SoundInsightN°18

Bonds

Equities

Half-time 2024: Financial Markets Exceed Expectations

The latest economic data supports the view of robust growth and declining inflation. As we reach the mid-year mark, nearly all asset classes are in positive territory, raising expectations for the second half of 2024.

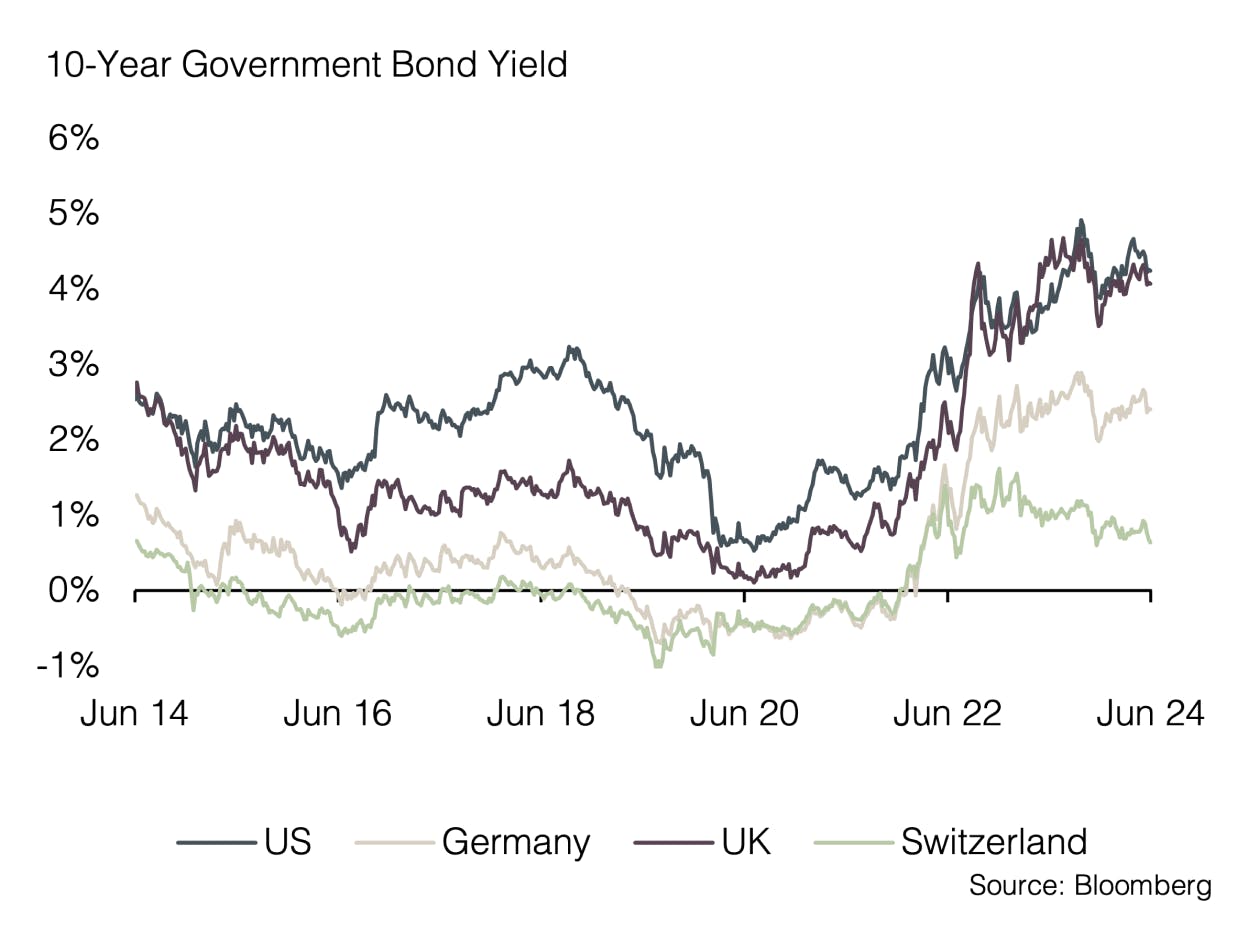

The Federal Reserve announced its latest sum of economic projections at the June meeting. The report is still indicating a stable economic situation, thereby reducing the need for lower interest rates compared to the last assessment published back in March. Three months ago, the Fed anticipated three rate cuts this year; currently, the central bank expects only one. Higher interest rates for longer - not exactly an ideal scenario for investors and risk assets.

