SoundInsightN°13

Bonds

Equities

High hopes for lower Rates

The past year provided positive returns across major asset classes. Numerous negative analyst forecasts proved to be wrong. What remains are elevated stock valuations and the central question of whether an economic soft landing can be achieved.

The year 2023 did not start on a promising note. The consensus among many analysts was clear: inflation was far from normal levels, prompting central banks to plan further interest rate hikes. Given the significant disruptions of the previous year, experts foresaw that further interest rate hikes would coincide with a renewed decline in stock prices. Initially, we shared this view, anticipating adverse economic consequences from the aggressive monetary tightening that had taken place over the last months. In early spring, the bankruptcy of Silicon Valley Bank validated the pessimistic forecasts. However, a swift government intervention to save the regional banking system in the US led to easing monetary conditions. As a result, the year turned out differently than expected: the US economy proved to be significantly more resilient than predicted. Consumer behavior, economic growth, and the job market remained unaffected by the highest interest rates since 2008—a paradigm shift that was clearly not anticipated.

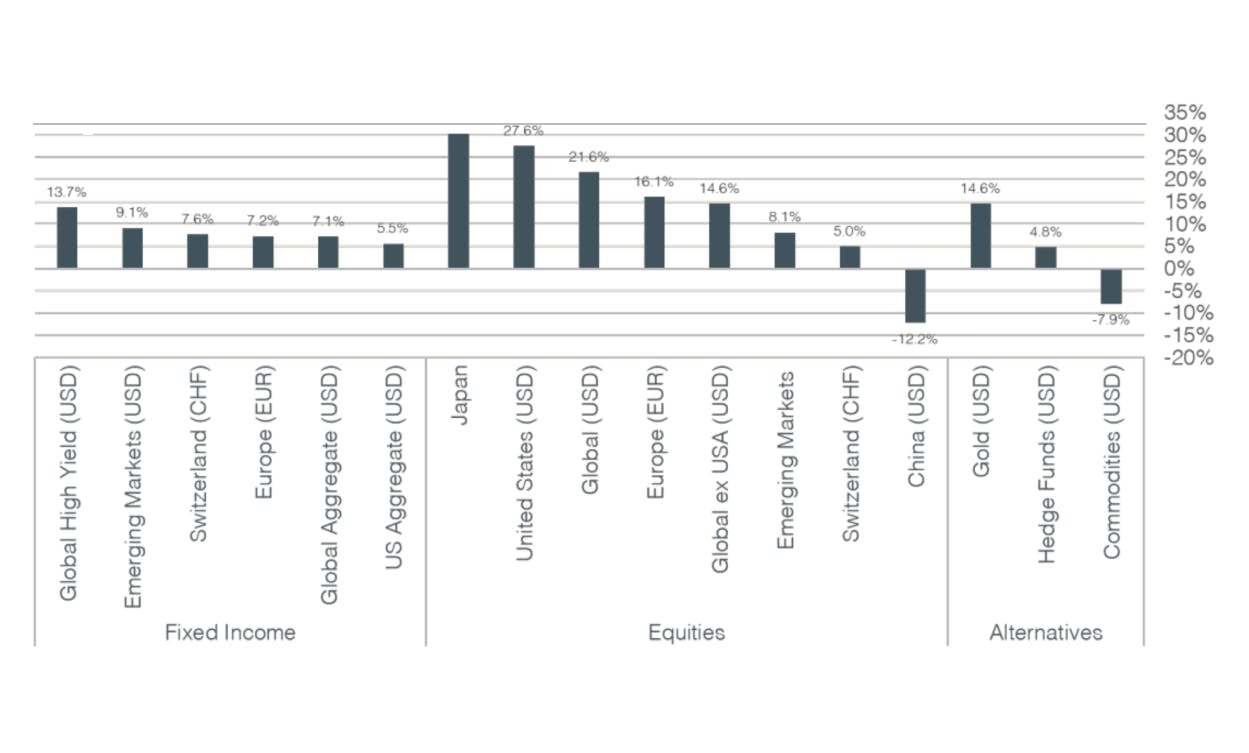

Asset Returns in 2023

The sustained economic momentum forced central banks to continue their restrictive course. In 2023, the Federal Reserve raised interest rates four times, totaling 1.0%, more than originally anticipated by economists.

