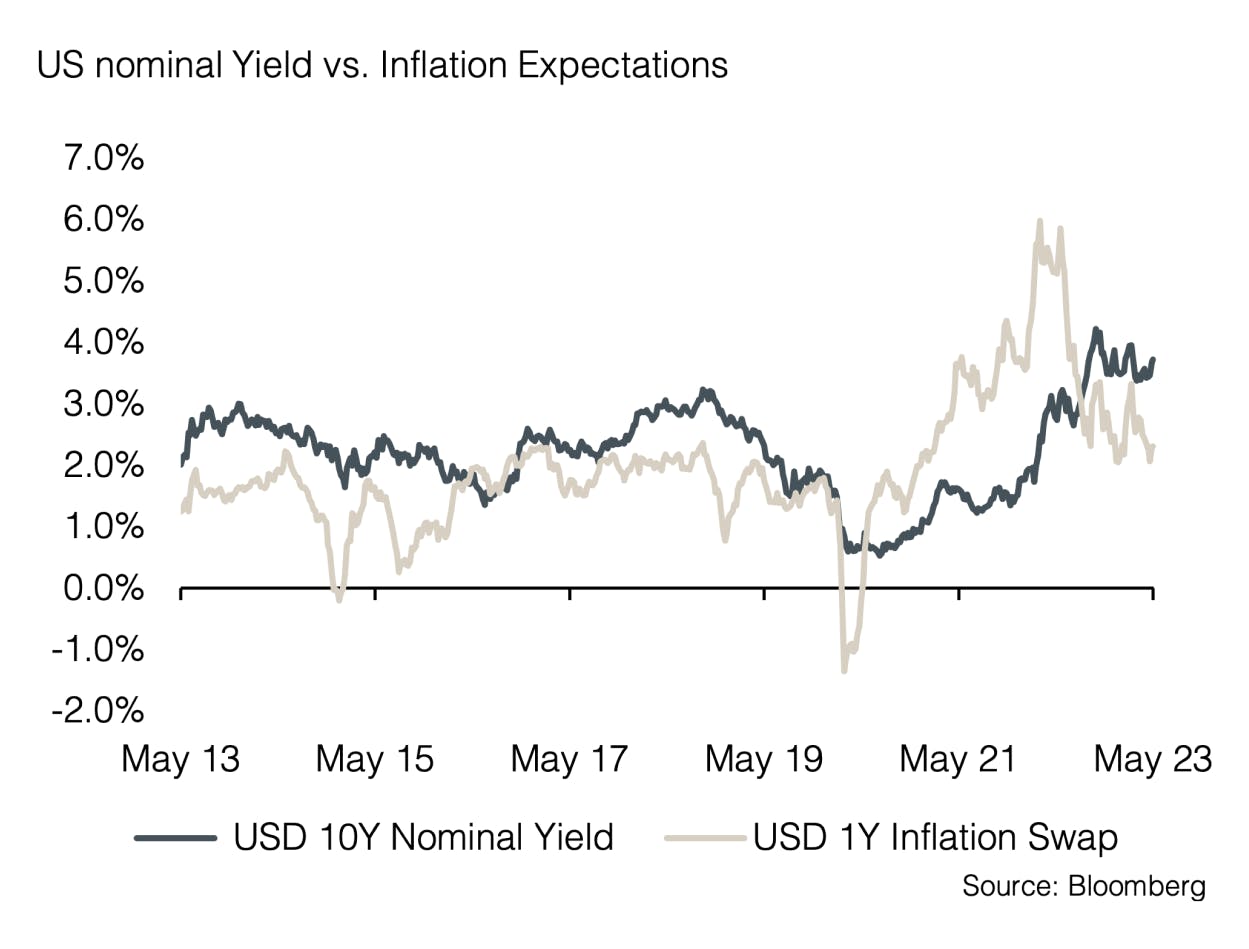

In April, both US consumer and producer prices rose less than expected by economists. Over the past 12 months, consumer prices in the US increased by 4.9%, while producer prices rose by 2.3%. The current wave of inflation is largely attributed to disruptions in global supply chains. Therefore, producer prices carry more significance when it comes to predicting the further development of inflation. Producer prices have been on a downward trajectory since March 2022, while consumer prices have been decreasing for the past 10 months, following producer prices with a delay of about 3 months. Given last month's data release, producer prices are now approaching the target range of 2% that the Federal Reserve wants to achieve with its goal-based approach.