Almost simultaneously with the Fed's communication, the release of consumer and producer prices brought a positive surprise: inflation fell short of economists' expectations for the second consecutive month. This led market participants to anticipate an additional rate cut this year, contrary to the Fed's forecast. This expectation was supported by slightly declining retail sales and a slowing US labor market.

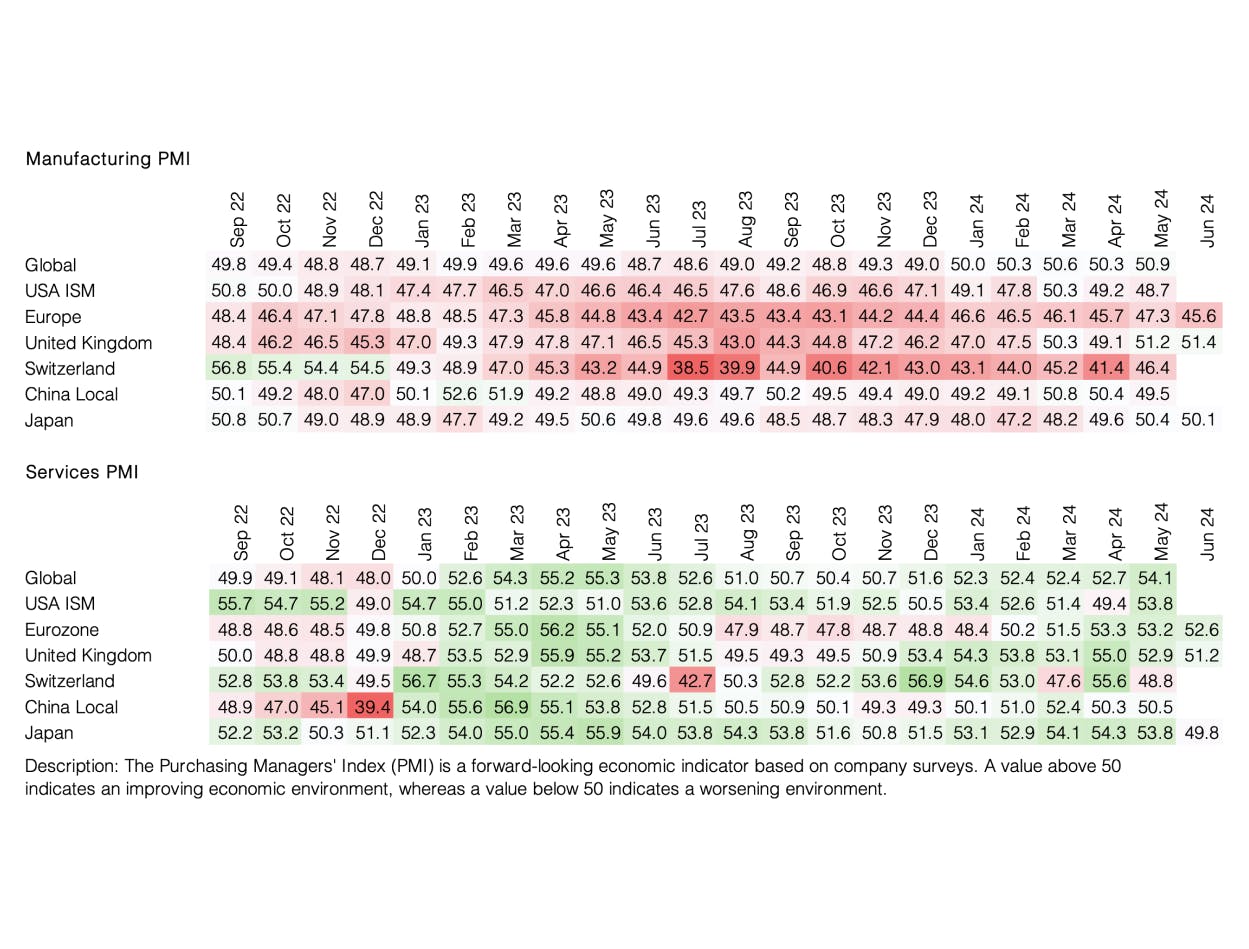

Meanwhile, policymakers in Canada and Europe lowered interest rates for the first time in the current cycle this month. This occurred despite the European Central Bank (ECB) raising its own inflation forecast. However, the biggest surprise in monetary policy came once again from the Swiss National Bank. For the second consecutive time, the SNB unexpectedly cut interest rates by 0.25%. As in March, the decision was justified by lower inflation and a still strong Swiss franc. The Purchasing Managers' Indices (PMI) showed a positive trend in June. Both the manufacturing and service sectors saw small gains. Notably, the global index for manufacturing reached its highest level since July 2022, while the service sector achieved its highest value in the past twelve months. The combination of lower inflation and a positive outlook for both industry and services is definitely favorable for investors.