Contrary to consensus, long-term US interest rates also rose significantly. The additional interest burden, which had led to a massive downturn in the stock markets the previous year, had almost no consequences in 2023. One of the main drivers for this development was increasing growth expectations for artificial intelligence, propelling some technology giants to new highs.

By year-end, the conviction emerged that central banks had completed their interest rate tightening cycle and that it was only a matter of time before the first interest rate cuts in USD, EUR, and CHF would be implemented. Hence, expectations for monetary policy easing in 2024 are high, with the consensus anticipating gradually lower interest rates, a further weakening of inflation, and simultaneously higher corporate profits.

In this more comprehensive edition of Sound Invest, we take a retrospective look at the year 2023 and highlight the returns of the major investment categories. In the second part, we discuss risks and opportunities in the investment year 2024 and explain our corresponding positioning.

Sound Capital Asset Allocation 2023

Fixed Income

In our investment outlook for the past year, we predicted positive bond returns. Following an exceptionally strong period of monetary tightening in 2021-2022, there were only two other periods in the United States (1955-1956, 1958-1959) where a negative year for fixed income was followed by an additional year of losses. Since the beginning of our data recording, there have never been three consecutive years of negative returns for fixed-income investments. Moreover, yields had reached levels that, from a historical perspective, represented solid risk compensation.

In line with this conviction, we started 2023 with an overweight positioning in bonds. However, we expected that additional interest rate hikes would bring volatility to the bond market. Hence, we only gradually increased the maturities throughout the year. Our focus was on high-quality bonds, guided by the principle that the longer the maturity, the higher the quality.