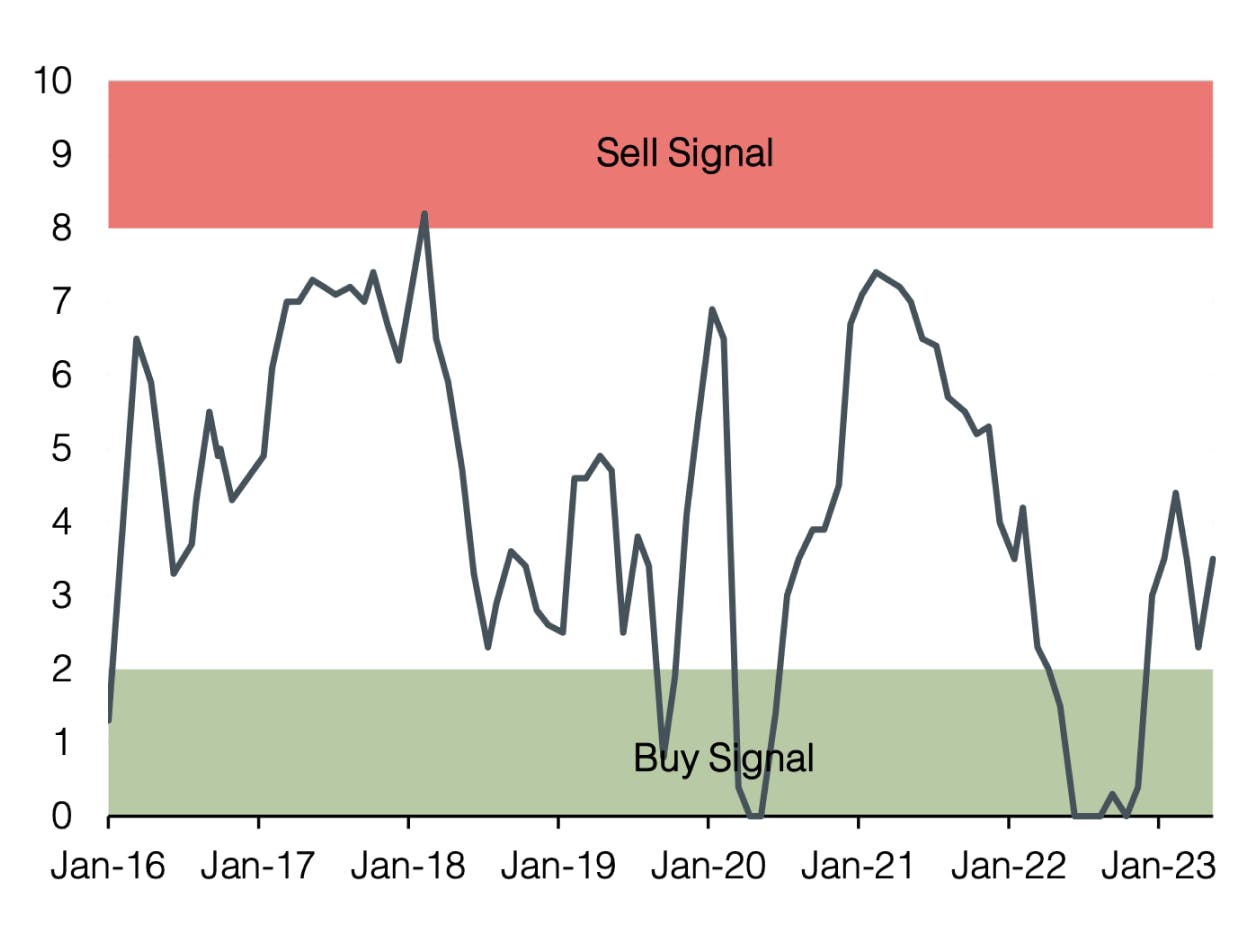

In general, global supply chain disruption no longer seems to pose a significant problem. The New York Fed's Global Supply Chain Pressure Index has fallen to its lowest level since the financial crisis back in 2008. The number of published news headlines on the topic of "supply chains" has halved in the past 12 months. Freight rates for standard 40-foot-container boxes, where costs temporarily exceeded $10,000, have decreased by more than 80% and have reached long-term average levels in a sign of normalization.