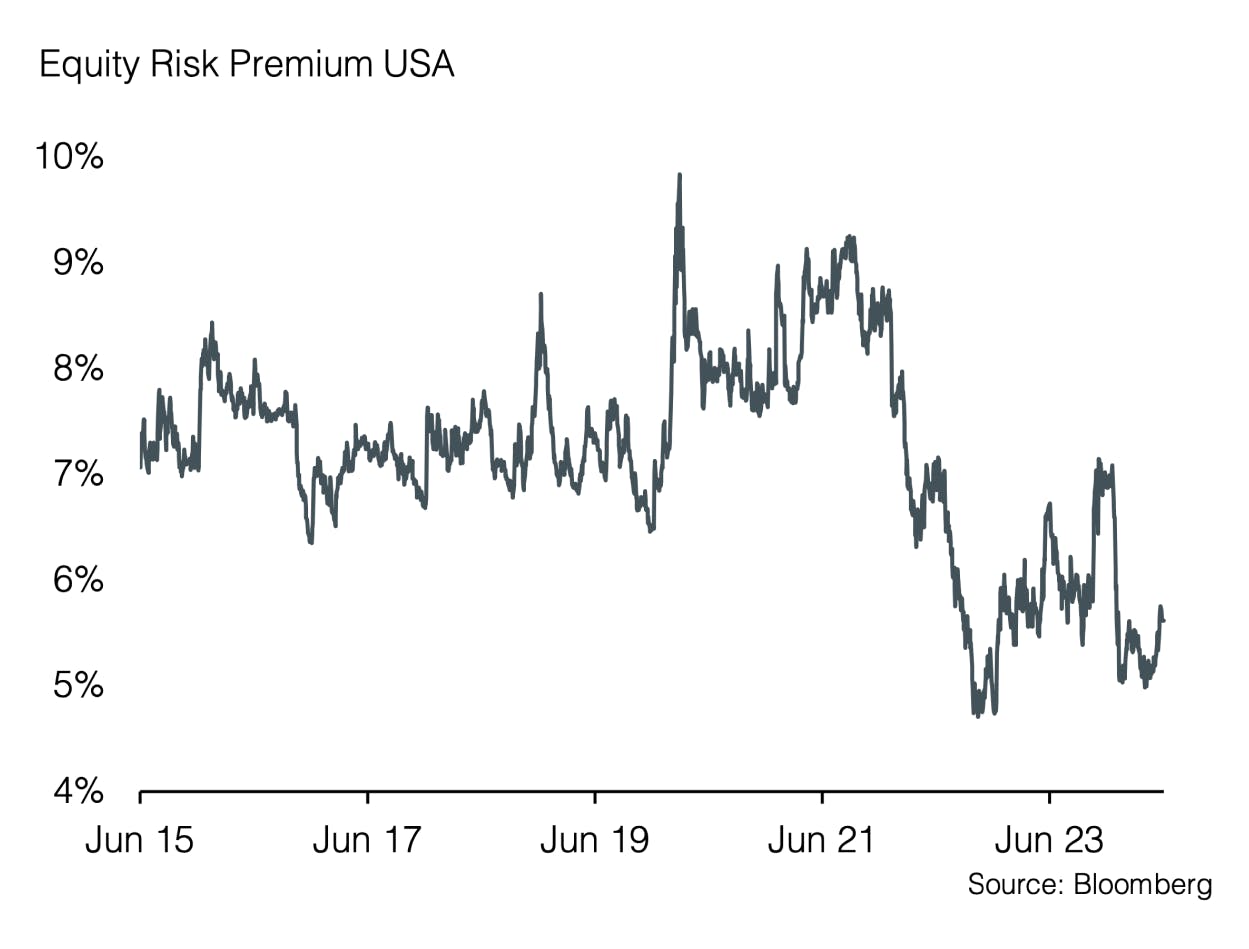

However, the fact that US interest rates are still holding at 5.5% was far from ideal at the beginning of the year. At that time, six rate cuts were predicted for 2024, with the first expected in March. In retrospect, it can be noted that the financial markets have exceeded return expectations in the first half of 2024 despite higher interest rates.

The coming months will reveal whether this trend continues, and the hoped-for market stability persists. Currently, the market is expecting an almost perfect scenario of rising corporate earnings, falling interest rates, and decreasing inflation. With these prospects, we look forward to the second half of 2024, which will show whether the positive expectations will be met. Over the next weeks, we expect to receive insightful data, particularly from the consumer sector, which will provide greater visibility regarding future growth. A rate cut following the US elections seems quite realistic to us.