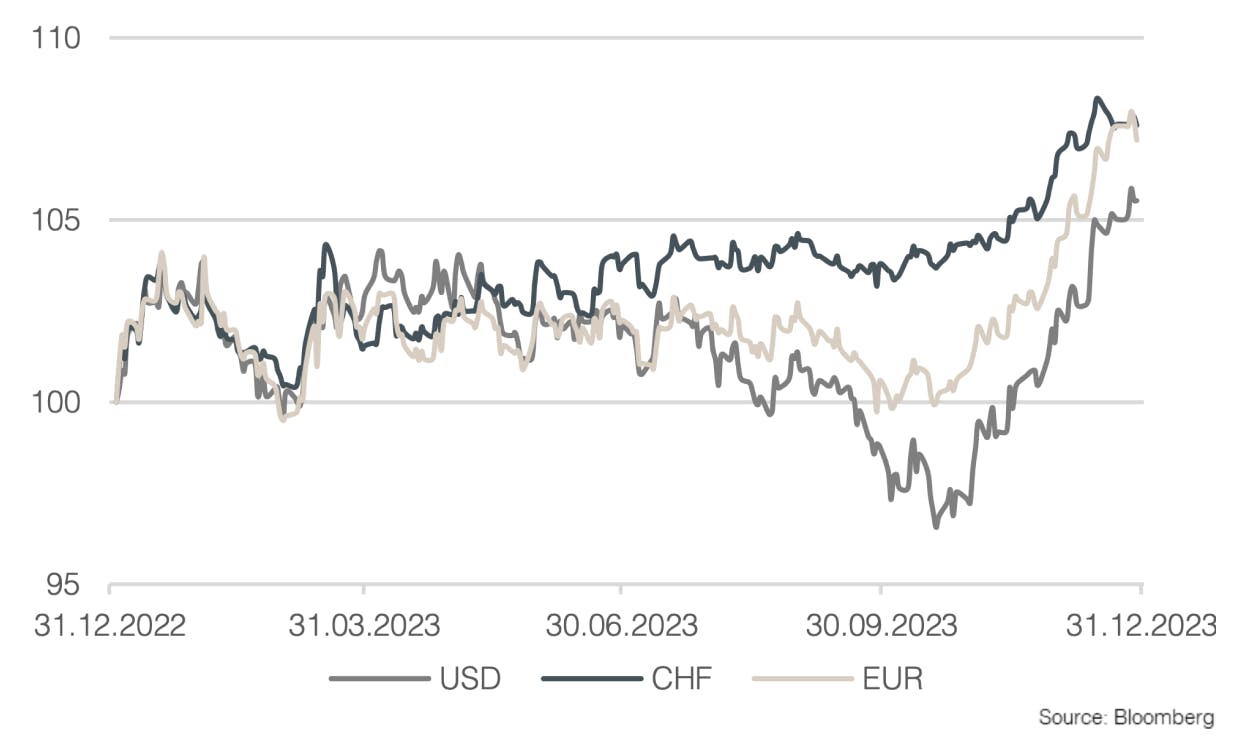

What proved to be a good strategy by year-end required a lot of nerves throughout the year. With the exception of CHF bonds, which already reached their interest rate peak in 2022, USD bonds specifically experienced losses due to the unexpectedly strong increase in interest rates until October. The chart below highlights that the majority of gains in the main bond markets were achieved towards the end of the year. This was primarily attributed to the Federal Reserve, which used the last meeting of the year to signal for the first time since the beginning of monetary policy tightening that the fight against inflation was succeeding. Hence, even the central banks communicated that no further interest rate hikes were needed.