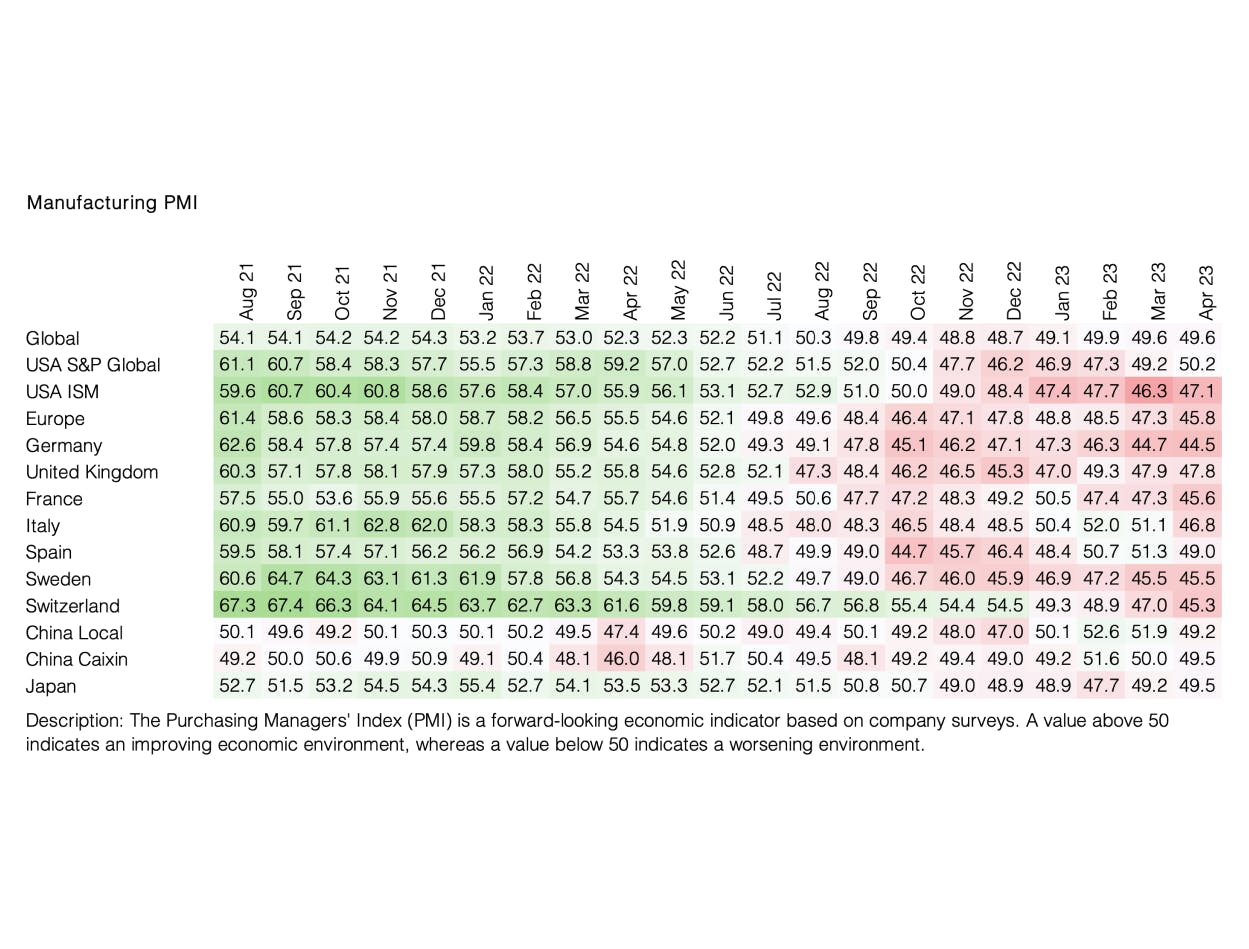

Declining inflation also indicates an end to the restrictive monetary policy that has significantly shaped markets for slightly more than a year. The bond market has been signaling this for some time, as the Fed’s first interest rate cuts in more than 3 years are already priced into the market by the end of the year. Global stock markets benefit from the prospect of lower interest rates and reflect an almost perfect scenario: inflation is decreasing, interest rates will gradually decline until 2025, and corporate profits will continue to rise within the same period.

However, the current reporting season on corporate earnings justifies a somewhat cautious stance. Profits are declining in most sectors compared to the previous year, even though they have partially exceeded analysts' expectations that were cautiously optimistic.

In the coming months, profit margins could also deteriorate as they strongly correlate with declining inflation. The normalization of price levels is likely to shift investors' focus back to fundamental valuation factors. However, these numbers are generally negatively impacted by a very sharp spike in interest rates, like the one that materialized over the last year. According to the latest Household Pulse Survey by the US Census Bureau, more Americans are facing difficulties in managing their expenses compared to immediately after the pandemic when millions of people lost their jobs. Approximately 38.5% of adult Americans are struggling to cover their household budgets. In the same period in 2021, this number was at 26.7%. One possible reason for this is the development of real wages, which have been declining for the past two years. Many households are accessing their credit card facilities to manage budget deficits, leading to increased debt among the lower-income segment, which is particularly affected by these circumstances. Considering the average credit card interest rates north of 20%, additional budget issues for consumers can be expected going forward. A research report provided by Bank of America shows that credit card transactions are already declining.