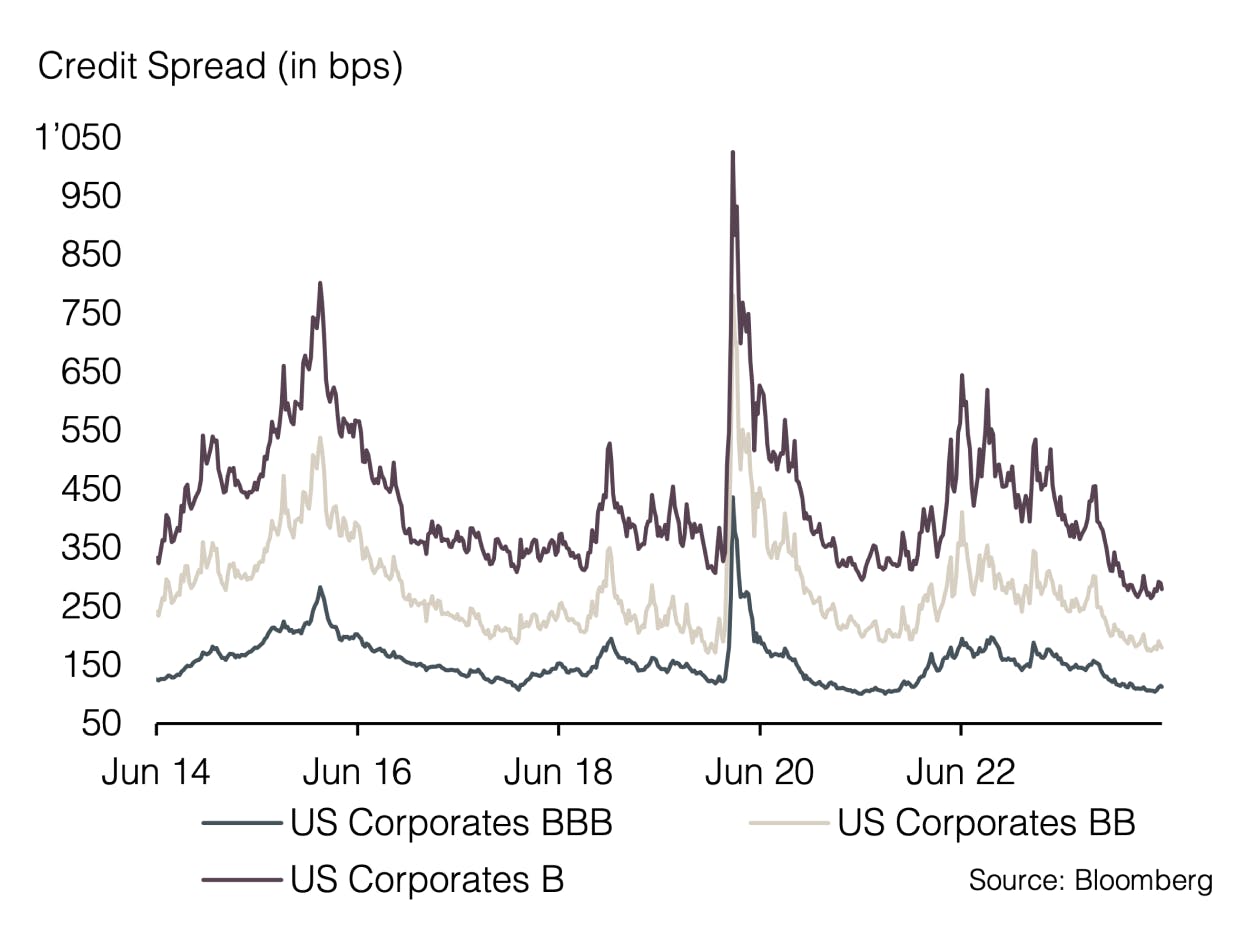

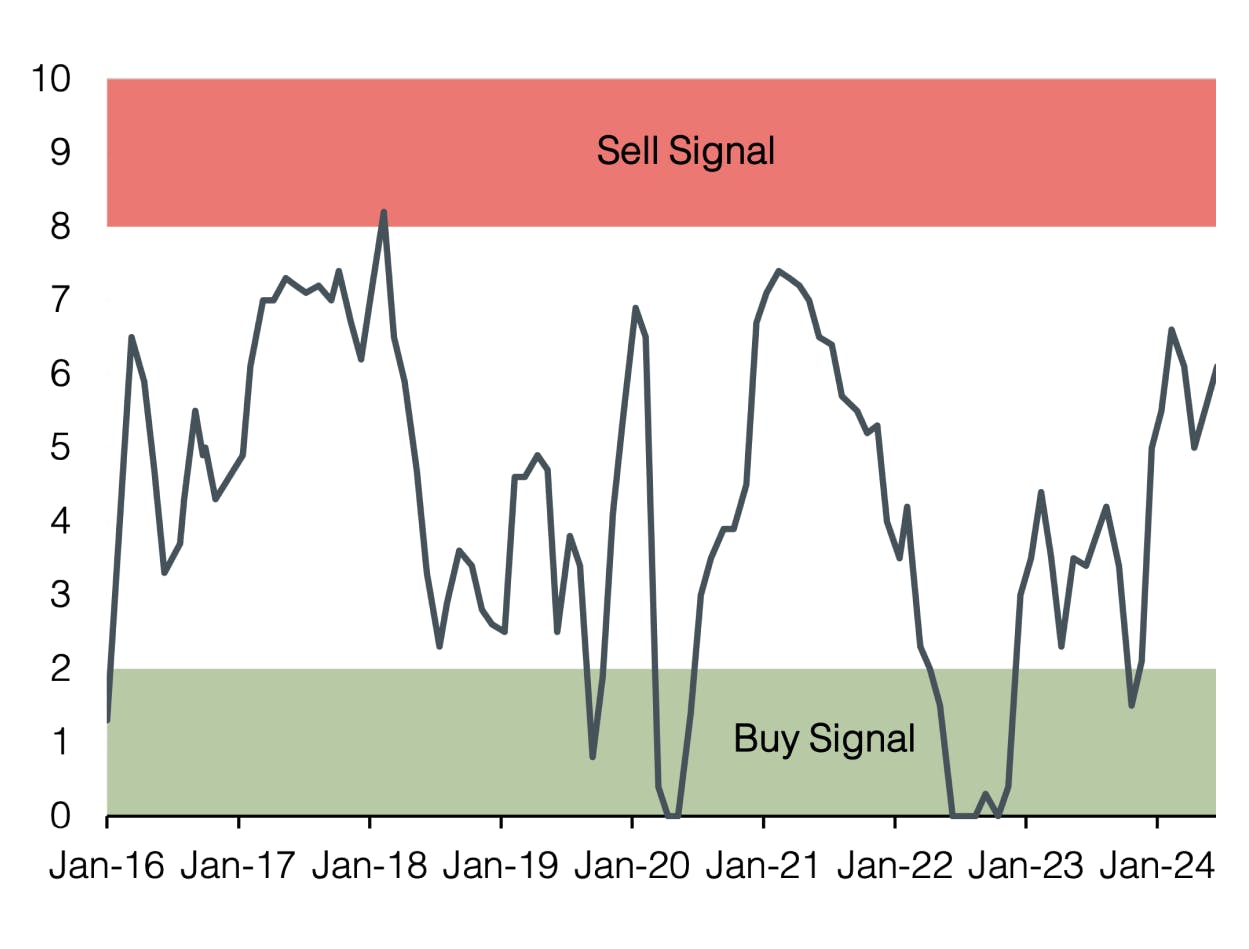

With the positive developments of the last month, investor sentiment is gradually moving towards the euphoric range, though it hasn't quite reached that point yet. We maintain a neutral position on equities and remain cautious regarding default risks in bonds.

Appendix

Sound Invest is the central tool for our investment allocation. We use it to systematically and consistently assess the aspects that are relevant to the development of the financial markets. As a result, our clients can rely on a rational and anti-cyclical implementation of our investment decisions.

- Focusing on the essentials Interest rate level, risk premium, valuation, economic development, investor sentiment and positioning. These are the decisive factors for success on the financial markets, especially in turbulent times when the temptation to react irrationally to the headlines is particularly strong.

- Comparability over time and place

The factors mentioned above are equally relevant for all markets and at all times. This is the result of a strict «backtesting» process that continues into the future. - Cumulating our investment experience

Our strength lies in the many years of experience of our partners and principals. It is precisely this experience that we summarize and make it applicable with Sound Invest. - Transparency

Thanks to our monthly publication, our clients always know where we stand in the investment cycle and how we expect the financial markets to develop.

Disclaimer

This document is an advertisement and is intended solely for information purposes and for the exclusive use by the recipient. This document was produced by Sound Capital Ltd. (hereafter «SC») with the greatest of care and to the best of its knowledge and belief. However, SC does not warrant any guarantee with regard to its correctness and completeness and does not accept any liability for losses that might occur through the use of this information. This document does not constitute an offer or a recommendation for the purchase or sale of financial instruments or services and does not discharge the recipient from his own judgment. Particularly, it is recommended that the recipient, if needed by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. Although information and data contained in this document originate form sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. A past performance of an investment does not constitute any guarantee of its performance in the future. Performance forecasts do not serve as a reliable indicator of future results. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of SC.

© 2024 Sound Capital AG.

Datasource: Bloomberg, BofA ML Research