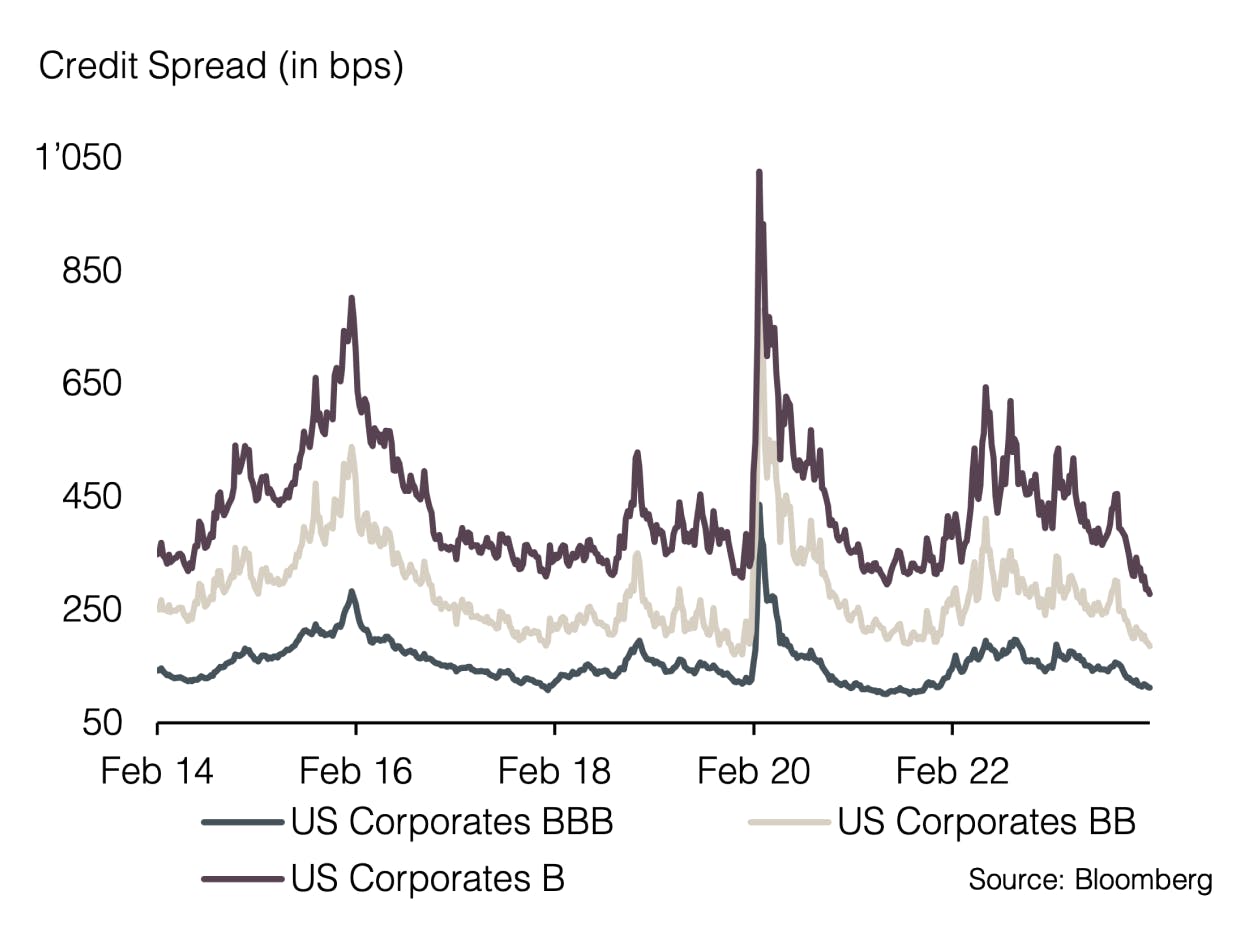

Given the expectation of slowing economic growth, we also anticipated an increase in default rates in the area of high-yield bonds. However, the riskiest area of the bond market delivered the highest returns. Hence, credit spreads of high-yield bonds have continued their decline and appear even less attractive in historical comparison than a year ago. In summary, it can be stated that risk taking has paid off in bonds. The absence of a recession increased investors' risk appetite, despite interest rates experiencing significant increases throughout the year.

Equities

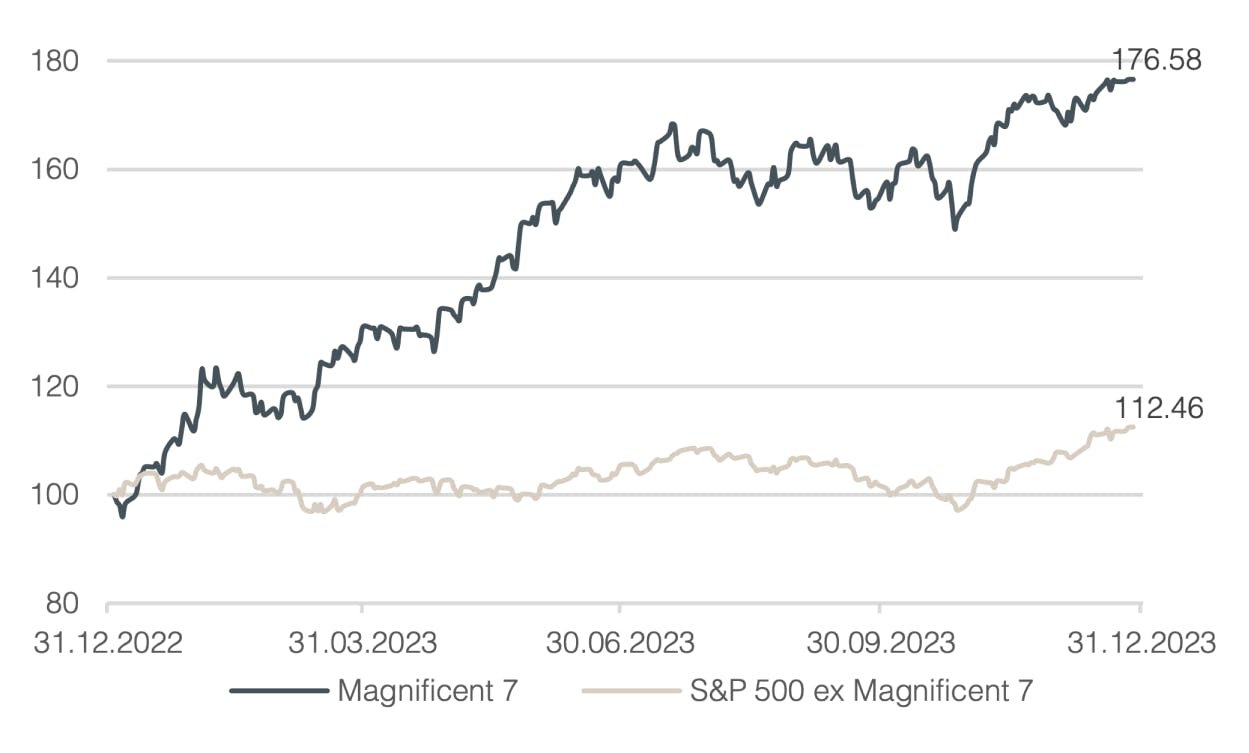

In the past two years, we have repeatedly reported that the development of global stock markets was significantly driven by a handful of US technology stocks. In 2023, the same companies once again drove the overall market. It is noteworthy that the dominance of these seven leading companies (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) has even increased, creating market distortions that deserve our attention.