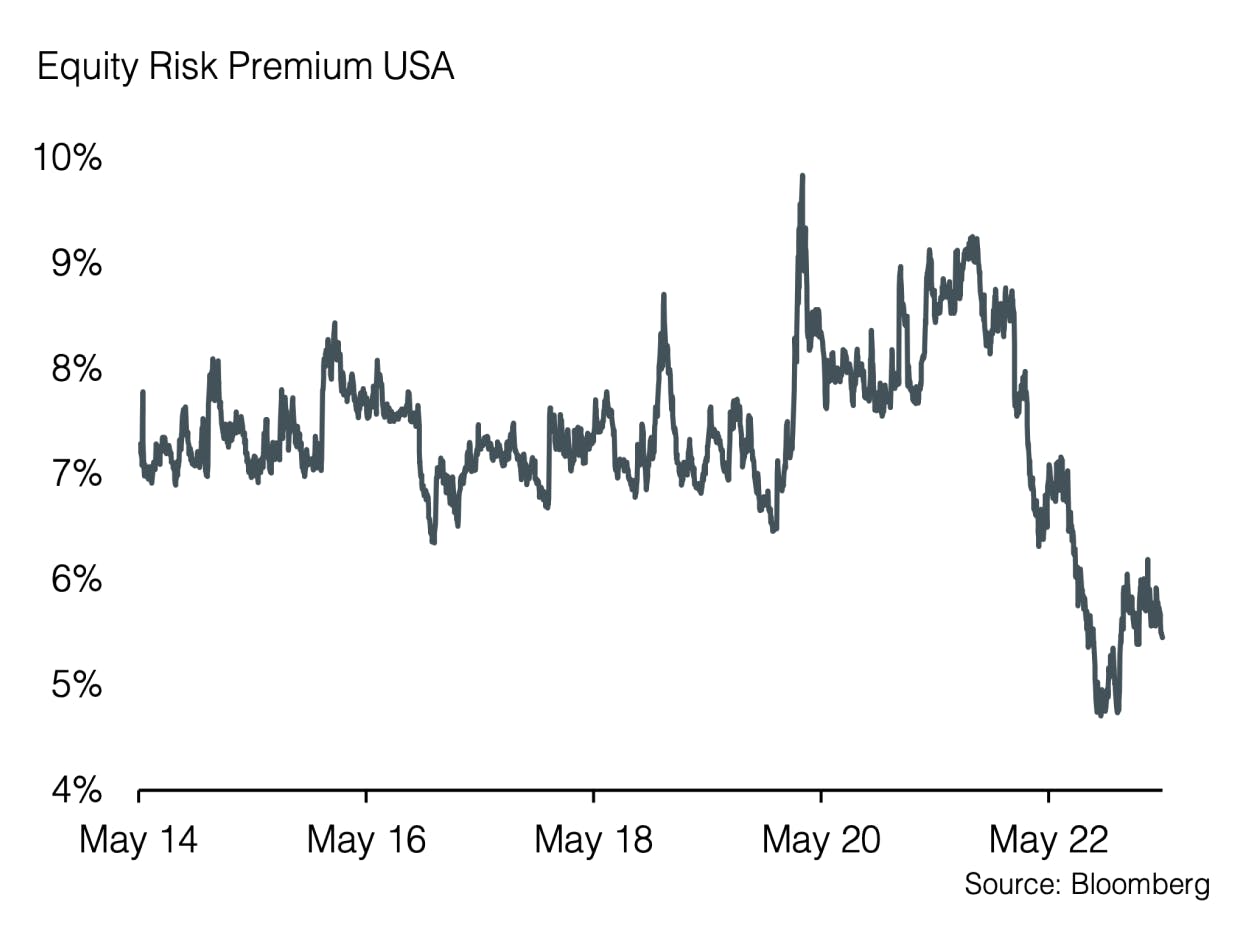

Currently, there is little evidence that the stock market is reflecting these negative economic developments. Therefore, it is worthwhile to take a closer look at valuations. The equity risk premium remains at an unattractively low level and has not improved materially over the last weeks. Rising stock prices are accompanied by declining profits, further inflating market valuation. Especially US heavyweights like Apple, Amazon, Google, Microsoft, NVIDIA, etc., have propelled the US market to rise by over 10% since the beginning of the year. Excluding these stocks from the overall calculation, the gain drops to 1.7%. Globally, slightly more than half of the stock market contribution year-to-date comes from just seven US companies, whose valuation now appears expensive in absolute and relative terms.