The term "the magnificent seven," inspired by the film classic from the 60s, has already established itself among investors as a designation for these market-dominating stocks. Since last year, there is even an exchange-traded fund that exclusively tracks the performance of these companies. For active investors, this phenomenon was likely the biggest challenge in the past year. In 2022, the prevailing belief was that higher interest rates would mean the end of the "dominance" of the magnificent seven. Technology stocks declined, and the Nasdaq 100 plummeted by almost a third. The prospect of higher interest rates formed the basis for the analyst consensus forecast of a challenging year for growth companies. In response, the majority of investors positioned themselves cautiously, which in hindsight was a crucial mistake. The chart below illustrates that the magnificent seven gained almost 80% last year. Excluding these stocks from the S&P 500 led to a performance of 12.5%, compared to 26.3% for the unrestrained index.

Sound Capital started last year with a defensive positioning. Despite the stock market's spectacular start to the year, strong divergences became apparent beneath the surface. While the magnificent seven gained over 50% by the end of October, the market for small and mid-cap companies was in negative territory. Accordingly, valuation disparities were striking at that time. The negative investor sentiment prompted us to increase the equity allocation to neutral by the end of October. While this proved to be good timing in hindsight, it was not enough to fully offset the underweight from the beginning of the year for the entire year.

Outlook 2024

Fixed Income

- Central bank pivot heavily priced in

- Focus on high quality issuers

- Maintain longer maturities

- Avoid high-yield bonds

The market is confident: 2024 will be the year of the interest rate pivot. After 2022 brought the most restrictive monetary policy in decades, the Federal Reserve is expected to cut interest rates six times, totaling 1.5% this year. Once again, there is a notable discrepancy as the market is much more optimistic than the central banks. According to the recently published "Dot Plot," the Fed plans to cut interest rates only three times this year. The European Central Bank is expected to nearly halve the current reference rate from 4% to 2.25% by the end of the year. Remarkably, the market anticipates the first interest rate cut starting in March and subsequent cuts in almost every meeting in 2024 for both central banks. Investors' expectations are thus based on a soft economic landing and sustainably lower inflation.

When looking at credit spreads, it is evident that the market expects little to no economic headwinds. At the end of the year, the additional compensation for high-yield bonds over government bonds reached its lowest level since the beginning of the pandemic (although governmental support distorted the market at that time). Hence, the market is starting the current year extremely optimistic with regards to default rates.

The speed of the tidal changes in the interest rate landscape is best reflected in the movement of long-term interest rates. Since the end of October, yields on 10-year US Treasury bonds have dropped from over 5% to 3.8%. Hence, the monetary policy pivot has also arrived at the longer end of the interest rate curve, with the structure of the yield curve (yield on 2-year vs. 10-year government bonds) likely to no longer be inverted for the first time since mid-2022 over the coming 12 months. However, it is likely that some of the macroeconomic effects of higher interest rates will start having an impact over the course of the year. In our view, it remains unlikely that central banks will proactively loosen monetary policy. Nevertheless, the past months have demonstrated that inflation can be very persistent and that it is all but easy to get it under control. Accordingly, central banks will do everything in their power to prevent a resurgence of inflation. Therefore, we expect that further negative effects of interest rates must take hold in the economy to fulfill the current interest rate expectations currently priced into fixed investment markets.

For the upcoming year, we prefer fixed income investments with longer maturities, focusing on high-quality issuers. The yield of solid corporate bonds remains attractive in our view, while we would only engage in high-yield bonds if credit spreads widen and offer a better reward for carrying higher default risks.

Equities

- Clouded macroeconomic environment

- Lower rates are anticipated

- Challenging valuations

- Opportunities in attractively valued sectors

The US economy surprised most investors with a very resilient positive development in 2023, largely due to pent-up demand as a result of the pandemic. However, the significant drop in household savings is expected to dampen economic growth in the current year, especially under the additional softening effect of high interest rates. A good illustration is the currently expensive auto loan borrowing, which has already led to a spike in delinquencies. Moreover, despite the highest mortgage rates in over 20 years, housing prices continued to rise in 2023, pushing the dream of homeownership further out of reach for many US citizens. The affordability for purchasing an average home in relation to median income has reached a historical low. At the same time, millions of households face a resumption of interest payments for student loans. Moreover, higher interest rates and a growing state deficit is leading to a reduction of subsidies for healthcare and childcare, leaving consumers with less money in their pockets.

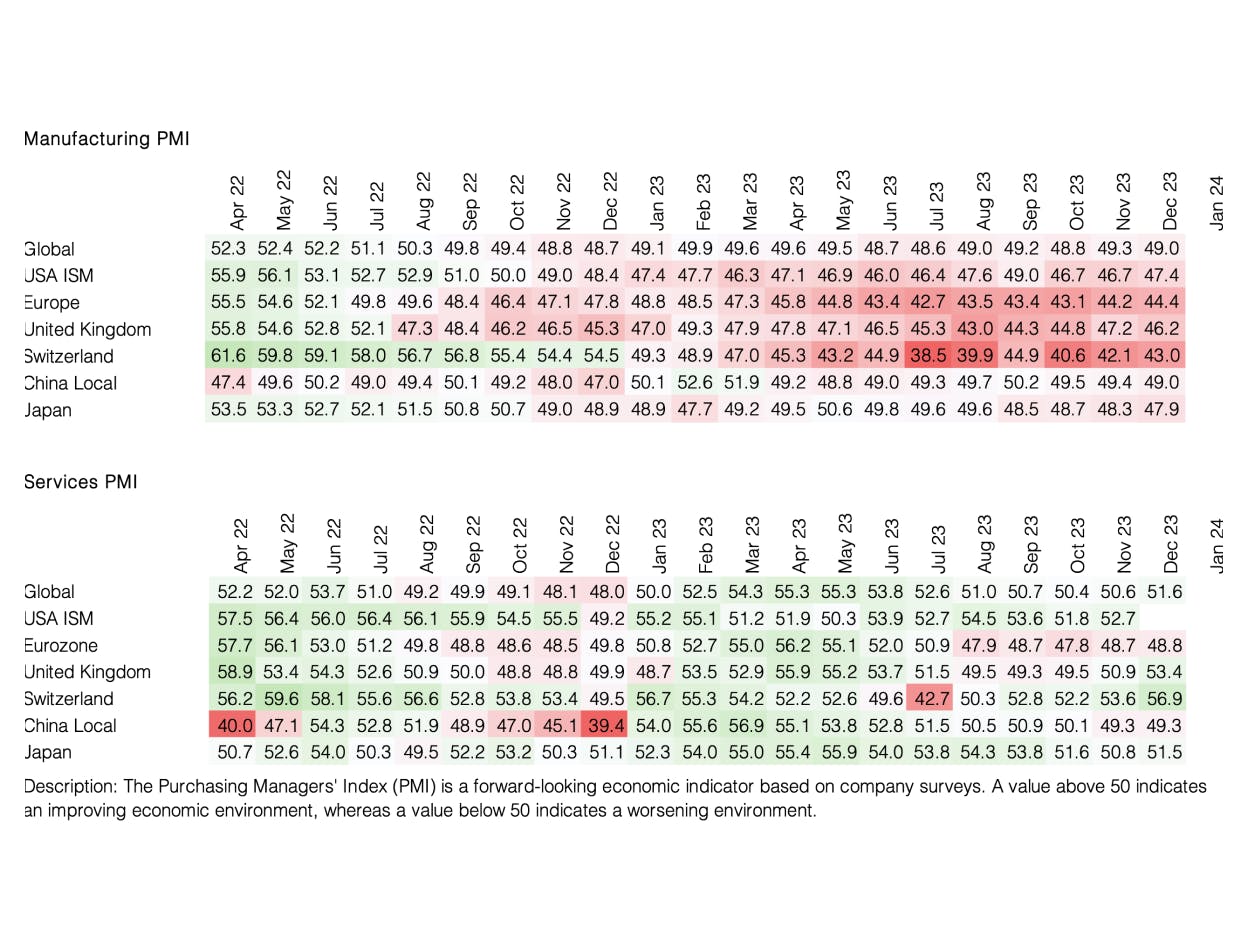

Additionally, for the 14th consecutive month, the activity of US industrial firms, measured by the ISM Manufacturing Index, remained in the contraction zone at the end of 2023. A weaker order intake is particularly dampening sentiment. The December result reflects the longest period of shrinking activity since 2000-2001. A large number of manufacturers face higher financing costs and declining demand for goods, leading to cautious investment plans.