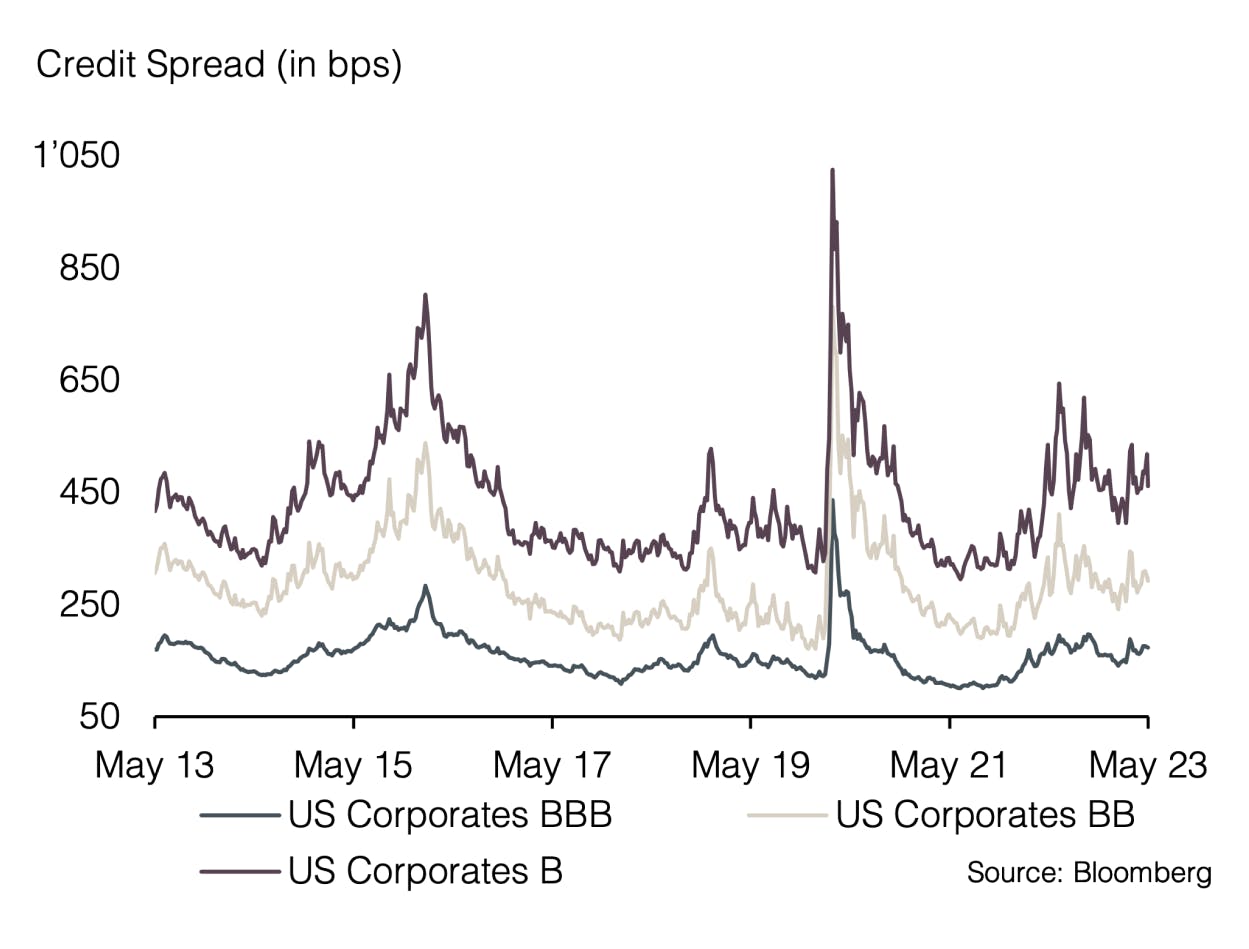

Hence, we continue to maintain a defensive position with an underweight in equities. We welcome the drop in equity volatility, which makes it cheaper to buy protection and hedge parts of an equity allocation through options. Higher credit spreads for bonds reinforce our view that quality should be the ultimate focus for fixed-income investments.

Appendix

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research