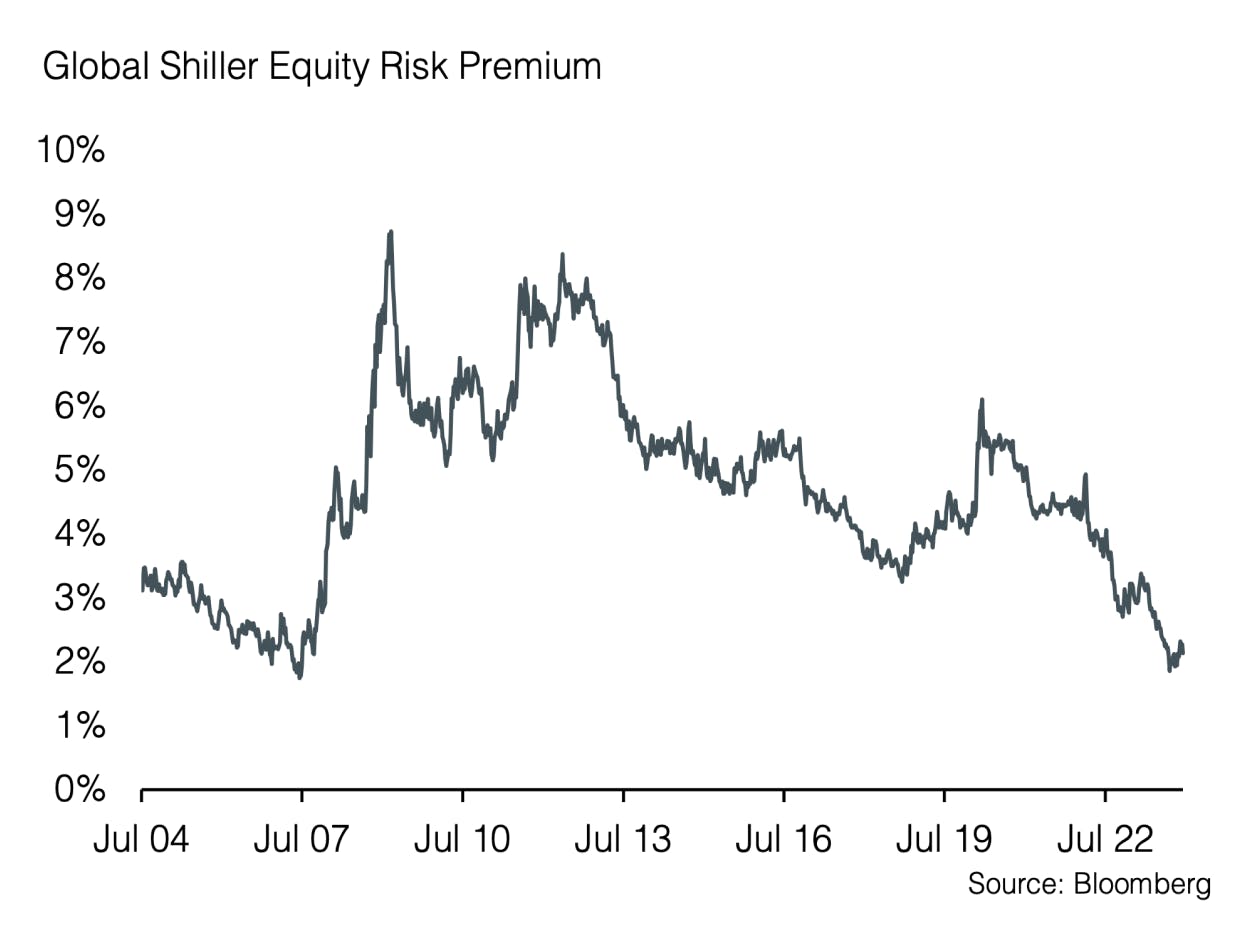

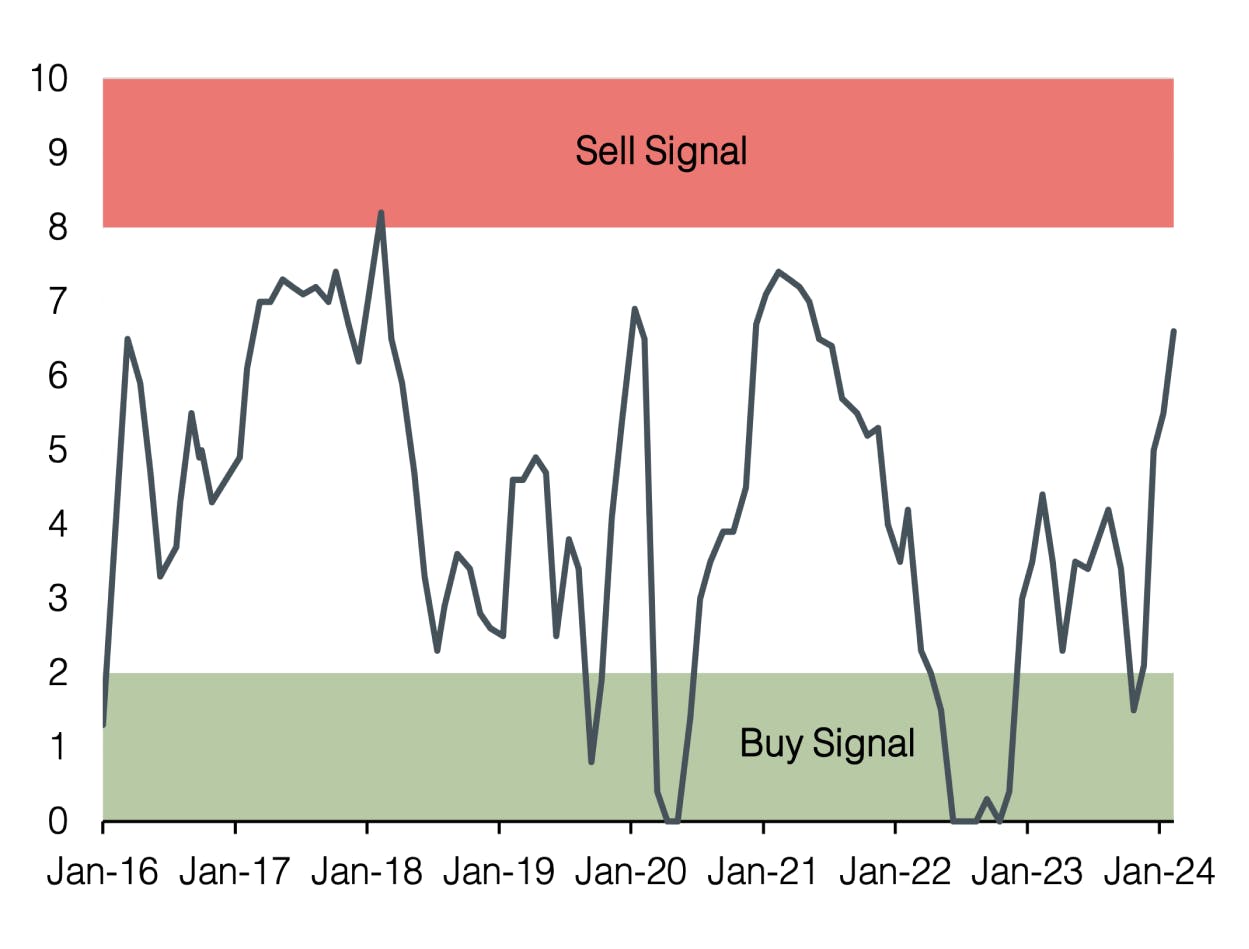

Despite a rather gloomy macroeconomic situation, the stock market closed only a few percentage points below its all-time high. As a result, we see challenging valuations and little room to absorb negative headlines. However, a closer look at sectors and countries reveals opportunities in the market. We begin the year with a neutral allocation to equities, focusing on attractively valued areas. Consumer staples, which not only offer good inflation protection but also solid returns which are less dependent on the economic situation, are part of our selection. Additionally, we consider the energy sector as a meaningful addition to the portfolio due to cheap valuations and a hedge given the current geopolitical situation. Regionally, we prefer Swiss equities, which, besides lower volatility, also provide a stable currency. Furthermore, we emphasize high-quality stocks globally with an appealing dividend yield – companies that generate continuous cash flows throughout the entire economic cycle are less susceptible to economic downturns.

Appendix

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research